Table of Contents

Chapter - 8

Bill of Exchange

Learning Objectives

After studying this chapter, you will be able to :

• state the meaning of bill of exchange and a promissory note;

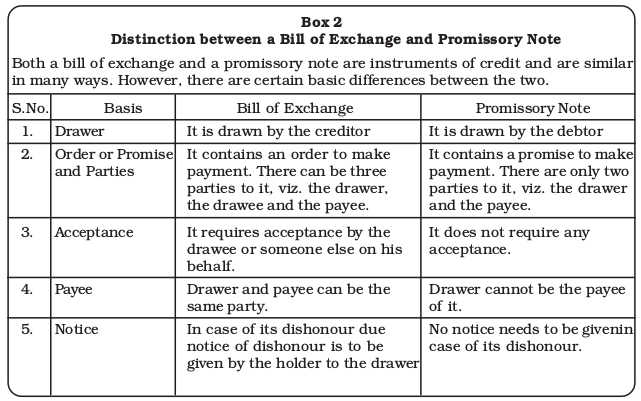

• distinguish between a bill of exchange and a promissory note;

• state the advantages of bill of exchange;

•explain the meaning of different terms involved in the bill transaction,

•record bill of exchange transactions in journal;

• record transactions relating to dishonour, retirement and renewal of bill;

• describe the uses of bill receivable and bill payable book;

• state the meaning and use of accommodation bill.

Goods can be sold or bought for cash or oncredit. When goods are sold or bought for cash, payment is received immediately. On the other hand, when goods are sold/bought on credit the payment is deferred to a future date. In such a situation, normally the firm relies on the party to make payment on the due date. But in some cases, to avoid any possibility of delay or default, an instrument of credit is used through which the buyer assures the seller that the payment shall be made according to the agreed conditions. In India, instruments of credit have been in use since time immemorial and are popularly known asHundies. The hundies are written in Indian languages and have a large variety (refer box1).

Box 1

Hundies and its Types

There are a variety of hundies used in our country. Let us discuss some of the most common ones.Shahjog Hundi: This is drawn by one merchant on another, asking the latter to pay the amount to a Shah. Shah is a respectable and responsible person, a man of worth and known in the bazaar. A shah-jog hundi passes from one hand to another till it reaches a shah, who, after reasonable enquiries, presents it to the drawee for acceptance of the payment.

Darshani Hundi: This is hundi payable at sight. It must be presented for payment within a reasonable time after its receipt by the holder. It is similar to a demand bill.

Muddati Hundi: A muddati or miadi hundi is payable after a specified period of time. This is similar to a time bill.

There are few other varieties of hundies likeNam-jog hundi, Dhani-jog hundi, Jawabee hundi, Hokhami hundi, Firman-jog hundi, and so on.

Now a days these instruments of credit are called bills of exchange or promissory notes. The bill of exchange contains an unconditional order to pay a certain amount on an agreed date while the promissory note contains an unconditional promise to pay a certain sum of money on a certain date. In India these instruments are governed by the Indian Negotiable Instruments Act 1881.

8.1 Meaning of Bill of Exchange

According to the Negotiable Instruments Act 1881, a bill of exchange is defined as an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of a certain person or to the bearer of the instrument. The following features of a bill of exchange emerge out of this definition.

• A bill of exchange must be in writing.

• It is an order to make payment.

• The order to make payment is unconditional.

• The maker of the bill of exchange must sign it.

• The payment to be made must be certain.

• The date on which payment is made must also be certain.

• The bill of exchange must be payable to a certain person.

• The amount mentioned in the bill of exchange is payable either on demand or on the expiry of a fixed period of time.

• It must be stamped as per the requirement of law.

A bill of exchange is generally drawn by the creditor upon his debtor. It has to be accepted by the drawee (debtor) or someone on his behalf. It is just adrafttill its acceptance is made.

For example, Amit sold goods to Rohit on credit for ₹ 10,000 for three months. To ensure payment on due date Amit draws a bill of exchange upon Rohit for ₹ 10,000 payable after three months. Before it is accepted by Rohit it will be called a draft. It will become a bill of exchange only when Rohit writes the word “accepted” on it and append his signature thereto communicate his acceptance.

8.1.1 Parties to a Bill of Exchange

There are three parties to a bill of exchange:

(1) Drawer is the maker of the bill of exchange. A seller/creditor who is entitled to receive money from the debtor can draw a bill of exchange upon the buyer/debtor. The drawer after writing the bill of exchange has to sign it as maker of the bill of exchange.

(2) Drawee is the person upon whom the bill of exchange is drawn. Drawee is the purchaser or debtor of the goods upon whom the bill of exchange is drawn.

(3) Payee is the person to whom the payment is to be made. The drawer of the bill himself will be the payee if he keeps the bill with him till the date of its payment. The payee may change in the following situations:

(a) In case the drawer has got the bill discounted, the person who has discounted the bill will become the payee;

(b) In case the bill is endorsed in favour of a creditor of the drawer, the creditor will become the payee.

Normally, the drawer and the payee is the same person. Similarly, the drawee and the acceptor is normally the person. For example, Mamta sold goods worth ₹10,000 to Jyoti and drew a bill of exchange upon her for the same amount payable after three months. Here, Mamta is the drawer of the bill and Jyoti is the drawee. If the bill is retained by Mamta for three months and the amount of

₹ 10,000 is received by her on the due date then Mamta will be the payee. If Mamta gives away this bill to her creditor Ruchi, then Ruchi will be the payee. If Mamta gets this bill discounted from the bank then the bankers will become the payee.

In the above mentioned bill of exchange, Mamta is thedrawerand Jyoti is thedrawee.Since Jyoti has accepted the bill, she is theacceptor.Suppose in place of Jyoti the bill is accepted by Ashok then Ashok will become theacceptor.

Test Your Understanding - I

Write ‘Ture’ or ‘False’ against each statement regarding a bill of exchange:

(i) A bill of exchange must be accepted by the payee.

(ii) A bill of exchange is drawn by the creditor.

(iii) A bill of exchange is drawn for all cash transaction.

(iv) A bill payable on demand is called Time bill;

(v) The person to whom payment is to be made in a bill or exchange is called payee.

(vi) A negotiable instrument does not require the signature of its maker.

(vii) ThehundiPayable at sight is calledDarshani hundi.

(viii) A negotiable instrument is not freely transferable.

(ix) Stamping of promissory note is not mandatory.

(x) The time of payment of a negotiable instrument need not be certain.

8.2 Promissory Note

According to the Negotiable Instruments Act 1881, a promissory note is defined as an instrument in writing (not being a bank note or a currency note), containing an unconditional undertaking signed by the maker, to pay a certain sum of money only to or to the order of a certain person, or to the bearer of the instrument. However, according to the Reserve Bank of India Act, a promissory note payable to bearer is illegal. Therefore, a promissory note cannot be made payable to the bearer.

This definition suggests that when a person gives a promise in writing to pay a certain sum of money unconditionally to a certain person or according to his order the document is called is a promissory note.

Following features of a promissory note emerge out of the above definition:

• It must be in writing

• It must contain an unconditional promise to pay.

• The sum payable must be certain.

• It must be signed by the maker.

• The maker must sign it.

• It must be payable to a certain person.

• It should be properly stamped.

A promissory note does not require any acceptance because the maker of the promissory note himself promises to make the payment.

8.2.1 Parties to a Promissory Note

There are two parties to a promissory note.

•Maker or Draweris the person who makes or draws the promissory note to pay a certain amount as specified in the promissory note. He is also called the promisor.

•Drawee or Payeeis the person in whose favour the promissory note is drawn. He is called the promisee.

Generally, the drawee is also the payee, unless, it is otherwise mentioned in the promissory note. In the specimen of promissory note(refer figure 8.2), Ashok Kumar is the drawer or maker who promises to pay ₹30,000 and Harish Chander is the drawee or payee to whom payment is to made. If Harish Chander endorses this promissory note in favour of Rohit then Rohit will become the payee. Similarly, if Harish Chander gets this promissory note discounted from the bank then the bank will become the payee.

Fig. 8.3Distinction between bills of exchange and promissory note

8.3 Advantages of Bill of Exchange

The bills of exchange as instruments of credit are used frequently in business because of the following advantages:

• Framework for relationships: A bill of exchange represents a device, which provides a framework for enabling the credit transaction between the seller/creditor and buyer/debtor on an agreed basis.

• Certainty of terms and conditions: The creditor knows the time when he would receive the money so also debtor is fully aware of the date by which he has to pay the money. This is due to the fact that terms and conditions of the relationships between debtor and creditor such as amount required to be paid; date of payment; interest to be paid, if any, place of payment are clearly mentioned in the bill of exchange.

• Convenient means of credit: A bill of exchange enables the buyer to buy the goods on credit and pay after the period of credit. However, the seller of goods even after extension of credit can get payment immediately either by discounting the bill with the bank or by endorsing it in favour of a third party.

• Conclusive proof:The bill of exchange is a legal evidence of a credit transaction implying thereby that during the course of trade buyer has obtained credit from the seller of the goods, therefore, he is liable to pay to the seller. In the event of refusal of making the payment, the law requires the creditor to obtain a certificate from the Notary to make it a conclusive evidence of the happening.

• Easy transferability: A debt can be settled by transferring a bill of exchange through endorsement and delivery.

8.4 Maturity of Bill

The term maturity refers the date on which a bill of exchange or a promissory note becomes due for payment. In arriving at the maturity date three days, known asdays ofgrace,must be added to the date on which the period of credit expires instrument is payable. Thus, if a bill dated March 05 is payable 30 days after date it, falls due on April 07, i.e., 33 days after March 05 If it were payable one month after date, the due date would be April 08, i.e., one month and 3 days after March 05. However, where the date of maturity is a public holiday, the instrument will become due on the preceding business day. In this case if April 08, falls on a public holiday then the April 07 will be the maturity date. But when an emergent holiday is declared under the Negotiable Instruments Act 1881, by the Government of India which may happen to be the date of maturity of a bill of exchange, then the date of maturity will be the next working day immediately after the holiday. For example, the Government declared a holiday on April 08 which happened to be the day on which a bill of exchange drawn by Gupta upon Verma for ₹20,000 became due for payment, Since April 08, has been declared a holiday under the Negotiable Instruments Act, therefore, April 09, will be the date of maturity for this bill.

8.5 Discounting of Bill

If the holder of the bill needs funds, he can approach the bank for encashment of the bill before the due date. The bank shall makes the payment of the bill after deducting some interest (called discount in this case). This process of encashing the bill with the bank is called discounting the bill. The bank gets the amount from the drawee on the due date.

8.6 Endorsement of Bill

Any holder may transfer a bill unless its transfer is restricted, i.e., the bill has been negotiated containing words prohibiting its transfer. The bill can be initially endorsed by the drawer by putting his signatures at the back of the bill along with the name of the party to whom it is being transferred. The act of signing and transferring the bill is calledendorsement.

8.7 Accounting Treatment

For the person who draws the bill of exchange and gets it back after its due acceptance, it is a bill receivable. For the person who accepts the bill, it is a bills payable. In case of a promissory note for the maker it is a bills payable and for the person in whose favour the promissory note is drawn it is a bills receivable. Bills receivables are assets and Bills payable are liabilities. Bills and Notes are used interchangeably.

8.7.1 In the Books of Drawer/Promissor

A bill receivable can be treated in the following four ways by its receiver.

1. He can retain it till the date of maturity, and

(a) get it collected on date of maturity directly, or

(b) get it collected through the banker.

2. He can get the bill discounted from the bank.

3. He can endorse the bill in favour of his Creditor.

The accounting treatment in the books of receiver under all the four alternatives is given below under the assumption that the bill is duly honoured on maturity by the acceptor.

(1) When the bill of exchange is retained by the receiver with him till date of its maturity:

On receiving the bill

Bills Receivable A/c Dr.

To Debtors A/c

On maturity of the bill

Cash/Bank A/c Dr.

To Bills Receivable A/c

However, when the bill of exchange is retained by the receiver with him and sent to bank for collection a few days before maturity, the following two entries are recorded:

On sending the bill for collection

Bills Sent for Collection A/c Dr.

To Bills Receivable A/c

On receiving the advice from the bank that the bill has been collected

Bank A/c Dr.

To Bills Sent for Collection A/c

(2) When the receiver gets the bill discounted from the bank:

On receiving the bill

Bills Receivable A/c Dr.

To Debtors A/c

On discounting the bill

Bank A/c Dr.

Discount A/c Dr.

To Bills Receivable A/c

On Maturity

No entry is recorded because the bill becomes the property of the bank, therefore, the bank collects the amount of the bill from the acceptor and no journal entry is recorded in the books of the drawer.

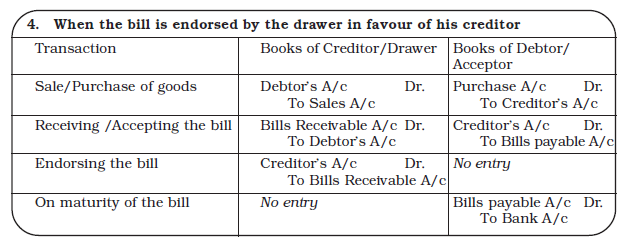

(3) When the bill is endorsed by the receiver in favour of his creditor:

On receiving the bill

Bills Receivable A/c Dr.

To Debtor’s A/c

On endorsing the bill

Creditor’s A/c Dr.

To Bills Receivable A/c

On Maturity

No entry is recorded because the bill has been transferred in favour of the creditor, therefore the creditor becomes its owner and will receive the payment on maturity. Hence, no entry is recorded in the books of drawer or endorser.

8.7.2 In the Books of Acceptor/Promissor

The following journal entries are recorded in the books of the acceptor or promisesor under all the four alternatives. It makes no difference whether the bill is retained discounted, endorsed or pledged.

On accepting the bill

Creditor’s A/c Dr.

To Bills Payable A/c

On Maturity of the bill

Bills Payable A/c Dr.

To Bank A/c

The journal entries to be recoded in the books of the drawer and the acceptor under all the four cases have been summarised below.

Illustration 1

Amit sold goods for ₹20,000 to Sumit on credit on Jan 01, 2017. Amit drew a bill of exchange upon Sumit for the same amount for three months. Sumit accepted the bill and returned it to Amit. Sumit met his acceptance on maturity. Record the necessary journal entries under the following circumstances:

(i) Amit retained the bill till the date of its maturity and collected directly

(ii) Amit discounted the bill @ 12% p.a from his bank

(iii) Amit endorsed the bill to his creditor Ankit

(iv) Amit retained the bill and on March 31, 2017 Amit sent the bill for collection to its bank. On April 05, 2017 bank advice was received.

Solution

Books of Amit

Journal

(i) When the bill was retained till its maturity.

| Date | Particulars | L.F. | Debit Amount ₹ | Credit Amount ₹ |

| 2017 Jan 01 | Sumit’s A/c Dr. To Sales A/c (Sold goods to Sumit’s on credit) | 20,000 | 20,000 | |

| Jan 01 | Bills Receivable A/c Dr. To Sumit’s A/c (Received Sumit’s acceptance payable after three months) | 20,000 | 20,000 | |

| Apr 05 | Bank A/c Dr. To Bills Receivable A/c (Sumit met his acceptance on maturity) | 20,000 | 20,000 |

(ii) When the bill was discounted from the book.

Journal

| Date | Particulars | L.F. | Debit Amount ₹ | Credit Amount ₹ |

| 2017 Jan 01 | Sumit’s A/c Dr. To Sales A/c (Sold goods to Sumit’s) | 20,000 | 20,000 | |

| Jan 01 | Bills Receivable A/c Dr. To Sumit’s A/c (Received Sumit’s acceptance three months) | 20,000 | 20,000 | |

| Jan 01 | Bank A/c Dr. Bank A/c Dr. To Bills Receivable A/c (Sumit’s acceptance discounted with the bank) | 19,400 600 | 20,000 |

(iii) When Amit endorsed the bill in favour of his creditor Ankit.

Journal

| Date | Particulars | L.F. | Debit Amount ₹ | Credit Amount ₹ |

| 2017 Jan 01 | Sumit’s A/c Dr. To Sales A/c (Sold goods to Sumit’s on credit) | 20,000 | 20,000 | |

| Jan 01 | Bills Receivable A/c Dr. To Sumit’s A/c (Received Sumit’s acceptance for three months) | 20,000 | 20,000 | |

| Jan 01 | Ankit’s A/c Dr. To Bills Receivable A/c (Sumit acceptance endorsed in favour of Ankit) | 20,000 | 20,000 |

(iv) When the bill was sent for collection by Amit to the bank.

Journal

| Date | Particulars | L.F. | Debit Amount ₹ | Credit Amount ₹ |

| 2017 Jan 01 | Sumit’s A/c Dr. To Sales A/c (Sold goods to Sumit’s on credit) | 20,000 | 20,000 | |

| Jan 01 | Bills Receivable A/c Dr. To Sumit’s A/c (Received Sumit’s acceptance payable after three months) | 20,000 | 20,000 | |

| Mar 31 | Bills Sent for Collection A/c Dr. To Bills Receivable A/c (Bills sent for collection) | 20,000 | 20,000 | |

| Apr 05 | Bank A/c Dr. To Bills sent for collection A/c (Bills sent for collection collected by the bank) | 20,000 | 20,000 |

The following journal entries will be made in the books of Sumit under all the four circumstances:

In the books of Sumit

Journal

| Date | Particulars | L.F. | Debit Amount ₹ | Credit Amount ₹ |

| 2017 Jan 01 | Purchases A/c Dr. To Amit’s A/c (Purchases goods from Amit on credit) | 20,000 | 20,000 | |

| Jan 01 | Amit’s A/c Dr. To Bill’s Payable A/c (Accepted bill drawn by Amit payable after three months) | 20,000 | 20,000 | |

| Apr 04 | Bills payable A/c Dr. To Bank A/c (Met acceptance maturity) | 20,000 | 20,000 |

Illustration 2

On March 15, 2017 Ramesh sold goods for ₹ 8,000 to Deepak on credit. Deepak accepted a bill of exchange drawn upon him by Ramesh payable after three months. On April, 15 Ramesh endorsed the bill in favour of his creditor Poonam in full settlement of her debt of ₹ 8,250. On May 15, Poonam discounted the bill with her bank @ 12% p.a. On the due date Deepak met the bill. Record the necessary journal entries in the books of Ramesh, Deepak, Poonam.

Books of Ramesh

Journal

| Date | Particulars | L.F. | Debit Amount ₹ | Credit Amount ₹ |

| 2017 Mar 15 | Deepak A/c Dr. To Sales A/c (Sold goods to Deepak on credit) | 8,000 | 8,000 | |

| Mar 15 | Bills Receivable A/c Dr. To Deepak A/c (Received Deepak’s acceptance for three months) | 8,000 | 8,000 | |

| Apr 15 | Poonam’s A/c Dr. To Bills Receivable A/c To Discount Received A/c (Bill endorsed in favour of Poonam in full settlement of her debt of ₹ 8,250) | 8,250 | 8,000 250 |

Book of Deepak

Journal

| Date | Particulars | L.F. | Debit Amount ₹ | Credit Amount ₹ |

| 2017 Mar 05 | Purchases A/c Dr. To Ramesh A/c (Sold goods to Deepak on credit) | 8,000 | 8,000 | |

| Mar 05 | Ramesh’s A/c Dr. To Bill’s Payable A/c (Accepted Ramesh’s draft payableafter three months) | 8,000 | 8,000 | |

| Jun 18 | Bills payable A/c Dr. To Bank A/c (Met the acceptance in favour of Rameshon maturity) | 8,000 | 8,000 |

Books of Poonam

Journal

| Date | Particulars | L.F. | Debit Amount ₹ | Credit Amount ₹ |

| 2017 Mar 15 | Bills Receivable A/c Dr. Discount Allowed A/c Dr. To Ramesh’s A/c (Ramesh endorsed Deepak’s acceptance in our favour for discharge his dept of ₹ 8,250 in full settlement) | 8,000 250 | 8,250 | |

| Mar 15 | Bank A/c Dr. Discount Allowed A/c Dr. To Bills Receivable A/c (Biils receivable encashed on maturity) | 7,920 80 | 8,000 |

8.8 Dishonour of a Bill

A bill is said to have been dishonoured when the drawee fails to make the payment on the date of maturity. In this situation, liability of the acceptor is restored. Therefore, the entries made on the receipt of the bill should be reversed. For example, Anju received bill of exchange duly accepted by Manju, which was dishonoured. The entries of dishonour will be as follows in the books of Anju (receiver):

When the bill was kept by Anju with her till maturity

Manju’s A/c Dr.

To Bill Receivables A/c

When the bill had been endorsed by Anju in favour of Sandhya

Manju’s A/cDr.

To Sandhaya’s A/c

When the bill was discounted by Anju with his bank

Manju’s A/cDr.

To Bank A/c

When the bill was sent for collection by Anju

Manju’s A/cDr.

To Bill Sent for Collection A/c

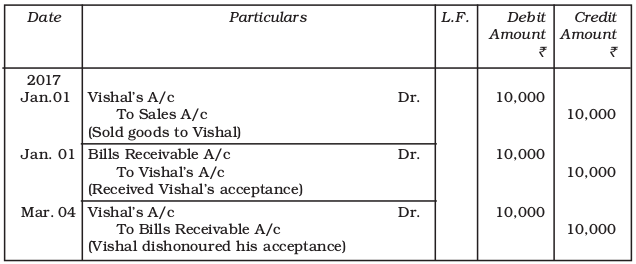

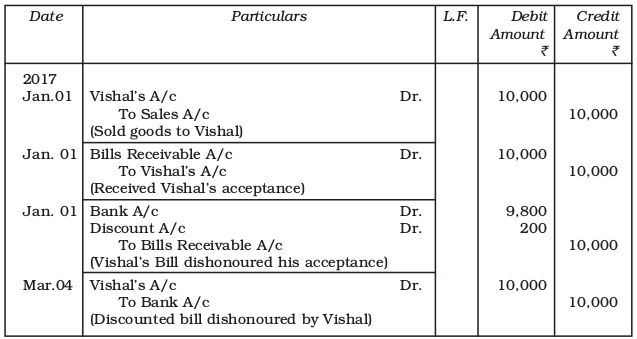

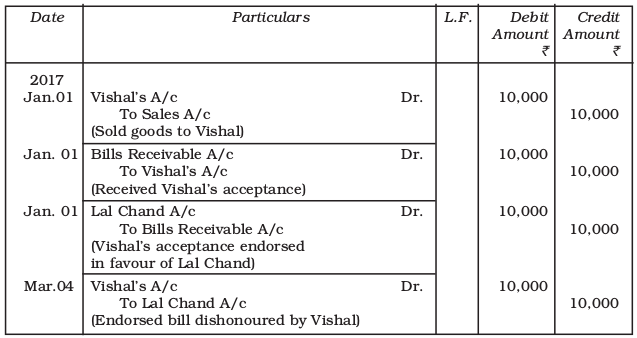

Illustration 3

On Jan 01, 2017 Shieba sold goods to Vishal for ₹ 10,000 and drew upon him a bill of exchange for 2 months. Vishal accepted the bill and returned it to Shieba. On the date of maturity the bill was dishonoured by Vishal. Record the necessary entries in all the cases listed below in the books of Shieba and Vishal:

(i) When the bill kept by Shieba till its maturity;

(ii) When the bill is discounted by Shieba for ₹ 200;

(iii) When the bill is endorsed to Lal Chand by Shieba.

Solution

(i) When the bill was kept by Shieba till its maturity.

Books of Shieba

Journal

(ii) When the bill was discounted by shieba

Journal

(iii) When the bill was endorsed by Shieba to Lal Chand

Journal

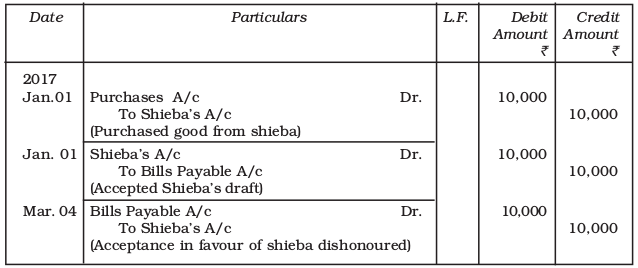

Whereas, in the book of Vishal, the following entries will be recorded

Books of Vishal

Journal

8.8.1 Noting Charges

A bill of exchange should be duly presented for payment on the date of its maturity. The drawee is absolved of his liability if the bill is not duly presented. Proper presentation of the bill means that it should be presented on the date of maturity to the acceptor during business working hou₹ To establish beyond doubt that the bill was dishonoured, despite its due presentation, it may preferably to begot notedby Notary Public. Noting authenticates the fact of dishonour. For providing this service, a fees is charged by the Notary Public which is calledNoting Charges.

The following facts are generally noted by the Notary:

•Date, fact and reasons of dishonour;

•If the bill is not expressly dishonoured, the reasons why he treats it as dishonoured and;

•The amount of noting charges.

The entries recorded for noting charges in the drawers book are as follows:

When Drawer himself pays

Drawee’s A/cDr.

To Cash A/c

Where endorsee pays

Drawee’s A/cDr.

To Endorsee A/c

When the bank pays on discounted bill

Drawee’s A/cDr.

To Bank A/c

When the bank pays in the event of sending the bill for collection to the bank

Drawee’s A/cDr.

To Bank A/c

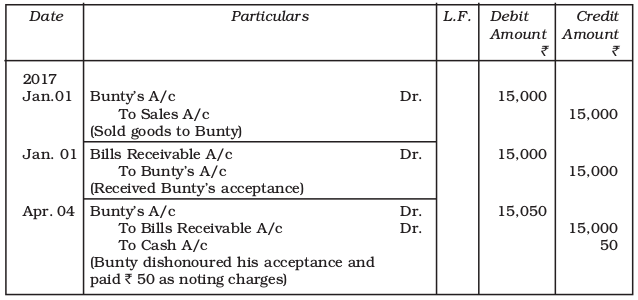

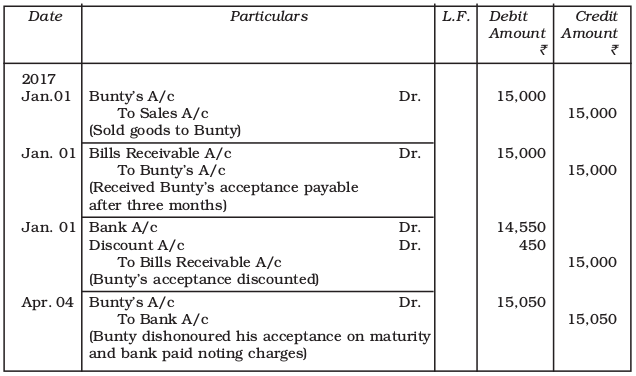

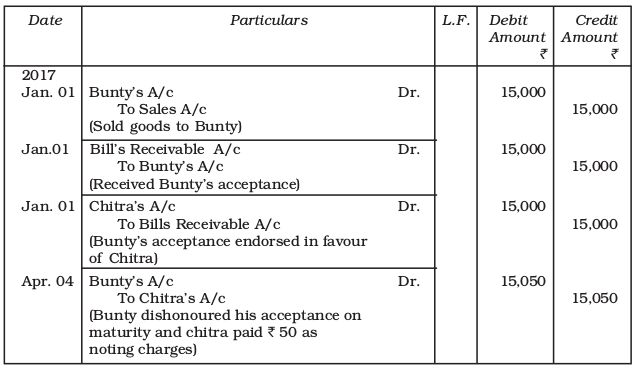

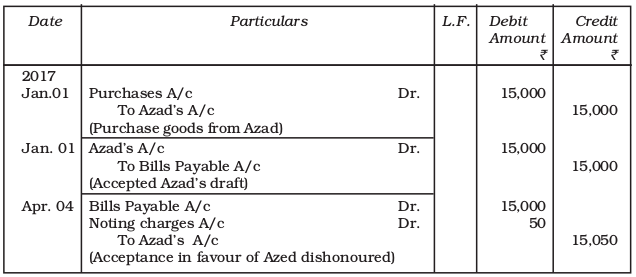

Itmay be noticed that whosoever pays the noting charges, ultimately these have to be borne by the drawee. That is why the drawee is invariably debited in the drawer’s books. This is because he is responsible for the dishonour of the bill and, hence, he has to bear these expenses. For recording the noting charges in his book the drawee opensNoting Charges Acccount. He debits the Noting Charges Account and credits theDrawer’s Account. For example, Azad sold goods for ₹ 15,000 to Bunty and immediately drew a bill upon him on Jan. 01, 2017 payable after 3 months. On maturity the bill was dishonoured and ₹ 50 were paid by the holder of the bill as noting charges. The journal entries will be recorded in the books of Azad and Bunty as given below under the following circumstances:

(a) When the bill was kept by Azad till maturity.

(b) When the bill was discounted by Azad with his bank immediately

@ 12% p.a.

(c) When the bill was endorsed by Azad in favour of his creditor Chitra.

In the books of Azad, entries will be recorded as:

(i) When the bill was retained till its maturity

Books of Azad

Journal

(ii) When the bill was discounted with the bank.

Journal

(iii) When the bill was endorsed to Chitra

Journal

The following journal entries will be made in the books of Bunty in all the three cases.

Book of Bunty

Journal

8.9 Renewal of the Bill

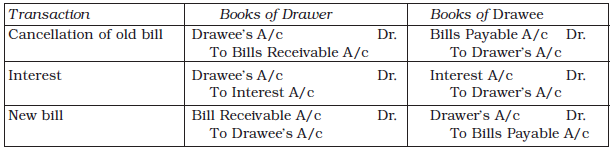

Sometimes, the acceptor of the bill foresees that it may be difficult to meet the obligation of the bill on maturity and may, therefore, approach the drawer with the request for extension of time for payment. If it is so, the old bill is cancelled and the fresh bill with new terms of payment is drawn and duly accepted and delivered. This is called renewal of the bill. Since the cancellation of bill is mutually agreed upon noting of the bill is not required.

The dreawee may have to pay interest to the drawer for the extended period of credit. The interest is paid in cash or may be included in the amount of the new bill. Sometimes, a part of the amount due may be paid and the new bill may be drawn only for the balance. For example, a bill of ₹ 10,000 is cancelled on a cash payment of ₹ 3,000 and acceptance of a new bill for the balance of ₹ 7,000 plus interest as agreed between the parties. The journal entries in the books of the drawer and the drawee will be the same as that of dishonour of bill. As for the interest invalued, if it is not paid in cash, the drawer debits the drawee’s account and credits the interest account, and the drawee debits the interest and credits the drawer’s account in his books.

The journal entries recorded in case of renewal for the cancellation of the old bill, for interest and for the acceptance of the new bill in the books of the drawer and drawee are given below:

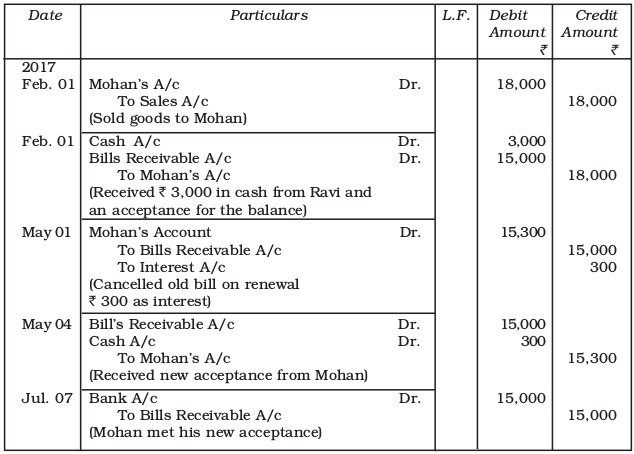

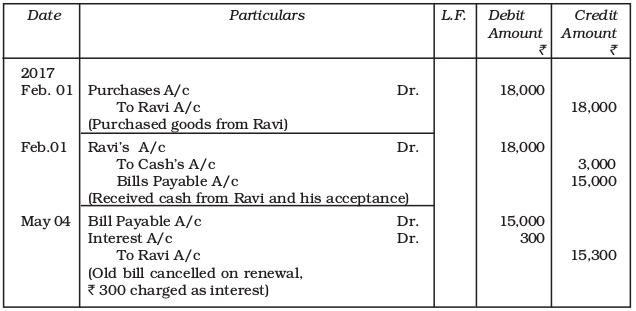

For example on February 01, 2017 Ravi sold goods to Mohan for ₹18,000; ₹ 3,000 were paid by Mohan immediately and for the balance he accepted three months bill drawn upon him by Ravi. On the date of maturity of the bill Mohan requested Ravi to cancel the old bill and a new bill upon him for a period of 2 months. He further agreed to pay interest in cash to Ravi @ 12% p.a. Ravi agreed to Mohan’s request and cancelled the old bill and drew a new bill. The new bill was met on maturity by Mohan. In this case, the following entries will be recorded in the books of Ravi and Mohan.

Books of Ravi

Journal

8.10 Retiring of the Bill

There are instances when a bill of exchange is arranged to be retired before the due date by mutual understanding between the drawer and the drawee. This happens when the drawee of the bill has funds at his disposal and makes a request to the drawer or holder to accept the payment of the bill before its maturity. If the holder agrees to do so, the bill is said to have beenretired.

The retiring of a bill draws a curtain on the bill transactions before the expiry of its normal term. To encourage the retirement of the bill, the holder allows some discount calledRebate on billsfor the period between date of retirement and maturity. The rebate is calculated at a certain rate of interest.

The accounting treatment on the retirement of a bill is similar to the accounting treatment when a bill is honoured by the acceptor on the due date in the ordinary course. The only difference between the two relates to the granting of rebate. The following journal entries are recorded:

In the books of the holder

On retiring the acceptance and rebate allowed

Cash A/c Dr.

Rebate on bills A/cDr.

To Bills Receivables A/c

In the books of the drawee

Bills Payable A/cDr.

Cash A/cDr.

To Rebate on Bills A/c

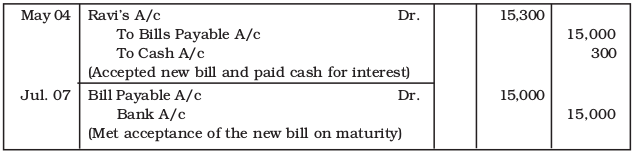

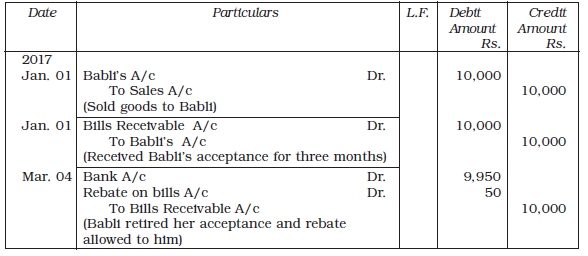

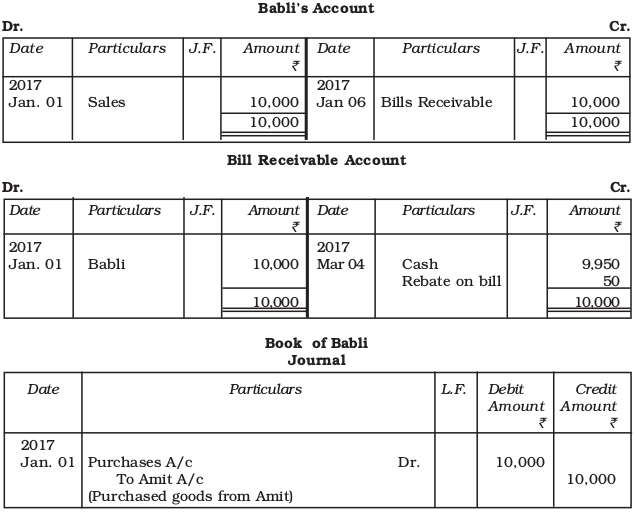

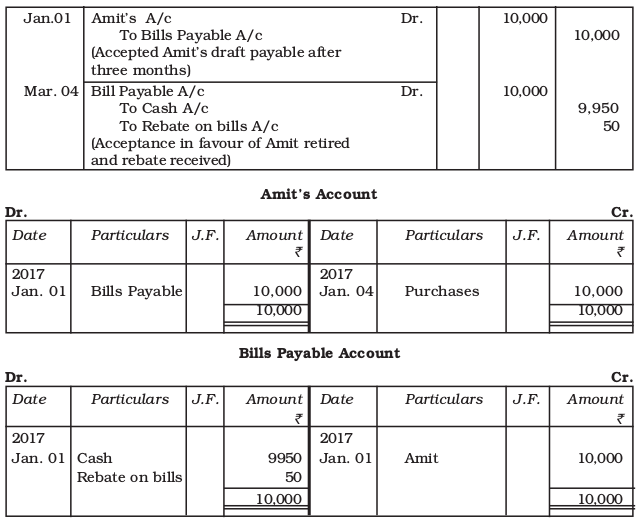

Amit sold goods ₹ 10,000 to Babli on Jan. 01, 2015 and immediately drew a bill on Babli for three month for the same amount, Babli accepted the bill and returned it to Amit. On March 04, 2017 Babli retired her acceptance underrebate of 6% per annum.

In the books of Amit

Journal

The recorded entries will be posted to the following ledger acounts

Illustration 4

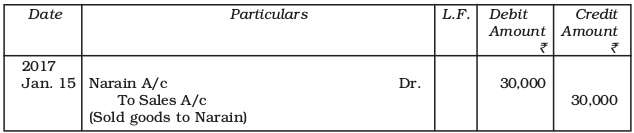

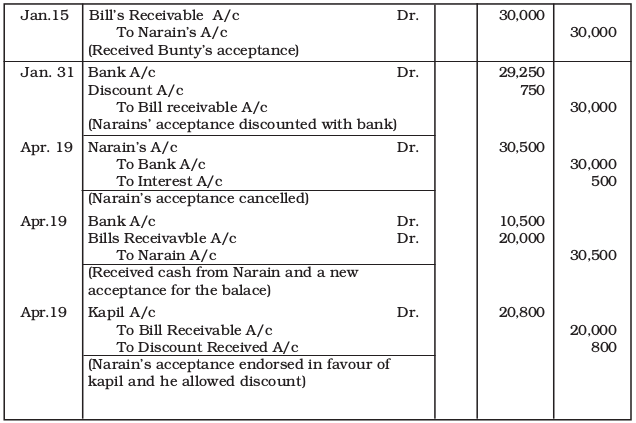

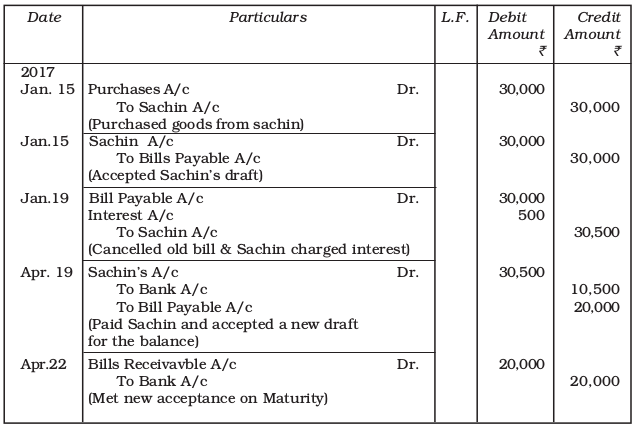

On Jan. 15, 2017 Sachin sold goods ₹30,000 to Narain and drew upon the later a bill for the same amount payable after 3 months. The bill was accepted by Narain. The bill was discounted by Sachin from his bank for ₹29,250 on Jan. 31, 2017. on maturity the bill was dishonoured. He further agreed to pay ₹10,500 in cash including ₹ 500 interest and accept a new bill for two months for the remaining ₹20,000.

The new bill was endorsed by sachin in favour of his creditor Kapil for settling a debt of ₹ 20,800. The new bill was duly met by Narain on maturity.

Record the necessary journal entries in the books of Sachin and Narain.

Solution

Books of Sachin

Journal

Books of Narain

Journal

Illustration 5

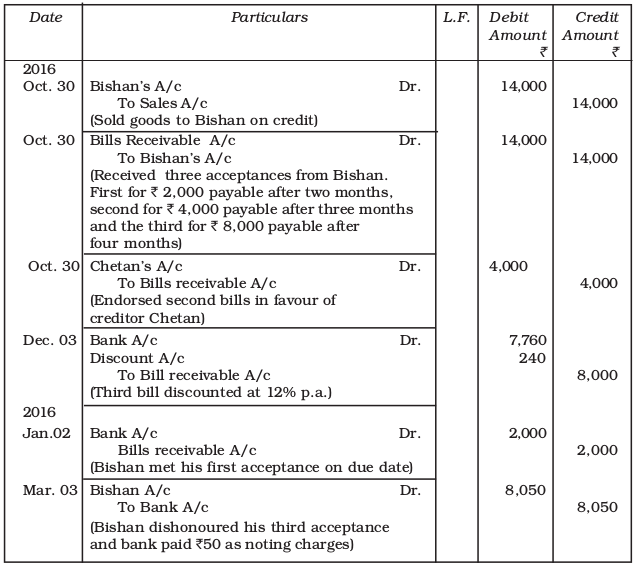

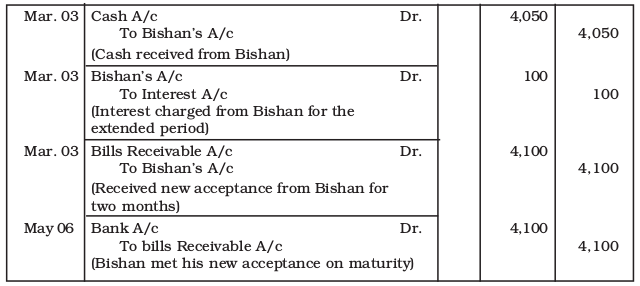

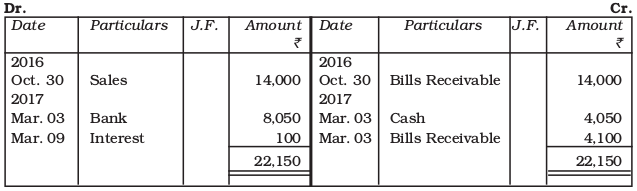

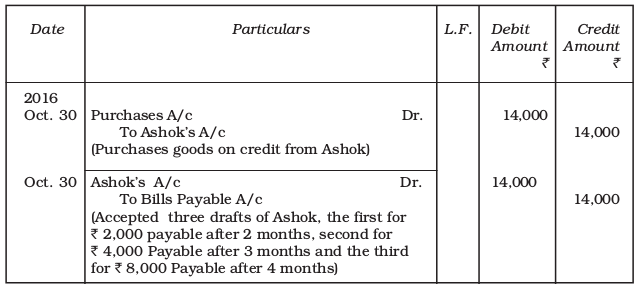

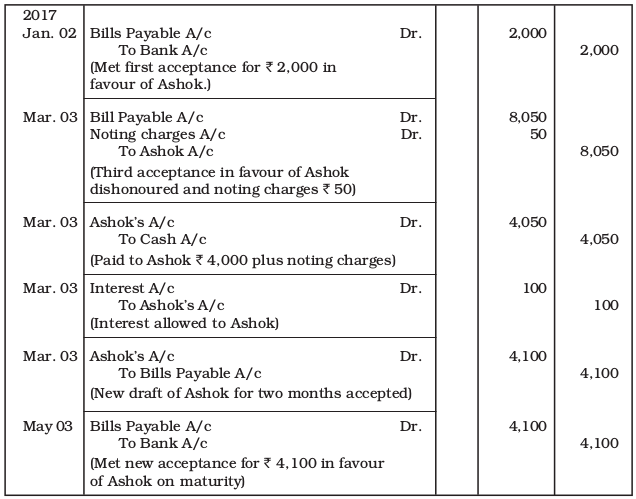

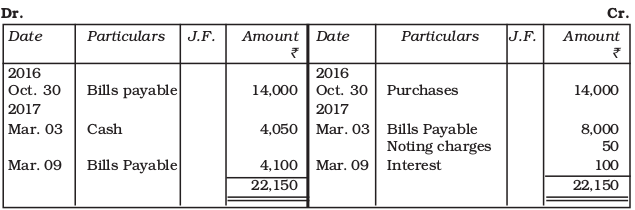

Ashok sold goods ₹14,000 to Bishan on October 30, 2016 and drew three bills for ₹2,000, ₹4,000 & ₹8,000 payable after two, three, and four months respectively. The first bill was kept by Ashok with him till maturity. He endorsed the second bill in favour of his creditor Chetan. The third bill was discounted on December 03, 2016 at 12% p.a. The first and second bills were duly met on maturity but the third bill was dishonoured and the bank paid ₹50 as noting charges. On March 03, 2017 Bishan paid ₹4,000 and noting charges in cash and accepted a new bill at two months after date for the balance plus interest ₹100. The new bill was met on maturity by Bishan.

You are required to give the journal entries in the books of both Ashok ans Bishan and prepare Bishan’s account in Ashok’s books and Ashok’s account in Bishan’s books.

Solution

Books of Ashok

Journal

Bishan’s Account

Books of Bishan

Journal

Ashok’s Account

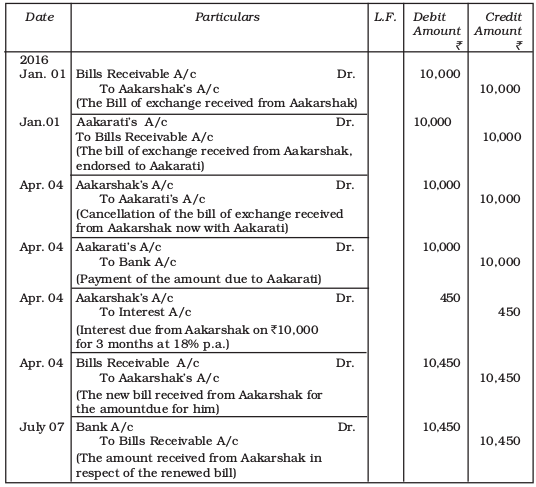

Illustration 6

Aashirwad draws on Aakarshak a Bill of exchange for 3 months for ₹10,000 which Aakarshak accepts on January 01, 2016. Aashirwad endorses the bill in favour of Aakarti. Before maturity Aakarshak approaches Aashirwad with the request that the bill be renewed for a further period of 3 months at 18 per cent per annum interest. Aashirwad pays the sum to Aakriti on the due date and agrees to the proposal of Aakarshak. Record journal entries in the books of Aashirwad, assuming that the second bill is duly met.

Solution

Book of Ashirwad

Journal

Illustration 7

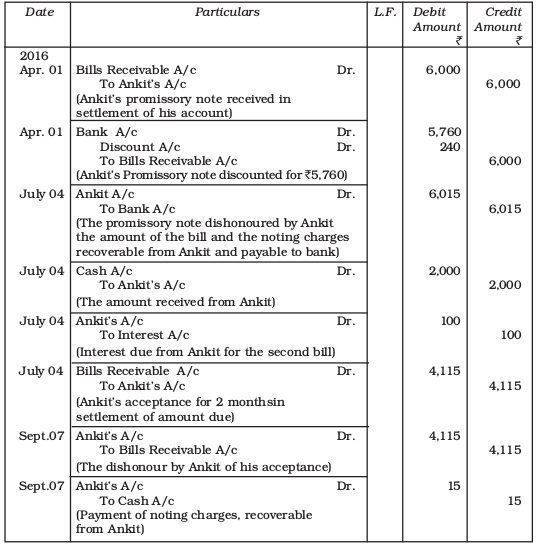

Ankit owes Nikita a sum of ₹6,000. On April 01, 2016 Ankit gives a promissory note for the amount for 3 months to Nikita who gets it discounted with her bankers for ₹5,760. on the due date the bill is dishonoured, the bank paid ₹15 as noting charges. Ankit then pays ₹2,000 in cash and accepts a bill of exchange drawn on him for the balance together with ₹100 as interest. This bill of exchange is for 2 months and on the due date the bill is again dishonoured, Nikita paid ₹15 as noting charges.

Draft the journal entries to be recorded in Nikita’s books.

Solution

Books of Nikita

Journal

Illustraion 8

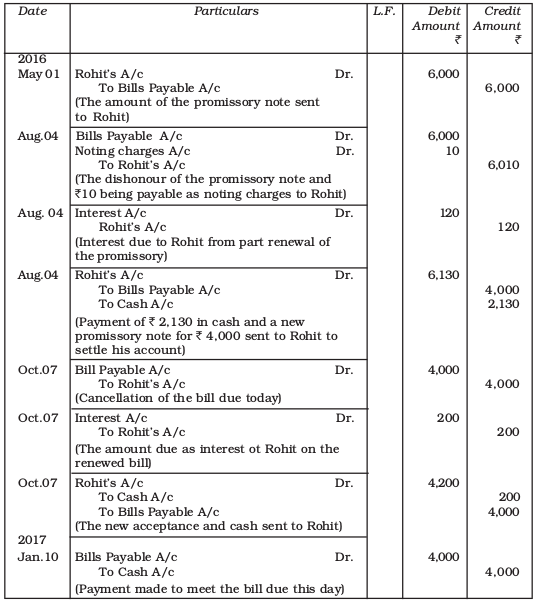

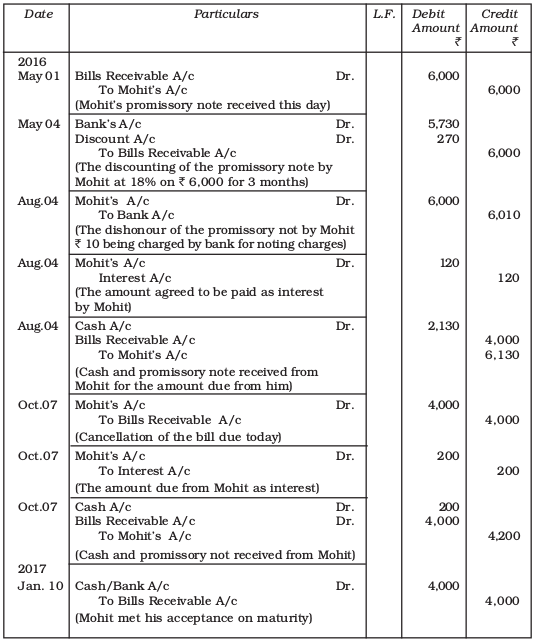

On May 01, 2016 Mohit sends his promissory note of ₹ 6000 for 3 months to Rohit. Rohit gets it discounted with his bankers at 18 percent per annum on May 04. On the due date the bill is dishonoured, the bank paying ₹10 as noting charges. Rohit agrees to accept ₹2,130 in cash (including ₹130 for noting charges and interest) and another promissory note for ₹4,000 at 2 months. On the due date, Mohit approaches Rohit again and asks for renewal of the bill for a further period of 3 months. Rohit agrees to the request, provided Mohit pays ₹200 as interest in cash. This last bill is paid on maturity.

Draft journal entries in the books of Mohit and Rohit.

Solution

Books of Mohit

Journal

Book of Rohit

Journal

Test Your Understanding - II

Fill in the blanks:

(i) A bill of exchange is a____________________instrument.

(ii) A bill of exchange is drawn by the ________________upon his___________.

(iii) A promissory note is drawn by ______________in favour of his__________.

(iv) There are ____________________parties to a bill of exchange.

(v) There are ____________________parties to a promissory note.

(vi) Drawer and ______________can not be the same parties in case of a bill of exchange.

(vii) Bill of exchange in India languages is called _____________

(viii)__________days of grace are added in terms of the bill to calculate the date of its__________.

Key Terms Introduced in the Chapter

(a) Drawer

(b) Drawee

(c) Payee

(d) Bill Receivable

(e) Bill Payable

(f) Drawing of a Bill

(g) Acceptance of a Bill

(h) Payment of a bill

Summary with Reference to Learning Objectives

1. Bill of exchange as an Instrument :A bill of exchange is a device by which the purchaser or debtor in a credit transaction is not required tomake immediate payment but satisfies the seller or creditor by accepting in writing the liability to pay the amount due from him.

2. Meaning of bill of exchange and promissory note:A bill of exchange is an acknowledgement of debt given by one person to another, incorporating all the terms and conditions of payments. A promissory note is an undertaking in writing given by the debtor to the creditor to pay the latter a certain sum of money in accordance with the conditions stated therein.

3. Difference between a bill and a note.

(a) A bill is prepared by the creditor and accepted by the debtor; a note

is prepared by the debtor.

(b) There are three parties to a bill; there are only two parties to a note.

(c) A bill requires acceptance to acquire financial status; a note in

itself has financial status.

4. Features and advantages of a bill :A bill is a written unconditional order; it is signed by the creditor and accepted by the debtor; the amount of the bill is payable either on demand or at a fixed period.

Questions for Practice

Short Answers

1. Name any two types of commonly used negotiable instruments.

2. Write two points of distinction between bills of exchange and promissory note.

3. State any four essential features of bill of exchange.

4. State the three parties involved in a bill of exchange.

5. What is meant by maturity of a bill of exchange?

6. What is meant by dishonour of a bill of exchange?

7. Name the parties to a promissory note

8. What is meant by acceptance of a bill of exchange?

9. What is Noting of a bill of exchange.

10. What is meant by renewal of a bill of exchange?

11. Give the performa of a Bills Receivable Book.

12. Give the performa of a Bills Payable Book.

13. What is retirement of a bill of exchange?

14. Give the meaning of rebate.

15. Give the performa of a Bill of Exchange.

Long Answers

1. A bill of exchange must contain “an unconditional promise to pay” Do you agree with a statement?

2. Briefly explain the effects of dishonour and noting of a bill of exchange.

3. Explain briefly the procedure of calculating the date of maturity of a bill of exchange? Give example.

4. Distinguish between bill of exchange and promissory note.

5. Briefly explain the purpose and benefits of retiring a bill of exchange to the debtor and the creditor.

6. Explain briefly the purpose and advantages of maintaining of a Bills Receivable Book.

7. Briefly explain the benefits of maintaining a Bills Payable Book and state how is its posting is done in the ledger?

Numerical Questions

1. On Jan 01, 2016 Rao sold goods ₹10,000 to Reddy. Half of the payment was made immediately and for the remaining half Rao drew a bill of exchange upon Reddy payable after 30 days. Reddy accepted the bill and returned it to Rao. On the due date Rao presented the bill to Reddy and received the payment.

Journalise the above transactions in the books Rao and prepare of Rao’s account in the books of Reddy.

2. On Jan 01, 2016, Shankar purchased goods from Parvati for ₹8,000 and immediately drew a promissory note in favour of Parvati payable after 3 months. On the date of maturity of the promissory note, the Government of India declared holiday under the Negotiable Instrument Act 1881. Since, Parvati was unaware about the provision of the law regarding the date of maturity of the bill, she handed over the bill to her lawyer, who duly presented the bill and received the payment. The amount of the bill was handed over by the lawyer to Parvati immediately. Recore the necessary Journal entries in the books of Parvati and Shankar.

3. Vishal sold goods for ₹7,000 to Manju on Jan 05, 2016 and drew upon her a bill of exchange payable after 2 months. Manju accepted Vishal’s draft and handed over the same to Vishal after acceptance. Vishal immediately discounted the bill with his bank@12% p.a. On the duedate Manju met her acceptance.

Journalise the above transactions in the books of Vishal and Manju.

4. On Feb 01, 2016, John purchased goods for ₹15,000 from Jimmi. He immediately made a payment of ₹5,000 by cheque and for the balance accepted the bill of exchange drawn upon him by Jimmi. The bill of exchange was payable after 40 days. Five days before the maturity of the bill, Jimmi sent the same to his bank for collection. The bank duly presented the bill to John on the due date who met the bill. The bank informed the same to Jimmi.

Prepare John’s account in the books of Jimmi and Jimmi account in the books of John.

5. On Jan 15, 2015, Kartar Sold goods for ₹30,000 to Bhagwan and drew upon him three bills of exchanges of ₹10,000 each payable after one month, two month, and three months respectively. The first bill was retained by Kartar till its maturity. The second bill was endorsed by him in favour of his creditor Ratna and the third bill was discounted by him immediately @ 6% p.a. All the bills were met by Bhagwan. Journalise the above transactions in the books of Kartar and Bhagwan. Also prepare ledger accounts in books of Kartar and Bhagwan.

6. On Jan. 01, 2016 Arun sold goods for ₹30,000 to Sunil. 50% of the payment was made immediately by Sunil on which Arun allowed a cash discount of 2%. For the balance Sunil drew a promissory note in favour of Arun payable after 20 days. Since, the date of maturity of bill was a public holiday, Arun presented the bill on a day, as per the provisions of Negotiable Instrument Act which was met by Sunil. State the date on which the bill was presented by Arun for payment and Jounalise the above transactions in the books of Arun and Sunil.

7. Darshan sold goods for ₹ 40,000 to Varun on 8.1.2016 and drew upon him a bill of exchange payable after two months. Varun accepted the bill and returned the same to Darshan. On the due date the bill was met by Varun. Record the necessary Journal entries in the books of Darshan and Varun in the following circumstances.

•When the bill was retained by Darshan till the date of its maturity.

•When Darshan immediately discounted the bill @ 6% p.a. withhis bank.

•When the bill was endorsed immediately by Darshan in favour ofhis creditor Suresh.

•When three days before its maturity, the bill was sent by Darshanto his bank for collection.

8. Bansal Traders allow a trade discount of 10% on the list price of the goods purchased from them. Mohan traders, who runs a retail shop made the following purchases from Bansal Trade₹

Date Amount (₹)

Dec. 21, 2016 1,000

Dec. 26, 2016 1,200

Dec. 18, 2016 2,000

Dec. 31, 2016 5,000

For all the purchases Mohan Traders drew promissory note in favour of Bansal Traders payable after 30 days. The promissory note for the sale of Dec. 21, 2016 was retained by Bansal Traders with them till the date of its maturity. The promissory note drawn on 26.12.2016 was discounted by Bansal Traders from their bank at 12% p.a. The promissory note drawn on Dec. 28, 2016 was endorsed by Bansal Traders in favour of their creditor Dream Soaps in full settlement of a purchase amounting to ₹ 1,900. On 25.1.2017 Bansal Traders sent the promissory note drawn on Dec. 31, 2016 to their bank for collection. All the promissory notes were met by Mohan Trade₹ Record the necessary journal entries for the above transactions in the books of Bansal Traders and Mohan Traders and prepare Mohan Traders account in the books of Bansal Traders and Bansal Traders account in the books of Mohan Trade₹

9.Narayanan purchased goods for ₹25,000 from Ravinderan on Feb. 01, 2016. Ravinderan drew upon Narayanan a bill of exchange for the same amount payable after 30 days. On the due date Narayanan dishonoured his acceptance.

Record the necessary journal entries in the books of Ravinderan and Narayanan in following cases:

•When the bill was retained by Ravinderan with him till the date ofits maturity.

•When the bill was discounted by Ravinderan immediately with hisbank @ 6% p.a.

•When the bill was endorsed to his creditor Ganeshan.

•When the bill was sent by Ravinderan to his bank for collection afew days before it maturity.

10.Ravi sold goods for ₹40,000 to Sudershan on Feb 13, 2016. He drew four bills of exchange upon Sudershan. The first bill was for ₹5,000 payable after one month. The second bill was for ₹10,000 payable after 40 days; the third bill was for ₹12,000 payable after three months and fourth bill was for the balance amount payable after 19 days. Sudershan accepted all the bills and returned the same to Ravi. Ravi discounted the first bill with his bank at 6% p.a. He endorsed the second bill to his creditor Mustaq for the full settlement of a debt of ₹10,200. The third bill was kept by Ravi with him till the date of maturity. Five days before the maturity of the fourth bill, Ravi sent the bill to his bank for collection. All the four bills were dishounoured by Sudarshan on maturity. Sudershan settled Ravi’s claim in cash three days after the dishonour of each bill along with interest @ 12% p.a. for the terms of the bills.

You are requested to record the necessary journal entries in the books to Ravi, Sudershan, Mustaq and bank for the above transaction. Also prepare Sudershan’s account and Mustaq’s account in the books

of Ravi.

11. On Jan 01, 2016 Neha sold goods for ₹20,000 to Muskan and drew upon her a bill of exchange payable after two months. One month before the maturity of the bill Muskan approached Neha to accept the payment against the bill at a rebate @ 12% p.a. Neha agreed to the request of Muskan and Muskan retired the bill under the agreed rate of rebate.

Journalise the above transaction in the books of Neha and Muskan.

12. On Jan 15, 2016 Raghu sold goods worth ₹ 35,000 to Devendra and drew upto the latter three bills of exchanges. The first bill was for ₹5,000 payable after one month, the second bill was for ₹20,000 payable after three months and third bill for balance amount for 4 months. Raghu endorsed the first bill in favour of his creditor Dewan in full settlement of a debt of ₹5,200. The second bill was discounted by Raghu @ 6 % p.a. and the third bill was retained by Raghu till the date of maturity. Devendra dishonoured the bill on maturity and the bank paid ₹ 30 as noting charges. Four days before the maturity of the third bill Raghu, sent the same for collection to his bank. The third bill was also dishonored by Devendra and the bank paid ₹200 as noting charges. Five days after the dishonour of the bill Devendra paid the entire amount due to Raghu along with interest ₹1,000 for this purpose Devendra obtained a short term loan from his bank.

You are requested to record the necessary journal entries in the books of Raghu Devendra and Dewan and also prepare Devendra’s account in Raghu’s books and Raghu’s account in Devendra’s account.

13. Viaml purchased goods ₹25,000 from Kamal on Jan 15, 2016 and accepted a bill of exchange drawn upon him by Kamal payable after two months. On the date of the maturity the bill was duly presented for payment. Vimal dishonoured the bill.

record the necessary journal entries in the books of Kamal and Vimal when.

•The bill was retained by Kamal till the date of its maturity.

•The bill was immediately discounted by Kamal with his bank @ 6% p.a.

•The bill was endorsed by Kamal in favour of his creditor Sharad.

•Five days before its maturity the bill was sent by Kamal to his bankfor collection.

14. Abdulla sold goods to Tahir on Jan 17, 2017 for ₹18,000. He drew a bill of exchange for the same amount on Tahir for 45 days. On the same date Tahir accepted the bill and returned it to Abdulla. On the due date Abdulla presented the bill to Tahir which was dishonoured. Abdulla paid ₹40 as noting charges. Five days after the dishonour of his acceptance Tahir settled his debt by making a payment of ₹18,700 including interest and noting charges.

Record the necessary journal entries in the books of Abdulla and Tahir. Also prepare Tahir’s account in the books of Abdulla and Abdulla’s account in the books of Tahir.

15. Asha sold goods worth ₹19,000 to Nisha on March 02, 2017. ₹4,000 were paid by Nisha immediately and for the balance she accepted a bill of exchange drawn upon her by Asha payable after three months. Asha discounted the bill immediately with her bank. On the due date Nisha dishonoured the bill and the bank paid ₹30 as noting charges.

Record the necessary journal entries in the books of Asha and Nisha.

16. On Feb. 02, 2017, Verma purchased from Sharma goods for ₹17,500. Verma paid ₹2,500 immediately and for the balance gave a promissory note to Sharma payable after 60 days. Sharma immediately endorsed the promissory note in favour of his creditor.

Gupta for the full settlement of a debt of ₹15,400. On the due date of the bill Gupta presented the bill to Verma which the latter dishonoured and Gupta paid ₹5,000 noting charges. On the same date Gupta informed Sharma about the dishonour of the bill. Sharma settled his debt to Gupta by cheque for ₹15,500 which includes noting charges and interest. Verma settled Sharma’s claim by cheque for the same amount.

Record the necessary journal entries is the books of Sharma, Gupta and Verma for the above transaction and prepare Verma’s and Gupta’s accounts in the books of Sharma. Sharma’s account in the books of Verma. And also Sharma’s account in the books of Gupta.

17. Lilly sold goods to Methew on 1.3.2017 for ₹12,000 and drew upon Methew a bill of exchange for the same amount payable after two months. Lilly immediately discounted the bill with her bank at 9% p.a. The maturity date of the bill was a non business day (holiday), therefore, Lilly had to present the bill as per the provisions of the Indian Instruments Act.1881. The bill was dishonoured by Methew and Lilly paid ₹45 as noting charges. Methew settled the claim of Lilly five days after the disonour of the bill by a cheque, whch includes interest @ 12% for the term of the bill.

Journalise the above transactions in the books of Lilly and Methew and prepare Mathew’s account in the books of Lilly and Lilly’s account in the books of Mathew.

18. Kapil purchased goods for ₹21,000 from Gaurav on 1.2.2017 and accepted a bill of exchange drawn by Gaurav for the same amount. The bill was payable after one month. On 25.2.2017 Gaurav sent the bill to his bank for collection. The bill was duly presented by the bank. Kapil dishonoured the bill and the bank paid ₹100 as noting charges.

Record the necessary journal entries for the above transactions in the books of Kapil and Gourav.

19. On Feb. 14, 2017 Rashmi sold good ₹7,500 to Alka. Alka paid ₹500 in cash and for the bank balance accepted a bill of exchange drawn upon her by Rashmi payable after two months. On Apr.10, 2017 Alka approached Rashmi to cancel the bill since she was short of funds. She further requested Rashmi to accept ₹2,000 in cash and draw a new bill for the balance including interest ₹500. Rashmi accepted Alka’s request and drew a new bill for the amount due payable after 2 months. The bill was accepted by Alka. The new bill was duly met by Alka on maturity.

Record the necessary journal entries in the books of Rashmi and Alka and prepared Alka’s account in the books of Rashmi’s and Rashmi’s account in the books of Alka’s

20. Nikhil sold goods for ₹23,000 to Akhil on Dec. 01, 2017. He drew upon Akhil a bill of exchange for the same amount payable after 2 months. Akhil accepted the bill and sent it back to Nikhil. Nikhil discounted the bill immediately with his bank @12 p.a. On the due date Akhil dishonoured the bill of exchange and the bank paid ₹100 as noting charges. Akhil requested Nikhil to draw a new bill upon him with interest @10% p.a. which he agreed. The new bill was payable after two months. A week before the maturity of the second bill Akhil requested Nikhil to cancel the second bill. He further requested to accept ₹10,000 in cash immediately and drew a third bill upon him including interest of ₹500. Nikhil agreed to Akhil’s request. The third bill was payable after one month. Akhil met the third bill on its maturity. record the necessary journal entries in the books of Nikhil and Akhil and also prepare Akhil’s account in the books of Nikhil and Nikhil’s account in the books of Akhil.

21. On Jan 01, 2017 Vibha sold goods worth ₹18,000 to Sudha and drew upon the latter a bill of exchange for the same amount payable after two months. Sudha accepted Vibha’s draft and returned the same to Vibha after acceptance. Vibha endorsed the bill immediately in favour of her creditor Geeta. Five days before the maturity of the bill Sudha requested Vibha to cancel the bill since she was short of funds. She further requested to draw a new bill upon her including interest of ₹200. Vibha accepted Sudha’s request. Vibha took the bill from Geeta by making the payment to her in cash and cancelled the same. Then she drew a new bill upon Sudha as agreed. The new bill was payable after one month. The new bill was duly met by Sudha on maturity. Record the necessary journal entries in the books of Vibha.

22. Following was the position of debtor and creditor of Gautam as on 1.1.2017.

Debtors Creditors

₹ ₹

Babu 5,000 -

Chanderkala 8,000 -

Kiran 13,500 -

Anita 14,000 -

Anju - 5,000

Sheiba - 12,000

Manju - 6,000

The following transactions took place in the month of Jan 2017:

Jan 2

Drew on Babu at two months after date at full settlement for ₹4,800. Babu accepted the bill and returned it on 5.1.2017 .

Jan. 04

Babu’s bill discounted for ₹4,750.

Jan. 08

Chanderkala sent a promissory note for ₹8,000 payable three months after date.

Jan. 10

Promissory note received from Chanderkala discounted for ₹7,900.

Jan. 12

Accepted Sheiba draft for the amount due payable two months after date.

Jan. 22

Anita sent his promissory note payable after two months.

Jan. 23

Anita’s promissory note endorsed in favour of Manju.

Jan. 25

Accepted Anju’s draft payable after three months.

Jan. 29

Kiran sent ₹2,000 in cash and a promissory note for the balance payable after three months.

Record the above transactions in the proper subsidiary books.

23. On Jan. 01, 2017 Harsh accepted a months bill for ₹ 10,000 drawn on him by tanu for latter’s benefit. Tanu discounted the bill on same

day @ 8% p.a On the due date tanu sent a cheque to Harsh for honour the bill. Harsh duly honoured his acceptance.

Record the journal entries in the Books of Tanu and Harsh.

Checklist to test Your Understanding

Test your understanding-I

(i) False (ii) True (iii) False (iv) False (v) True

(vi) False (vii) True (viii) False (ix) False (x) False

Test Your Understanding-II

(i)Promisee (ii) Endorsement (iii) Promissor (iv) Endorser

Test Your Understanding-III

(i) Negotiable, (ii) Drawer, Drawee (iii) Debtor, Creditor (iv)Three

(v) Two. (vi) Drawee (vii) Hundi (viii) 3, Maturity