Table of Contents

10

Financial Statements - II

In chapter 9, you learnt about the preparation of simple final accounts in the format of trading and profit and loss account and balance sheet. The preparation of simple final accounts pre-supposes the absence of any accounting complexities which are normal to business operations. These complexities arise due to the fact that the process of determining income and financial position is based on the accrual basis of accounting. This emphasises that while ascertaining the profitability, the revenues be considered on earned basis and not on receipt basis, and the expenses be considered on incurred basis and not on paid basis. Hence, many items need some adjustment while preparing the financial statements. In this chapter we shall discuss all items which require adjustments and the way these are brought into the books of account and incorporated in the final accounts.

Learning Objectives

After studying this chapter, you will be able to :

• describe the need for adjustments while preparing the financial statements;

• explain the accounting treatment of adjustments for outstanding and prepaid expenses, accrued and advance receipts of incomes;

• discuss the adjust-ments to be made regarding deprecia-tion, bad debts, provision for doubtful debts, provision for discount on debtors;

• explain the concepts and adjustment of manager’s commission and interest on capital;

• prepare profit and loss account and balance sheet with adjustments.

10.1 Need for Adjustments

According to accrual concept of accounting, the profit or loss for an accounting year is not based on the revenues realised in cash and the expenses paid in cash during that year. There may exist some receipts and expenses in the current year which partially relate to the previous year or to the next year. Also, there may exist incomes and expenses relating to the current year that still need to be brought into books of account. Such items duly adjusted, the final accounts will not reflect the true and fair view of the state of affairs of the business.

For example, an amount of Rs. 1,200 paid on July 01, 2016 towards insurance premium. Any general insurance premium paid usually covers a period of 12 months. Suppose the accounting year ends on March 31, 2017, it would mean that one fourth of the insurance premium is paid on July 01, 2016 relate to the next accounting year 2017-18. Therefore, while preparing the financial statements for 2016-17, the expense on insurance premium that should be debited to the profit and loss account is Rs. 900 (Rs. 1,200 – Rs. 300).

Let us take another example. The salaries for the month of March, 2017 were paid on April 07, 2017. This means that the salaries account of 2016-17 does not include the salaries for the month of March 2017. Such unpaid salaries is termed as salaries outstanding which have to be brought into books of account and is debited to profit and loss account along with the salaries already paid for the month of April, 2016 up to Feburary, 2017.

Similarly, adjustments may also become necessary in respect of certain incomes received in advance or those which have accrued but are still to be received. Apart from these, there are certain items which are not recorded on day-to-day basis such as depreciation on fixed assets, interest on capital, etc. These are adjusted at the time of preparing financial statements. The purpose of making various adjustments is to ensure that the final accounts reveal the true profit or loss and the true financial position of the business. The items which usually need adjustments are:

1. Closing stock

2. Outstanding/expenses

3. Prepaid/Unexpired expenses

4. Accrued income

5. Income received in advance

6. Depreciation

7. Bad debts

8. Provision for doubtful debts

9. Provision for discount on debtors

10. Manager’s commission

11. Interest on capital

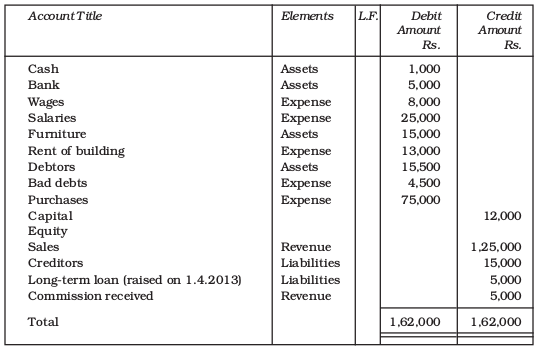

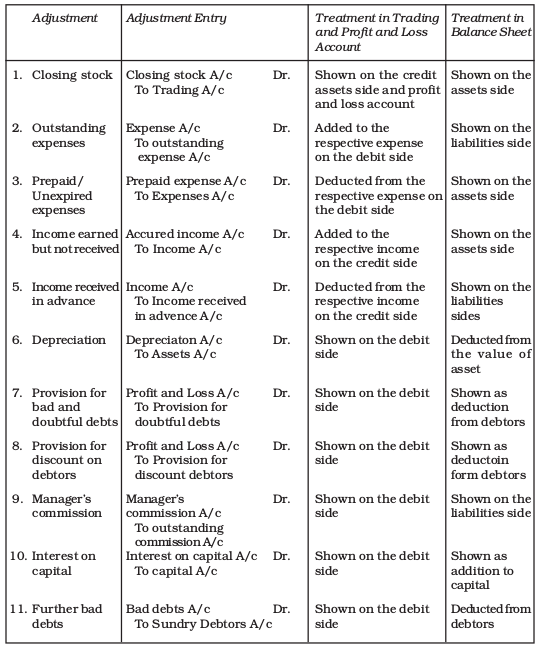

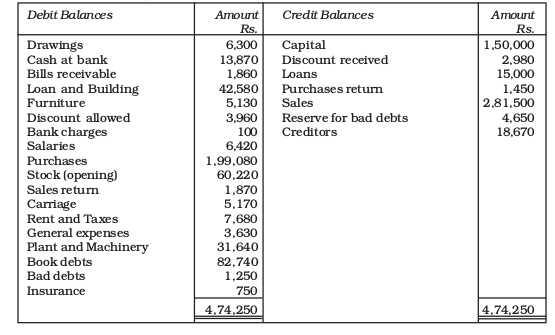

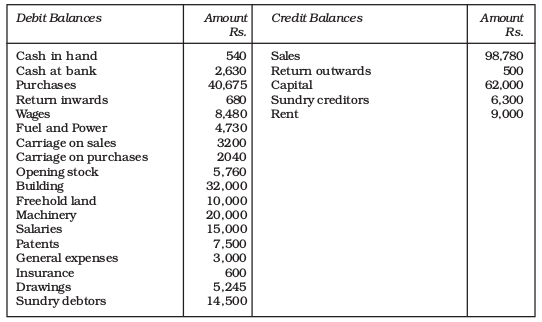

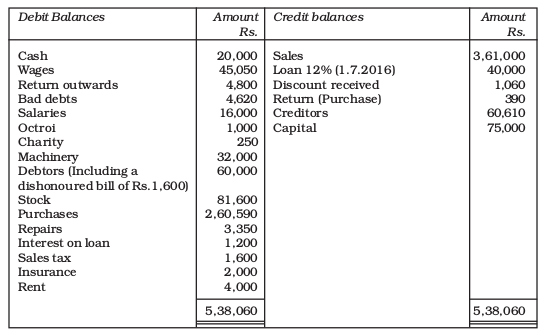

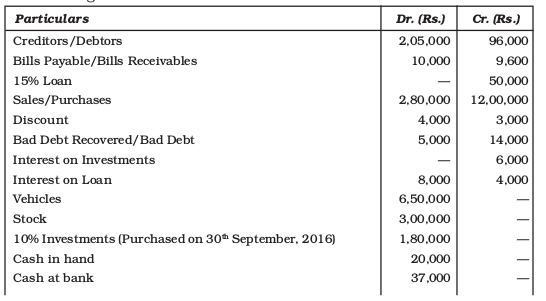

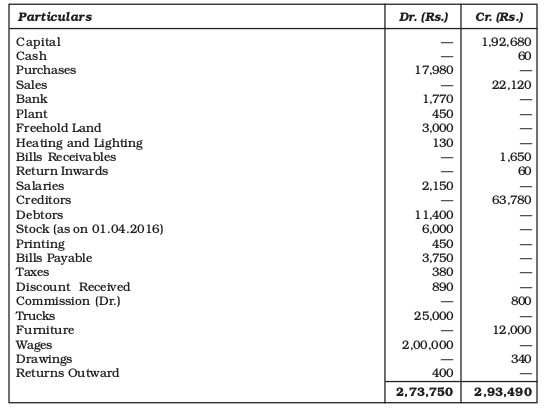

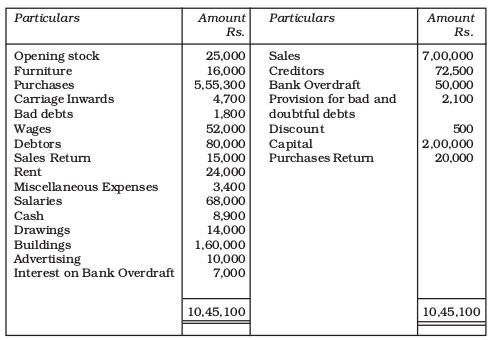

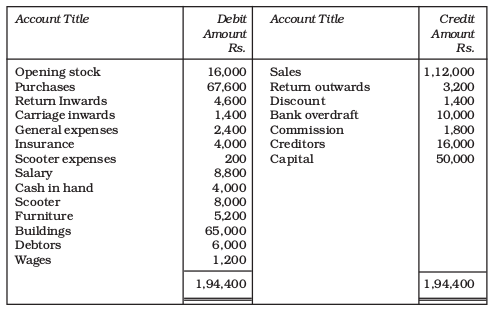

It may be noted that when we prepare the financial statements, we are provided with the trial balance and some other additional information in respect of the adjustments to be made. All adjustments are reflected in the final accounts at two places to complete the double entry. Our earlier example in chapter 9 (Page no. 336) which represents the trial balance of Ankit is reproduced in figure 10.1:

Trial Balance of Ankit as on March 31, 2017

Additional Information : The stock on March 31, 2017 was Rs. 15,000.

Figure 10.1 : Showing the trial balance of Ankit

We will now study about the items of adjustments and you will observe how these adjustments are helpful in the preparation of financial statements in order to reflect the true profit and loss and financial position of the firm.

10.2 Closing Stock

As per the example in chapter 9 (Page no. 336), the closing stock represents the cost of unsold goods lying in the stores at the end of the accounting period. The adjustment with regard to the closing stock is done by (i) by crediting it to the trading and profit and loss account, and (ii) by showing it on the asset side of the balance sheet. The adjustment entry to be recorded in this regard is :

Closing stock A/c Dr.

To Trading A/c

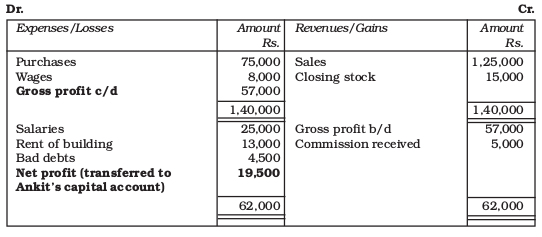

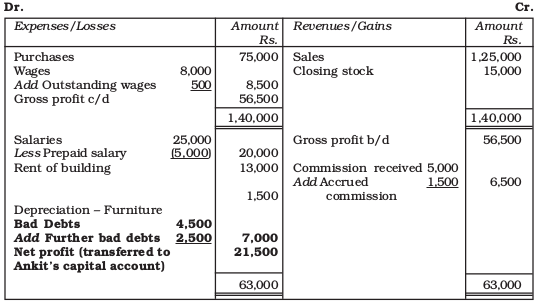

The closing stock of the year becomes the opening stock of the next year and is reflected in the trial balance of the next year. The trading and profit and loss account of Ankit for the year ended March 31, 2017 and his balance sheet as on that date shall appear as follows :

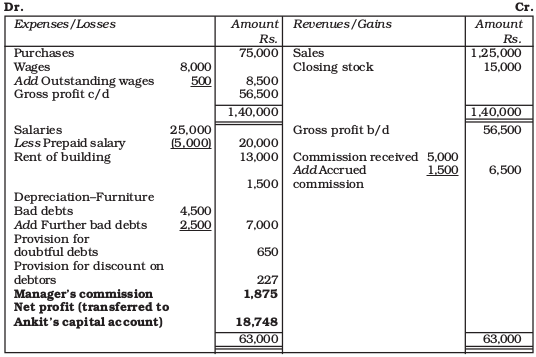

Trading and Profit and Loss Account of Ankit for the year ended March 31, 2017

Sometimes the opening and closing stock are adjusted through purchases account. In that case, the entry recorded is as follows :

Closing stock A/c Dr.

To Purchases A/c

This entry reduces the amount in the purchases account and is also known as adjusted purchases which is shown on the debit side of the trading and profit and loss account. In this context, it may be noted, that the closing stock will not be shown on the credit side of the trading and profit and loss as it has been already been adjusted through the purchases account. Not only, in such a situation, even the opening stock will not be separately reflected in the trading and profit and loss account, as it is also adjusted in purchases by recording the following entry:

Purchases A/c Dr.

To Opening stock A/c

Another important point to be noted in this context is that when the opening and closing stocks are adjusted through purchases, the trial balance does not show any opening stock. Instead, the closing stock shall appear in the trial balance (not as additional information or as an adjustment item) and so also the adjusted purchases. In such a situation, the adjusted purchases shall be debited to the trading and profit and loss account.

The closing stock shall be shown on the assets side of the balance sheet as shown below:

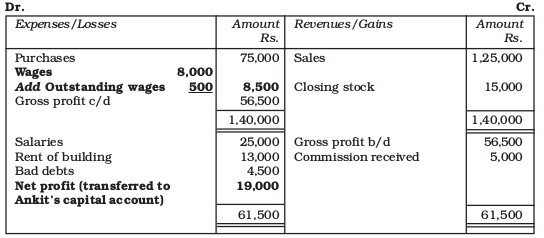

Balance Sheet of Ankit as at March 31, 2017

10.3 Outstanding Expenses

It is quite common for a business enterprise to have some unpaid expenses in the normal course of business operations at the end of an accounting year. Such items usually are wages, salaries, interest on loan, etc.

When expenses of an accounting period remain unpaid at the end of an accounting period, they are termed as outstanding expenses. As they relate to the earning of revenue during the current accounting year, it is logical that they should be duly charged against revenue for computation of the correct amount of profit or loss. The entry to bring such expenses into account is :

Concerned expense A/c Dr.

To Outstanding expense A/c

The above entry opens a new account called Outstanding Expenses which is shown on the liabilities side of the balance sheet. The amount of outstanding expenses is added to the total of expenses under a particular head for the purpose of preparing trading and profit and loss account.

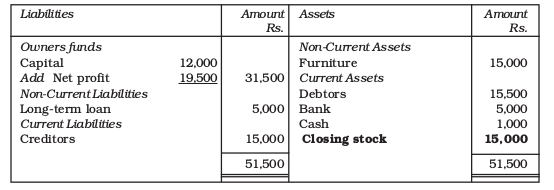

For example, refer to Ankit’s trial balance (refer figure 10.1). You will notice that wages are shown at Rs. 8,000. Let us assume that Ankit owes Rs.500 as wages relating to the year 2016-17 to one of his employees. In that case, the correct expense on wages amounts to Rs. 8,500 instead of Rs. 8,000. Ankit must show Rs. 8,500 as expense on account of wages in the trading and profit and loss account and recognise a current liability of Rs. 500 towards the sum owed to his staff. It will be referred to as wages outstanding and it will be adjusted to wages account by recording the following journal entry:

Wages A/c Dr. 500

To Wages outstanding A/c 500

The amount of outstanding wages will be added to wages account for the preparation of the trading and profit and loss account as follows :

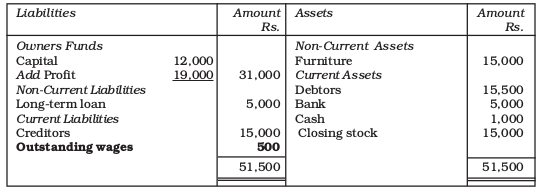

Trading and Profit and Loss Account of Ankit for the year ended March 31, 2017

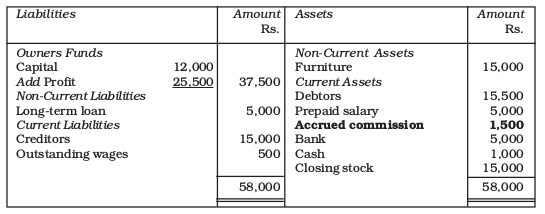

Observe carefully the trading and profit and loss account of Ankit. Did you notice the amount of net profit is reduced to Rs. 19,000 on account of outstanding wages. The item relating to outstanding wages will be shown in balance sheet as follows :

Balance Sheet of Ankit as at March 31, 2017

10.4 Prepaid Expenses

There are several items of expense which are paid in advance in the normal course of business operations. At the end of the accounting year, it is found that the benefits of such expenses have not yet been fully received; a portion of its benefit would be received in the next accounting year. This portion of expense, is carried forward to the next year and is termed as prepaid expenses. The necessary adjustment in respect of prepaid expenses is made by recording the following entry:

Prepaid expense A/c Dr.

To concerned expense A/c

The effect of the above adjustment entry is that the amount of prepaid part is deducted from the total of the particular expense, and the new account of prepaid expense is shown on the assets side of the balance sheet. For example, in Ankit’s trial balance, let us assume that the amount of salary paid by him to the employees includes an amount of Rs. 5,000 which was paid in advance to one of his employees upon his joining the office. This implies that Ankit has overpaid his staff by Rs. 5,000 on account of his salary. Hence, correct expense on account of salary during the current period will be Rs. 20,000 instead of Rs. 25,000. Ankit must show Rs. 20,000 expense on account of salary in the profit and loss account and recognise a current asset of Rs. 5,000 as an advance salary to the employee. It will be termed as prepaid salary account and will be recorded by the following journal entry :

Prepaid salary A/c Dr. 5,000

To salary A/c 5,000

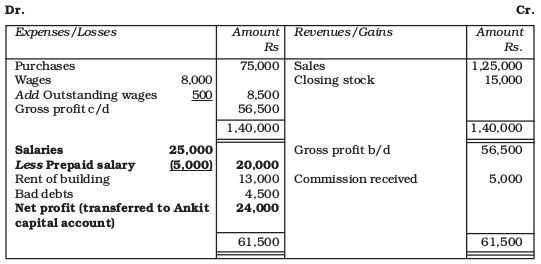

The account of prepaid salary will be shown in the trading and profit and loss account as follows:

Trading and Profit and Loss Account of Ankit for the year ended March 31, 2017

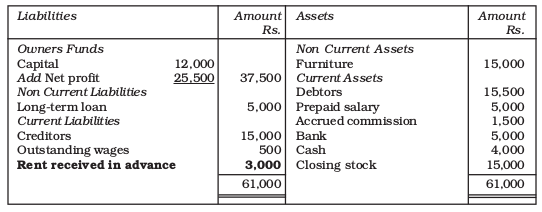

Observe how the prepaid salary has resulted in an increase of net profit by Rs. 5,000 making it as Rs. 24,000 Further, the item relating to prepaid salary will be shown in the balance sheet on the assets side as follows :

Balance Sheet of Ankit as at March 31, 2017

10.5 Accrued Income

It may also happen that certain items of income such as interest on loan, commission, rent, etc. are earned during the current accounting year but have not been actually received by the end of the same year. Such incomes are known as accrued income. The adjusting entry for accrued income is :

Accrued income A/c Dr.

To Concerned income A/c

The amount of accrued income will be added to the related income in the profit and loss account and the new account of accrued income will appear on the asset side of the balance sheet.

Let us, for example, assume that Ankit was giving a little help to a fellow businessman by introducing few parties to him on commission for this service. In the trial balance of Ankit you will notice an item of commission received amounting to Rs. 5,000. Assume that the commission amounting to Rs.1,500 was still receivable from the fellow businessman. This implies that income from commission earned during 2016-17 is Rs. 6, 500 (Rs.5, 000 + Rs. 1,500) Ankit needs to record an adjustment entry to give effect to the accrued commission as follows :

Accrued Commission A/c Dr. 1,500

To Commission A/c 1,500

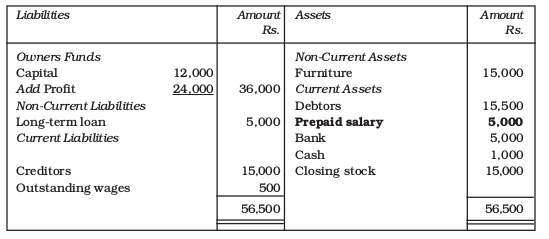

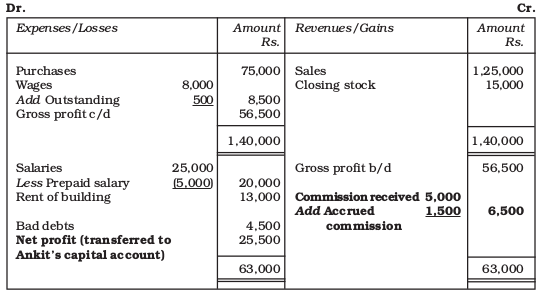

The account of accrued income will be recorded in trading and profit and loss account as follows :

Observe that the accrued income has resulted in an increase in the net profit by Rs. 1,500 making it as Rs. 25,500. Further, it will be shown in the balance sheet of Ankit on the assets side under the head current asset.

Balance Sheet of Ankit as at March 31, 2017

10.6 Income Received in Advance

Sometimes, a certain income is received but the whole amount of it does not belong to the current period. The portion of the income which belongs to the next accounting period is termed as income received in advance or an Unearned Income. Income received in advance is adjusted by recording the following entry:

Concerned income A/c Dr.

To Income received in advance A/c

The effect of this entry will be that the balance in the income account will be equal to the amount of income earned for the current accounting period, and the new account of income received in advance will be shown as a liability in the balance sheet.

For example, let us assume Ankit has agreed in March 31, 2017 to sublet a part of the building to a fellow shopkeeper @ Rs. 1,000 per month. The person gives him rent in advance for the next three months of April, May and June. The amount received had been credited to the profit and loss account. However, this income does not pertain to current year and hence will not be credited to profit and loss account. It is income received in advance and will be recognised as a liability amounting to Rs. 3,000. Ankit needs to record an adjustment entry to give effect to income received in advance by way of following journal entry:

Rent received A/c Dr. 3,000

To Rent received in advance A/c 3,000

This will lead a new account of rent received in advance of Rs. 3,000 which will appear as follows :

Balance Sheet of Ankit as at March 31, 2017

10.7 Depreciation

Recall from chapter 7 (Part-I), that depreciation is the decline in the value of assets on account of wear and tear and passage of time. It is treated as a business expense and is debited to profit and loss account. This, in effect, amounts to writing-off a portion of the cost of an asset which has been used in the business for the purpose of earning profits. The entry for providing depreciation is :

Depreciation A/c Dr.

To Concerned asset A/c

In the balance sheet, the asset will be shown at cost minus the amount of depreciation. For example, the trial balance in our example shows that Ankit has a furniture account with a balance of Rs. 15,000. Let us assume that furniture is subject to a depreciation of 10% per annum. This implies that Ankit must recognise that at the end of the year the value attached to furniture is to be reduced by Rs. 1,500 (Rs. 15,000 × 10%). Ankit needs to record an adjustment entry to give effect to depreciation on furniture as follows :

Depreciation A/c Dr. 1,500

To Furniture A/c 1,500

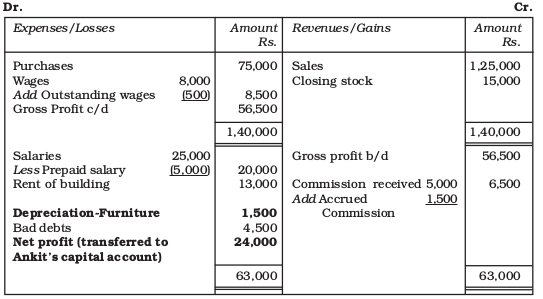

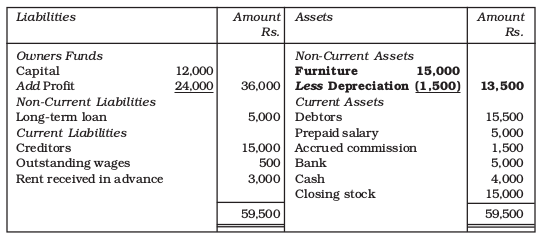

Depreciation will be shown in the profit and loss account and balance sheet as follows :

Trading and Profit and Loss Account of Ankit for the year ended March 31, 2017

Notice that the amount of net profit declines with the adjustment of depreciation. Let us now see how depreciation as an expense will be shown in balance sheet.

Balance Sheet of Ankit as at March 31, 2017

10.8 Bad Debts

Bad debts refer to the amount that the firm has not been able to realise from its debtors. It is regarded as a loss and is termed as bad debt. The entry for recording bad debt is:

Bad debts A/c Dr.

To Debtors A/c

You will notice in Ankit’s trial balance, that it contains bad debts amounting to Rs. 4,500. Whereas, the sundry debtors of Ankit are reported as Rs. 15,500. The existence of bad debts in the trial balance signifies that Ankit has incurred a loss arising out of bad debts during the year and which has been already recorded in the books of account.

However, assuming one of his debtors who owed him Rs. 2,500 had become insolvent, and nothing is receivable from him. But the amount of bad debts related to the current year is still to be account for. This fact appears as additional information and is termed as further bad debts. The adjustment entry to be recorded for the amount will be as follows. For this purpose, Ankit needs to record an adjustment entry as under :

Bad debts A/c Dr. 2,500

To Debtors A/c 2,500

This entry will reduce the value of debtors to Rs. 13,000( Rs. 15,500 – Rs. 2,500) and increases the amount of bad debts to Rs. 7,000 (Rs. 4,500 + Rs. 2,500).

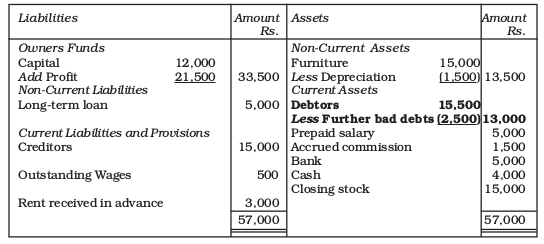

The treatment of further bad debts in profit and loss account and balance sheet is shown below :

Trading and Profit and Loss Account of Ankit for the year ended March 31, 2017

Balance Sheet of Ankit as at March 31, 2017

10.9 Provision for Bad and Doubtful Debts

In the above balance sheet, debtors now appears at Rs. 13,000, which is their estimated realisable value during next year. It is quite possible that the whole of this amount may not be realised in future. However, it is not possible to accurately know the amount of such bad debts. Hence, we make a reasonable estimate of such loss and provide the same. Such provision is called provision for bad debts and is created by debiting profit and loss account. The following journal entry is recorded in this context :

Profit and Loss A/c Dr.

To Provision for doubtful debts A/c

Provision for doubtful debts is also shown as a deduction from the debtors on the asset side of the balance sheet.

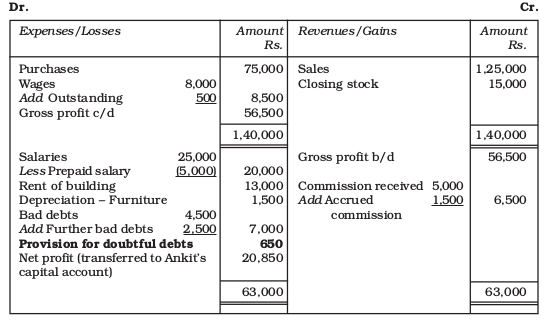

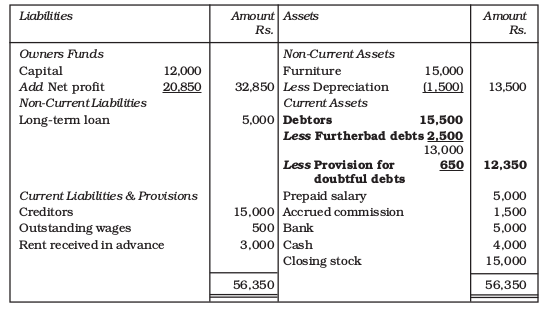

Let us assume, Ankit feels that 5% of his debtors on March 31, 2017 are likely to default on their payments next year. This implies he expects bad debts of Rs. 650 (Rs. 13,000 × 5%). Ankit needs to record the adjustment entry as :

Profit and loss A/c Dr. 650

To Provision for doubtful debts A/c 650

This implies that Rs. 650 will reduce the current year’s profit on account of doubtful debts. In the balance sheet, it will be shown as a deduction from sundry debtors.

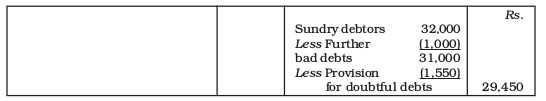

Trading and Profit and Loss Account of Ankit for the year ended March 31, 2017

Balance Sheet of Ankit as at March 31, 2017

It may be noted that the provision created for doubtful debts at the end of a particular year will be carried forward to the next year and it will be used for meeting the loss due to bad debts incurred during the next year. The provision for doubtful debts brought forward from the previous year is called the opening provision or old provision.When such a provision already exists, the loss due to bad debts during the current year are adjusted against the same and while making provision for doubtful debts required at the end of the current year is called new provision. The balance of old provision as given in trial balance should also be taken into account.

Let us take an example to understand how bad debts and provision for doubtful debts are recorded. An extract from a trial balance on March 31, 2017 is given below :

Rs.

Sundry debtors 32,000

Bad debts 2,000

Provision for doubtful debts 3,500

Additional Information :

Write-off further bad debts Rs. 1,000 and create a provision for doubtful debts @ 5% on debtors.

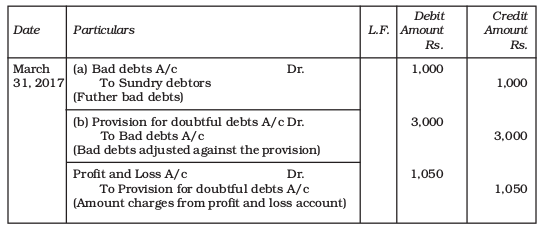

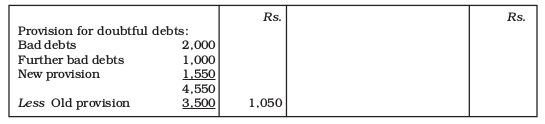

In this case, the following journal entries will be recorded :

Profit and Loss Account for the year ended March 31, 2017

Balance Sheet as at March 31, 2017

*Only relevant items.

Note : The amount of new provision for doubtful debts has been calculated as follows:

Rs. 31,000 1 × 5/100 = Rs. 1,550.

10.10 Provision for Discount on Debtors

A business enterprise allows discount to its debtors to encourage prompt payments. Discount likely to be allowed to customers in an accounting year

can be estimated and provided for by creating a provision for discount on debtors. Provision for discount is made on good debtors which are arrived at by deducting further bad debts and the provision for doubtful debts. The following journal entry is recorded to create provision for discount on debtors:

Profit and loss A/c Dr.

To Provision for discount on debtors A/c

As stated above, the provision for discount on debtors will be created only on good debtors. It will be calculated on the amount of debtors arrived at after deducting the doubtful debts, i.e. Rs. 12,350 (Rs. 13,000 – Rs. 650).

Ankit needs to record the adjustment entry as :

Profit and loss A/c Dr. 227

To Provision for discount on debtors A/c 227

This will reduce the current year profit by Rs. 227 on account of probable discount on prompt payment. In the balance sheet, it will be shown as a deduction from the debtors account to portray correctly the expected realiable value of debtors as Rs. 12,123.

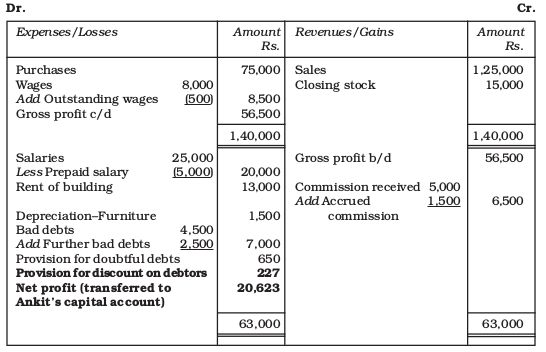

Trading and Profit and Loss Account of Ankit for the year ended March 31, 2017

Balance Sheet of Ankit as on March 31, 2017

In the subsequent year, the discount will be transferred to the provision for discount on debtors account. The account will be treated in the same manner as the provision for doubtful debts.

10.11 Manager’s Commission

The manager of the business is sometimes given the commission on the net profit of the company. The percentage of the commission is applied on the profit either before charging such commission or after charging such commission.

In the absence of any such information, it is assumed that commission is allowed as a percentage of the net profit before charging such commission.

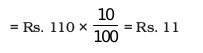

Suppose the net profit of a business is Rs. 110 before charging commission. If the manager is entitled to 10% of the profit before charging such commission, the commission will be calculated as :

In case the commission is 10% of the profit after charging such commission, it will be calculated as :

= Profit before commission × Rate of commission/ (100 + commission)

The managers commission will be adjusted in the books of account by recording the following entry :

Profit and loss A/c Dr.

To Manager’s commission A/c

Let us recall our example and assume that Ankit’s manager is entitled to a commission @ 10%. Observe the following profit and loss account if it is based on :

(i) amount of net profit before charging such commission

(ii) amount of profit after charging such commission.

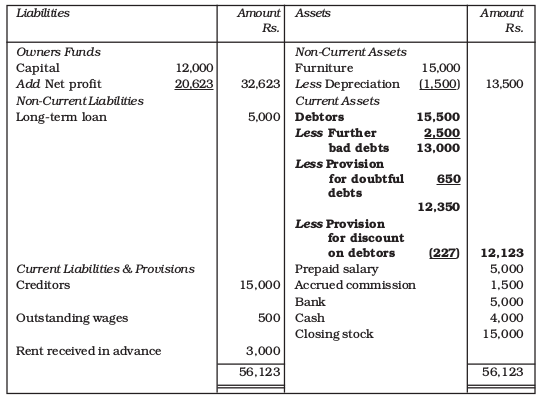

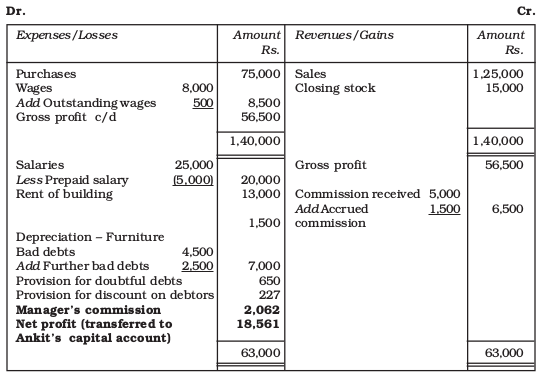

(i) Trading and Profit and Loss Account of Ankit for the year ended March 31, 2017

Balance Sheet of Ankit as at March 31, 2017

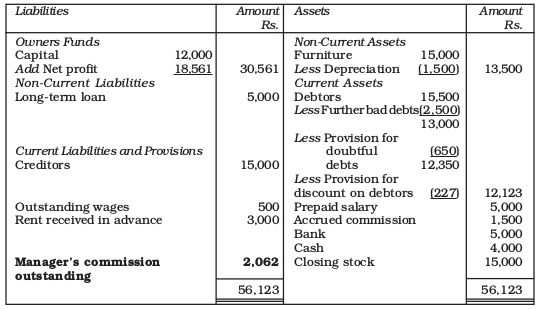

(ii) Trading and Profit and Loss Account of Ankit for the year ended March 31, 2017

Balance Sheet of Ankit as at March 31, 2017

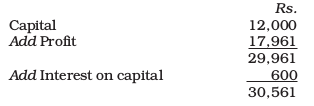

10.12 Interest on Capital

Sometimes, the proprietor may like to know the profit made by the business after providing for interest on capital. In such a situation, interest is calculated at a given rate of interest on capital as at the beginning of the accounting year. If however, any additional capital is brought during the year, the interest may also be computed on such amount from the date on which it was brought into the business. Such interest is treated as expense for the business and the following journal entry is recorded in the books of account:

Interest on capital A/c Dr.

To Capital A/c

In the final accounts, it is shown as an expense on the debit side of the profit and loss account and added to capital in the balance sheet.

Let us assume, Ankit decides to provide 5% interest on his capital. This shall amount to Rs. 600 for which the following journal entry will be recorded:

Interest on capital A/c Dr. 600

To Capital A/c 600

This implies that net profit shall be reduced by Rs. 600. As a result, the reduced amount of profit shall be added to the capital in the balance sheet. But, when interest on capital shall be added to the capital, this effect shall be neutralised. As shown below :

Test Your Understanding

Tick the correct answer :

1. Rahul’s trial balance provide you the following information :

Debtors Rs. 80,000

Bad debts Rs. 2,000

Provision for doubtful debts Rs. 4,000

It is desired to maintain a provision for bad debts of Rs. 1,000

State the amount to be debited/credited in profit and loss account :

(a) Rs. 5,000 (Debit) (b) Rs. 3,000 (Debit)

(c) Rs. 1,000 (Credit) (d) none of these.

2. If the rent of one month is still to be paid the adjustment entry will be :

(a) Debit outstanding rent account and Credit rent account

(b) Debit profit and loss account and Credit rent account

(c) Debit rent account and Credit profit and loss account

(d) Debit rent account and Credit outstanding rent account.

3. If the rent received in advance Rs. 2,000. The adjustment entry will be :

(a) Debit profit and loss account and Credit rent account

(b) Debit rent account Credit rent received in advance account

(c) Debit rent received in advance account and Credit rent account

(d) None of these.

4. If the opening capital is Rs. 50,000 as on April 01, 2016 and additional capital introduced Rs. 10,000 on January 01, 2017. Interest charge on capital 10% p.a.

The amount of interest on capital shown in profit and loss account as on March 31, 2017 will be :

(a) Rs. 5,250 (b) Rs. 6,000

(c) Rs. 4,000 (d) Rs, 3,000.

5. If the insurance premium paid Rs. 1,000 and pre-paid insurance Rs. 300. The amount of insurance premium shown in profit and loss account will be :

(a) Rs. 1,300 (b) Rs. 1,000

(c) Rs. 300 (d) Rs. 700.

Illustration 1

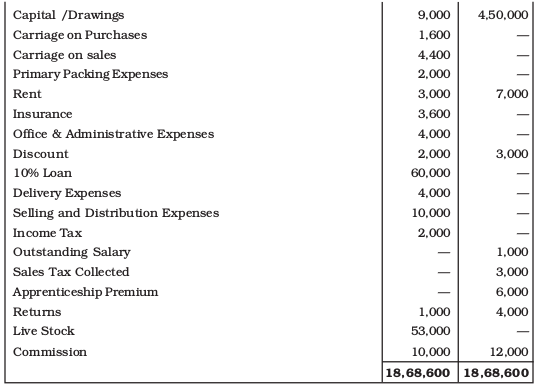

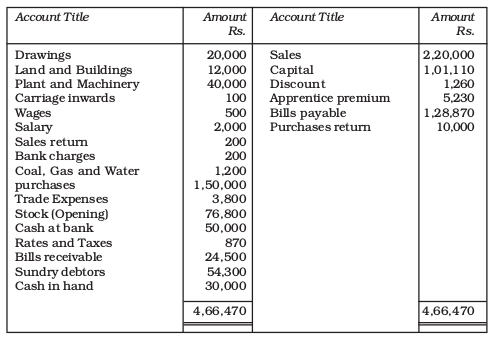

From the following balances, prepare the trading and profit and loss account and balance sheet as on March 31, 2017.

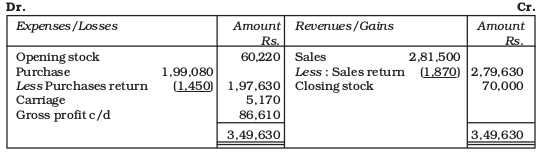

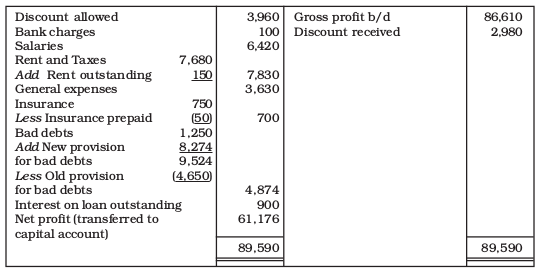

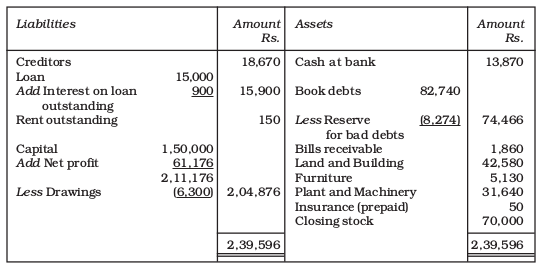

Adjustments

1. Closing stock Rs. 70,000

2. Create a reserve for bad and doubtful debts @ 10% on book debts

3. Insurance prepaid Rs. 50

4. Rent outstanding Rs. 150

5. Interest on loan is due @ 6% p.a.

Solution

Trading and Profit and Loss Account for the year ended March 31, 2017

Balance Sheet as at March 31, 2017

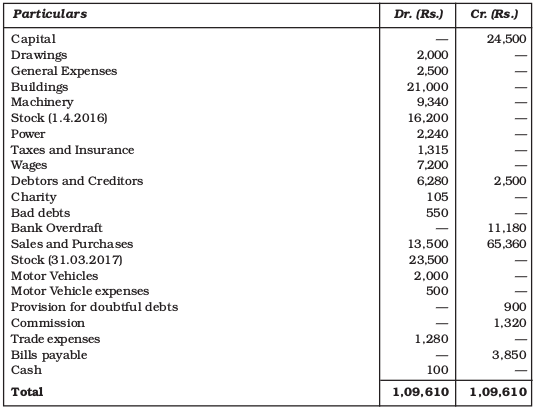

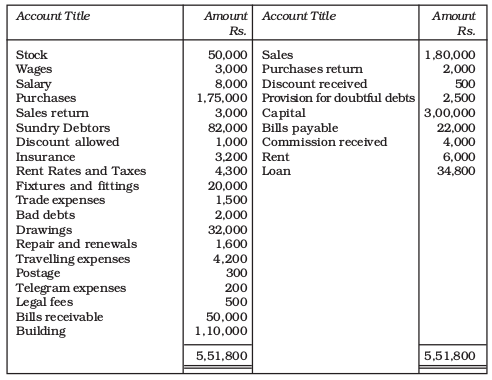

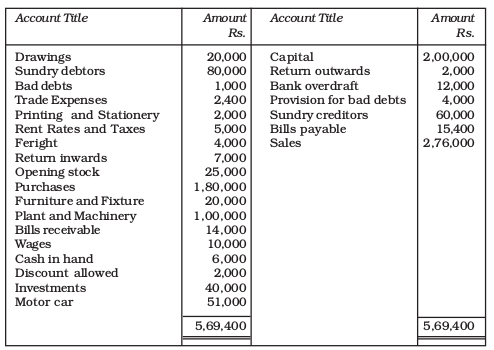

Illustration 2

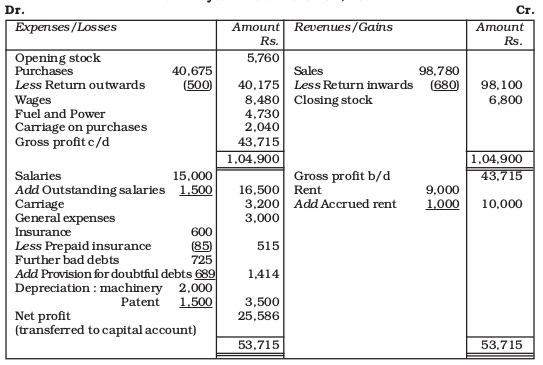

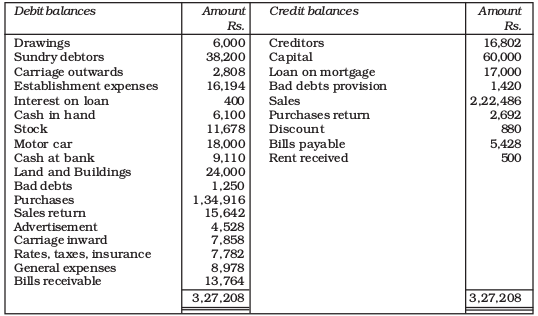

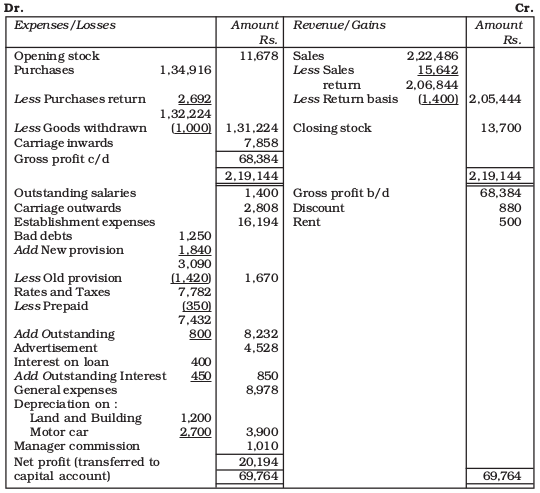

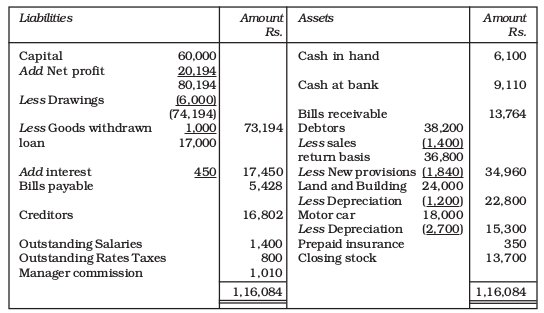

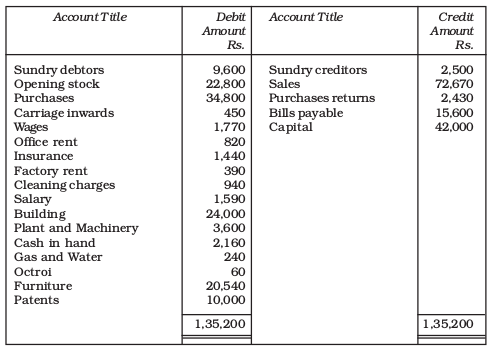

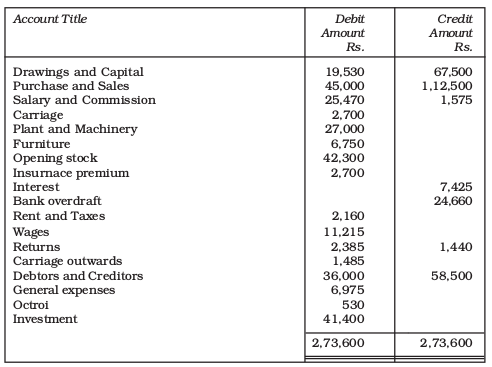

The following were the balances extracted from the books of Yogita as on March 31, 2017:

Taking into account the following adjustments prepare trading and profit and loss account and balance sheet as on March 31, 2017 :

(a) Stock in hand on March 31, 2017, was Rs. 6,800.

(b) Machinery is to be depreciated at the rate of 10% and patents @ 20%.

(c) Salaries for the month of March, 2017 amounting to Rs. 1,500 were outstanding.

(d) Insurance includes a premium of Rs. 170 on a policy expiring on September 30, 2017.

(e) Further bad debts are Rs. 725. Create a provision @ 5% on debtors.

(f) Rent receivable Rs. 1,000.

Solution:

Books of Yogita Trading and Profit and Loss Account for the year ended March 31, 2017

Balance Sheet as at March 31, 2017

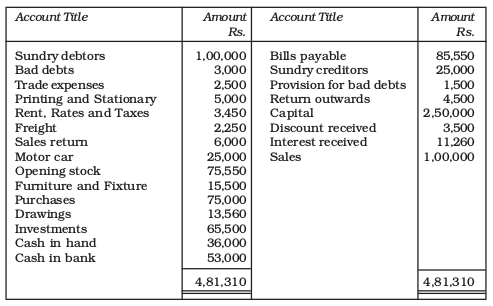

Illustration 3

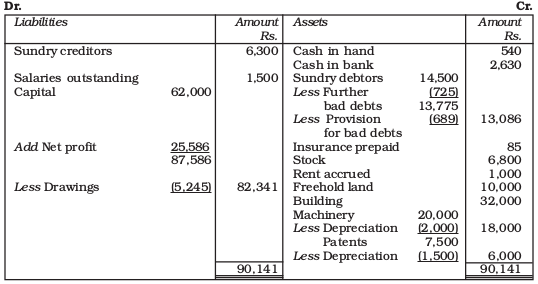

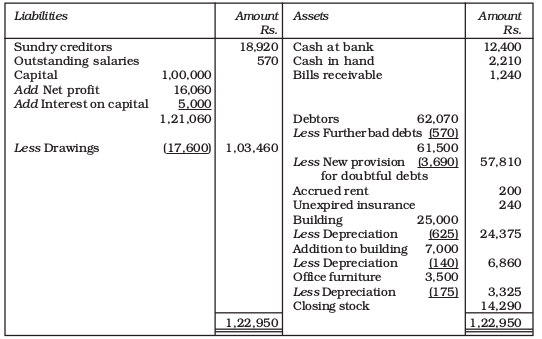

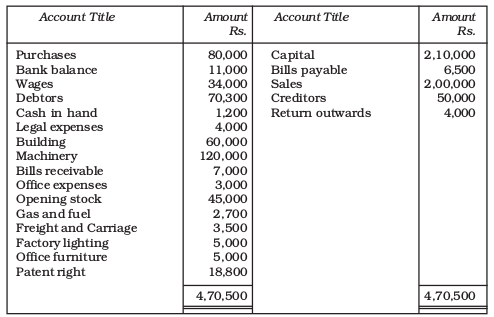

The following balances were extracted from the books of Shri R. Lal on March 31, 2017:

Prepare the trading and profit and loss account and a balance sheet as on March 31, 2017 after keeping in view the following adjustments :

(i) Depreciate old building by Rs. 625 and addition to building at 2% and office furniture at 5%.

(ii) Write-off further bad debts Rs. 570.

(iii) Increase the bad debts reserve to 6% of debtors.

(iv) On March 31, 2017 Rs. 570 are outstanding for salary.

(v) Rent receivable Rs. 200 on March 31, 2017.

(vi) Interest on capital at 5% to be charged.

(vii) Unexpired insurance Rs. 240.

(viii) Stock was valued at Rs. 14,290 on March 31, 2017.

Solution

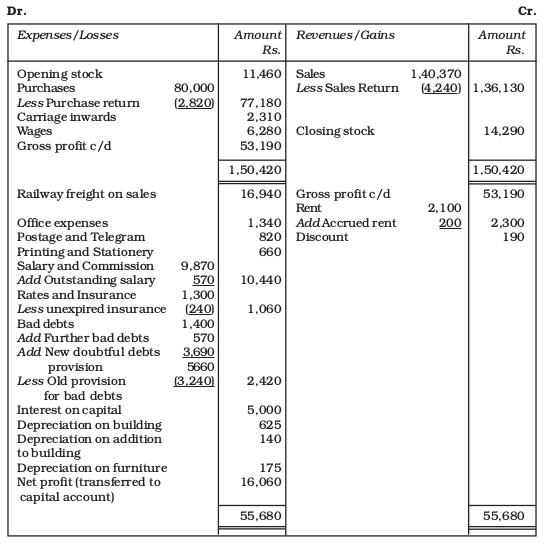

Books of Shri R. Lal Trading and Profit and Loss Account for the year ended March 31, 2017

Balance Sheet as at March 31, 2017

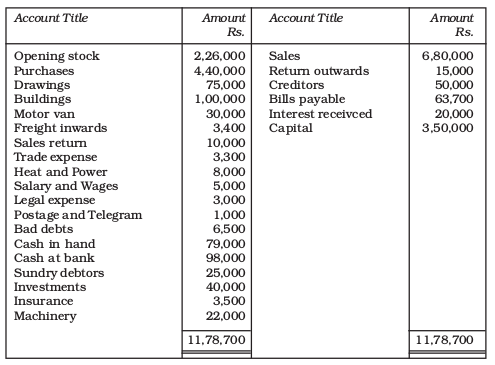

Illustration 4

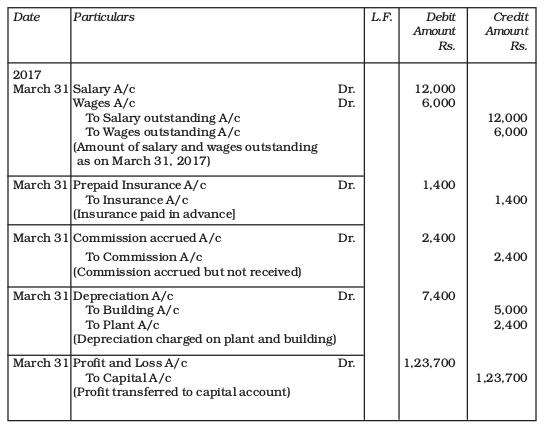

Prepare the trading profit and loss account of M/s Mohit Traders as on 31 March 2017 and draw necessary Journal entries and balance sheet as on that date :

Adjustments Rs.

(a) Salaries outstanding 12,000

(b) Wages outstanding 6,000

(c) Commission is accrued 2,400

(d) Depreciation on building 5% and plant 3%

(e) Insurance paid in advance 700

(f) Closing stock 12,000

Solution

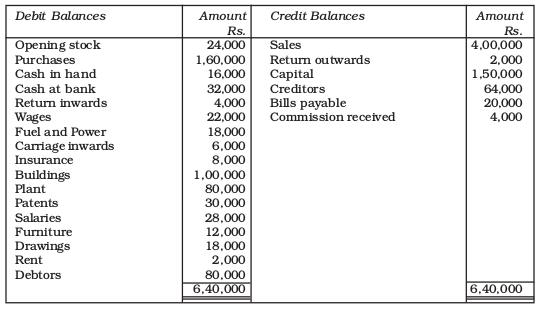

Books of Mohit Traders Journal

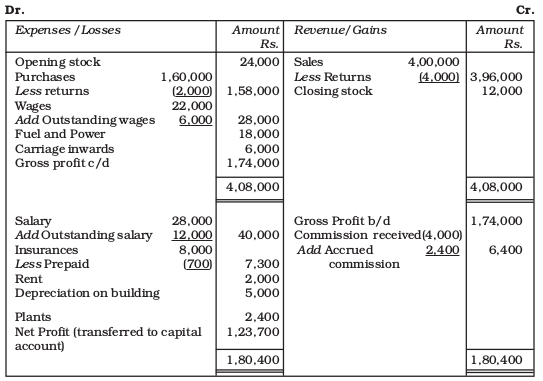

Books of Mohit Traders Trading and Profit and Loss Account for the year ended March 31, 2017

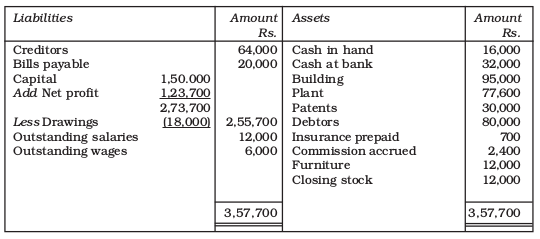

Balance Sheet as at March 31, 2017

Illustration 5

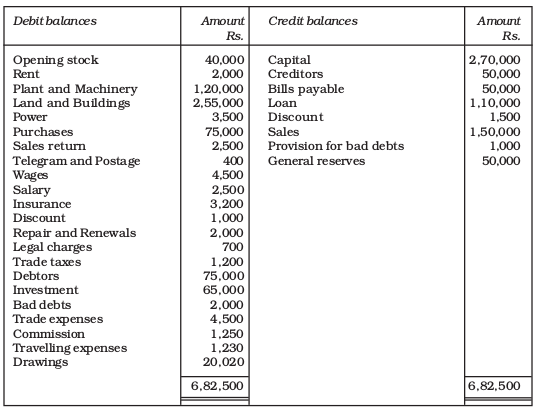

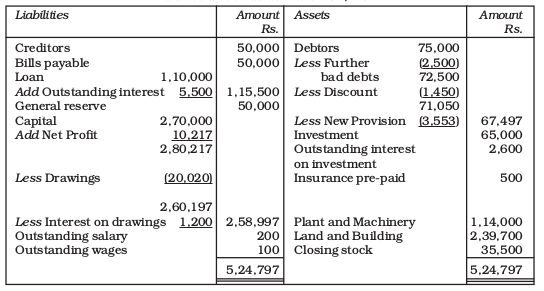

The following information has been extracted from the trial balance of M/s Randhir Transport Corporation.

Adjustments

1. Closing stock for the year was Rs. 35,500.

2. Depreciation charged on plant and machinery 5% and land and building 6%.

3. Interest on drawing @ 6% and Interest on loan @ 5%.

4. Interest on investments @ 4%.

5. Further bad debts 2,500 and make provision for doubtful debts on debtors 5%.

6. Discount on debtors @ 2%.

7. Salary outstanding Rs. 200.

8. Wages outstanding Rs. 100.

9. Insurance prepaid Rs. 500.

You are required to make trading and profit and loss account and a balance sheet on March 31, 2017

Solution

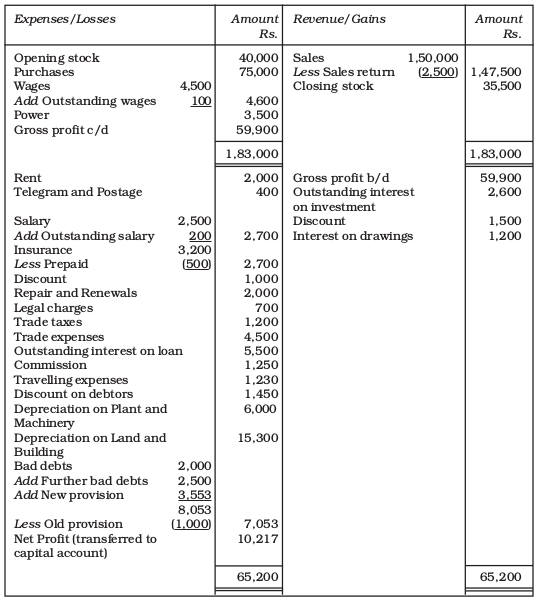

Books of Randhir Transport Corporation Trading and Profit and Loss Account for the year ended March 31, 2017

Balance Sheet as at March 31, 2017

Illustration 6

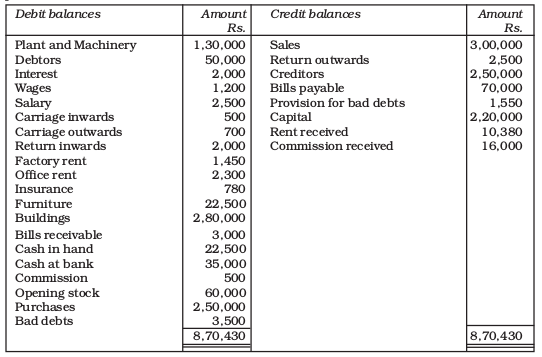

From the following balances of M/s Keshav Bros. You are required to prepare trading and profit and loss account and a balance sheet of March 31, 2017.

Adjustment

(i) Provision for bad debts @ 5% and further bad debts Rs. 2,000.

(ii) Rent received in advance Rs. 6,000.

(iii) Prepaid insurance Rs. 200.

(iv) Depreciation on furniture @ 5%, plant and machinery @ 6%, building @ 7%.

Solution

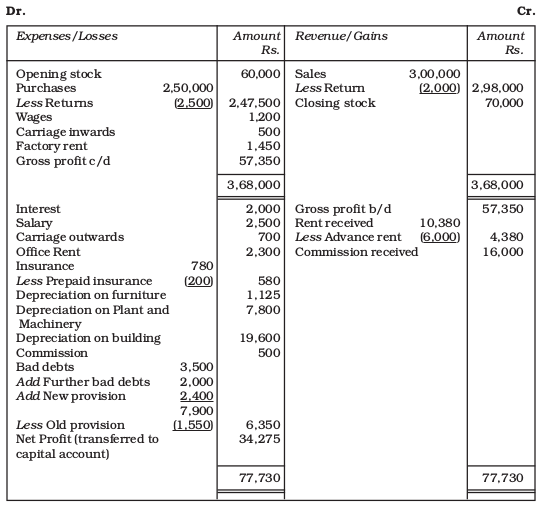

Books of Keshav Bros. Trading and Profit and Loss Account for the year ended March 31, 2017

Balance Sheet as at March 31, 2017

Illustration 7

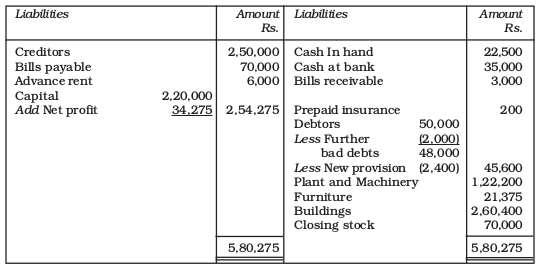

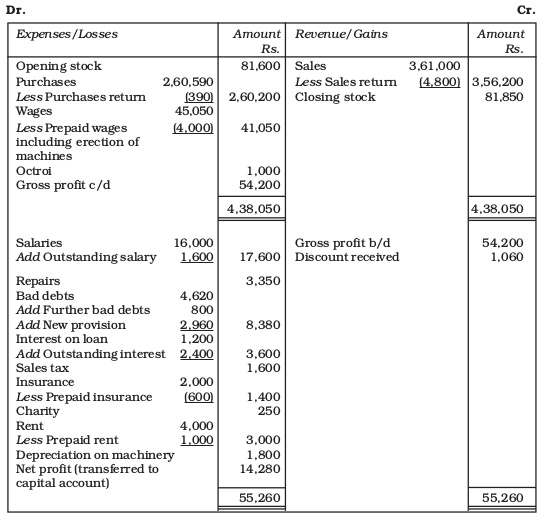

The following information have been taken from the trial balance of M/s Fair Brothers Ltd. You are required to prepare the trading and profit and loss account and a balance sheet as at March 31, 2017.

Adjustments

1. Wages include Rs. 4,000 for erection of new machinery on April 01, 2016.

2. Provide 5% depreciation on furniture.

3. Salaries unpaid Rs.1,600.

4. Closing stock Rs. 81,850.

5. Create a provision at 5% on debtors.

6. Half the amount of bill is recoverable.

7. Rent is paid up to July 30, 2017.

8. Insurance unexpired Rs. 600.

Books of Fair Brothers Ltd. Trading and Profit and Loss Account for the year ended March 31, 2017

Balance Sheet as at March 31, 2017

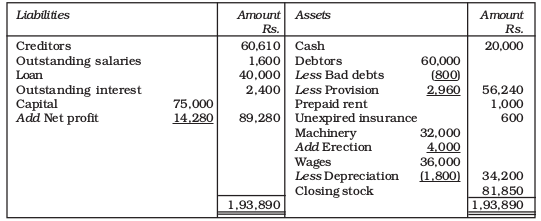

Illustration 8

From the following balance extracted from the books of of M/s Hariharan Brother, you are require to prepare the trading and profit and loss account and a balance sheet as on December 31, 2017.

Adjustments

1. Closing stock Rs. 14,000.

2. Wages outstanding Rs. 600, Salaries Outstanding Rs. 1,000, Rent outstanding Rs. 200.

3. Fire Insurance premium includes Rs. 1,200 paid in July 01, 2016 to run for one year from July 01, 2016 to June 30, 2017.

4. Apprenticeship Premium is for three years paid in advance on January 01, 2016.

5. Stationery bill for Rs. 60 remain unpaid.

6. Depreciation on Premises @ 5%, furniture @ 10%, Machinery @ 10%.

7. Interest on loan given accrued for one year @ 7%.

8. Interest on investment @ 5% for half year to December 31, 2016 has accrued.

9. Interest on capital to be allowed at 5% for one year.

10. Interest on drawings to be charged to him ascertained for the year Rs. 160.

Solution

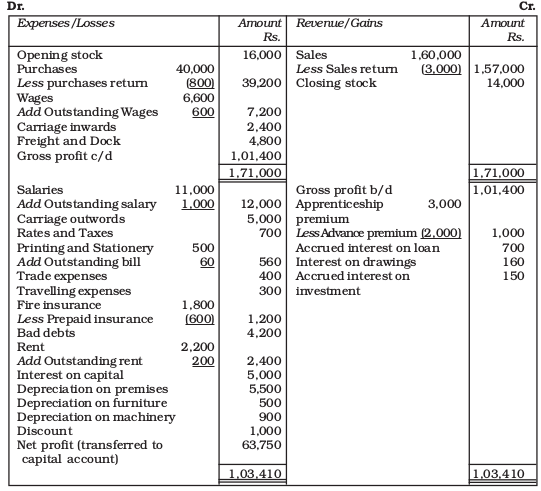

Books of Hariharan Bros. Trading and Profit and Loss Account for the year ended December 31, 2017

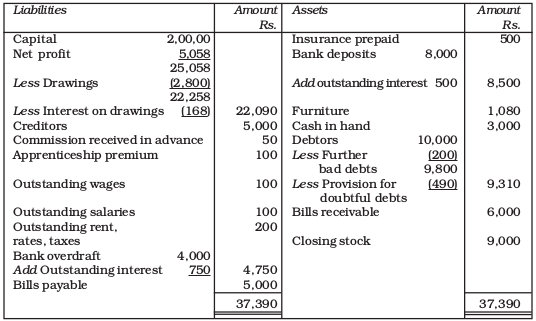

Balance Sheet as at December 31, 2017

Illustration 9

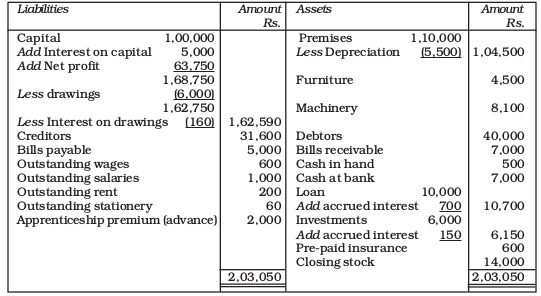

The following balances have been extracted from the trial balance of M/s Kolkata Ltd. You are required to prepare the trading and profit and loss account on dated March 31, 2017.

Also prepare balance sheet on that date.

Adjustments

1. Outstanding salaries Rs. 100. Rent and taxes Rs. 200, Wages Rs. 100.

2. Unexpired insurance Rs. 500.

3. Commission is received in advances Rs. 50.

4. Interest Rs. 500 is to be received on bank deposits.

5. Interest on bank overdraft Rs. 750.

6. Depreciation on furniture @ 10%.

7. Closing stock Rs. 9,000.

8. Further bad debts Rs. 200 New provision @ 5% on debtors.

9. Apprenticeship premium received in advance Rs. 100.

10. Interest on drawings @ 6%.

Solution

Books of Kolkata Ltd. Trading and Profit and Loss Account for the year ended as at March 31, 2017

Balance Sheet as at March 31, 2017

Illustration 10

Prepare the trading and profit and loss account of M/s Roni Plastic Ltd. from the following trial balance and a balance sheet as at March 31, 2017.

Adjustments

1. Depreciation on land and building at @ 5% and Motor vehicle at @ 15%.

2. Interest on loan is @ 5% taken on April 01, 2016.

3. Goods costing Rs1,200 were sent to a customer on sale on return basis for Rs. 1,400 on March 30, 2017 and has been recorded in the books as actual sales.

4. Salaries amounting to Rs. 1,400 and Rates amounting to Rs. 800 are due.

5. The bad debts provision is to be brought up to @ 5% on sundry debtors.

6. Closing stock was Rs. 13,700.

7. Goods costing Rs. 1,000 were taken away by the proprietor for his personal use but not entry has been made in the books of account.

8. Insurance pre-paid Rs. 350.

9. Provide the manager’s commission at @ 5% on Net profit after charging such commission.

Solution

Books of Roni’s Plastic Ltd. Trading and Profit and Loss Account for the year ended March 31, 2017

Balance Sheet as at March 31, 2017

Do it yourself

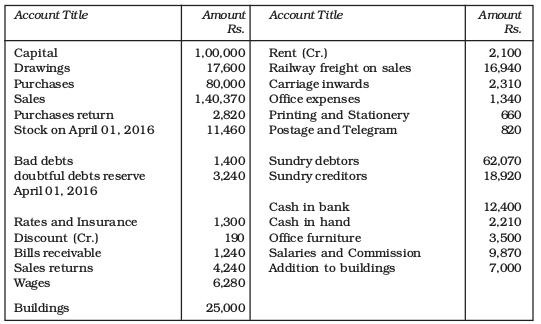

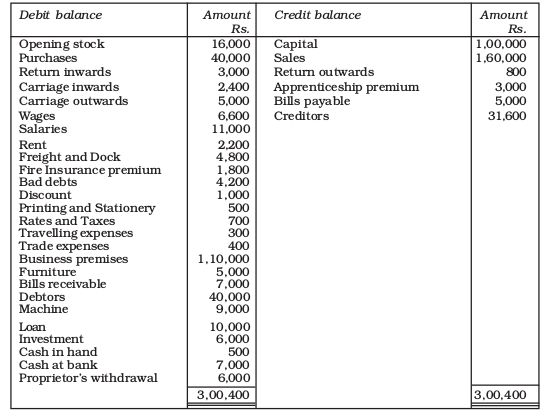

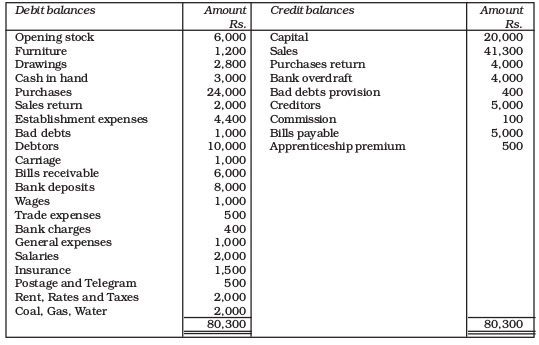

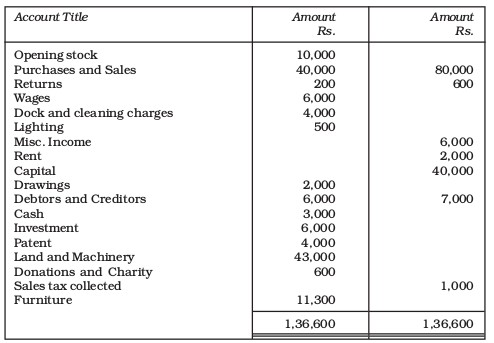

1. From the following Trial Balance of M/s Karan on March 31, 2017, prepare a Trading and Profit and Loss Account and a Balance Sheet:

(I) Additional Information

(a) The cost of closing stock was Rs. 50,000 but the market value was Rs. 40,000.

(b) Rent is due but not yet paid for March 2017 Rs. 500.

(c) Insurance carried forward Rs. 900.

(d) 1/3 of the commission received is in respect of work to be done in next year and commission paid represents only 1/4 of the actual commission to be paid during the year.

(e) Vehicles were valued at 90% of the book value.

(f) The Horse worth Rs. 30,000 was donated to a charitable organization.

(II) Name the accounting concept followed while treating the adjustment (a), (b) and (d) above?

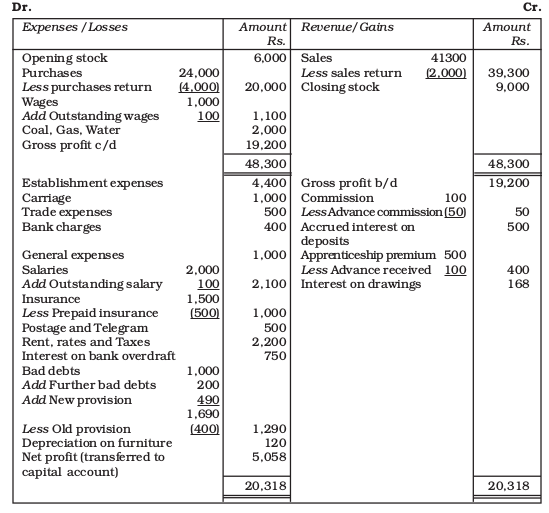

2. The following balances were extracted from the books of Avika Enterprises on 31st March 2017.

You are required to :

(i) Prepare final accounts for the year ended March 31, 2017 after giving effect to the following adjustments:

(a) 1/5th of General expenses and Taxes & Insurance to be charged to factory and the balance to the office.

(b) Write off a further Bad debts of Rs. 160 and maintain the provision for

doubtful debts at 5% and create a provision for discount on Debtors at 10%.

(c) Depreciate Machinery at 10% and Motor Vehicles by Rs. 240

(d) Provide Rs. 700 for interest on Bank Overdraft to be paid.

(e) Rs. 50 is to be carried forward to next year out of Insurance.

(f) Provide for Manager’s Commission at 10% on the Net Profit after charging such commission.

(ii) Name the accounting concepts which are followed while treating the adjustment (a), (b) and (d) above?

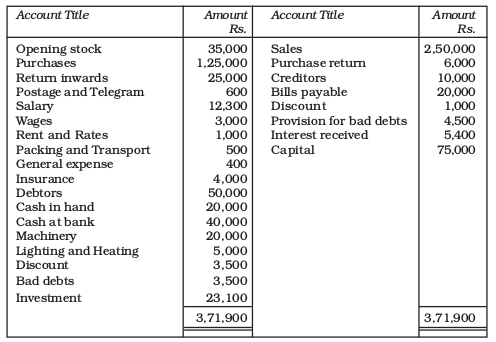

3. The following balances were extracted from the books of Anushka Enterprises on March 31, 2017.

You are required to :

(i) Prepare final accounts for the year ended March 31, 2017 after giving effect to the following adjustments:

(a) Insurance is due but not yet paid for 31 March 2017 Rs. 500.

(b) Salary Unexpired Rs. 900.

(c) Write off a further Bad debts Rs. 2,000 and maintain the provision for bad debts at 5% on Debtors.

(d) Machinery is to be valued at 90% less than the book value.

(e) Goods kept in warehouse worth Rs. 10,0000 were used for staff welfare.

(f) Half of the Bills Receivable were irrecoverable.

(h) Closing Stock is Rs. 40,000

(ii) Name the accounting concepts which will be followed while treating the adjustment (a), (b), (c) and (d) above?

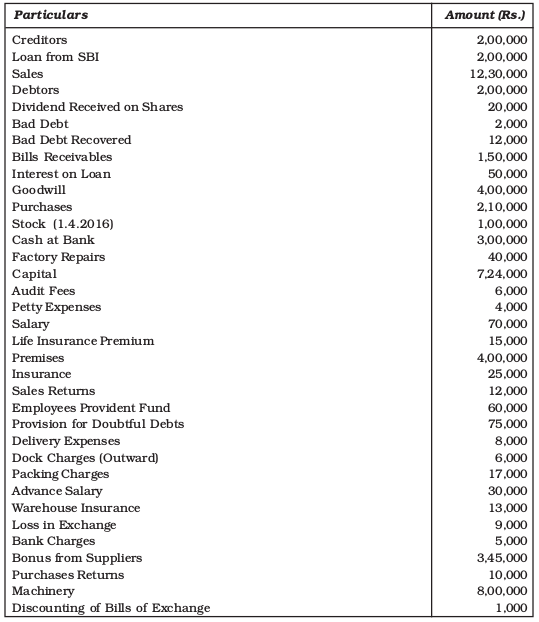

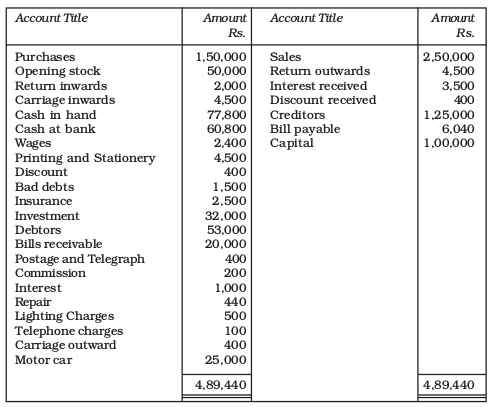

4. The following balances were extracted from the books of Ankita Enterprises on March 31, 2017.

You are required to :

(i) Redraft the Trial Balance.

(ii) Prepare final accounts for the year ended March 31, 2017 after giving effect to the following adjustments:

(a) Taxes are paid for 10 months only.

(b) Creditors worth Rs. 780 have accepted bills payables.

c) Depreciate furniture by 10%.

(d) Trucks were depreciated to the extent of Rs. 21,000.

(e) Wages includes Rs. 2,000 for the making of Furniture.

(f) Closing Stock is of Rs. 20,000.

(g) Provide for Manager’s Commission at 10% on the Net Profit before charging such commission.

(h) Land was acquired on 1st April, 2016 by paying a claim at 50% less than market value to the owner.

(iii) Name the accounting principles which will be followed while treating the adjustment (a), (c) and (e) above?

(Correct total of Trial Balance Rs. 2,83,620)

Key Terms Introduced in the Chapter

• Outstanding /Accrued expenses • Prepaid/Unexpired expenses

• Accrued Incomes • Income received in advance

• Depreciation • Bad Debts

• Provision for doubtful debts • Provision for discount on debtors

• Managers Commission • Interest on Capital

Summary with Reference to Learning Objectives

1 Need for adjustments : For the preparation of financial statements, it is necessary that all the adjustments arising out of the accrual basis of accounting are made at the end of the accounting period. Another important consideration in the preparation of final accounts with adjustments, is the distinction between capital and revenue items. Entries which are recorded to give effect to these adjustments are known as adjusting entries.

2 Outstanding expenses : At the end of the accounting period sometimes a business enterprises is left with some unpaid expenses due to one reason or another. Such expenses are termed as outstanding expenses.

3. Prepaid expenses : At the end of the accounting year, it is found that the benefits of some expenses have not been fully received; a portion of total benefits would be received in the next accounting year. That portion of the expense, the benefit of which will be received during the next accounting period is known as ‘prepaid expenses’.

4. Accrued Income : These are certain items is received by a business enterprise but the whole amount of it does not belong to the next period. Such portion of income which belongs to the next accounting period is income received in advance and is known as “unearned income”.

5. Depreciation : Depreciation is the decline in the value of an asset an account of wear and tear or passage of time or with. It actually amounts to writing off a portion of the cost of an asset which has been used in the business for the purpose of earning profits. In the balance sheet, the asset is shown at loss minus the amount of depreciation.

6 Provisions for bad and doubtful debts : It is a normal feature of business operations that some debts prove irrecoverable which means that the amount to the realised from them becomes had to view of this. An attempt is made to bring in a certain element of certainty in the amount in respect of bad debts charged every year against incomes.

Questions for Practice

Short Answers

1. Why is it necessary to record the adjusting entries in the preparation of final accounts?

2. What is meant by closing stock? Show its treatment in final accounts?

3. State the meaning of:

(a) Outstanding expenses

(b) Prepaid expenses

(c) Income received in advance

(d) Accrued income

4. Give the Performa of income statement and balance in vertical form.

5. Why is it necessary to create a provision for doubtful debts at the time of preparation of final accounts?

6. What adjusting entries would you record for the following :

(a) Depreciation

(b) Discount on debtors

(c) Interest on capital

(d) Manager’s commission

7. What is meant by provision for discount on debtors?

8. Give the journal entries for the following adjustments :

(a) Outstanding salary Rs. 3,500.

(b) Rent unpaid for one month at Rs. 6,000 per annum.

(c) Insurance prepaid for a quarter at Rs. 16,000 per annum.

(d) Purchase of furniture costing Rs. 7,000 entered in the purchases book.

Long Answers

1. What are adjusting entries? Why are they necessary for preparing final accounts?

2. What is meant by provision for doubtful debts? How are the relevant accounts prepared and what journal entries are recorded in final accounts? How is the amount for provision for doubtful debts calculated?

3. Show the treatment of prepaid expenses depreciation, closing stock at the time of preparation of final accounts when:

(a) When given inside the trial balance?

(b) When given outside the trial balance?

Numerical Questions

1. Prepare a trading and profit and loss account for the year ending March 31, 2017. from the balances extracted of M/s Rahul Sons. Also prepare a balance sheet at the end of the year.

Adjustments

1. Commission received in advance Rs.1,000.

2. Rent receivable Rs. 2,000.

3. Salary outstanding Rs. 1,000 and insurance prepaid Rs. 800.

4. Further bad debts Rs. 1,000 and provision for doubtful debts @ 5% on debtors and discount on debtors @ 2%.

5. Closing stock Rs. 32,000.

6. Depreciation on building @ 6% p.a.

(Ans : Gross loss Rs.17,000 ; Net loss Rs.43,189 ; Total balance sheet Rs.2,83,611)

2. Prepare a trading and profit and loss account of M/s Green Club Ltd. for the year ending March 31, 2017. from the following figures taken from his trial balance :

Adjustments

1. Depreciation charged on machinery @ 5% p.a.

2. Further bad debts Rs.1,500, discount on debtors @ 5% and make a provision on debtors @ 6%.

3. Wages prepaid Rs.1,000.

4. Interest on investment @ 5% p.a.

5. Closing stock 10,000.

(Ans. : Gross Profit Rs.79.000 ; Net Profit Rs.52,565 ; Total Balance Sheet Rs.1,57,565).

3 The following balances has been extracted from the trial of M/s Runway Shine Ltd. Prepare a trading and profit and loss account and a balance sheet as on March 31, 2017.

Adjustments

1. Further bad debts Rs. 1,000. Discount on debtors Rs. 500 and make a provision on debtors @ 5%.

2. Interest received on investment @ 5%.

3. Wages and interest outstanding Rs. 100 and Rs. 200 respectely.

4. Depreciation charged on motor car @ 5% p.a.

5. Closing Stock Rs. 32,500.

(Ans. : Gross profit Rs. 78,000 ; Net profit Rs. 66,010, Total balance sheet

Rs. 2,97,350).

4. From the following Trial Balance you are required to prepare trading and profit and loss account for the year ending March 31, 2017 and Balance Sheet on that date.

Adjustments

1. Closing stock valued at Rs. 36,000.

2. Private purchases amounting to Rs. 5000 debited to purchases account.

3. Provision for doubtful debts @ 5% on debtors.

4. Sign board costing Rs. 4,000 includes in advertising.

5. Depreciate furniture by 10%.

(Ans : Gross Profit Rs.1,09,000; Net loss Rs. 4,600; Total balance sheet Rs.2,98,900)

5. From the following information prepare trading and profit and loss account of M/s Indian sports house for the year ending March 31, 2017.

Adjustments

1. Closing stock was Rs.45,000.

2. Provision for doubtful debts is to be maintained @ 2% on debtors.

3. Depreciation charged on : furniture and fixture @ 5%, plant and Machinery @ 6% and motor car @ 10%.

4. A Machine of Rs.30,000 was purchased on October 01, 2016.

5. The manager is entitle to a commission of @ 10% of the net profit after charging such commission.

(Ans. : Gross profit Rs.1,01,000 ; Net profit Rs.68,909 ; Total balance sheet Rs. 3,43,200 ; Manager’s commission Rs.6,891)

6. Prepare the trading and profit and loss account and a balance sheet of M/s Shine Ltd. from the following particulars.

Adjustments

1. Closing stock was valued Rs. 35,000.

2. Depreciation charged on furniture and fixture @ 5%.

3. Further bad debts Rs. 1,000. Make a provision for bad debts @ 5% on sundry debtors.

4. Depreciation charged on motor car @ 10%.

5. Interest on drawing @ 6%.

6. Rent, rates and taxes was outstanding Rs.200.

7. Discount on debtors 2%.

(Ans. : Gross loss Rs,17,050 ; Net loss Rs.27,482 ; Total balance sheet

Rs. 3,18,894).

7. Following balances have been extracted from the trial balance of M/s Keshav Electronics Ltd. You are required to prepare the trading and profit and loss account and a balance sheet as on March 31, 2017.

The following additional information is available :

1. Stock on March 31, 2017 was Rs. 30,000.

2. Depreciation is to be charged on building at 5% and motor van at 10%.

3. Provision for doubtful debts is to be maintained at 5% on Sundry Debtors.

4. Unexpired insurance was Rs. 600.

5. The Manager is entitled to a commissiion @ 5% on net profit after charging such commission.

(Ans. : Gross profit Rs,37,600 ; Net profit Rs.25,381 ; Total balance sheet Rs.4,15,350 ; Manager’s commission Rs.1,269)

8. From the following balances extracted from the books of Raga Ltd. prepare a trading and profit and loss account for the year ended March 31, 2017 and a balance sheet as on that date.

The additional information is as under :

1. Closing stock was valued at the end of the year Rs, 20,000.

2. Depreciation on plant and machinery charged at 5% and land and building at 10%.

3. Discount on debtors at 3%.

4. Make a provision at 5% on debtors for doubtful debts.

5. Salary outstanding was Rs.100 and Wages prepaid was Rs. 40.

6. The manager is entitled a commission of 5% on net profit after charging such commission.

(Ans. : Gross profit Rs,21,240 ; Net profit Rs.12,664 ; Total balance sheet Rs.2,23,377 ; Manager’s commission Rs.633)

9. From the following balances of M/s Jyoti Exports, prepare trading and profit and loss account for the year ended March 31, 2017 and balance sheet as on this date.

Closing stock Rs.10,000.

1. To provision for doubtful debts is to be maintained at 5 per cent on sundry debtors.

2. Wages amounting to Rs.500 and salary amounting to Rs. 350 are outstanding.

3. Factory rent prepaid Rs. 100.

4. Depreciation charged on Plant and Machinery @ 5% and Building @ 10%.

5. Outstanding insurance Rs.100.

(Ans : Gross profit Rs.23,250 ; Net profit Rs.15,895 ; Total balance Sheet

Rs. 76,945)

10. The following balances have been extracted from the books of M/s Green House for the year ended March 31, 2017, prepare trading and profit and loss account and balance sheet as on this date.

Adjustments :

(a) Machinery is depreciated at 10% and buildings depreciated at 6%.

(b) Interest on capital @ 4%.

(c) Outstanding wages Rs. 50.

(d) Closing stock Rs.50,000.

(Ans : Gross profit Rs.83,750 ; Net Profit Rs.52,750 ; Total balance sheet Rs.3,27,700).

11. From the following balances extracted from the book of M/s Manju Chawla on March 31, 2017. You are requested to prepare the trading and profit and loss account and a balance sheet as on this date.

Closing stock was Rs.2,000.

(a) Interest on drawings @ 7% and interest on capital @ 5%.

(b) Land and Machinery is depreciated at 5%.

(c) Interest on investment @ 6%.

(d) Unexpired rent Rs.100.

(e) Charge 5% depreciation on furniture.

(Ans. : Gross profit Rs.21,900 ; Net profit Rs.25,185 ; Total balance sheet Rs.71,185).

12. The following balances were extracted from the books of M/s Panchsheel Garments on March 31, 2017.

Prepare the trading and profit and loss account for the year ended March 31, 2017 and a balance sheet as on that date.

(a) Unexpired insurance Rs 1,000.

(b) Salary due but not paid Rs. 1800.

(c) Wages outstanding Rs. 200.

(d) Interest on capital 5%.

(e) Scooter is depreciated @ 5%.

(f) Furniture is depreciated Rs.@ 10%.

(g) Closing stock was Rs. 15,000.

(Ans.: Gross profit Rs.39,200 ; Net profit Rs.22,780 ; Total balance sheet

Rs.1,03,280}.

13. Prepare the trading and profit and loss account and balance sheet of M/s Control Device India on March 31, 2017 from the following balance as on that date.

Closing stock was valued Rs. 20,000.

(a) Interest on capital @ 10%.

(b) Interest on drawings @ 5%.

(c) Wages outstanding Rs.50.

(d) Outstanding salary Rs.20.

(e) Provide a depreciation @ 5% on plant and machinery.

(f) Make a 5% provision on debtors.

(Ans.: Gross profit Rs.29,760 ; Net loss Rs.8,973 ; Total balance sheet Rs.1,28,000)

14. The following balances appeared in the trial balance of M/s Kapil Traders as on March 31, 2017

Rs.

Sundry debtors 30,500

Bad debts 500

Provision for doubtful debts 2,000

The partners of the firm agreed to records the following adjustments in the books of the Firm: Further bad debts Rs.300. Maintain provision for bad debts 10%. Show the following adjustments in the bad debts account, provision account, debtors account, profit and loss account and balance sheet.

(Ans ; Dr. Profit and Loss account Rs.1,820)

15. Prepare the bad debts account, provision for account, profit and loss account and balance sheet from the following information as on March 31, 2017

Rs.

Debtors 80,000

Bad debts 2,000

Provision for doubtful debts 5,000

Adjustments :

Bad debts Rs.500 Provision on debtors @ 3%.

(Ans : Credit Profit and Loss account Rs.115)

Checklist to Test Your Understanding

1. (c), 2. (d), 3. (b), 4. (a), 5. (d)