Table of Contents

13

Computerised Accounting System

In chapter 12, you have learnt about the need for use of computers in accounting the nature and use of accounting information system. In this chapter, we shall discuss the nature of computrised accounting system, its advantages, limitations and sourcing.

13.1 Concept of Computerised Accounting System

A computerised accounting system is an accounting information system that processes the financial transactions and events as per Generally Accepted Accounting Principles (GAAP) to produce reports as per user requirements. Every accounting system, manual or computerised, has two aspects. First, it has to work under a set of well-defined concepts called accounting principles. Another, that there is a user-defined framework for maintenance of records and generation of reports.

Learning Objectives

After studying this chapter, you will be able to :

• define a computerised accounting system;

• distinguish between a manual and computer-ised accounting sys-tem;

• highlight the advanta-ges and limitations of computerised account-ing system; and

• state the sourcing of a computerised account-ing system.

In a computerised accounting system, the framework of storage and processing of data is called operating environment that consists of hardware as well as software in which the accounting system, works. The type of the accounting system used determines the operating environment. Both hardware and software are interdependent. The type of software determines the structure of the hardware. Further, the selection of hardware is dependent upon various factors such as the number of users, level of secrecy and the nature of various activities of functional departments in an organisation.

Take the case of a club, for example, where the number of transactions and their variety is relatively small, a Personal Computer with standardised software may be sufficient. However, for a large business organisation with a number of geographically scattered factories and offices, more powerful computer systems supported by sophisticated networks are required to handle the voluminous data and the complex reporting requirements. In order to handle such requirements, multi-user operating systems such as UNIX, Linux, etc. are used.

Modern computerised accounting systems are based on the concept of database. A database is implemented using a database management system, which is define by a set of computer programmes (or software) that manage and organise data effectively and provide access to the stored data by the application programmes. The accounting database is well-organised with active interface that uses accounting application programs and reporting system. Every computerised accounting system has two basic requirements;

• Accounting Framework : It consists a set of principles, coding and grouping structure of accounting.

• Operating Procedure : It is a well-defined operating procedure blended suitably with the operating environment of the organisation.

The use of computers in any database oriented application has four basic requirements as mentioned below ;

• Front-end Interface : It is an interactive link or a dialog between the user and database-oriented software through which the user communicates to the back-end database. For example, a transaction relating to purchase of goods may be dealt with the accounting system through a purchase voucher, which appears on the computer’s monitor of data entry operator and when entered into the system is stored in the database. The same data may be queried through reporting system say purchase analysis software programme.

• Back-end Database : It is the data storage system that is hidden from the user and responds to the requirement of the user to the extent the user is authorised to access.

• Data Processing : It is a sequence of actions that are taken to transform the data into decision useful information.

• Reporting System: It is an integrated set of objects that constitute the report.

The computerised accounting is also one of the database-oriented applications wherein the transaction data is stored in well-organised database. The user operates on such database using the required and desired interface and also takes the desired reports by suitable transformations of stored data into information. Therefore, the fundamentals of computerised accounting embrace all the basic requirements of any database-oriented application in computers. Accordingly, the computerised accounting system has the above four additional requirements.

13.2 Comparison between Manual and Computerised Accounting

Accounting, by definition, is the process of identifying, recording, classifying and summarising financial transactions to produce the financial reports for their ultimate analysis. Let us understand these activities in the context of manual and computerised accounting system.

• Identifying : The identification of transactions, based on application of accounting principles is, common to both manual and computerised accounting system.

• Recording : The recording of financial transactions, in manual accounting system is through books of original entries while the data content of such transactions is stored in a well-designed accounting database in computerised accounting system.

• Classification : In a manual accounting system, transactions recorded in the books of original entry are further classified by posting into ledger accounts. This results in transaction data duplicity. In computerised accounting, no such data duplication is made to cause classification of transactions. In order to produce ledger accounts, the stored transaction data is processed to appear as classified so that the same is presented in the form of a report. Different forms of the same transaction data are made available for being presented in various reports.

• Summarising : The transactions are summarised to produce trial balance in manual accounting system by ascertaining the balances of various accounts. As a result, preparation of ledger accounts becomes a pre-requisite for preparing the trial balance. However, in computerised accounting, the originally stored transactions data are processed to churn out the list of balances of various accounts to be finally shown in the trial balance report. The generation of ledger accounts is not a necessary condition for producing trial balance in a computerised accounting system.

• Adjusting Entries : In a manual accounting system, these entries are made to adhere to the principle of cost matching revenue. These entries are recorded to match the expenses of the accounting period with the revenues generated by them. Some other adjusting entries may be made as part of errors and rectification. However, in computerised accounting, Journal vouchers are prepared and stored to follow the principle of cost matching revenue, but there is nothing like passing adjusting entries for errors and rectification, except for rectifying an error of principle by having recorded a wrong voucher such as using payment voucher for a receipt transaction.

• Financial Statements : In a manual system of accounting, the preparation of financial statements pre-supposes the availability of trial balance. However, in computerised accounting, there is no such requirement. The generation of financial statements is independent of producing the trial balance because such statements can be prepared by direct processing of originally stored transaction data.

• Closing the Books : After the preparation of financial reports, the accountants make preparations for the next accounting period. This is achieved by posting of closing and reversing journal entries. In computerised accounting, there is year-end processing to create and store opening balances of accounts in database.

It may be observed that conceptually, the accounting process is identical regardless of the technology used.

13.3 Advantages of Computerised Accounting System

Computerised accounting offers several advantages vis-a-vis manual accounting, these are summarised as follows ;

• Speed : Accounting data is processed faster by using a computerised accounting system than it is achieved through manual efforts. This is because computers require far less time than human beings in performing a task.

• Accuracy : The possibility of error is eliminated in a computerised accounting system because the primary accounting data is entered once for all the subsequent usage and processes in preparing the accounting reports. Normally, accounting errors in a manual accounting system occur because of repeated posting of same set of original data by several times while preparing different types of accounting reports.

• Reliability : The computer system is well-adapted to performing repetitive operations. They are immune to tiredness, boredom or fatigue. As a result, computers are highly reliable compared to human beings. Since computerised accounting system relies heavily on computers, they are relatively more reliable than manual accounting systems.

• Up-to-Date Information : The accounting records, in a computerised accounting system are updated automatically as and when accounting data is entered and stored. Therefore, latest information pertaining to accounts get reflected when accounting reports are produced and printed. For example, when accounting data pertaining to a transaction regarding cash purchase of goods is entered and stored, the cash account, purchase account and also the financial statements (trading and profit and loss account) reflect the impact immediately.

• Real Time User Interface : Most of the automated accounting systems are inter-linked through a network of computers. This facilitates the availability of information to various users at the same time on a real time basis (that is spontaneously).

• Automated Document Production : Most of the computerised accounting systems have standardised, user defined format of accounting reports that are generated automatically. The accounting reports such as Cash book, Trial balance, Statement of accounts are obtained just by click of a mouse in a computerised accounting environment.

• Scalability : In a computerised accounting system, the requirement of additional manpower is confined to data entry operators for storing additional vouchers. The additional cost of processing additional transactions is almost negligible. As a result the computerised accounting systems are highly scalable.

• Legibility : The data displayed on computer monitor is legible. This is because the characters (alphabets, numerals, etc.) are type written using standard fonts. This helps in avoiding errors caused by untidy written figures in a manual accounting system.

• Efficiency : The computer based accounting systems ensure better use of resources and time. This brings about efficiency in generating decisions, useful informations and reports.

• Quality Reports : The inbuilt checks and untouchable features of data handling facilitate hygienic and true accounting reports that are highly objective and can be relied upon.

• MIS Reports : The computerised accounting system facilitates the real time production of management information reports, which will help management to monitor and control the business effectively. Debtors’ analysis would indicate the possibilities of defaults (or bad debts) and also concentration of debt and its impact on the balance sheet. For example, if the company has a policy of restricting the credit sales by a fixed amount to a given party, the information is available on the computer system immediately when every voucher is entered through the data entry form. However, it takes time when it comes to a manual accounting system. Besides, the results may not be accurate.

• Storage and Retrieval : The computerised accounting system allows the users to store data in a manner that does not require a large amount of physical space. This is because the accounting data is stored in

hard-disks, CD-ROMs, floppies that occupy a fraction of physical space compared to books of accounts in the form of ledger, journal and other accounting registers. Besides, the system permits fast and accurate retrieval of data and information.

• Motivation and Employees Interest : The computer system requires a specialised training of staff, which makes them feel more valued. This motivates them to develop interest in the job. However, it may also cause resistance when we switch over from a manual system to a computer system.

Test Your Understanding - I

1. The framework of storage and processing of data is called as ........

2. Database is implemented using ........

3. A sequence of actions taken to transform the data into decision useful information is called.......

4. An appropriate accounting software for a small business organisation having only one user and single office location would be ........

13.4 Limitations of Computerised Accounting System

The main limitations emerge out of the environment in which the computerised accounting system is made to operate. These limitations are as given below ;

• Cost of Training : The sophisticated computerised accounting packages generally require specialised staff personnel. As a result, a huge training costs are incurred to understand the use of hardware and software on a continuous basis because newer types of hardware and software are acquired to ensure efficient and effective use of computerised accounting systems.

• Staff Opposition : Whenever the accounting system is computerised, there is a significant degree of resistance from the existing accounting staff, partly because of the fear that they shall be made redundant and largely because of the perception that they shall be less important to the organisation.

• Disruption : The accounting processes suffer a significant loss of work time when an organisation switches over to the computerised accounting system. This is due to changes in the working environment that requires accounting staff to adapt to new systems and procedures.

• System Failure : The danger of the system crashing due to hardware failures and the subsequent loss of work is a serious limitation of computerised accounting system. However, providing for back-up arrangements can obviate this limitation. Software damage and failure may occur due to attacks by viruses. This is of particular relevance to accounting systems that extensively use Internet facility for their online operations. No full-proof solutions are available as of now to tackle the menace of attacks on software by viruses.

• Inability to Check Unanticipated Errors : Since the computers lack capability to judge, they cannot detect unanticipated errors as human beings commit. This is because the software to detect and check errors is a set of programmes for known and anticipated errors.

• Breaches of Security : Computer related crimes are difficult to detect as any alteration of data may go unnoticed. The alteration of records in a manual accounting system is easily detected by first sight. Fraud and embezzlement are usually committed on a computerised accounting system by alteration of data or programmes. Hacking of passwords or user rights may change the accounting records. This is achieved by tapping telecommunications lines, wire-tapping or decoding of programmes. Also, the people responsible for tampering of data cannot be located which in a manual system is relatively easier to detect.

• Ill-effects on Health : The extensive use of computers systems may lead to development of various health problems: bad backs, eyestrain, muscular pains, etc. This affects adversely the working efficiency of accounting staff on one hand and increased medical expenditure on such staff on the other.

Do It Yourself

Visit a commercial organisation where the accounting is performed manually. Observe the various accounting activities. Now list the advantages, which would have accrued, had the accounting being performed through computers.

13.5 Sourcing of Accounting Software

Accounting software is an integral part of the computerised accounting system. An important factor to be considered before acquiring accounting software is the accounting expertise of people responsible in organisation for accounting work. People, not computers, are responsible for accounting. The need for accounting software arises in two situations : (a) when the computerised accounting system is implemented to replace the manual system or (b) when the current computerised system needs to be replaced with a new one in view of changing needs.

Variety of accounting software is available in the market. The most popular software used in India are Tally and Ex. The basic features of all accounting software are same on a global basis. The legal reporting requirements in a given country and the business needs affect the software contents. The other popular softwares are Sage, Wings 2000, Best Books, Cash Manager, and Ace Pays, etc.

13.5.1 Accounting Packages

Every Computerised Accounting System is implemented to perform the accounting activity (recording and storing of accounting data) and generate reports as per the requirements of the user. From this perspective.

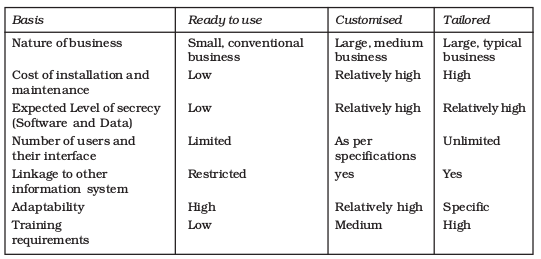

The accounting packages are classified into the following categories :

(a) Ready to use

(b) Customised

(c) Tailored

Each of these categories offers distinctive features. However, the choice of the accounting software would depend upon the suitability to the organisation especially in terms of accounting needs.

13.5.2 Ready-to-Use

Ready-to-Use accounting software is suited to organisations running small/conventional business where the frequency or volume of accounting transactions is very low. This is because the cost of installation is generally low and number of users is limited. Ready-to-use software is relatively easier to learn and people (accountant) adaptability is very high. This also implies that level of secrecy is relatively low and the software is prone to data frauds. The training needs are simple and sometimes the vendor (supplier of software) offers the training on the software free. However, these software offer little scope of linking to other information systems.

13.5.3 Customised

Accounting software may be customised to meet the special requirement of the user. Standardised accounting software available in the market may not suit or fulfil the user requirements. For example, standardised accounting software may contain the sales voucher and inventory status as separate options. However, when the user requires that inventory status to be updated immediately upon entry of sales voucher and report be printed, the software needs to be customised.

Customised software is suited for large and medium businesses and can be linked to the other information systems. The cost of installation and maintenance is relatively high because the high cost is to be paid to the vendor for customisation. The customisation includes modification and addition to the software contents, provision for the specified number of users and their authentication, etc. Secrecy of data and software can be better maintained in customised software. Since the need to train the software users is important, the training costs are therefore high.

13.5.4 Tailored

The accounting software is generally tailored in large business organisations with multi users and geographically scattered locations. These software requires specialised training to the users. The tailored software is designed to meet the specific requirements of the users and form an important part of the organisational MIS. The secrecy and authenticity checks are robust in such softwares and they offer high flexibility in terms of number of users.

To summarise, the following table represents the comparison between the various categories of accounting software :

13.6 Generic Considerations before Sourcing an Accounting Software

The following factors are usually taken in considerations before sourcing an accounting software.

13.6.1 Flexibility

An important consideration before sourcing an accounting software is flexibility, viz. data entry and the availability and design of various reports expected from it. Also, it should offer some flexibility between the users of the software, the switch over between the accountants (users), operating systems and the hardware. The user should be able to run the software on variety of platforms and machines, e.g. Windows 98/2000, Linux, etc.

13.6.2 Cost of Installation and Maintenance

The choice of the software obviously requires consideration of organisation ability to afford the hardware and software. A simple guideline to take such a decision is the cost benefit analysis of the available options and the financing opportunities available to the firm. Some times, certain software which appears cheap to buy, involve heavy maintenance and alteration costs, e.g. cost of addition of modules, training of staff, updating of versions, data failure/restoring costs. Conversely, the accounting software which appear initially expensive to buyers, may require least maintenance and free upgrading and negligible alteration costs.

13.6.3 Size of Organisation

The size of organisation and the volume of business transactions do affect the software choices. Small organisations, e.g. in non-profit organisations, where the number of accounting transactions is not so large, may opt for a simple, single user operated software. While, a large organisation may require sophisticated software to meet the multi-user requirements, geographically scattered and connected through complex networks.

13.6.4 Ease of Adaptation and Training needs

Some accounting software is user friendly requiring a simple training to the users. However, some other complex software packages linked to other information systems require intensive training on a continuous basis. The software must be capable of attracting users and, if its requires simple training, should be able to motivate its potential users.

13.6.5 Utilities/MIS Reports

The MIS reports and the degree to which they are used in the organisation also determine the acquisition of software. For example, software that requires simply producing the final accounts or cash flow/ratio analysis may be ready-to-use software. However, the software, which is expected to produce cost records needs to be customised as per user requirements.

13.6.6 Expected Level of Secrecy (Software and Data)

Another consideration before buying accounting software is the security features, which prevent unauthorised personnel from accessing and/or manipulating data in the accounting system. In tailored software for large businesses, the user rights may be restricted to purchase vouchers for the purchase department, sales vouchers to the billing accountants and petty cash module access with the cashier. The operating system also matters. Unix environment allows multi-users compared to Windows. In Unix, the user cannot make the computer system functional unless the user clicks with a password, which is not a restriction in Windows.

13.6.7 Exporting/Importing Data Facility

The transfer of database to other systems or software is sometimes expected from the accounting software. Organisations may need to transfer information directly from the ledger into spreadsheet software such as Lotus or Excel for more flexible reporting. The software should allow the hygienic, untouched data transfer.

Accounting software may be required to be linked to MIS software in the organisation. In some ready to use accounting softwares, the exporting, importing facility is available but is limited to MS Office modules only, e.g. MS Word, MS Excel, etc. However, tailored softwares are designed in manner that they can interact and share information with the various sub components of the organisational MIS.

13.6.8 Vendors Reputation and Capability

Another important consideration is the reputation and capability of about

the vendor. This depends upon how long has he been the vendor is in business of software development, whether there are other users of the software and

extent of the availability of support mechanisms outside the premises of the vendor.

Key Terms Introduced in the Chapter

• Computerised Accounting System

• Mannual Accounting System

• Generally Accepted Accounting Principles

• Operating Environment

• Accounting Software

• Accounting Packages

Summary with Reference to Learning Objectives

1 Computerised Accounting System : A computerised accounting system is an accounting information system that processes the financial transactions and events to produce reports as per user requirements. It is based on the concept of database and has two basic requirements: (a) Accounting framework and

(b) Operating Procedure.

2 Advantages of Computerised Accounting System :

• Speed

• Accuracy

• Reliability

• Up-to-date

• Scalability

• Legibility

• Efficiency

• Quality Report

• MIS Reports

• Real time user interface

• Storage and Retrieval

• Motivation and Employees interest

• Automated document production

3 Limitations of Computerised Accounting System :

• Cost of training

• Staff Opposition

• Disruption

• System failure

• Breache of security

• Ill-effects on health

• Inability to check

unanticipated errors

4 Categories of Accounting Packages :

• Ready-to-Use

• Customised

• Tailored

Questions for Practice

Short Answers

1. State the four basic requirements of a database applications.

2. Name the various categories of accounting package.

3. Give examples of two types of operating systems.

4. List the various advantages of computerised accounting systems.

5. Give two examples each of the organisations where ‘ready-to-use’, ‘customised’, and ‘tailored’ accounting packages respectively suitable to perform the accounting activity.

6. Distinguish between a ‘ready-to-use’ and ‘tailored’ accounting software.

Long Answers

1. Define a computerised accounting system. Distinguish between a manual and computerised accounting system.

2. Discuss the advantages of computerised accounting system over the manual accounting system.

3. Describe the various types of accounting software along with their advantages and limitations.

4. ‘Accounting software is an integral part of the computerised accounting system’ Explain. Briefly list the generic considerations before sourcing an accounting software.

5. ‘Computerised Accounting Systems are best form of accounting system’. Do you agree? Comment.

Checklist to Test Your Understanding

1. Operating environment 2. DBMS 3. Data Processing 4. Ready to use