Table of Contents

Chapter 7

Formation of a Company

Learning Objectives

After studying this chapter, you should be able to:

• specify the important stages in the formation of a company;

• describe the steps involved in each stage of company formation;

• specify the documents to be submitted to the registrar of companies; and

• state the need of certificate of incorporation and certificate to commence business.

Avtar, a brilliant automobile engineer, has recently developed a new carburettor in his factory which he is running as a sole proprietor. The new carburettor can cut down petrol consumption of a car engine by 40 percent. He is now thinking of producing it on a large scale for which he requires a large amount of money. He is to evaluate different forms of organisations for doing the business of manufacturing and marketing his carburettor. He decides against converting his sole proprietorship to partnership as the requirement of funds for the project is large and the product being new, there is a lot of risk involved. He is advised to form a company. He wants to know about the formalities required for the formation of a company.

7.1 Introduction

Modern day business requires large amount of money. Also, due to increasing competition and fast changing technological environment, the element of risk is increasing. As a result, the company form of organisation is being preferred by more and more business firms, particularly for setting up medium and large sized organisations.

The steps which are required from the time a business idea originates to the time, a company is legally ready to commence business are referred to as stages in the formation of a company. Those who are taking these steps and the associated risks are promoting a company and are called its promoters.

The present chapter describes in some details the stages in the formation of a company and also the steps required to be taken in each stage so that a fair idea about these aspects can be made.

7.2 Formation of a Company

Formation of a company is a complex activity involving completion of legal formalities and procedures. To fully understand the process one can divide the formalities into three distinct stages, which are: (i) Promotion; (ii) Incorporation and (iii) Subscription of capital.

It may, however, be noted that these stages are appropriate from the point of view of formation of any kind of company. Private company as against the public limited company is prohibited to raise funds from public, it does not need to issue a prospectus and complete the formality of minimum subscription.

In the next section, we shall discuss the stages in the formation of a company in detail.

7.2.1 Promotion of a Company

Promotion is the first stage in the formation of a company. It involves conceiving a business idea and taking an initiative to form a company so that practical shape can be given to exploiting the available business opportunity. Thus, it begins with somebody having discovered a potential business idea. Any person or a group of persons or even a company may have discovered an opportunity. If such a person or a group of persons or a company proceeds to form a company, then, they are said to be the promoters of the company.

A promoter is said to be the one who undertakes to form a company with reference to a given project and to set it going and who takes the necessary steps to accomplish that purpose. Thus, apart from conceiving a business opportunity the promoters analyse its prospects and bring together the men, materials, machinery, managerial abilities and financial resources and set the organisation going.

As per section 69, a promoter means a person

(a) Who has been named as such in a prospectus or is identified by the company in the annual return referred to in section 92; or

(b) Who has control over the affairs of the company, directly or indirectly whether as a shareholder, director or otherwise; or

(c) In accordance with whose advice, directions or instructions the Board of Directors of the company is accustomed to act. However, it is provided that nothing in this sub-clause shall apply to a person who is acting merely in a professional capacity.

After thoroughly examining the feasibility of the idea, the promoters assemble resources, prepare necessary documents, give a name and perform various other activities to get a company registered and obtain the necessary certificate enabling the company to commence business. Thus, the promoters perform various functions to bring a company into existence.

Functions of a Promoter

The important functions of promoters may be listed as below:

(i) Identification of business opportunity: The first and foremost activity of a promoter is to identify a business opportunity. The opportunity may be in respect of producing a new product or service or making some product available through a different channel or any other opportunity having an investment potential. Such opportunity is then analysed to see its technical and economic feasibility.

(ii) Feasibility studies: It may not be feasible or profitable to convert all identified business opportunities into real projects. The promoters, therefore, undertake detailed feasibility studies to investigate all aspects of the business they intend to start. Depending upon the nature of the project, the following feasibility studies may be undertaken, with the help of the specialists like engineers, chartered accountants etc., to examine whether the perceived business opportunity can be profitably exploited.

( a) Technical feasibility: Sometimes an idea may be good but technically not possible to execute. It may be so because the required raw material or technology is not easily available. For example, in our earlier story suppose Avtar needs a particular metal to produce the carburettor. If that metal is not produced in the country and because of poor political relations, it can not be imported from the country which produces it, the project would be technically unfeasible until arrangements are made to make the metal available from alternative sources.

( b) Financial feasibility: Every business activity requires funds. The promoters have to estimate the fund requirements for the identified business opportunity. If the required outlay for the project is so large that it cannot easily be arranged within the available means, the project has to be given up. For example, one may think that developing townships is very lucrative. It may turn out that the required funds are in several crores of rupees, which cannot be arranged by floating a company by the promoters. The idea may be abandoned because of the lack of financial feasibility of the project.

( c) Economic feasibility: Sometimes it so happens that a project is technically viable and financially feasible but the chance of it being profitable is very little. In such cases as well, the idea may have to be abondoned. Promoters usually take the help of experts to conduct these studies. It may be noted that these experts do not become promoters just because they are assisting the promoters in these studies.

Only when these investigations throw up positive results, the promoters may decide to actually launch a company.

Name Clause

A name is considered undesirable in the following cases:

(a) If it is identical with or too closely resembles the name of an existing company

(b) If it is misleading. It is so considered if the name suggests that the company is in a particular business or it is an association of a particular type when it is not true

(c) If it is violative of the provisions of ‘The Emblem and Names (Prevention of Improper Use) Act 1950, as given in the schedule to this Act. This schedule specifies, inter alia, the name, emblem or official seal of the UNO and its bodies like WHO, UNESCO etc. Government of India, State Governments, President of India or Governer of any State, the Indian National Flag. The Act also prohibits use of any name which may suggest patronage of Government of India, or any state government or any local authority

(iii) Name approval: Having decided incorporate to a company, the promoters have to select a name for it and submit, an application to the registrar of companies of the state in which the registered office of the company is to be situated, for its approval. The proposed name may be approved if it is not considered undesirable. It may happen that another company exists with the same name or a very similar name or the preferred name is misleading, say, to suggest that the company is in a particular business when it is not true. In such cases the proposed name is not accepted but some alternate name may be approved. Therefore, three names, in order of their priority are given in the application to the Registrar of Companies. (Proforma INC1 is given at the end of the Book).

(iv) Fixing up Signatories to the Memorandum of Association: Promoters have to decide about the members who will be signing the Memorandum of Association of the proposed company. Usually the people signing memorandum are also the first Directors of the Company. Their written consent to act as Directors and to take up the qualification shares in the company is necessary.

(v) Appointment of professionals: Certain professionals such as mercantile bankers, auditors etc., are appointed by the promoters to assist them in the preparation of necessary documents which are required to be with the Registrar of Companies. The names and addresses of shareholders and the number of shares allotted to each is submitted to the Registrar in a statement called return of allotment.

(vi) Preparation of necessary documents: The promoter takes up steps to prepare certain legal documents, which have to be submitted under the law, to the Registrar of the Companies for getting the company registered. These documents are Memorandum of Association, Articles of Association and Consent of Directors.

Documents Required to be Submitted

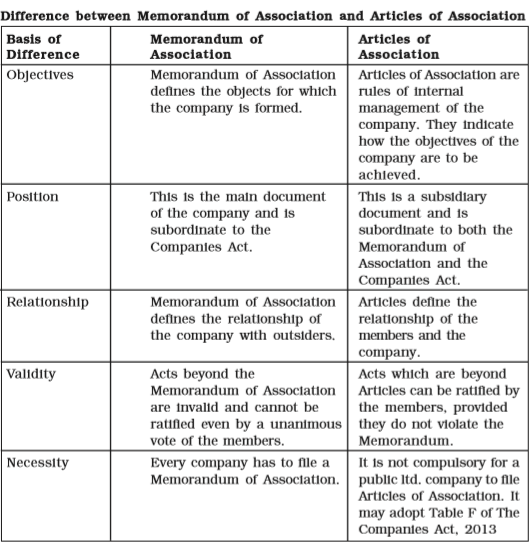

A. Memorandum of Association: Memorandum of Association is the most important document as it defines the objectives of the company. No company can legally undertake activities that are not contained in its Memorandum of Association. As per section 2(56) of The Companies Act, 2013 “memorandum” means the memorandum of association of a company as originally framed or as altered from time to time in pursuance of any previous company law or of this Act. The Memorandum of Association contains different clauses, which are given as follows:

(i) The name clause: This clause contains the name of the company with which the company will be known, which has already been approved by the Registrar of Companies.

(ii) Registered office clause: This clause contains the name of the state, in which the registered office of the company is proposed to be situated. The exact address of the registered office is not required at this stage but the same must be notified to the Registrar within thirty days of the incorporation of the company.

(iii) Objects clause: This is probably the most important clause of the memorandum. It defines the purpose for which the company is formed. A company is not legally entitled to undertake an activity, which is beyond the objects stated in this clause. The main objects for which the company is formed are listed in this sub-clause. It must be observed that an act which is either essential or incidental for the attainment of the main objects of the company is deemed to be valid, although it may not have been stated explicitly.

(iv) Liability clause: This clause limits the liability of the members to the amount unpaid on the shares owned by them.

For example, if a shareholder has purchased 1000 shares of `10 each and has already paid ` 6 per share, his/her liability is limited to ` 4 per share. Thus, even in the worst case, he/she may be called upon to pay ` 4, 000 only.

(v) Capital clause: This clause specifies the maximum capital which the company will be authorised to raise through the issue of shares. The authorised share capital of the proposed company along with its division into the number of shares having a fixed face value is specified in this clause. For example, the authorised share capital of the company may be ` 25 lakhs with divided into 2.5 lakh shares of ` 10 each. The said company cannot issue share capital in excess of the amount mentioned in this clause.

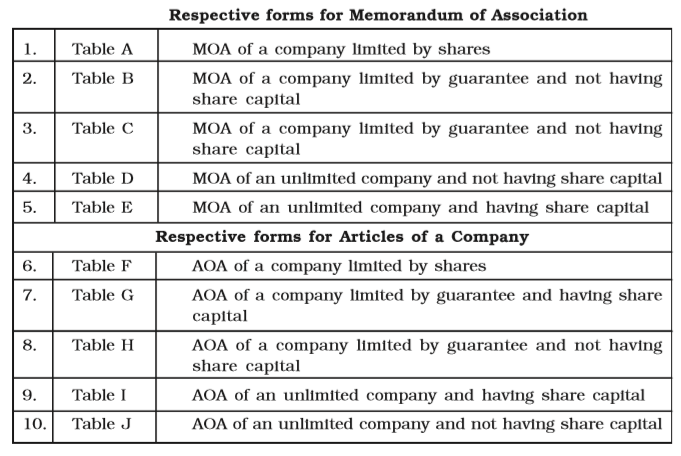

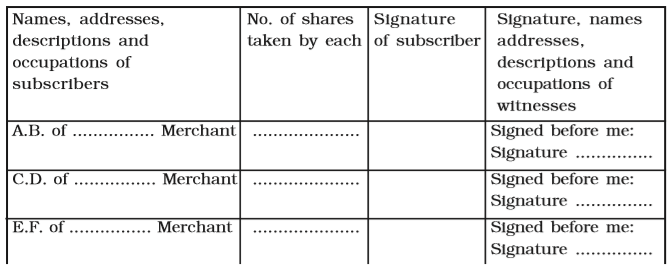

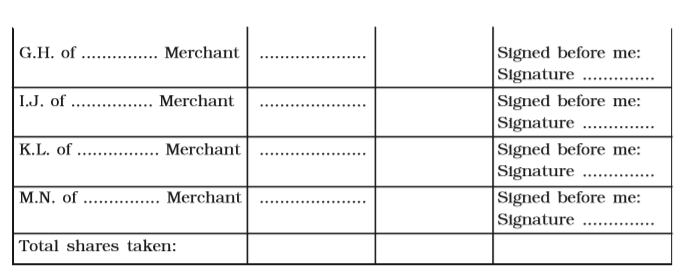

The signatories to the Memorandum of Association state their intention to be associated with the company and give their undertaking to subscribe to the shares mentioned against their names. The memorandum of a company shall be in respective forms specified in Tables A, B, C, D and E in Schedule I as may be applicable to such company.

The Memorandum of Association must be signed by at least seven persons in case of a public company and by two persons in case of a private company.

A copy of a Memorandum of Association is given at the end of the chapter.

B. Articles of Association: Articles of Association are the rules regarding internal management of a company. These rules are subsidiary to the Memorandum of Association and hence, should not contradict or exceed anything stated in the Memorandum of Association.

According to section 2(5) of The Companies Act, 2013, ‘articles’ means the article of association of a company as originally framed or as altered from time to time or applied in pursuance of any previous company law or of this Act. The articles of a company shall be in respective forms as specified in Table F, G, H, I and J in schedule I as may be applicable to such company. However, the companies are free to make their own articles of association which may be contrary to the clauses of Table F,G,H,I,J and in that case articles of association as adopted by the company shall apply.

C. Consent of Proposed Directors: Apart from the Memorandum and Articles of Association, a written consent of each person named as a director is required confirming that they agree to act in that capacity and undertake to buy and pay for qualification shares, as mentioned in the Articles of Association.

D. Agreement: The agreement, if any, which the company proposes to enter with any individual for appointment as its Managing Director or a whole time Director or Manager is another document which is required to be submitted to the registrar for getting the company registered under the Act.

Qualification Shares

To ensure that the directors have some stake in the proposed company, the Articles usually have a provision requiring them to buy a certain number of shares. They have to pay for these shares before the company obtains Certificate of Commencement of Business. These are called Qualification Shares.

The Articles generally contains the following matters:

1. Exclusion wholly or in part of Table F.

2. Adoption of preliminary contracts.

3. Number and value of shares.

4. Issue of preference shares.

5. Allotment of shares.

6. Calls on shares.

7. Lien on shares.

8. Transfer and transmission of shares.

9. Nomination.

10. Forfeiture of shares.

11. Alteration of capital.

12. Buy back.

13. Share certificates.

14. Dematerialization.

15. Conversion of shares into stock. Incorporation of Companies and Matters Incidental Thereto

16. Voting rights and proxies.

17. Meetings and rules regarding committees.

18. Directors, their appointment and delegations of powers.

19. Nominee directors.

20. Issue of Debentures and stocks.

21. Audit committee.

22. Managing director, Whole-time director, Manager, Secretary.

23. Additional directors.

24. Seal.

25. Remuneration of directors.

26. General meetings.

27. Directors meetings.

28. Borrowing powers.

29. Dividends and reserves.

30. Accounts and audit.

31. Winding up.

32. Indemnity.

33. Capitalisation of reserves.

E. Statutory Declaration: A declaration stating that all the legal requirements pertaining to registration have been complied with is to be submitted to the Registrar with the above mentioned documents for getting the company registered under the law. This statement can be signed by an advocate or by a Chartered Accountant or a Cost Accountant or a Company Secretary in practice who is engaged in the formation of a company and by a person named in the articles as a director or manager or secretary of the company.

F. Receipt of Payment of fee: Along with the above-mentioned documents, necessary fees has to be paid for the registration of the company. The amount of such fees shall depend on the authorised share capital of the company.

Position of Promoters

Promoters undertake various activities to get a company registered and get it to the position of commencement of business. But they are neither the agents nor the trustees of the company. They can’t be the agents as the company is yet to be incorporated. Therefore, they are personally liable for all the contracts which are entered by them, for the company before its incorporation, in case the same are not ratified by the company later on. Also promoters are not the trustees of the company.

Promoters of a company enjoy a fiduciary position with the company, which they must not misuse. They can make a profit only if it is disclosed but must not make any secret profits. In the event of a non-disclosure, the company can rescind the contract and recover the purchase price paid to the promoters. It can also claim damages for the loss suffered due to the non-disclosure of material information.

Promoters are not legally entitled to claim the expenses incurred in the promotion of the company. However, the company may choose to reimburse them for the pre-incorporation expenses. The company may also remunerate the promoters for their efforts by paying a lump sum amount or a commission on the purchase price of property purchased through them or on the shares sold. The company may also allot them shares or debentures or give them an option to purchase the securities at a future date.

7.2.2 Incorporation

After completing the aforesaid formalities, promoters make an application for the incorporation of the company. The application is to be filed with the Registrar of Companies of the state within which they plan to establish the registered office of the company. The application for registration must be accompanied with certain documents about which we have already discussed in the previous sections. These may be briefly mentioned again:

1. The Memorandum of Association duly stamped, signed and witnessed. In case of a public company, at least seven members must sign it. For a private company however the signatures of two members are sufficient. The signatories must also give information about their address, occupation and the number of shares subscribed by them.

2. The Articles of Association duly stamped and witnessed as in case of the Memorandum. However, as stated earlier, a public company may adopt Table A, which is a model set of Articles, given in the Companies Act. In that case a statement in lieu of the prospectus is submitted, instead of Articles of Association.

3. Written consent of the proposed directors to act as directors and an undertaking to purchase qualification shares.

4. The agreement, if any, with the proposed Managing Director, Manager or whole-time director.

5. A copy of the Registrar’s letter approving the name of the company.

6. A statutory declaration affirming that all legal requirements for registration have been complied with. This must be duly signed.

7. A notice about the exact address of the registered office may also be submitted along with these documents. However, if the same is not submitted at the time of incorporation, it can be submitted within 30 days of the receipt of the certificate of incorporation.

8. Documentary evidence of payment of registration fees.

The Registrar upon submission of the application along with the required documents has to be satisfied that the documents are in order and that all the statutory requirements regarding the registration have been complied with. However, it is not his duty to carry out a thorough investigation about the authenticity of the facts mentioned in the documents.

When the Registrar is satisfied, about the completion of formalities for registration, a Certificate of Incorporation is issued to the company, which signify the birth of the company. The certificate of incorporation may therefore be called the birth certificate of the company.

With effect from November 1, 2000, the Registrar of Companies allots a CIN (Corporate Identity Number) to the Company.

Preliminary Contracts

During the promotion of the company, promoters enter into certain contracts with third parties on behalf of the company. These are called preliminary contracts or pre-incorporation contracts. These are not legally binding on the company. A company after coming into existence may, if it so chooses, decide to enter into fresh contracts with the same terms and conditions to honour the contracts made by the promoters. Note that it cannot ratify a preliminary contract. A company thus cannot be forced to honour a preliminary contract. Promoters, however, remain personally liable to third parties for these contracts.

Effect of the Certificate of Incorporation

A company is legally born on the date printed on the Certificate of Incorporation. It becomes a legal entity with perpetual succession on such date. It becomes entitled to enter into valid contracts. The Certificate of Incorporation is a conclusive evidence of the regularity of the incorporation of a company. Imagine, what would happen to an unsuspecting party with which the company enters into a contract, if it is later found that the incorporation of the company was improper and hence invalid. Therefore, the legal situation is that once a Certificate of Incorporation has been issued, the company has become a legal business entity irrespective of any flaw in its registration. The Certificate of Incorporation is thus conclusive evidence of the legal existence of the company. Some interesting examples showing the impact of the conclusiveness of the Certificate of Incorporation are as under:

(a) Documents for registration were filed on 6th January. Certificate of Incorporation was issued on 8th January. But the date mentioned on the Certificate was 6th January. It was decided that the company was in existence and the contracts signed on 6th January were considered valid.

( b) A person forged the signatures of others on the Memorandum. The Incorporation was still considered valid.

Director Identification Number (DIN)

Every Individual intending to be appointed as director of a company shall make an application for allotment of Director Identification Number (DIN) to the Central Government in prescribed form along with fees.

The Central Government shall allot a Director Identification Number to an application within one month from the receipt of the application.

No individual, who has already been allotted a Director Identification Number, shall apply for, obtain or possess another Director Identification Number

Thus, whatever be the deficiency in the formalities, the Certificate of Incorporation once issued, is a conclusive evidence of the existence of the company. Even when a company gets registered with illegal objects, the birth of the company cannot be questioned. The only remedy available is to wind it up. Because the Certificate of Incorporation is so crucial, the Registrar has to go very carefully before issuing it.

Both public and private companies are required to obtain the certificate for commencement of business within 180 days of its incorporation. Once the certificate for commencement of business is issued by Registrar of companies it can undertake their business operations.

7.2.3 Capital Subscription

A public company can raise the required funds from the public by means of issue of securities (shares and debentures etc.). For doing the same, it has to issue a prospectus which is an invitation to the public to subscribe to the capital of the company and undergo various other formalities. The following steps are required for raising funds from the public:

(i) SEBI Approval: SEBI (Securities and Exchange Board of India) which is the regulatory authority in our country has issued guidelines for the disclosure of information and investor protection. A public company inviting funds from the general public must make adequate disclosure of all relevant information and must not conceal any material information from the potential investors. This is necessary for protecting the interest of the investors. Prior approval from SEBI is, therefore, required before going ahead with raising funds from public.

(ii) Filing of Prospectus: A copy of the prospectus or statement in lieu of prospectus is filed with the Registrar of Companies. A prospectus is ‘any document described or issued as a prospectus including any notice, circular, advertisement or other document inviting deposits from the public or inviting offers from the public for the subscription or purchase of any securities of, a body corporate’. In other words, it is an invitation to the public to apply for securities (shares, debentures etc.) of the company or to make deposits in the company. Investors make up their minds about investment in a company primarily on the basis of the information contained in this document. Therefore, there must not be a mis-statement in the prospectus and all material significant information must be fully disclosed.

(iii) Appointment of Bankers, Brokers, Underwriters: Raising funds from the public is a stupendous task. The application money is to be received by the bankers of the company. The brokers try to sell the shares by distributing the forms and encouraging the public to apply for the shares. If the company is not reasonably assured of a good public response to the issue, it may appoint underwriters to the issue. Underwriters undertake to buy the shares if these are not subscribed by the public. They receive a commission for underwriting the issue. Appointment of underwriters is not necessary.

(iv) Minimum Subscription: In order to prevent companies from commencing business with inadequate resources, it has been provided that the company must receive applications for a certain minimum number of shares before going ahead with the allotment of shares. According to the Companies Act, this is called the ‘minimum subscription’. As per the SEBI Guidelines the limit of minimum subscription is 90 per cent of the size of the issue. Thus, if applications received for the shares are for an amount less than 90 per cent of the issue size, the allotment cannot be made and the application money received must be returned to the applicants.

(v) Application to Stock Exchange: An application is made to at least one stock exchange for permission to deal in its shares or debentures. If such permission is not granted before the expiry of ten weeks from the date of closure of subscription list, the allotment shall become void and all money received from the applicants will have to be returned to them within eight days.

(vi) Allotment of Shares: Till the time shares are alloted, application money received shoud remain in a seperate bank account and must not be used by the company. In case the number of shares allotted is less than the number applied for, or where no shares are allotted to the applicant, the excess application money, if any, is to be returned to applicants or adjusted towards allotment money due from them. Allotment letters are issued to the successful allottees. ‘Return of allotment’, signed by a director or secretary is filed with the Registrar of Companies within 30 days of allotment.

A public company may not invite public to subscribe to its securities (shares, debentures etc.). Instead, it can raise the funds through friends, relatives or some private arrangements as done by a private company. In such cases, there is no need to issue a prospectus. A ‘Statement in Lieu of Prospectus’ is filed with the Registrar at least three days before making the allotment.

With the implementation of The Companies Act, 2013, a single person could constitute a company, under the One Person Company (OPC) concept.

The introduction of OPC in the legal system is a move that would encourage corporatisation of micro businesses and entrepreneurship.

In India, in the year 2005, the JJ Irani Expert Committee recommended the formation of OPC. It had suggested that such an entity may be provided with a simpler legal regime through exemptions so that the small entrepreneur is not compelled to devote considerable time, energy and resources on complex legal compliance.

One Person Company is a company with only one person as a member. That one person will be the shareholder of the company. It avails all the benefits of a private limited company such as separate legal entity, protecting personal assets from business liability and perpetual succession.

Characteristics

(1) Only a natural person who is an Indian citizen and resident in India-

(a) Shall be eligible to incorporate a One Person Company;

(b) Shall be a nominee for the sole member of a One Person Company.

Explanation – For the purposes of this rule, the term “resident in India” means a person who has stayed in India for a period of not less than one hundred and eighty two days during the immediately preceding one calendar year.

(2) No person shall be eligible to incorporate more than a One Person Company or become nominee in more than one such company.

(3) Where a natural person, being member in One Person Company in accordance with this rule becomes a member in another such Company by virtue of his being a nominee in that One Person Company, such person shall meet the eligibility criteria specified in sub rule (2) within a period of one hundred and eighty days.

(4) No minor shall become member or nominee of the One Person Company or can hold share with beneficial interest.

(5) Such Company cannot be incorporated or converted into a company under section 8 of the Act.

(6) Such Company cannot carry out Non-Banking Financial Investment activities including investment in securities of anybody corporates.

(7) No such company can convert voluntarily into any kind of company unless two years have expired from the date of incorporation of One Person Company, except threshold limit (paid up share capital) is increased beyond fifty lakh rupees or its average annual turnover during the relevant period exceeds two crore rupees.

“SCHEDULE I”

(See sections 4 and 5)

Table A

MEMORANDUM OF ASSOCIATION OF A COMPANY LIMITED BY SHARES

1st The name of the company is “.......................................... Limited/Private Limited”.

2nd The registered office of the company will be situated in the State of ..................

3rd (a) The objects to be pursued by the company on its incorporation are:-

.........................................................................................................................

.........................................................................................................................

(b) Matters which are necessary for furtherance of the objects specified in clause 3 (a) are:-

.........................................................................................................................

.........................................................................................................................

4th The liability of the member(s) is limited and this liability is limited to the amount unpaid, if any, on the shares held by them.

5th The share capital of the company is ................................................................... rupees, divided into ........................ shares of ........................ rupees each.

6th We, the several persons, whose names and addresses are subscribed, are desirous of being formed into a company in pursuance of this memorandum of association, and we respectively agree to take the number of shares in the capital of the company set against our respective names:-

7th I, whose name and address is given below, am desirous of forming a company in pursuance of this memorandum of association and agree to take all the shares in the capital of the company (Applicable in case of one person company):-

___________________________________________________________________________________

___________________________________________________________________________________

8th Shri/Smt ......................................, son/daughter of ......................................, resident of .................................................................... aged ...................... years shall be the nominee in the event of death of the sole member (Applicable in case of one person company)

Dated ...................................... The day of ......................................

Key Terms

Promotion

Memorandum of Association

Articles of Association

Prospectus

Incorporation

Capital subscription

Commencement of Business

Summary

There are two stages in the formation of a private company, promotion and incorporation. A public company has to undergo capital subscription stage to begin operations.

1. Promotion: It begins with a potential business idea. Certain feasibility studies e.g., technical, financial and economic, are conducted to determine whether the idea can be profitably exploited. In case, the investigations yield favourable results, promoters may decide to form the company. Persons who conceive the business idea, decide to form a company, take necessary steps for the same, and assume associated risks, are called promoters.

Steps in Promotion

i. Approval of company’s name is taken from the Registrar of Companies

ii. Signatories to the Memorandum of Association are fixed

iii. Certain professionals are appropriated to assist the promoters

iv. Documents necessary for registration are prepared

Necessary Documents

a. Memorandum of Association

b. Articles of Association

c. Consent of proposed directors

d. Agreement, if any, with proposed managing or whole time director

e. Statutory declaration

2. Incorporation: An application is made by promoters to the Registrar of Companies alongwith necessary documents and registration fee. The Registrar, after due scrutiny, issues certificate of incorporation. The certificate of incorporation is a conclusive evidence of the legal existence of the company.

3. Capital Subscription: A public company raising funds from the public needs to take following steps for fundraising:

(i) SEBI approval;

(ii) File a copy of prospectus with the Registrar of Companies;

(iii) Appointment of brokers, bankers and underwriters etc.;

(iv) Ensure that minimum subscription is received;

(v) Application for listing of company’s securities;

(vi) Refund/adjust excess application money received;

(vii) Issue allotment letters to successful applicants; and

(viii) File return of allotment with the Registrar of Companies (ROC).

A public company, raising funds, raising funds from friends/relatives (not public) has to file a statement in lieu of prospectus with the ROC at least three days before allotment of shares and returns of allotment after completing the allotment. As per the SEBI guidelines, minimum subcription has to be 90% of the shares to be issued to be public.

Preliminary Contracts: Contracts signed by promoters with third parties before the incorporation of company.

Provisional Contracts: Contracts signed after incorporation but before commencement of business.

Exercises

True/False Answer Questions

1. It is necessary to get every company incorporated, whether private or public.

2. Statement in lieu of prospectus can be filed by a public company going for a public issue.

3. A company can commence business after incorporation.

4. Experts who help promoters in the promotion of a company are also called promoters.

5. A company can ratify preliminary contracts after incorporation.

6. If a company is registered on the basis of fictitious names, its incorporation is invalid.

7. ‘Articles of Association’ is the main document of a company.

8. Every company must file Articles of Association.

9. If a company suffers heavy issues and its assets are not enough to pay off its liabilities, the balance can be recovered from the private assets of its members.

Short Answer Questions

1. Name the stages in the formation of a company.

2. List the documents required for the incorporation of a company.

3. What is a prospectus? Is it necessary for every company to file a prospectus?

4. Briefly explain the term ‘Return of Allotment’.

5. At which stage in the formation of a company does it interact with SEBI.

Long Answer Questions

1. What is meant by the term ‘Promotion’. Discuss the legal position of promoters with respect to a company promoted by them.

2. Explain the steps taken by promoters in the promotion of a company.

3. What is a ‘Memorandum of Association’? Briefly explain its clauses.

4. Distinguish between ‘Memorandum of Association’ and ‘Articles of Association.’

5. What is the meaning of ‘Certificate of Incorporation’?

6. Discuss the stages of formation of a company?

Project/Assignment

Find out from the office of the Registrar of Companies, the actual procedure for formation of companies. Does it match with what you have studied. What are the obstacles which companies face in getting themselves registered.