Table of Contents

Chapter 8

Sources of Business Finance

Learning Objectives

After studying this chapter, you should be able to:

• state the meaning, nature and importance of business finance;

• classify the various sources of business finance;

• evaluate merits and limitations of various sources of finance;

• identify the international sources of finance; and

• examine the factors that affect the choice of an appropriate source of finance.

Mr. Anil Singh has been running a restaurant for the last two years. The excellent quality of food has made the restaurant popular in no time. Motivated by the success of his business, Mr. Singh is now contemplating the idea of opening a chain of similar restaurants at different places. However, the money available with him from his personal sources is not sufficient to meet the expansion requirements of his business. His father told him that he can enter into a partnership with the owner of another restaurant, who will bring in more funds but it would also require sharing of profits and control of business. He is also thinking of getting a bank loan. He is worried and confused, as he has no idea as to how and from where he should obtain additional funds. He discusses the problem with his friend Ramesh, who tells him about some other methods like issue of shares and debentures, which are available only to a company form of organisation. He further cautions him that each method has its own advantages and limitations and his final choice should be based on factors like the purpose and period for which funds are required. He wants to learn about these methods.

8.1 Introduction

This chapter provides an overview of the various sources from where funds can be procured for starting as also for running a business. It also discusses the advantages and limitations of various sources and points out the factors that determine the choice of a suitable source of business finance.

It is important for any person who wants to start a business to know about the different sources from where money can be raised. It is also important to know the relative merits and demerits of different sources so that choice of an appropriate source can be made.

8.2 Meaning, Nature and Significance of Business Finance

Business is concerned with the production and distribution of goods and services for the satisfaction of needs of society. For carrying out various activities, business requires money. Finance, therefore, is called the life blood of any business. The requirements of funds by business to carry out its various activities is called business finance.

A business cannot function unless adequate funds are made available to it. The initial capital contributed by the entrepreneur is not always sufficient to take care of all financial requirements of the business. A business person, therefore, has to look for different other sources from where the need for funds can be met. A clear assessment of the financial needs and the identification of various sources of finance, therefore, is a significant aspect of running a business organisation.

The need for funds arises from the stage when an entrepreneur makes a decision to start a business. Some funds are needed immediately say for the purchase of plant and machinery, furniture, and other fixed assets. Similarly, some funds are required for day-to-day operations, say to purchase raw materials, pay salaries to employees, etc. Also when the business expands, it needs funds.

The financial needs of a business can be categorised as follows:

( a) Fixed capital requirements: In order to start business, funds are required to purchase fixed assets like land and building, plant and machinery, and furniture and fixtures. This is known as fixed capital requirements of the enterprise. The funds required in fixed assets remain invested in the business for a long period of time. Different business units need varying amount of fixed capital depending on various factors such as the nature of business, etc. A trading concern for example, may require small amount of fixed capital as compared to a manufacturing concern. Likewise, the need for fixed capital investment would be greater for a large enterprise, as compared to that of a small enterprise.

(b) Working capital requirements: The financial requirements of an enterprise do not end with the procurement of fixed assets. No matter how small or large a business is, it needs funds for its day-to-day operations. This is known as working capital of an enterprise, which is used for holding current assets such as stock of material, bills receivables and for meeting current expenses like salaries, wages, taxes, and rent.

The amount of working capital required varies from one business concern to another depending on various factors. A business unit selling goods on credit, or having a slow sales turnover, for example, would require more working capital as compared to a concern selling its goods and services on cash basis or having a speedier turnover.

The requirement for fixed and working capital increases with the growth and expansion of business. At times additional funds are required for upgrading the technology employed so that the cost of production or operations can be reduced. Similarly, larger funds may be required for building higher inventories for the festive season or to meet current debts or expand the business or to shift to a new location. It is, therefore, important to evaluate the different sources from where funds can be raised.

8.3 Classification of Sources of Funds

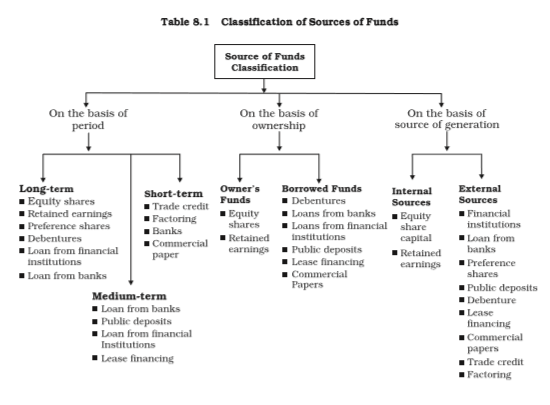

In case of proprietary and partnership concerns, the funds may be raised either from personal sources or borrowings from banks, friends etc. In case of company form of organisation, the different sources of business finance which are available may be categorised as given in Table 8.1

As shown in the table, the sources of funds can be categorised using different basis viz., on the basis of the period, source of generation and the ownership. A brief explanation of these classifications and the sources is provided as follows:

8.3.1 Period Basis

On the basis of period, the different sources of funds can be categorised into three parts. These are long-term sources, medium-term sources and short-term sources.

The long-term sources fulfil the financial requirements of an enterprise for a period exceeding 5 years and include sources such as shares and debentures, long-term borrowings and loans from financial institutions. Such financing is generally required for the acquisition of fixed assets such as equipment, plant, etc.

Where the funds are required for a period of more than one year but less than five years, medium-term sources of finance are used. These sources include borrowings from commercial banks, public deposits, lease financing and loans from financial institutions.

Short-term funds are those which are required for a period not exceeding one year. Trade credit, loans from commercial banks and commercial papers are some of the examples of the sources that provide funds for short duration.

Short-term financing is most common for financing of current assets such as accounts receivable and inventories. Seasonal businesses that must build inventories in anticipation of selling requirements often need short-term financing for the interim period between seasons. Wholesalers and manufacturers with a major portion of their assets tied up in inventories or receivables also require large amount of funds for a short period.

8.3.2 Ownership Basis

On the basis of ownership, the sources can be classified into ‘owner’s funds’ and ‘borrowed funds’. Owner’s funds means funds that are provided by the owners of an enterprise, which may

be a sole trader or partners or shareholders of a company. Apart from capital, it also includes profits reinvested in the business. The owner’s capital remains invested in the business for a longer duration and is not required to be refunded during the life period of the business. Such capital forms the basis on which owners acquire their right of control of management. Issue of equity shares and retained earnings are the two important sources from where owner’s funds can be obtained.

‘Borrowed funds’ on the other hand, refer to the funds raised through loans or borrowings. The sources for raising borrowed funds include loans from commercial banks, loans from financial institutions, issue of debentures, public deposits and trade credit. Such sources provide funds for a specified period, on certain terms and conditions and have to be repaid after the expiry of that period. A fixed rate of interest is paid by the borrowers on such funds. At times it puts a lot of burden on the business as payment of interest is to be made even when the earnings are low or when loss is incurred. Generally, borrowed funds are provided on the security of some fixed assets.

8.3.3 Source of Generation Basis

Another basis of categorising the sources of funds can be whether the funds are generated from within the organisation or from external sources. Internal sources of funds are those that are generated from within the business. A business, for example, can generate funds internally by accelerating collection of receivables, disposing of surplus inventories and ploughing back its profit. The internal sources of funds can fulfill only limited needs of the business.

External sources of funds include those sources that lie outside an organisation, such as suppliers, lenders, and investors. When large amount of money is required to be raised, it is generally done through the use of external sources. External funds may be costly as compared to those raised through internal sources. In some cases, business is required to mortgage its assets as security while obtaining funds from external sources. Issue of debentures, borrowing from commercial banks and financial institutions and accepting public deposits are some of the examples of external sources of funds commonly used by business organisations.

8.4 Sources of Finance

A business can raise funds from various sources. Each of the source has unique characteristics, which must be properly understood so that the best available source of raising funds can be identified. There is not a single best source of funds for all organisations. Depending on the situation, purpose, cost and associated risk, a choice may be made about the source to be used. For example, if a business wants to raise funds for meeting fixed capital requirements, long term funds may be required which can be raised in the form of owned funds or borrowed funds. Similarly, if the purpose is to meet the day-to-day requirements of business, the short term sources may be tapped. A brief description of various sources, along with their advantages and limitations is given below.

8.4.1 Retained Earnings

A company generally does not distribute all its earnings amongst the shareholders as dividends. A portion of the net earnings may be retained in the business for use in the future. This is known as retained earnings. It is a source of internal financing or self-financing or ‘ploughing back of profits’. The profit available for ploughing back in an organisation depends on many factors like net profits, dividend policy and age of the organisation.

Merits

The merits of retained earning as a source of finance are as follows:

(i) Retained earnings is a permanent source of funds available to an organisation;

(ii) It does not involve any explicit cost in the form of interest, dividend or floatation cost;

(iii) As the funds are generated internally, there is a greater degree of operational freedom and flexibility;

(iv) It enhances the capacity of the business to absorb unexpected losses;

(v) It may lead to increase in the market price of the equity shares of a company.

Limitations

Retained earning as a source of funds has the following limitations:

(i) Excessive ploughing back may cause dissatisfaction amongst the shareholders as they would get lower dividends;

(ii) It is an uncertain source of funds as the profits of business are fluctuating;

(iii) The opportunity cost associated with these funds is not recognised by many firms. This may lead to sub-optimal use of the funds.

8.4.2 Trade Credit

Trade credit is the credit extended by one trader to another for the purchase of goods and services. Trade credit facilitates the purchase of supplies without immediate payment. Such credit appears in the records of the buyer of goods as ‘sundry creditors’ or ‘accounts payable’. Trade credit is commonly used by business organisations as a source of short-term financing. It is granted to those customers who have reasonable amount of financial standing and goodwill. The volume and period of credit extended depends on factors such as reputation of the purchasing firm, financial position of the seller, volume of purchases, past record of payment and degree of competition in the market. Terms of trade credit may vary from one industry to another and from one person to another. A firm may also offer different credit terms to different customers.

Merits

The important merits of trade credit are as follows:

(i) Trade credit is a convenient and continuous source of funds;

(ii) Trade credit may be readily available in case the credit worthiness of the customers is known to the seller;

(iii) Trade credit needs to promote the sales of an organisation;

(iv) If an organisation wants to increase its inventory level in order to meet expected rise in the sales volume in the near future, it may use trade credit to, finance the same;

(v) It does not create any charge on the assets of the firm while providing funds.

Limitations

Trade credit as a source of funds has certain limitations, which are given as follows:

(i) Availability of easy and flexible trade credit facilities may induce a firm to indulge in overtrading, which may add to the risks of the firm;

(ii) Only limited amount of funds can be generated through trade credit;

(iii) It is generally a costly source of funds as compared to most other sources of raising money.

8.4.3 Factoring

Factoring is a financial service under which the ‘factor’ renders various services which includes:

(a) Discounting of bills (with or without recourse) and collection of the client’s debts. Under this, the receivables on account of sale of goods or services are sold to the factor at a certain discount. The factor becomes responsible for all credit control and debt collection from the buyer and provides protection against any bad debt losses to the firm. There are two methods of factoring — recourse and non-recourse. Under recourse factoring, the client is not protected against the risk of bad debts. On the other hand, the factor assumes the entire credit risk under non-recourse factoring i.e., full amount of invoice is paid to the client in the event of the debt becoming bad.

(b) Providing information about credit worthiness of prospective client’s etc., Factors hold large amounts of information about the trading histories of the firms. This can be valuable to those who are using factoring services and can thereby avoid doing business with customers having poor payment record. Factors may also offer relevant consultancy services in the areas of finance, marketing, etc.

The factor charges fees for the services rendered. Factoring appeared on the Indian financial scene only in the early nineties as a result of RBI initiatives. The organisations that provides such services include SBI Factors and Commercial Services Ltd., Canbank Factors Ltd., Foremost Factors Ltd., State Bank of India, Canara Bank, Punjab National Bank, Allahabad Bank. In addition, many non-banking finance companies and other agencies provide factoring service.

Merits

The merits of factoring as a source of finance are as follows:

(i) Obtaining funds through factoring is cheaper than financing through other means such as bank credit;

(ii) With cash flow accelerated by factoring, the client is able to meet his/her liabilities promptly as and when these arise;

(iii) Factoring as a source of funds is flexible and ensures a definite pattern of cash inflows from credit sales. It provides security for a debt that a firm might otherwise be unable to obtain;

(iv) It does not create any charge on the assets of the firm;

(v) The client can concentrate on other functional areas of business as the responsibility of credit control is shouldered by the factor.

Limitations

The limitations of factoring as a source of finance are as follows:

(i) This source is expensive when the invoices are numerous and smaller in amount;

(ii) The advance finance provided by the factor firm is generally available at a higher interest cost than the usual rate of interest;

(iii) The factor is a third party to the customer who may not feel comfortable while dealing with it.

8.4.4 Lease Financing

A lease is a contractual agreement whereby one party i.e., the owner of an asset grants the other party the right to use the asset in return for a periodic payment. In other words it is a renting of an asset for some specified period. The owner of the assets is called the ‘lessor’ while the party that uses the assets is known as the ‘lessee’ (see Box A). The lessee pays a fixed periodic amount called lease rental to the lessor for the use of the asset. The terms and conditions regulating the lease arrangements are given in the lease contract. At the end of the lease period, the asset goes back to the lessor. Lease finance provides an important means of modernisation and diversification to the firm. Such type of financing is more prevalent in the acquisition of such assets as computers and electronic equipment which become obsolete quicker because of the fast changing technological developments. While making the leasing decision, the cost of leasing an asset must be compared with the cost of owning the same.

Merits

The important merits of lease financing are as follows:

(i) It enables the lessee to acquire the asset with a lower investment;

(ii) Simple documentation makes it easier to finance assets;

(iii) Lease rentals paid by the lessee are deductible for computing taxable profits;

(iv) It provides finance without diluting the ownership or control of business;

(v) The lease agreement does not affect the debt raising capacity of an enterprise;

(vi) The risk of obsolescence is borne by the lesser. This allows greater flexibility to the lessee to replace the asset.

Limitations

The limitations of lease financing are given as below:

(i) A lease arrangement may impose certain restrictions on the use of assets. For example, it may not allow the lessee to make any alteration or modification in the asset;

(ii) The normal business operations may be affected in case the lease is not renewed;

(iii) It may result in higher payout obligation in case the equipment is not found useful and the lessee opts for premature termination of the lease agreement; and

(iv) The lessee never becomes the owner of the asset. It deprives him of the residual value of the asset.

8.4.5 Public Deposits

The deposits that are raised by organisations directly from the public are known as public deposits. Rates of interest offered on public deposits are usually higher than that offered on bank deposits. Any person who is interested in depositing money in an organisation can do so by filling up a prescribed form. The organisation in return issues a deposit receipt as acknowledgment of the debt. Public deposits can take care of both medium and short-term financial requirements of a business. The deposits are beneficial to both the depositor as well as to the organisation. While the depositors get higher interest rate than that offered by banks, the cost of deposits to the company is less than the cost of borrowings from banks. Companies generally invite public deposits for a period upto three years. The acceptance of public deposits is regulated by the Reserve Bank of India.

Merits

The merits of public deposits are:

(i) The procedure of obtaining deposits is simple and does not contain restrictive conditions as are generally there in a loan agreement;

(ii) Cost of public deposits is generally lower than the cost of borrowings from banks and financial institutions;

(iii) Public deposits do not usually create any charge on the assets of the company. The assets can be used as security for raising loans from other sources;

(iv) As the depositors do not have voting rights, the control of the company is not diluted.

Limitations

The major limitation of public deposits are as follows:

(i) New companies generally find it difficult to raise funds through public deposits;

(ii) It is an unreliable source of finance as the public may not respond when the company needs money;

(iii) Collection of public deposits may prove difficult, particularly when the size of deposits required is large.

Box A

The Lessors

1. Specialised leasing companies: There are about 400-odd large companies which have an organisational focus on leasing, and hence, are known as leasing companies.

2. Banks and bank-subsidiaries: In February 1994, the RBI allowed banks to directly enter leasing. Till then, only bank subsidiaries were allowed to engage in leasing operations, which was regarded by the RBI as a non-banking activity.

3. Specialised financial institutions: A number of financial institutions, at the Central as well as the State level in India, use the lease instrument along with traditional financing instruments. Significantly, the ICICI is one of the pioneers in Indian leasing.

4. Manufacturer-lessors: As competition forces the manufacturer to add value to his sales, he finds the best way to sell the product on lease. Vendor leasing is gaining increasing importance. Presently, vendors of automobiles, consumer durables, etc., have alliances or joint ventures with leasing companies to offer lease finance against their products.

The Lessees

1. Public sector undertakings: This market has witnessed a good rate of growth in the past. There is an increasing number of both centrally as well as State-owned entities which have resorted to lease financing.

2. Mid-market companies: The mid-market companies (i.e., companies with reasonably good creditworthiness but with lower public profile) have resorted to lease financing basically as an alternative to bank/institutional financing.

3. Consumers: Recent bad experience with corporate financing has focussed attention towards retail funding of consumer durables. For instance, car leasing is a big market in India today.

4. Government deptts. and authorities: One of the latest entrants in leasing markets is the government itself. Recently the Department of Telecommunications of the central government took the lead by floating tenders for lease finance worth about ` 1000 crores.

8.4.6 Commercial Paper (CP)

Commercial Paper emerged as a source of short term finance in our country in the early nineties. Commercial paper is an unsecured promissory note issued by a firm to raise funds for a short period, varying from 90 days to 364 days. It is issued by one firm to other business firms, insurance companies, pension funds and banks. The amount raised by CP is generally very large. As the debt is totally unsecured, the firms having good credit rating can issue the CP. Its regulation comes under the purview of the Reserve Bank of India.

The merits and limitations of a Commercial Paper are as follows:

Merits

(i) A commercial paper is sold on an unsecured basis and does not contain any restrictive conditions;

(ii) As it is a freely transferable instrument, it has high liquidity;

(iii) It provides more funds compared to other sources. Generally, the cost of CP to the issuing firm is lower than the cost of commercial bank loans;

(iv) A commercial paper provides a continuous source of funds. This is because their maturity can be tailored to suit the requirements of the issuing firm. Further, maturing commercial paper can be repaid by selling new commercial paper;

(v) Companies can park their excess funds in commercial paper thereby earning some good return on the same.

Limitations

(i) Only financially sound and highly rated firms can raise money through commercial papers. New and moderately rated firms are not in a position to raise funds by this method;

(ii) The size of money that can be raised through commercial paper is limited to the excess liquidity available with the suppliers of funds at a particular time;

(iii) Commercial paper is an impersonal method of financing. As such if a firm is not in a position to redeem its paper due to financial difficulties, extending the maturity of a CP is not possible.

8.4.7 Issue of Shares

The capital obtained by issue of shares is known as share capital. The capital of a company is divided into small units called shares. Each share has its nominal value. For example, a company can issue 1,00,000 shares of Rs. 10 each for a total value of Rs. 10,00,000. The person holding the share is known as shareholder. There are two types of shares normally issued by a company. These are equity shares and preference shares. The money raised by issue of equity shares is called equity share capital, while the money raised by issue of preference shares is called preference share capital.

(a) Equity Shares

Equity shares is the most important source of raising long term capital by a company. Equity shares represent the ownership of a company and thus the capital raised by issue of such shares is known as ownership capital or owner’s funds. Equity share capital is a prerequisite to the creation of a company. Equity shareholders do not get a fixed dividend but are paid on the basis of earnings by the company. They are referred to as ‘residual owners’ since they receive what is left after all other claims on the company’s income and assets have been settled. They enjoy the reward as well as bear the risk of ownership. Their liability, however, is limited to the extent of capital contributed by them in the company. Further, through their right to vote, these shareholders have a right to participate in the management of the company.

Merits

The important merits of raising funds through issuing equity shares are given as below:

(i) Equity shares are suitable for investors who are willing to assume risk for higher returns;

(ii) Payment of dividend to the equity shareholders is not compulsory. Therefore, there is no burden on the company in this respect;

(iii) Equity capital serves as permanent capital as it is to be repaid only at the time of liquidation of a company. As it stands last in the list of claims, it provides a cushion for creditors, in the event of winding up of a company;

(iv) Equity capital provides credit worthiness to the company and confidence to prospective loan providers;

(v) Funds can be raised through equity issue without creating any charge on the assets of the company. The assets of a company are, therefore, free to be mortgaged for the purpose of borrowings, if the need be;

(vi) Democratic control over management of the company is assured due to voting rights of equity shareholders.

Limitations

The major limitations of raising funds through issue of equity shares are as follows:

(i) Investors who want steady income may not prefer equity shares as equity shares get fluctuating returns;

(ii) The cost of equity shares is generally more as compared to the cost of raising funds through other sources;

(iii) Issue of additional equity shares dilutes the voting power, and earnings of existing equity shareholders;

(iv) More formalities and procedural delays are involved while raising funds through issue of equity share.

(b) Preference Shares

The capital raised by issue of preference shares is called preference share capital. The preference shareholders enjoy a preferential position over equity shareholders in two ways:

(i) receiving a fixed rate of dividend, out of the net profits of the company, before any dividend is declared for equity shareholders; and (ii) receiving their capital after the claims of the company’s creditors have been settled, at the time of liquidation. In other words, as compared to the equity shareholders, the preference shareholders have a preferential claim over dividend and repayment of capital. Preference shares resemble debentures as they bear fixed rate of return. Also as the dividend is payable only at the discretion of the directors and only out of profit after tax, to that extent, these resemble equity shares. Thus, preference shares have some characteristics of both equity shares and debentures. Preference shareholders generally do not enjoy any voting rights. A company can issue different types of preference shares (see Box B).

Box B

Types of Preference Shares

1. Cumulative and Non-Cumulative: The preference shares which enjoy the right to accumulate unpaid dividends in the future years, in case the same is not paid during a year are known as cumulative preference shares. On the other hand, on non-cumulative shares, dividend is not accumulated if it is not paid in a particular year.

2. Participating and Non-Participating: Preference shares which have a right to participate in the further surplus of a company shares which after dividend at a certain rate has been paid on equity shares are called participating preference shares. The non-participating preference are such which do not enjoy such rights of participation in the profits of the company.

3. Convertible and Non-Convertible: Preference shares that can be converted into equity shares within a specified period of time are known as convertible preference shares. On the other hand, non-convertible shares are such that cannot be converted into equity shares.

Merits

The merits of preference shares are given as follows:

(i) Preference shares provide reasonably steady income in the form of fixed rate of return and safety of investment;

(ii) Preference shares are useful for those investors who want fixed rate of return with comparatively low risk;

(iii) It does not affect the control of equity shareholders over the management as preference shareholders don’t have voting rights;

(iv) Payment of fixed rate of dividend to preference shares may enable a company to declare higher rates of dividend for the equity shareholders in good times;

(v) Preference shareholders have a preferential right of repayment over equity shareholders in the event of liquidation of a company;

(vi) Preference capital does not create any sort of charge against the assets of a company.

Limitations

The major limitations of preference shares as source of business finance are as follows:

(i) Preference shares are not suitable for those investors who are willing to take risk and are interested in higher returns;

(ii) Preference capital dilutes the claims of equity shareholders over assets of the company;

(iii) The rate of dividend on preference shares is generally higher than the rate of interest on debentures;

(iv) As the dividend on these shares is to be paid only when the company earns profit, there is no assured return for the investors. Thus, these shares may not be very attractive to the investors;

(v) The dividend paid is not deductible from profits as expense. Thus, there is no tax saving as in the case of interest on loans.

8.4.8 Debentures

Debentures are an important instrument for raising long term debt capital. A company can raise funds through issue of debentures, which bear a fixed rate of interest. The debenture issued by a company is an acknowledgment that the company has borrowed a certain amount of money, which it promises to repay at a future date. Debenture holders are, therefore, termed as creditors of the company. Debenture holders are paid a fixed stated amount of interest at specified intervals say six months or one year. Public issue of debentures requires that the issue be rated by a credit rating agency like CRISIL (Credit Rating and Information Services of India Ltd.) on aspects like track record of the company, its profitability, debt servicing capacity, credit worthiness and the perceived risk of lending. A company can issue different types of debentures (see Box C and D). Issue of Zero Interest Debentures (ZID) which do not carry any explicit rate of interest has also become popular in recent years. The difference between the face value of the debenture and its purchase price is the return to the investor.

Box C

Types of Debentures

1. Secured and Unsecured: Secured debentures are such which create a charge on the assets of the company, thereby mortgaging the assets of the company. Unsecured debentures on the other hand do not carry any charge or security on the assets of the company.

2. Registered and Bearer: Registered debentures are those which are duly recorded in the register of debenture holders maintained by the company. These can be transferred only through a regular instrument of transfer. In contrast, the debentures which are transferable by mere delivery are called bearer debentures.

3. Convertible and Non-Convertible: Convertible debentures are those debentures that can be converted into equity shares after the expiry of a specified period. On the other hand, non-convertible debentures are those which cannot be converted into equity shares.

4. First and Second: Debentures that are repaid before other debentures are repaid are known as first debentures. The second debentures are those which are paid after the first debentures have been paid back.

BOX D

Inter Corporate Deposits (ICD)

Inter Corporate Deposits are unsecured short-term deposits made by a company with another company. ICD market is used for short-term cash management of a large corporate. As per the RBI guidelines, the minimum period of ICDs is 7 days which can be extended to one year.

The three types of Inter Corporate Deposits are:

(i) Three months deposits;

(ii) Six months deposits;

(iii) Call deposits.

Interest rate on ICDs may remain fixed or may be floating. The rate of interest on these deposits is higher than that of banks. These deposits are usually considered by the borrower company to solve problems of short-term funds insufficiency.

Merits

The merits of raising funds through debentures are given as follows:

(i) It is preferred by investors who want fixed income at lesser risk;

(ii) Debentures are fixed charge funds and do not participate in profits of the company;

(iii) The issue of debentures is suitable in the situation when the sales and earnings are relatively stable;

(iv) As debentures do not carry voting rights, financing through debentures does not dilute control of equity shareholders on management;

(v) Financing through debentures is less costly as compared to cost of preference or equity capital as the interest payment on debentures is tax deductible.

Limitations

Debentures as source of funds has certain limitations. These are given as follows:

(i) As fixed charge instruments, debentures put a permanent burden on the earnings of a company. There is a greater risk when earnings of the company fluctuate;

(ii) In case of redeemable debentures, the company has to make provisions for repayment on the specified date, even during periods of financial difficulty;

(iii) Each company has certain borrowing capacity. With the issue of debentures, the capacity of a company to further borrow funds reduces.

8.4.9 Commercial Banks

Commercial banks occupy a vital position as they provide funds for different purposes as well as for different time periods. Banks extend loans to firms of all sizes and in many ways, like, cash credits, overdrafts, term loans, purchase/discounting of bills, and issue of letter of credit. The rate of interest charged by banks depends on various factors such as the characteristics of the firm and the level of interest rates in the economy. The loan is repaid either in lump sum or in installments.

Bank credit is not a permanent source of funds. Though banks have started extending loans for longer periods, generally such loans are used for medium to short periods. The borrower is required to provide some security or create a charge on the assets of the firm before a loan is sanctioned by a commercial bank.

Merits

The merits of raising funds from a commercial bank are as follows:

(i) Banks provide timely assistance to business by providing funds as and when needed by it.

(ii) Secrecy of business can be maintained as the information supplied to the bank by the borrowers is kept confidential;

(iii) Formalities such as issue of prospectus and underwriting are not required for raising loans from a bank. This, therefore, is an easier source of funds;

(iv) Loan from a bank is a flexible source of finance as the loan amount can be increased according to business needs and can be repaid in advance when funds are not needed.

Limitations

The major limitations of commercial banks as a source of finance are as follows:

(i) Funds are generally available for short periods and its extension or renewal is uncertain and difficult;

(iii) In some cases, difficult terms and conditions are imposed by banks. for the grant of loan. For example, restrictions may be imposed on the sale of mortgaged goods, thus making normal business working difficult.

8.4.10 Financial Institutions

The government has established a number of financial institutions all over the country to provide finance to business organisations (see Box E). These institutions are established by the central as well as state governments. They provide both owned capital and loan capital for long and medium term requirements and supplement the traditional financial agencies like commercial banks. As these institutions aim at promoting the industrial development of a country, these are also called ‘development banks’. In addition to providing financial assistance, these institutions also conduct market surveys and provide technical assistance and managerial services to people who run the enterprises. This source of financing is considered suitable when large funds for longer duration are required for expansion, reorganisation and modernisation of an enterprise.

Box E

Companies rush to float GDR issues

It’s not the IPO (initial public offer) market alone which is humming with activity. Companies — mostly small and medium-sized — are rushing to the overseas market to raise funds through Global Depository Receipts (GDRs). Five firms have already raised $464 million (around ` 2,040 crore) from the international markets through GDR offerings this year. This is almost double of $228.6 mn raised by nine companies in 2004 and $63.09 mn mobilised by four companies in 2003. Nearly 20 companies are waiting in the wings to launch GDR issues worth over $1 bn in the coming months. On the other hand, though the number of companies going for FCCB (Foreign Currency Convertible Bonds) issues has come down, several companies are still in the FCCB race, thanks to lax rules and disclosure norms. For example, Aarti Drugs Ltd. has decided to raise $12 mn by issuing FCCBs.

Significantly, small and medium companies are now taking the GDR route to raise funds this time even for a small amount. For example, Opto Circuits has decided to go for a GDR issue of $20 mn with a green-shoe option of $5 mn. The share price of this company shot up by 370 per cent from ` 34 on May 17, 2004 to around ` 160 on the BSE recently. Videocon Industries, Lyka Labs, Indian Overseas Bank, Jubilant Organosys, Maharashtra Seamless, Moschip Semiconductors, and Crew BOS are planning GDR issues. Two banks — UTI Bank ($240 million) and Centurion Bank ($70 million) — raised funds from the GDR market recently. Companies now prefer GDR over FCCB issues in view of the rise in interest rates abroad.

Merits

The merits of raising funds through financial institutions are as follows:

(i) Financial institutions provide long-term finance, which are not provided by commercial banks;

(ii) Besides providing funds, many of these institutions provide financial, managerial and technical advice and consultancy to business firms;

(iii) Obtaining loan from financial institutions increases the goodwill of the borrowing company in the capital market. Consequently, such a company can raise funds easily from other sources as well;

(iv) As repayment of loan can be made in easy instalments, it does not prove to be much of a burden on the business;

(v) The funds are made available even during periods of depression, when other sources of finance are not available.

Limitations

The major limitations of raising funds from financial institutions are as given below:

(i) Financial institutions follow rigid criteria for grant of loans. Too many formalities make the procedure time consuming and expensive;

(ii) Certain restrictions such as restriction on dividend payment are imposed on the powers of the borrowing company by the financial institutions;

(iii) Financial institutions may have their nominees on the Board of Directors of the borrowing company thereby restricting the powers of the company.

8.5 International Financing

In addition to the sources discussed above, there are various avenues for organisations to raise funds internationally. With the opening up of an economy and the operations of the business organisations becoming global, Indian companies have an access to funds in global capital market. Various international sources from where funds may be generated include:

(i) Commercial Banks: Commercial banks all over the world extend foreign currency loans for business purposes. They are an important source of financing non-trade international operations. The types of loans and services provided by banks vary from country to country. For example, Standard Chartered emerged as a major source of foreign currency loans to the Indian industry.

(ii) International Agencies and Development Banks: A number of international agencies and development banks have emerged over the years to finance international trade and business. These bodies provide long and medium term loans and grants to promote the development of economically backward areas in the world. These bodies were set up by the Governments of developed countries of the world at national, regional and international levels for funding various projects. The more notable among them include International Finance Corporation (IFC), EXIM Bank and Asian Development Bank.

(iii) International Capital Markets: Modern organisations including multinational companies depend upon sizeable borrowings in rupees as well as in foreign currency. Prominent financial instruments used for this purpose are:

(a) Global Depository Receipts (GDR’s): The local currency shares of a company are delivered to the depository bank. The depository bank issues depository receipts against these shares. Such depository receipts denominated in US dollars are known as Global Depository Receipts (GDR). GDR is a negotiable instrument and can be traded freely like any other security. In the Indian context, a GDR is an instrument issued abroad by an Indian company to raise funds in some foreign currency and is listed and traded on a foreign stock exchange. A holder of GDR can at any time convert it into the number of shares it represents. The holders of GDRs do not carry any voting rights but only dividends and capital appreciation. Many Indian companies such as Infosys, Reliance, Wipro and ICICI have raised money through issue of GDRs (see Box F).

(b) American Depository Receipts (ADRs): The depository receipts issued by a company in the USA are known as American Depository Receipts. ADRs are bought and sold in American markets, like regular stocks. It is similar to a GDR except that it can be issued only to American citizens and can be listed and traded on a stock exchange of USA.

(c) Indian Depository Receipt (IDRs): An Indian Depository Receipt is a financial instrument denominated in Indian Rupees in the form of a Depository Receipt. It is created by an Indian Depository to enable a foreign company to raise funds from the Indian securities market. The IDR is a specific Indian version of the similar global depository receipts.

The foreign company issuing IDR deposits shares to an Indian Depository (custodian of securities registered with the Securities and Exchange Board of India). In turn, the depository issues receipts to investors in India against these shares. The benefits of the underlying shares (like bonus, dividends, etc.) accrue to the IDR holders in India.

According to SEBI guidelines, IDRs are issued to Indian residents in the same way as domestic shares are issued. The issuer company makes a public offer in India, and residents can bid in exactly the same format and method as they bid for Indian shares.

‘Standard Chartered PLC’ was the first company that issued Indian Depository Receipt in Indian securities market in June 2010.

(d) Foreign Currency Convertible Bonds (FCCBs): Foreign currency convertible bonds are equity linked debt securities that are to be converted into equity or depository receipts after a specific period. Thus, a holder of FCCB has the option of either converting them into equity shares at a predetermined price or exchange rate, or retaining the bonds. The FCCB’s are issued in a foreign currency and carry a fixed interest rate which is lower than the rate of any other similar non-convertible debt instrument. FCCB’s are listed and traded in foreign stock exchanges. FCCB’s are very similar to the convertible debentures issued in India.

8.6 Factors Affecting the Choice of the Source of Funds

Financial needs of a business are of different types — long term, short term, fixed and fluctuating. Therefore, business firms resort to different types of sources for raising funds. Short-term borrowings offer the benefit of reduced cost due to reduction of idle capital, but long – term borrowings are considered a necessity on many grounds. Similarly equity capital has a role to play in the scheme for raising funds in the corporate sector.

As no source of funds is devoid of limitations, it is advisable to use a combination of sources, instead of relying only on a single source. A number of factors affect the choice of this combination, making it a very complex decision for the business. The factors that affect the choice of source of finance are briefly discussed below:

(i) Cost: There are two types of cost viz., the cost of procurement of funds and cost of utilising the funds. Both these costs should be taken into account while deciding about the source of funds that will be used by an organisation.

(ii) Financial strength and stability of operations: The financial strength of a business is also a key determinant. In the choice of source of funds business should be in a sound financial position so as to be able to repay the principal amount and interest on the borrowed amount. When the earnings of the organisation are not stable, fixed charged funds like preference shares and debentures should be carefully selected as these add to the financial burden of the organisation.

(iii) Form of organisation and legal status: The form of business organisation and status influences the choice of a source for raising money. A partnership firm, for example, cannot raise money by issue of equity shares as these can be issued only by a joint stock company.

(iv) Purpose and time period: Business should plan according to the time period for which the funds are required. A short-term need for example can be met through borrowing funds at low rate of interest through trade credit, commercial paper, etc. For long term finance, sources such as issue of shares and debentures are more appropriate. Similarly, the purpose for which funds are required need to be considered so that the source is matched with the use. For example, a long-term business expansion plan should not be financed by a bank overdraft which will be required to be repaid in the short term.

(v) Risk profile: Business should evaluate each of the source of finance in terms of the risk involved. For example, there is a least risk in equity as the share capital has to be repaid only at the time of winding up and dividends need not be paid if no profits are available. A loan on the other hand, has a repayment schedule for both the principal and the interest. The interest is required to be paid irrespective of the firm earning a profit or incurring a loss.

(vi) Control: A particular source of fund may affect the control and power of the owners on the management of a firm. Issue of equity shares may mean dilution of the control. For example, as equity share holders enjoy voting rights, financial institutions may take control of the assets or impose conditions as part of the loan agreement. Thus, business firm should choose a source keeping in mind the extent to which they are willing to share their control over business.

(vii) Effect on credit worthiness: The dependence of business on certain sources may affect its credit worthiness in the market. For example, issue of secured debentures may affect the interest of unsecured creditors of the company and may adversely affect their willingness to extend further loans as credit to the company.

(viii) Flexibility and ease: Another aspect affecting the choice of a source of finance is the flexibility and ease of obtaining funds. Restrictive provisions, detailed investigation and documentation in case of borrowings from banks and financial institutions for example may be the reason that a business organisations may not prefer it, if other options are readily available.

(ix)Tax benefits: Various sources may also be weighed in terms of their tax benefits. For example, while the dividend on preference shares is not tax deductible, interest paid on debentures and loan is tax deductible and may, therefore, be preferred by organisations seeking tax advantage.

Key Terms

Finance Owned

Capital Fixed capital

Working capital

Borrowed capital

Short term sources

Restrictive conditions

Long term sources

Charge on assets

Voting power

Fixed charge funds

Accounts receivable

Bill discounting

Factoring

GDRs

FCCBs

ADRs

1CD

1DR

Summary

Meaning and significance of business finance: Finance required by business to establish and run its operations is known as business finance. No business can function without adequate amount of funds for undertaking various activities. The funds are required for purchasing fixed assets (fixed capital requirement), for running day-to-day operations (working capital requirement), and for undertaking growth and expansion plans in a business organisation.

Classification of sources of funds: Various sources of funds available to a business can be classified according to three major basis, which are (i) time period (long, medium and short term), (ii) ownership (owner’s funds and borrowed funds), and (iii) source of generation (internal sources and external sources).

Long, medium and short-term sources of funds: The sources that provide funds for a period exceeding 5 years are called long-term sources. The sources that fulfill the financial requirements for the period of more than one year but not exceeding 5 years are called medium term sources and the sources that provide funds for a period not exceeding one year are termed as short term sources.

Owner’s funds and borrowed funds: Owner’s funds refer to the funds that are provided by the owners of an enterprise. Borrowed capital, on the other hand, refers to the funds that are generated through loans or borrowings from other individuals or institutions.

Internal and external sources: Internal sources of capital are those sources that are generated within the business say through ploughing back of profits. External sources of capital, on the other hand are those that are outside the business such as finance provided by suppliers, lenders, and investors.

Sources of business finance: The sources of funds available to a business include retained earnings, trade credit, factoring, lease financing, public deposits, commercial paper, issue of shares and debentures, loans from commercial banks, financial institutions and international sources of finance.

Retained earnings: The portion of the net earnings of the company that is not distributed as dividends is known as retained earnings. The amount of retained earnings available depends on the dividend policy of the company. It is generally used for growth and expansion of the company.

Trade credit: The credit extended by one trader to another for purchasing goods or services is known as trade credit. Trade credit facilitates the purchase of supplies on credit. The terms of trade credit vary from one industry to another and are specified on the invoice. Small and new firms are usually more dependent on trade credit, as they find it relatively difficult to obtain funds from other sources.

Factoring: Factoring has emerged as a popular source of short-term funds in recent years. It is a financial service whereby the factor is responsible for all credit control and debt collection from the buyer and provides protection against any bad-debt losses to the firm. There are two methods of factoring — recourse and non-recourse factoring.

Lease financing: A lease is a contractual agreement whereby the owner of an asset (lessor) grants the right to use the asset to the other party (lessee). The lessor charges a periodic payment for renting of an asset for some specified period called lease rent.

Public deposits: A company can raise funds by inviting the public to deposit their savings with their company. Pubic deposits may take care of both long and short-term financial requirements of business. Rate of interest on deposits is usually higher than that offered by banks and other financial institutions.

Commercial paper (CP): It is an unsecured promissory note issued by a firm to raise funds for a short period The maturity period of commercial paper usually ranges from 90 days to 364 days. Being unsecured, only firms having good credit rating can issue the CP and its regulation comes under the purview of the Reserve Bank of India.

Issue of equity shares: Equity shares represents the ownership capital of a company. Due to their fluctuating earnings, equity shareholders are called risk bearers of the company. These shareholders enjoy higher returns during prosperity and have a say in the management of a company, through exercising their voting rights.

Issue of preference shares: These shares provide a preferential right to the shareholders with respect to payment of earnings and the repayment of capital. Investors who prefer steady income without undertaking higher risks prefer these shares. A company can issue different types of preference shares.

Issue of debentures: Debenture represents the loan capital of a company and the holders of debentures are the creditors. These are the fixed charged funds that carry a fixed rate of interest. The issue of debentures is suitable in the situation when the sales and earnings of the company are relatively stable.

Commercial banks: Banks provide short and medium-term loans to firms of all sizes. The loan is repaid either in lump sum or in instalments. The rate of interest charged by a bank depends upon factors including the characteristics of the borrowing firm and the level of interest rates in the economy.

Financial institutions: Both central and state governments have established a number of financial institutions all over the country to provide industrial finance to companies engaged in business. They are also called development banks. This source of financing is considered suitable when large funds are required for expansion, reorganisation and modernisation of the enterprise.

International financing: With liberalisation and globalisation of the economy, Indian companies have started generating funds from international markets. The international sources from where the funds can be procured include foreign currency loans from commercial banks, financial assistance provided by international agencies and development banks, and issue of financial instruments (GDRs/ ADRs/ FCCBs) in international capital markets.

Factors affecting choice: An effective appraisal of various sources must be instituted by the business to achieve its main objectives. The selection of a source of business finance depends on factors such as cost, financial strength, risk profile, tax benefits and flexibility of obtaining funds. These factors should be analysed together while making the decision for the choice of an appropriate source of funds.

Exercises

Short Answer Questions

1. What is business finance? Why do businesses need funds? Explain.

2. List sources of raising long-term and short-term finance.

3. What is the difference between internal and external sources of raising funds? Explain.

4. What preferential rights are enjoyed by preference shareholders. Explain.

5. Name any three special financial institutions and state their objectives.

6. What is the difference between GDR and ADR? Explain.

Long Answer Questions

1. Explain trade credit and bank credit as sources of short-term finance for business enterprises.

2. Discuss the sources from which a large industrial enterprise can raise capital for financing modernisation and expansion.

3. What advantages does issue of debentures provide over the issue of equity shares?

4. State the merits and demerits of public deposits and retained earnings as methods of business finance.

5. Discuss the financial instruments used in international financing.

6. What is a commercial paper? What are its advantages and limitations.

Projects/Assignment

1. Collect information about the companies that have issued debentures in recent years. Give suggestions to make debentures more popular.

2. Institutional financing has gained importance in recent years. In a scrapbook paste detailed information about various financial institutions that provide financial assistance to Indian companies.

3. On the basis of the sources discussed in the chapter, suggest suitable options to solve the financial problem of the restaurant owner.

4. Prepare a comparative chart of all the sources of finance.