Table of Contents

Chapter 11

International Business

Learning Objectives

After studying this chapter, you should be able to:

• State the meaning of International Business

• Distinguish between Internal and International Business

• Discuss the scope of International Business

• Enumerate the benefits of International Business

• Discuss the documents required for import and export transactions

• Identify the incentives and schemes available for international firms

• Discuss the role of different organisations for the promotion of International Business

• List the major international institutions and agreements at the global level for the promotion of international trade and development.

Mr. Sudhir Manchanda is a small manufacturer of automobile components. His factory is located in Gurgaon and employs about 55 workers with an investment of Rs. 9.2 million in plant and machinery. Due to recession in the domestic market, he foresees prospects of his sales going up in the next few years in the domestic market. He is exploring the possibility of going international. Some of his competitors are already in export business. A casual talk with one of his close friends in the tyre business reveals that there is a substantial market for automobile components and accessories in South-East Asia and Middle East. But his friend also tells him, “Doing business internationally is not the same as carrying out business within the home country. International business is more complex as one has to operate under market conditions that are different from those that one faces in domestic business”. Mr. Manchanda is, moreover, not sure as to how he should go about setting up international business. Should he himself identify and contact some overseas customers and start exporting directly to them or else route his products through export houses which specialise in exporting products made by others?

Mr. Manchanda’s son who has just returned after an MBA in USA suggests that they should set up a fully owned factory in Bangkok for supplying to customers in South-East Asia and Middle East. Setting up a manufacturing plant there will help them save costs of transporting goods from India. This would also help them coming closer to the overseas customers. Mr. Manchanda is in a fix as to what to do. In the face of difficulties involved in overseas ventures as pointed out by his friend, he is wondering about the desirability of entering into global business. He is also not sure as to what the different ways of entering into international market are and which one will best suit his purpose.

11.1 Introduction

Countries all over the world are undergoing a fundamental shift in the way they produce and market various products and services. The national economies which so far were pursuing the goal of self-reliance are now becoming increasingly dependent upon others for procuring as well as supplying various kinds of goods and services. Due to increased cross border trade and investments, countries are no more isolated.

The prime reason behind this radical change is the development of communication, technology, infrastructure etc. Emergence of newer modes of communication and development of faster and more efficient means of transportation have brought nations closer to one another. Countries that were cut-off from one another due to geographical distances and socio-economic differences have now started increasingly interacting with others. World Trade Organisation (WTO) and reforms carried out by the governments of different countries have also been a major contributory factor to the increased interactions and business relations amongst the nations.

We are today living in a world where the obstacles to cross-border movement of goods and persons have substantially come down. The national economies are increasingly becoming borderless and getting integrated into the world economy. Little wonder that the world has today come to be known as a ‘global village’. Business in the present day is no longer restricted to the boundaries of the domestic country. More and more firms are making forays into international business which presents them with numerous opportunities for growth and increased profits.

India has been trading with other countries for a long time. But it has of late considerably speeded up its process of integrating with the world economy and increasing its foreign trade and investments (see Box A: India Embarks on the Path to Globalisation).

Box A

India Embarks on the Path to Globalisation

International business has entered into a new era of reforms. India too did not remain cut-off from these developments. India was under a severe debt trap and was facing crippling balance of payment crisis. In 1991, it approached the International Monetary Fund (IMF) for raising funds to tide over its balance of payment deficits. IMF agreed to lend money to India subject to the condition that India would undergo structural changes to be able to ensure repayment of borrowed funds.

India had no alternative but to agree to the proposal. It was the very conditions imposed by IMF which more or less forced India to liberalise its economic policies. Since then a fairly large amount of liberalisation at the economic front has taken place.

Though the process of reforms has somewhat slowed down, India is very much on the path to globalisation and integrating with the world economy. While, on the one hand, many multinational corporations (MNCs) have ventured into Indian market for selling their products and services; many Indian companies too have stepped out of the country to market their products and services to consumers in foreign countries.

11.1.1 Meaning of International Business

Business transaction taking place within the geographical boundaries of a nation is known as domestic or national business. It is also referred to as internal business or home trade. Manufacturing and trade beyond the boundaries of one’s own country is known as international business. International or external business can, therefore, be defined as those business activities that take place across the national frontiers. It involves not only the international movements of goods and services, but also of capital, personnel, technology and intellectual property like patents, trademarks, know-how and copyrights.

It may be mentioned here that mostly people think of international business as international trade. But this is not true. No doubt international trade, comprising exports and imports of goods, has historically been an important component of international business. But of late, the scope of international business has substantially expanded. International trade in services such as international travel and tourism, transportation, communication, banking, ware-housing, distribution and advertising has considerably grown. The other equally important developments are increased foreign investments and overseas production of goods and services. Companies have started increasingly making investments into foreign countries and undertaking production of goods and services in foreign countries to come closer to foreign customers and serve them more effectively at lower costs. All these activities form part of international business. To conclude, we can say that international business is a much broader term and is comprised of both the trade and production of goods and services across frontiers.

11.1.2 Reason for International Business

The fundamental reason behind international business is that the countries cannot produce equally well or cheaply all that they need. This is because of the unequal distribution of natural resources among them or differences in their productivity levels. Availability of various factors of production such as labour, capital and raw materials that are required for producing different goods and services differ among nations. Moreover, labour productivity and production costs differ among nations due to various socio-economic, geographical and political reasons.

Due to these differences, it is not uncommon to find one particular country being in a better position to produce better quality products and/or at lower costs than what other nations can do. In other words, we can say that some countries are in an advantageous position in producing select goods and services which other countries cannot produce that effectively and efficiently, and vice-versa. As a result, each country finds it advantageous to produce those select goods and services that it can produce more effectively and efficiently at home, and procuring the rest through trade with other countries which the other countries can produce at lower costs. This is precisely the reason as to why countries trade with others and engage in what is known as international business.

The international business as it exists today is to a great extent the result of geographical specialisation as pointed out above. Fundamentally, it is for the same reason that domestic trade between two states or regions within a country takes place. Most states or regions within a country tend to specialise in the production of goods and services for which they are best suited. In India, for example, while West Bengal specialises in jute products; Mumbai and neighbouring areas in Maharashtra are more involved with the production of cotton textiles. The same principle of territorial division of labour is applicable at the international level too. Most developing countries which are labour abundant, for instance, specialise in producing and exporting garments. Since they lack capital and technology, they import textile machinery from the developed nations which the latter are in a position to produce more efficiently.

What is true for the nation is more or less true for firms. Firms too engage in international business to import what is available at lower prices in other countries, and export goods to other countries where they can fetch better prices for their products. Besides price considerations, there are several other benefits which nations and firms derive from international business. In a way, these other benefits too provide an impetus to nations and firms to engage in international business. We shall turn our attention to some of these benefits accruing to nations and firms from engaging in international business in a later section.

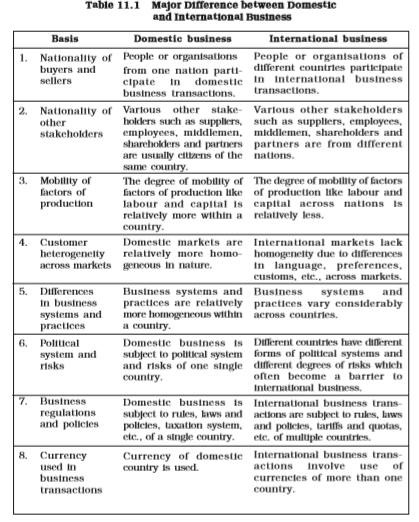

11.1.3 International Business vs. Domestic Business

Conducting and managing international business operations is more complex than undertaking domestic business. Because of variations in political, social, cultural and economic environments across countries, business firms find it difficult to extend their domestic business strategy to foreign markets. To be successful in the overseas markets, they need to adapt their product, pricing, promotion and distribution strategies and overall business plans to suit the specific requirements of the target foreign markets (see Box B on Firms need to be Cognisant of Environmental Differences). Key aspects in respect of which domestic and international businesses differ from each other are discussed below.

(i) Nationality of buyers and sellers: Nationality of the key participants (i.e., buyers and sellers) to the business deals differs between domestic and international businesses. In the case of domestic business, both the buyers and sellers are from the same country. This makes it easier for both the parties to understand each other and enter into business deals. But this is not the case with international business where buyers and sellers come from different countries. Because of differences in their languages, attitudes, social customs and business goals and practices, it becomes relatively more difficult for them to interact with one another and finalise business transactions.

(ii) Nationality of other stakeholders: Domestic and international businesses also differ in respect of the nationalities of the other stakeholders such as employees, suppliers, shareholders/partners and general public who interact with business firms. While in the case of domestic business all such factors belong to one country, and therefore relatively speaking depict more consistency in their value systems and behaviours; decision making in international business becomes much more complex as the concerned business firms have to take into account a wider set of values and aspirations of the stakeholders belonging to different nations.

(iii) Mobility of factors of production: The degree of mobility of factors like labour and capital is generally less between countries than within a country. While these factors of movement can move freely within the country, there exist various restrictions to their movement across nations. Apart from legal restrictions, even the variations in socio-cultural environments, geographic influences and economic conditions come in a big way in their movement across countries. This is especially true of the labour which finds it difficult to adjust to the climatic, economic and socio-cultural conditions that differ from country to country.

Box B

Firms need to be Cognisant of Environmental Differences

It is to be kept in mind that conducting and managing international business is not an easy venture. It is more difficult to manage international business operations due to variations in the political, social, cultural and economic environments that differ from country to country.

Simply being aware of these differences is not sufficient. One also needs to be sensitive and responsive to these changes by way of introducing adaptations in their marketing programmes and business strategies. It is, for instance, a well known fact that because of poor lower per capita income, consumers in most of the developing African and Asian countries are price sensitive and prefer to buy less expensive products. But consumers in the developed countries like Japan, United States, Canada, France, Germany and Switzerland have a marked preference for high quality and high priced products due to their better ability to pay. Business prudence, therefore, demands that the firms interested in marketing to these countries are aware of such differences among the countries, and design their strategies accordingly. It will be in the fitness of things if the firms interested in exporting to these countries produce less expensive products for the consumers in the African and Asian regions, and design and develop high quality products for consumers in Japan and most of the European and North American countries.

(iv) Customer heterogeneity across markets: Since buyers in international markets hail from different countries, they differ in their socio-cultural background. Differences in their tastes, fashions, languages, beliefs and customs, attitudes and product preferences cause variations in not only their demand for different products and services, but also in variations in their communication patterns and purchase behaviours. It is precisely because of the socio-cultural differences that while people in China prefer bicycles, the Japanese in contrast like to ride bikes. Similarly, while people in India use right-hand driven cars, Americans drive cars fitted with steering, brakes, etc., on the left side. Moreover, while people in the United States change their TV, bike and other consumer durables very frequently — within two to three years of their purchase, Indians mostly do not go in for such replacements until the products currently with them have totally worn out.

Such variations greatly complicate the task of designing products and evolving strategies appropriate for customers in different countries. Though to some extent customers within a country too differ in their tastes and preferences. These differences become more striking when we compare customers across nations.

(v) Differences in business systems and practices: The differences in business systems and practices are considerably much more among countries than within a country. Countries differ from one another in terms of their socio-economic development, availability, cost and efficiency of economic infrastructure and market support services, and business customs and practices due to their socio-economic milieu and historical coincidences. All such differences make it necessary for firms interested in entering into international markets to adapt their production, finance, human resource and marketing plans as per the conditions prevailing in the international markets.

(vi) Political system and risks: Political factors such as the type of government, political party system, political ideology, political risks, etc., have a profound impact on business operations. Since a business person is familiar with the political environment of his/her country, he/she can well understand it and predict its impact on business operations. But this is not the case with international business. Political environment differs from one country to another. One needs to make special efforts to understand the differing political environments and their business implications. Since political environment keeps on changing, one needs to monitor political changes on an ongoing basis in the concerned countries and devise strategies to deal with diverse political risks.

A major problem with a foreign country’s political environment is a tendency among nations to favour products and services originating in their own countries to those coming from other countries. While this is not a problem for business firms operating domestically, it quite often becomes a severe problem for the firms interested in exporting their goods and services to other nations or setting up their plants in the overseas markets.

(vii) Business regulations and policies: Coupled with its socio-economic environment and political philosophy, each country evolves its own set of business laws and regulations. Though these laws, regulations and economic policies are more or less uniformly applicable within a country, they differ widely among nations. Tariff and taxation policies, import quota system, subsidies and other controls adopted by a nation are not the same as in other countries and often discriminate against foreign products, services and capital.

(viii) Currency used in business transactions: Another important difference between domestic and international business is that the latter involves the use of different currencies. Since the exchange rate, i.e., the price of one currency expressed in relation to that of another country’s currency, keeps on fluctuating, it adds to the problems of international business firms in fixing prices of their products and hedging against foreign exchange risks.

11.1.4 Scope of International Business

As pointed out earlier, international business is much broader than international trade. It includes not only international trade (i.e., export and import of goods and services), but also a wide variety of other ways in which the firms operate internationally. Major forms of business operations that constitute international business are as follows.

(i) Merchandise exports and imports: Merchandise means goods that are tangible, i.e., those that can be seen and touched. When viewed from this perceptive, it is clear that while merchandise exports means sending tangible goods abroad, merchandise imports means bringing tangible goods from a foreign country to one’s own country. Merchandise exports and imports, also known as trade in goods, include only tangible goods and exclude trade in services.

(ii) Service exports and imports: Service exports and imports involve trade in intangibles. It is because of the intangible aspect of services that trade in services is also known as invisible trade. A wide variety of services are traded internationally and these include: tourism and travel, boarding and lodging (hotel and restaurants), entertainment and recreation, transportation, professional services (such as training, recruitment, consultancy and research), communication (postal, telephone, fax, courier and other audio-visual services), construction and engineering, marketing (e.g., wholesaling, retailing, advertising, marketing research and warehousing), educational and financial services (such as banking and insurance). Of these, tourism, transportation and business services are major constituents of world trade in services (see Box C).

(iii) Licensing and franchising: Permitting another party in a foreign country to produce and sell goods under your trademarks, patents or copy rights in lieu of some fee is another way of entering into international business. It is under the licensing system that Pepsi and Coca Cola are produced and sold all over the world by local bottlers in foreign countries. Franchising is similar to licensing, but it is a term used in connection with the provision of services. McDonalds, for instance, operates fast food restaurants the world over through its franchising system.

(iv) Foreign investments: Foreign investment is another important form of international business. Foreign investment involves investments of funds abroad in exchange for financial return. Foreign investment can be of two types: direct and portfolio investments.

Direct investment takes place when a company directly invests in properties such as plant and machinery in foreign countries with a view to undertaking production and marketing of goods and services in those countries. Direct investment provides the investor a controlling interest in a foreign company, known as Direct Investment, i.e., FDI. It can be in the form of joint venture on PPP. A company, if it so desires, can also set up a wholly owned subsidiary abroad by making 100 per cent investment in foreign ventures, and thus acquiring full control over subsidiary’s operations in the foreign market.

A portfolio investment, on the other hand, is an investment that a company makes into another company by the way of acquiring shares or providing loans to the latter, and earns income by way of dividends or interest on loans. Unlike foreign direct investments, the investor under portfolio investment does not get directly involved into production and marketing operations. It simply earns an income by investing in shares, bonds, bills, or notes in a foreign country or providing loans to foreign business firms.

Box C

Tourism, Transportation and Business Services dominate International Trade in Services

Tourism and transportation have emerged as major components of international trade in services. Most of the airlines, shipping companies, travel agencies and hotels get their major share of revenues from their overseas customers and operations abroad. Several countries have come to heavily depend on services as an important source of foreign exchange earnings and employment. India, for example, earns a sizeable amount of foreign exchange from exports of services related to travel and tourism.

Business services: When one country provides services to other country and in the process earns foreign exchange, this is also treated as a form of international business activity. Fee received for services like banking, insurance, rentals, engineering and management services form part of country’s foreign exchange earnings. Undertaking of construction projects in foreign countries is also an example of export of business services. The other examples of such services include overseas management contracts where arrangements are made by one company of a country which provides personnel to perform general or specialised management functions for another company in a foreign country in lieu of the other country.

11.1.5 Benefits of International Business

Notwithstanding greater complexities and risks, international business is important to both nations and business firms. It offers them several benefits. Growing realisation of these benefits over time has in fact been a contributory factor to the expansion of trade and investment amongst nations, resulting in the phenomenon of globalisation. Some of the benefits of international business to the nations and business firms are discussed below.

Benefits to Countries

(i) Earning of foreign exchange: International business helps a country to earn foreign exchange which it can later use for meeting its imports of capital goods, technology, petroleum products and fertilisers, pharma-ceutical products and a host of other consumer products which otherwise might not be available domestically.

(ii) More efficient use of resources: As stated earlier, international business operates on a simple principle —produce what your country can produce more efficiently, and trade the surplus production so generated with other countries to procure what they can produce more efficiently. When countries trade on this principle, they end up producing much more than what they can when each of them attempts to produce all the goods and services on its own. If such an enhanced pool of goods and services is distributed equitably amongst nations, it benefits all the trading nations.

(iii) Improving growth prospects and employment potentials: Producing solely for the purposes of domestic consumption severely restricts a country’s prospects for growth and employment. Many countries, especially the developing ones, could not execute their plans to produce on a larger scale, and thus create employment for people because their domestic market was not large enough to absorb all that extra production. Later on a few countries such as Singapore, South Korea and China which saw markets for their products in the foreign countries embarked upon the strategy ‘export and flourish’, and soon became the star performers on the world map. This helped them not only in improving their growth prospects, but also created opportunities for employment of people living in these countries.

(iv) Increased standard of living: In the absence of international trade of goods and services, it would not have been possible for the world community to consume goods and services produced in other countries that the people in these countries are able to consume and enjoy a higher standard of living.

Benefits to Firms

(i) Prospects for higher profits: International business can be more profitable than the domestic business. When the domestic prices are lower, business firms can earn more profits by selling their products in countries where prices are high.

(ii) Increased capacity utilisation: Many firms setup production capacities for their products which are in excess of demand in the domestic market. By planning overseas expansion and procuring orders from foreign customers, they can think of making use of their surplus production capacities and also improving the profitability of their operations. Production on a larger scale often leads to economies of scale, which in turn lowers production cost and improves per unit profit margin.

(iii) Prospects for growth: Business firms find it quite frustrating when demand for their products starts getting saturated in the domestic market. Such firms can considerably improve prospects of their growth by plunging into overseas markets. This is precisely what has prompted many of the multinationals from the developed countries to enter into markets of developing countries. While demand in their home countries has got almost saturated, they realised their products were in demand in the developing countries and demand was picking up quite fast.

(iv) Way out to intense competition in domestic market: When competition in the domestic market is very intense, internationalisation seems to be the only way to achieve significant growth. Highly competitive domestic market drives many companies to go international in search of markets for their products. International business thus acts as a catalyst of growth for firms facing tough market conditions on the domestic turf.

(v) Improved business vision: The growth of international business of many companies is essentially a part of their business policies or strategic management. The vision to become international comes from the urge to grow, the need to become more competitive, the need to diversify and to gain strategic advantages of internationalisation.

11.2 Modes of Entry into International Business

Simply speaking, the term mode means the manner or way. The phrase ‘modes of entry into international business’, therefore, means various ways in which a company can enter into international business. While discussing the meaning and scope of international business, we have already familiarised you with some of the modes of entry into international business. In the following sections, we shall discuss in detail important ways of entering into international business along with their advantages and limitations. Such a discussion will enable you to know as to which mode is more suitable under what conditions.

11.2.1 Exporting and Importing

Exporting refers to sending of goods and services from the home country to a foreign country. In a similar vein, importing is purchase of foreign products and bringing them into one’s home country. There are two important ways in which a firm can export or import products: direct and indirect exporting/importing. In the case of direct exporting/importing, a firm itself approaches the overseas buyers/suppliers and looks after all the formalities related to exporting/importing activities including those related to shipment and financing of goods and services. Indirect exporting/importing, on the other hand, is one where the firm’s participation in the export/import operations is minimum, and most of the tasks relating to export/import of the goods are carried out by some middle men such as export houses or buying offices of overseas customers located in the home country or wholesale importers in the case of import operations. Such firms do not directly deal with overseas customers in the case of exports and suppliers in the case of imports.

Advantages

Major advantages of exporting include:

• As compared to other modes of entry, exporting/importing is the easiest way of gaining entry into international markets. It is less complex an activity than setting up and managing joint-ventures or wholly owned subsidiaries abroad.

• Exporting/importing is less involving in the sense that business firms are not required to invest that much time and money as is needed when they desire to enter into joint ventures or set up manufacturing plants and facilities in host countries.

• Since exporting/importing does not require much of investment in foreign countries, exposure to foreign investment risks is nil or much lower than that is present when firms opt for other modes of entry into international business.

Limitations

Major limitations of exporting/importing as an entry mode of international business are as follows:

• Since the goods physically move from one country to another, exporting/importing involves additional packaging, trans-portation and insurance costs. Especially in the case of heavy items, transportation costs alone become an inhibiting factor to their exports and imports. On reaching the shores of foreign countries, such products are subject to custom duty and a variety of other levies and charges. Taken together, all these expenses and payments substantially increase product costs and make them less competitive.

• Exporting is not a feasible option when import restrictions exist in a foreign country. In such a situation, firms have no alternative but to opt for other entry modes such as licensing/franchising or joint venture which makes it feasible to make the product available by way of producing and marketing it locally in foreign countries.

• Export firms basically operate from their home country. They produce in the home country and then ship the goods to foreign countries. Except a few visits made by the executives of export firms to foreign countries to promote their products, the export firms in general do not have much contact with the foreign markets. This puts the export firms in a disadvan-tageous position vis-à-vis the local firms which are very near the customers and are able to better understand and serve them.

Despite the above mentioned limitations, exporting/importing is the most preferred way for business firms when they are getting initially involved with international business. As usually is the case, firms start their overseas operations with exports and imports, and later having gained familiarity with the foreign market operations switch over to other forms of international business operations.

11.2.2 Contract Manufacturing

Contract manufacturing refers to a type of international business where a firm enters into a contract with one or a few local manufacturers in foreign countries to get certain components or goods produced as per its specifications. Contract manufacturing, also known as outsourcing, can take three major forms:

• Production of certain components such as automobile components or shoe uppers to be used later for producing final products such as cars and shoes;

• Assembly of components into final products such as assembly of hard disk, mother board, floppy disk drive and modem chip into computers; and

• Complete manufacture of the products such as garments.

The goods are produced or assembled by the local manufacturers as per the technology and management guidance provided to them by the foreign company. The goods so manufactured or assembled by the local producers are delivered to the international firm for use in its final products or out rightly sold as finished products by the international firm under its brand names in various countries including the home, host and other countries. All the major international companies such as Nike, Reebok, Levis and Wrangler today get their products or components produced in the developing countries under contract manufacturing.

Advantages

Contract manufacturing offers several advantages to both the international company and local producers in the foreign countries.

• Contract manufacturing permits the international firms to get the goods produced on a large scale without requiring investment in setting up production facilities. These firms make use of the production facilities already existing in the foreign countries.

• Since there is no or little investment in the foreign countries, there is hardly any investment risk involved in the foreign countries.

• Contract manufacturing also gives an advantage to the international company of getting products manufactured or assembled at lower costs especially if the local producers happen to be situated in countries which have lower material and labour costs.

• Local producers in foreign countries also gain from contract manufacturing. If they have any idle production capacities, manufacturing jobs obtained on contract basis in a way provide a ready market for their products and ensure greater utilisation of their production capacities. This is how the Godrej group is benefitting from contract manufacturing in India. It is manufacturing soaps under contract for many multinationals including Dettol soap for Reckitt and Colman. This has considerably helped it in making use of its excess soap manufacturing capacity.

• The local manufacturer also gets the opportunity to get involved with international business and avail incentives, if any, available to the export firms in case the international firm desires goods so produced be delivered to its home country or to some other foreign countries.

Limitations

The major disadvantages of contract manufacturing to international firm and local producer in foreign countries are as follows:

• Local firms might not adhere to production design and quality standards, thus causing serious product quality problems to the international firm.

• Local manufacturer in the foreign country loses his control over the manufacturing process because goods are produced strictly as per the terms and specifications of the contract.

• The local firm producing under contract manufacturing is not free to sell the contracted output as per its will. It has to sell the goods to the international company at predetermined prices. This results in lower profits for the local firm if the open market prices for such goods happen to be higher than the prices agreed upon under the contract.

11.2.3 Licensing and Franchising

Licensing is a contractual arrangement in which one firm grants access to its patents, trade secrets or technology to another firm in a foreign country for a fee called royalty. The firm that grants such permission to the other firm is known as licensor and the other firm in the foreign country that acquires such rights to use technology or patents is called the licensee. It may be mentioned here that it is not only technology that is licensed. In the fashion industry, a number of designers license the use of their names. In some cases, there is exchange of technology between the two firms. Sometimes there is mutual exchange of knowledge, technology and/or patents between the firms which is known as cross-licensing.

Franchising is a term very similar to licensing. One major distinction between the two is that while the former is used in connection with production and marketing of goods, the term franchising applies to service business. The other point of difference between the two is that franchising is relatively more stringent than licensing. Franchisers usually set strict rules and regulations as to how the franchisees should operate while running their business. Barring these two differences, franchising is pretty much the same as licensing. Like in the case of licensing, a franchising agreement too involves grant of rights by one party to another for use of technology, trademark and patents in return of the agreed payment for a certain period of time. The parent company is called the franchiser and the other party to the agreement is called franchisee. The franchiser can be any service provider be it a restaurant, hotel, travel agency, bank wholesaler or even a retailer - who has developed a unique technique for creating and marketing of services under its own name and trade mark. It is the uniqueness of the technique that gives the franchiser an edge over its competitors in the field, and makes the would-be-service providers interested in joining the franchising system. McDonald, Pizza Hut and Wal-Mart are examples of some of the leading franchisers operating worldwide.

Advantages

As compared to joint ventures and wholly owned subsidiaries, licensing/franchising is relatively a much easier mode of entering into foreign markets with proven product/technology without much business risks and investments. Some of the specific advantages of licensing are as follows:

• Under the licensing/franchising system, it is the licensor/franchiser who sets up the business unit and invests his/her own money in the business. As such, the licensor/franchiser has to virtually make no investments abroad. Licensing/franchising is, therefore, considered a less expensive mode of entering into international business.

• Since no or very little foreign investment is involved, licensor/franchiser is not a party to the losses, if any, that occur to foreign business. Licensor/franchiser is paid by the licensee/franchisee by way of fees fixed in advance as a percentage of production or sales turnover. This royalty or fee keeps accruing to the licensor/franchiser so long as the production and sales keep on taking place in the licensee’s/franchisee’s business unit.

• Since the business in the foreign country is managed by the licensee/franchisee who is a local person, there are lower risks of business takeovers or government interventions.

• Licensee/franchisee being a local person has greater market knowledge and contacts which can prove quite helpful to the licensor/franchiser in successfully conducting its marketing operations.

• As per the terms of the licensing/franchising agreement, only the parties to the licensing/franchising agreement are legally entitled to make use of the licensor’s/franchiser’s copyrights, patents and brand names in foreign countries. As a result, other firms in the foreign market cannot make use of such trademarks and patents.

Limitations

Licensing/franchising as a mode of international business suffers from the following weaknesses.

• When a licensee/franchisee becomes skilled in the manu-facture and marketing of the licensed/franchised products, there is a danger that the licensee can start marketing an identical product under a slightly different brand name. This can cause severe competition to the licenser/franchiser.

• If not maintained properly, trade secrets can get divulged to others in the foreign markets. Such lapses on the part of the licensee/franchisee can cause severe losses to the licensor/franchiser.

• Over time, conflicts often develop between the licensor/franchiser and licensee/franchisee over issues such as maintenance of accounts, payment of royalty and non-adherence to norms relating to production of quality products. These differences often result in costly litigations, causing harm to both the parties.

11.2.4 Joint Ventures

Joint venture is a very common strategy for entering into foreign markets. A joint venture means establishing a firm that is jointly owned by two or more otherwise independent firms. In the widest sense of the term, it can also be described

as any form of association which implies collaboration for more than a transitory period. A joint ownership venture may be brought about in three major ways:

(i) Foreign investor buying an interest in a local company

(ii) Local firm acquiring an interest in an existing foreign firm

(iii) Both the foreign and local entrepreneurs jointly forming a new enterprise.

Advantages

Major advantages of joint venture include:

• Since the local partner also contributes to the equity capital of such a venture, the international firm finds it financially less burdensome to expand globally.

• Joint ventures make it possible to execute large projects requiring huge capital outlays and manpower.

• The foreign business firm benefits from a local partner’s knowledge of the host countries regarding the competitive conditions, culture, language, political systems and business systems.

• In many cases entering into a foreign market is very costly and risky. This can be avoided by sharing costs and/or risks with a local partner under joint venture agreements.

Limitations

Major limitations of a joint venture are discussed below:

• Foreign firms entering into joint ventures share the technology and trade secrets with local firms in foreign countries, thus always running the risks of such a technology and secrets being disclosed to others.

• The dual ownership arrangement may lead to conflicts, resulting in battle for control between the investing firms.

11.2.5 Wholly Owned Subsidiaries

This entry mode of international business is preferred by companies which want to exercise full control over their overseas operations. The parent company acquires full control over the foreign company by making 100 per cent investment in its equity capital. A wholly owned subsidiary in a foreign market can be established in either of the two ways:

(i) Setting up a new firm altogether to start operations in a foreign country — also referred to as a green field venture, or

(ii) Acquiring an established firm in the foreign country and using that firm to manufacture and/or promote its products in the host nation.

Advantages

Major advantages of a wholly owned subsidiary in a foreign country are as follows:

• The parent firm is able to exercise full control over its operations in foreign countries.

• Since the parent company on its own looks after the entire operations of foreign subsidiary, it is not required to disclose its technology or trade secrets to others.

Limitations

The limitations of setting up a wholly owned subsidiary abroad include:

• The parent company has to make 100 per cent equity investments in the foreign subsidiaries. This form of international business is, therefore, not suitable for small and medium size firms which do not have enough funds with them to invest abroad.

• Since the parent company owns 100 per cent equity in the foreign company, it alone has to bear the entire losses resulting from failure of its foreign operations.

• Some countries are averse to setting up of 100 per cent wholly owned subsidiaries by foreigners in their countries. This form of international business operations, therefore, becomes subject to higher political risks.

11.3 Export-Import Procedures and Documentation

A major distinction between domestic and international operations is the complexity of the latter. Export and import of goods is not that straight forward as buying and selling in the domestic market. Since foreign trade transactions involves movement of goods across frontiers and use of foreign exchange, a number of formalities are needed to be performed before the goods leave the boundaries of a country and enter into that of another. Following sections are devoted to a discussion of major steps that need to be undertaken for completing export and import transactions.

11.3.1 Export Procedure

The number of steps and the sequence in which these are taken vary from one export transaction to another. Steps involved in a typical export transaction are as follows.

(i) Receipt of enquiry and sending quotations: The prospective buyer of a product sends an enquiry to different exporters requesting them to send information regarding price, quality and terms and conditions for export of goods. Exporters can be informed of such an enquiry even by way of advertisement in the press put in by the importer. The exporter sends a reply to the enquiry in the form of a quotation —referred to as proforma invoice. The proforma invoice contains information about the price at which the exporter is ready to sell the goods and also provides information about the quality, grade, size, weight, mode of delivery, type of packing and payment terms.

(ii) Receipt of order or indent: In case the prospective buyer (i.e., importing firm) finds the export price and other terms and conditions acceptable, it places an order for the goods to be despatched. This order, also known as indent, contains a description of the goods ordered, prices to be paid, delivery terms, packing and marking details and delivery instructions.

(iii) Assessing the importer’s creditworthiness and securing a guarantee for payments: After receipt of the indent, the exporter makes necessary enquiry about the creditworthiness of the importer. The purpose underlying the enquiry is to assess the risks of non payment by the importer once the goods reach the import destination. To minimise such risks, most exporters demand a letter of credit from the importer. A letter of credit is a guarantee issued by the importer’s bank that it will honour payment up to a certain amount of export bills to the bank of the exporter. Letter of credit is the most appropriate and secure method of payment adopted to settle international transactions.

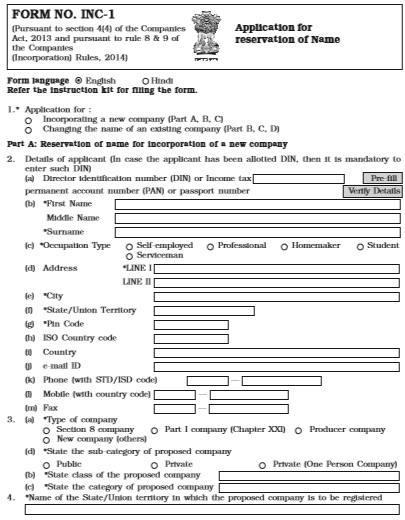

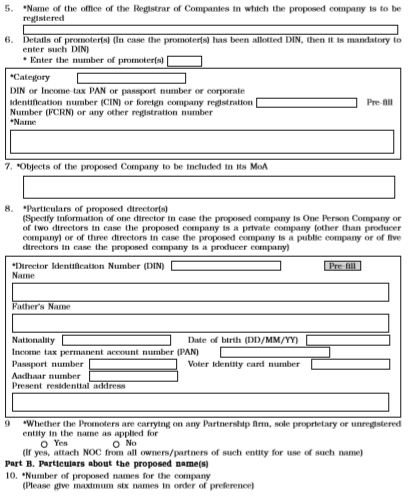

(iv) Obtaining export licence: Having become assured about payments, the exporting firm initiates the steps relating to compliance of export regulations. Export of goods in India is subject to custom laws which demand that the export firm must have an export licence before it proceeds with exports. Important pre-requisites for getting an export licence are as follows:

- Opening a bank account in any bank authorised by the Reserve Bank of India (RBI) and getting an account number.

- Obtaining Import Export Code (IEC) number from the Directorate General Foreign Trade (DGFT) or Regional Import Export Licensing Authority.

- Registering with appropriate export promotion council.

- Registering with Export Credit and Guarantee Corporation (ECGC) in order to safeguard against risks of non payments.

An export firm needs to have the Import Export Code (IEC) number as it needs to be filled in various export/import documents. For obtaining the IEC number, a firm has to apply to the Director General for Foreign Trade (DGFT) with documents such as exporter/importer profile, bank receipt for requisite fee, certificate from the banker on the prescribed form, two copies of photographs attested by the banker, details of the non-resident interest and declaration about the applicant’s non association with caution listed firms.

It is obligatory for every exporter to get registered with the appropriate export promotion council. Various export promotion councils such as Engineering Export Promotion Council (EEPC) and Apparel Export Promotion Council (AEPC) have been set up by the Government of India to promote and develop exports of different categories of products. We shall discuss about export promotion councils in a later section. But it may be mentioned here that it is necessary for the exporter to become a member of the appropriate export promotion council and obtain

a Registration cum Membership Certificate (RCMC) for availing benefits available to export firms from the Government.

Registration with the ECGC is necessary in order to protect overseas payments from political and commercial risks. Such a registration also helps the export firm in getting financial assistance from commercial banks and other financial institutions.

(v) Obtaining pre-shipment finance: Once a confirmed order and also a letter of credit have been received, the exporter approaches his banker for obtaining pre-shipment finance to undertake export production. Pre-shipment finance is the finance that the exporter needs for procuring raw materials and other components, processing and packing of goods and transportation of goods to the port of shipment.

(vi) Production or procurement of goods: Having obtained the pre-shipment finance from the bank, the exporter proceeds to get the goods ready as per the specifications of the importer. Either the firm itself goes in for producing the goods or else it buys from the market.

(vii) Pre-shipment inspection: The Government of India has initiated many steps to ensure that only good quality products are exported from the country. One such step is compulsory inspection of certain products by a competent agency as designated by the government. The government has passed Export Quality Control and Inspection Act, 1963 for this purpose. and has authorised some agencies to act as inspection agencies. If the product to be exported comes under such a category, the exporter needs to contact the Export Inspection Agency (EIA) or the other designated agency for obtaining inspection certificate. The pre-shipment inspection report is required to be submitted along with other export documents at the time of exports. Such an inspection is not compulsory in case the goods are being exported by star trading houses, trading houses, export houses, industrial units setup in export processing zones/special economic zones (EPZs/SEZs) and 100 per cent export oriented units (EOUs). We shall discuss about these special types of export firms in a later section.

(viii) Excise clearance: As per the Central Excise Tariff Act, excise duty is payable on the materials used in manufacturing goods. The exporter, therefore, has to apply to the concerned Excise Commissioner in the region with an invoice. If the Excise Commissioner is satisfied, he may issue the excise clearance. But in many cases the government exempts payment of excise duty or later on refunds it if the goods so manufactured are meant for exports. The idea underlying such exemption or refund is to provide an incentive to the exporters to export more and also to make the export products more competitive in the world markets. The refund of excise duty is known as duty drawback. This scheme of duty drawback is presently administered by the Directorate of Drawback under the Ministry of Finance which is responsible for fixing the rates of drawback for different products. The work relating to sanction and payment of drawback is, however, looked after by the Commissioner of Customs or Central Excise Incharge of the concerned port/airport/land custom station from where the export of goods is considered to have taken place.

(ix) Obtaining certificate of origin: Some importing countries provide tariff concessions or other exemptions to the goods coming from a particular country. For availing such benefits, the importer may ask the exporter to send a certificate of origin. The certificate of origin acts as a proof that the goods have actually been manufactured in the country from where the export is taking place. This certificate can be obtained from the trade consulate located in the exporter’s country.

(x) Reservation of shipping space: The exporting firm applies to the shipping company for provision of shipping space. It has to specify the types of goods to be exported, probable date of shipment and the port of destination. On acceptance of application for shipping, the shipping company issues a shipping order. A shipping order is an instruction to the captain of the ship that the specified goods after their customs clearance at a designated port be received on board.

(xi) Packing and forwarding: The goods are then properly packed and marked with necessary details such as name and address of the importer, gross and net weight, port of shipment and destination, country of origin, etc. The exporter then makes necessary arrangement for transportation of goods to the port. On loading goods into the railway wagon, the railway authorities issue a ‘railway receipt’ which serves as a title to the goods. The exporter endorses the railway receipt in favour of his agent to enable him to take delivery of goods at the port of shipment.

(xii) Insurance of goods: The exporter then gets the goods insured with an insurance company to protect against the risks of loss or damage of the goods due to the perils of the sea during the transit.

(xiii) Customs clearance: The goods must be cleared from the customs before these can be loaded on the ship. For obtaining customs clearance, the exporter prepares the shipping bill. Shipping bill is the main document on the basis of which the customs office gives the permission for export. Shipping bill contains particulars of the goods being exported, the name of the vessel, the port at which goods are to be discharged, country of final destination, exporter’s name and address, etc.

Five copies of the shipping bill along with the following documents are then submitted to the Customs Appraiser at the Customs House:

Export Contract or Export Order

Letter of Credit

Commercial Invoice

Certificate of Origin

Certificate of Inspection, where necessary

Marine Insurance Policy

After submission of these

documents, the Superintendent of the concerned port trust is approached for obtaining the carting order. Carting order is the instruction to the staff at the gate of the port to permit the entry of the cargo inside the dock. After obtaining the carting order, the cargo is physically moved into the port area and stored in the appropriate shed. Since the exporter cannot make himself or herself available all the time for performing all these formalities, these tasks are entrusted to an agent —referred to as Clearing and Forwarding (C&F) agent.

(xiv) Obtaining mates receipt: The goods are then loaded on board the ship for which the mate or the captain of the ship issues mate’s receipt to the port superintendent. A mate receipt is a receipt issued by the commanding officer of the ship when the cargo is loaded on board, and contains the information about the name of the vessel, berth, date of shipment, descripton of packages, marks and numbers, condition of the cargo at the time of receipt on board the ship, etc. The port superintendent, on receipt of port dues, hands over the mate’s receipt to the C&F agent.

(xv) Payment of freight and issuance of bill of lading: The C&F agent surrenders the mates receipt to the shipping company for computation of freight. After receipt of the freight, the shipping company issues a bill of lading which serves as an evidence that the shipping company has accepted the goods for carrying to the designated destination. In the case the goods are being sent by air, this document is referred to as airway bill.

(xvi) Preparation of invoice: After sending the goods, an invoice of the despatched goods is prepared. The invoice states the quantity of goods sent and the amount to be paid by the importer. The C&F agent gets it duly attested by the customs.

(xvii) Securing payment: After

the shipment of goods, the exporter informs the importer about the shipment of goods. The importer needs various documents to claim the title of goods on their arrival at his/her country and getting them customs cleared. The documents that are needed in this connection include certified copy of invoice, bill of lading, packing list, insurance policy, certificate of origin and letter of credit. The exporter sends these documents through his/her banker with the instruction that these may be delivered to the importer after acceptance of the bill of exchange — a document which is sent along with the above mentioned documents. Submission of the relevant documents to the bank for the purpose of getting the payment from the bank is called ‘negotiation of the documents’.

Bill of exchange is an order to the importer to pay a certain amount of money to, or to the order of, a certain person or to the bearer of the instrument. It can be of two types: document against sight (sight draft) or document against acceptance (usance draft). In case of sight draft, the documents are handed over to the importer only against payment. The moment the importer agrees to sign the sight draft, the relevant documents are delivered. In the case of usance draft, on the other hand, the documents are delivered to the importer against his or her acceptance of the bill of exchange for making payment at the end of a specified period, say three months.

On receiving the bill of exchange, the importer releases the payment in case of sight draft or accepts the usance draft for making payment on maturity of the bill of exchange. The exporter’s bank receives the payment through the importer’s bank and is credited to the exporter’s account.

The exporter, however, need not wait for the payment till the release of money by the importer. The exporter can get immediate payment from his/her bank on the submission of documents by signing a letter of indemnity. By signing the letter, the exporter undertakes to indemnify the bank in the event of non-receipt of payment from the importer along with accrued interest.

Having received the payment for exports, the exporter needs to get a bank certificate of payment. Bank certificate of payment is a certificate which says that the necessary documents (including bill of exchange) relating to the particular export consignment has been negotiated (i.e., presented to the importer for payment) and the payment has been received in accordance with the exchange control regulations.

11.3.2 Import Procedure

Import trade refers to purchase of goods from a foreign country. Import procedure differs from country to country depending upon the country’s import and custom policies and other statutory requirements. The following paragraphs discuss various steps involved in a typical import transaction for bringing goods into Indian territory.

(i) Trade enquiry: The first thing that the importing firm has to do is to gather information about the countries and firms which export the given product. The importer can gather such information from the trade directories and/or trade associations and organisations. Having identified the countries and firms that export

the product, the importing firm approaches the export firms with the help of a trade enquiry for collecting information about their export prices and terms of exports. A trade enquiry is a written request by an importing firm to the exporter for supply of information regarding the price and various terms and conditions on which the latter is ready to exports goods.

After receiving a trade enquiry, the exporter prepares a quotation and sends it to the importer. The quotation is known as proforma invoice. A proforma invoice is a document that contains details as to the quality, grade, design, size, weight and price of the export product, and the terms and conditions on which their export will take place.

(ii) Procurement of import licence: There are certain goods that can be imported freely, while others need licensing. The importer needs to consult the Export Import (EXIM) policy in force to know whether the goods that he or she wants to import are subject to import licensing. In case goods can be imported only against the licence, the importer needs to procure an import licence. In India, it is obligatory for every importer (and also for exporter) to get registered with the Directorate General Foreign Trade (DGFT) or Regional Import Export Licensing Authority, and obtain an Import Export Code (IEC) number. This number is required to be mentioned on most of the import documents.

(iii) Obtaining foreign exchange: Since the supplier in the context of an import transaction resides in a foreign country, he/she demands payment in a foreign currency. Payment in foreign currency involves exchange of Indian currency into foreign currency. In India, all foreign exchange transactions are regulated by the Exchange Control Department of the Reserve Bank of India (RBI). As per the rules in force, every importer is required to secure the sanction of foreign exchange. For obtaining such a sanction, the importer has to make an application to a bank authorised by RBI to issue foreign exchange. The application is made in a prescribed form along with the import licence as per the provisions of Exchange Control Act. After proper scrutiny of the application, the bank sanctions the necessary foreign exchange for the import transaction.

Major Documents needed in Connection with Export Transaction

A. Documents related to goods

Export invoice: Export invoice is a sellers’ bill for merchandise and contains information about goods such as quantity, total value, number of packages, marks on packing, port of destination, name of ship, bill of lading number, terms of delivery and payments, etc.

Packing list: A packing list is a statement of the number of cases or packs and the details of the goods contained in these packs. It gives details of the nature of goods which are being exported and the form in which these are being sent.

Certificate of origin: This is a certificate which specifies the country in which the goods are being produced. This certificate entitles the importer to claim tariff concessions or other exemptions such as non-applicability of quota restrictions on goods originating from certain pre-specified countries. This certificate is also required when there is a ban on imports of certain goods from select countries. The goods are allowed to be brought into the importing country if these are not originating from the banned countries.

Certificate of inspection: For ensuring quality, the government has made it compulsory for certain products that these be inspected by some authorised agency. Export Inspection Council of India (EICI) is one such agency which carries out such inspections and issues the certificate that the consignment has been inspected as required under the Export (Quality Control and Inspection) Act, 1963, and satisfies the conditions relating to quality control and inspection as applicable to it, and is export worthy. Some countries have made this certificate mandatory for the goods being imported to their countries.

B. Documents related to shipment

Mate’s receipt: This receipt is given by the commanding officer of the ship to the exporter after the cargo is loaded on the ship. The mate’s receipt indicates the name of the vessel, berth, date of shipment, description of packages, marks and numbers, condition of the cargo at the time of receipt on board the ship, etc. The shipping company does not issue the bill of lading unless it receives the mate’s receipt.

Shipping Bill: The shipping bill is the main document on the basis of which customs office grants permission for the export. The shipping bill contains particulars of the goods being exported, the name of the vessel, the port at which goods are to be discharged, country of final destination, exporter’s name and address, etc.

Bill of lading: Bill of lading is a document wherein a shipping company gives its official receipt of the goods put on board its vessel and at the same time gives an undertaking to carry them to the port of destination. It is also a document of title to the goods and as such is freely transferable by the endorsement and delivery.

Airway Bill: Like a bill of lading, an airway bill is a document wherein an airline company gives its official receipt of the goods on board its aircraft and at the same time gives an undertaking to carry them to the port of destination. It is also a document of title to the goods and as such is freely transferable by the endorsement and delivery.

Marine insurance policy: It is a certificate of insurance contract whereby the insurance company agrees in consideration of a payment called premium to indemnify the insured against loss incurred by the latter in respect of goods exposed to perils of the sea.

Cart ticket: A cart ticket is also known as a cart chit, vehicle or gate pass. It is prepared by the exporter and includes details of the export cargo in terms of the shipper’s name, number of packages, shipping bill number, port of destination and the number of the vehicle carrying the cargo.

C. Documents related to payment

Letter of credit: A letter of credit is a guarantee issued by the importer’s bank that it will honour up to a certain amount the payment of export bills to the bank of the exporter. Letter of credit is the most appropriate and secure method of payment adopted to settle international transactions

Bill of exchange: It is a written instrument whereby the person issuing the instrument directs the other party to pay a specified amount to a certain person or the bearer of the instrument. In the context of an export-import transaction, bill of exchange is drawn by exporter on the importer asking the latter to pay a certain amount to a certain person or the bearer of the bill of exchange. The documents giving title to the export consignment are passed on to the importer only when the importer accepts the order contained in the bill of exchange.

Bank certificate of payment: Bank certificate of payment is a certificate that the necessary documents (including bill of exchange) relating to the particular export consignment has been negotiated (i.e., presented to the importer for payment) and the payment has been received in accordance with the exchange control regulations.

(iv) Placing order or indent: After obtaining the import licence, the importer places an import order or indent with the exporter for supply of the specified products. The import order contains information about the price, quantity size, grade and quality of goods ordered and the instructions relating to packing, shipping, ports of shipment and destination, delivery schedule, insurance and mode of payment. The import order should be carefully drafted so as to avoid any ambiguity and consequent conflict between the importer and exporter.

(v) Obtaining letter of credit: If the payment terms agreed between the importer and the overseas supplier is a letter of credit, then the importer should obtain the letter of credit from its bank and forward it to the overseas supplier. As stated previously, a letter of credit is a guarantee issued by the importer’s bank that it will honour payment up to a certain amount of export bills to the bank of the exporter. Letter of credit is the most appropriate and secured method of payment adopted to settle international transactions. The exporter wants this document to be sure that there is no risk of non-payment.

(vi) Arranging for finance: The importer should make arrangements in advance to pay to the exporter on arrival of goods at the port. Advanced planning for financing imports is necessary so as to avoid huge demurrages (i.e., penalties) on the imported goods lying uncleared at the port for want of payments.

(vii) Receipt of shipment advice: After loading the goods on the vessel, the overseas supplier dispatches the shipment advice to the importer. A shipment advice contains information about the shipment of goods. The information provided in the shipment advice includes details such as invoice number, bill of lading/airways bill number and date, name of the vessel with date, the port of export, description of goods and quantity, and the date of sailing of vessel.

(viii) Retirement of import documents: Having shipped the goods, the overseas supplier prepares a set of necessary documents as per the terms of contract and letter of credit and hands it over to his or her banker for their onward transmission and negotiation to the importer in the manner as specified in the letter of credit. The set of documents normally contains bill of exchange, commercial invoice, bill of lading/airway bill, packing list, certificate of origin, marine insurance policy, etc.

The bill of exchange accompanying the above documents is known as the documentary bill of exchange. As mentioned earlier in connection with the export procedure, documentary bill of exchange can be of two types: documents against payment (sight draft) and documents against acceptance (usance draft). In the case of sight draft, the drawer instructs the bank to hand over the relevant documents to the importer only against payment. But in the case of usance draft, the drawer instructs the bank to hand over the relevant documents to the importer against acceptance of the bill of exchange. The acceptance of bill of exchange for the purpose of getting delivery of the documents is known as retirement of import documents. Once the retirement is over, the bank hands over the import documents to the importer.

(ix) Arrival of goods: Goods are shipped by the overseas supplier as per the contract. The person in charge of the carrier (ship or airway) informs the officer in charge at the dock or the airport about the arrival of goods in the importing country. He provides the document called import general manifest. Import general manifest is a document that contains the details of the imported goods. It is a document on the basis of which unloading of cargo takes place.

(x) Customs clearance and release of goods: All the goods imported into India have to pass through customs clearance after they cross the Indian borders. Customs clearance is a somewhat tedious process and calls for completing a number of formalities. It is, therefore, advised that importers appoint C&F agents who are

well- versed with such formalities and play an important role in getting the goods customs cleared.

Firstly, the importer has to obtain a delivery order which is otherwise known as endorsement for delivery. Generally when the ship arrives at the port, the importer obtains the endorsement on the back of the bill of lading. This endorsement is done by the concerned shipping company. In some cases instead of endorsing the bill, the shipping company issues a delivery order. This order entitles the importer to take the delivery of goods. Of course, the importer has to first pay the freight charges (if these have not been paid by the exporter) before he or she can take possession of the goods.

The importer has to also pay dock dues and obtain port trust dues receipt. For this, the importer has to submit to the ‘Landing and Shipping Dues Office’ two copies of a duly filled in form — known as ‘application to import’. The ‘Landing and Shipping Dues Office’ levies a charge for services of dock authorities which has to be borne by the importer. After payment of dock charges, the importer is given back one copy of the application as a receipt. This receipt is known as ‘port trust dues receipt’.

The importer then fills in a form ‘bill of entry’ for assessment of customs import duty. One appraiser examines the document carefully and gives the examination order. The importer procures the said document prepared by the appraiser and pays the duty,

if any.

After payment of the import duty, the bill of entry has to be presented to the dock superintendent. The same has to be marked by the superintendent and an examiner will be asked to physically examine the goods imported. The examiner gives his report on the bill of entry. The importer or his agent presents the bill of entry to the port authority. After receiving necessary charges, the port authority issues the release order.

Major Documents used in an Import Transaction

Trade enquiry: A trade enquiry is a written request by an importing firm to the exporter for supply of information regarding the price and various terms and conditions on which the latter exports goods.

Proforma invoice: A proforma invoice is a document that contains details as to the quality, grade, design, size, weight and price of the export product, and the terms and conditions on which their export will take place.

Import order or indent: It is a document in which the buyer (importer) orders for supply of requisite goods to the supplier (exporter). The order or indent contains the information such as quantity and quality of goods to be imported, price to be charged, method of forwarding the goods, nature of packing, mode of payment, etc.

Letter of credit: It is document that contains a guarantee from the importer bank to the exporter’s bank that it is undertaking to honour the payment up to a certain amount of the bills issued by the exporter for exports of the goods to the importer.

Shipment advice: The shipment advice is a document that the exporter sends to the importer informing him that the shipment of goods has been made. Shipment of advice contains invoice number, bill of lading/airways bill number and date, name of the vessel with date, the port of export, description of goods and quantity, and the date of sailing of the vessel.

Bill of lading: It is a document prepared and signed by the master of the ship acknowledging the receipt of goods on board. It contains terms and conditions on which the goods are to be taken to the port of destination.

Airway Bill: Like a bill of lading, an airway bill is a document wherein an airline/ shipping company gives its official receipt of the goods on board its aircraft and at the same time gives an undertaking to carry them to the port of destination. It is also a document of title to the goods and as such is freely transferable by the endorsement and delivery.

Bill of entry: Bill of entry is a form supplied by the customs office to the importer. It is to be filled in by the importer at the time of receiving the goods. It has to be in triplicate and is to be submitted to the customs office. The bill of entry contains information such as name and address of the importer, name of the ship, number of packages, marks on the package, description of goods, quantity and value of goods, name and address of the exporter, port of destination, and customs duty payable.

Bill of exchange: It is a written instrument whereby the person issuing the instrument directs the other party to pay a specified amount to a certain person or the bearer of the instrument. In the context of an export-import transaction, bill of exchange is drawn by the exporter on the importer asking the latter to pay a certain amount to a certain person or the bearer of the bill of exchange. The documents giving title to the export consignment are passed on to the importer only when the importer accepts the order contained in the bill of exchange.

Sight draft: It is a type of bill of exchange wherein the drawer of the bill of exchange instructs the bank to hand over the relevant documents to the importer only against payment.

Usance draft: It is a type of bill of exchange wherein the drawer of the bill of exchange instructs the bank to hand over the relevant documents to the importer only against acceptance of the bill of exchange.

Import general manifest. Import general manifest is a document that contains the details of the imported good. It is the document on the basis of which unloading of cargo takes place.

Dock challan: Dock charges are to be paid when all the formalities of the customs are completed. While paying the dock dues, the importer or his clearing agent specifies the amount of dock dues in a challan or form which is known as dock challan.

11.4 Foreign Trade Promotion: Incentives and Organisational Support

Various incentives and schemes are operational in the country to help business firms improve competitiveness of their exports. From time-to-time, the government has also setup a number of organisations to provide infra-structural support and marketing assistance to firms engaged in international business. Major foreign trade promotion schemes and organisations are discussed in the following sections.

11.4.1 Foreign Trade Promotion Measures and Schemes

Details of various trade promotion measures and schemes available to business firms to facilitate their export and import operations are announced by the government in its export-import (EXIM) policy. Major trade promotion measures (especially those related to exports) are as follows:

(i) Duty drawback scheme: Since goods meant for exports are not consumed domestically, these are not subjected to payment of various excise and customs duties. Any such duties paid on export goods are, therefore, refunded to exporters on production of proof of exports of these goods to the concerned authorities. Such refunds are called duty draw backs. Some major duty draw backs include refund of excise duties paid on goods meant for exports, refund of customs duties paid on raw materials and machines imported for export production. The latter is also called customs drawback.