Table of Contents

1

Accounting for Not-for-Profit Organisation

Learning Objectives

After studying this chapter, you will be able to;

• Identiy the need for, and nature of accounting records relating to not-for-profit organisations;

• List the principal financial statements prepared by not-for-profit organisations;

• Prepare the Receipt, and Payment Account and Income and Expenditure Account;

• Prepare Income and Expenditure Account and Balance Sheet from a given Receipt and Payment Account;

• Explain treatment of certain peculiar items of Receipts and Payments such as subscriptions from members, special funds, legacies, sale of old fixed assets, etc.

There are certain organisations which are set up for providing service to its members and the public in general. Such organisations include clubs, charitable institutions, schools, religious organisations, trade unions, welfare societies and societies for the promotion of art and culture. These organisations have service as the main objective and not the profit as is the case of organisations in business. Normally, these organisations do not undertake any business activity, and are managed by trustees who are fully accountable to their members and the society for the utilization of the funds raised for meeting the objectives of the organisation. Hence, they also have to maintain proper accounts and prepare the financial statement which take the form of Receipt and Payment Account; Income and Expenditure Account; and Balance Sheet. at the end of for every accounting period (normally a financial year).

This is also a legal requirement and helps them to keep track of their income and expenditure, the nature of which is different from those of the business organisations. In this chapter we shall learn about the accounting aspects relating to not-for-profit organisation.

1.1 Meaning and Characteristics of Not-for-Profit Organisation

Not-for-Profit Organisations refer to the organisations that are for used for the welfare of the society and are set up as charitable institutions which function without any profit motive. Their main aim is to provide service to a specific group or the public at large. Normally, they do not manufacture, purchase or sell goods and may not have credit transactions. Hence they need not maintain many books of account (as the trading concerns do) and Trading and Profit and Loss Account. The funds raised by such organisations are credited to capital fund or general fund. The major sources of their income usually are subscriptions from their members donations, grants-in-aid, income from investments, etc. The main objective of keeping records in such organisations is to meet the statutory requirement and help them in exercising control over utilisation of their funds. They also have to prepare the financial statements at the end of each accounting period (usually a financial year) and ascertain their income and expenditure and the financial position, and submit them to the statutory authority called Registrar of Societies.

The main characteristics of such organisations are:

1. Such organisations are formed for providing service to a specific group or public at large such as education, health care, recreation, sports and so on without any consideration of caste, creed and colour. Its sole aim is to provide service either free of cost or at nominal cost, and not to earn profit.

2. These are organised as charitable trusts/societies and subscribers to such organisation are called members.

3. Their affairs are usually managed by a managing/executive committee elected by its members.

4. The main sources of income of such organisations are: (i) subscriptions from members, (ii) donations (general). (iii) legacies(general). (iv) grant-in-aid, (v) income from investments, etc.

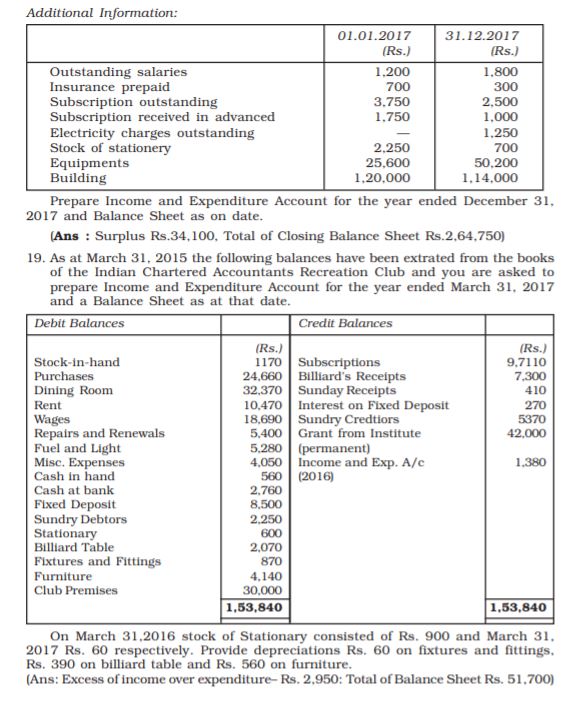

5. The funds raised by such organisations through various sources are credited to capital fund or general fund.

6. The surplus generated in the form of excess of income over expenditure is not distributed amongst the members. It is simply added in the

capital fund.

7. The Not-for-Profit Organisations earn their reputation on the basis of their contributions to the welfare of the society rather than on the customers’ or owners’ satisfaction.

8. The accounting information provided by such organisations is meant for the present and potential contributors and to meet the statutory requirement.

1.2 Accounting Records of Not-for-Profit Organisations

As stated earlier, normally such organisations are not engaged in any trading or business activities. The main sources of their income are subscriptions from members, donations, financial assistance from government and income from investments. Most of their transactions are in cash or through the bank. These institutions are required by law to keep proper accounting records and keep proper control over the utilization of their funds. This is why they usually keep a cash book in which all receipts and payments are duly recorded. They also maintain a ledger containing the accounts of all incomes, expenses, assets and liabilities which facilitates the preparation of financial statements at the end of the accounting period. In addition, they are required to maintain a stock register to keep complete record of all fixed assets and the consumables.

They do not maintain any capital account. Instead they maintain capital fund which is also called general fund that goes on accumulating due to surpluses generated, life membership fee, etc., received from year to year. In fact, a proper system of accounting is desirable to avoid or minimise the chances of misappropriations or embezzlement of the funds contributed by the members and other donors.

Final Accounts or Financial Statements: The Not-for-Profit Organisations are also required to prepare financial statements at the end of the each accounting period. Although these organisations are non-profit making entities and they are not required to make Trading and Profit & Loss Account but it is necessary to know whether the income during the year was sufficient to meet the expenses or not. Not only that they have to provide the necessary financial information to members, donors, and contributors and also to the Registrar of Societies. For this purpose, they have to prepare their final accounts at the end of the accounting period and the general principles of accounting are fully applicable in their preparation as stated earlier, the final accounts of a ‘not-for-profit organisation’ consist of the following:

(i) Receipt and Payment Account

(ii) Income and Expenditure Account, and

(iii) Balance Sheet.

The Receipt and Payment Account is the summary of cash and bank transactions which helps in the preparation of Income and Expenditure Account and the Balance Sheet. Besides, it is a legal requirement as the Receipts and Payments Account has also to be submitted to the Registrar of Societies along with the Income and Expenditure Account, and the Balance Sheet.

Income and Expenditure Account is akin to Profit and Loss Account. The Not-for-Profit Organisations usually prepare the Income and Expenditure Account and a Balance Sheet with the help of Receipt and Payment Account. However, this does not imply that they do not make a trial balance. In order to check the accuracy of the ledger accounts, they also prepare a trial balance which facilitates the preparation of accurate Receipt and Payment Account as well as the Income and Expenditure Account and the Balance Sheet.

In fact, if an organisation has followed the double entry system they must prepare a trial balance for checking the accuracy of the ledger accounts and it will also facilitate the preparation of Receipt and Payment account. Income and Expenditure Account and the Balance Sheet.

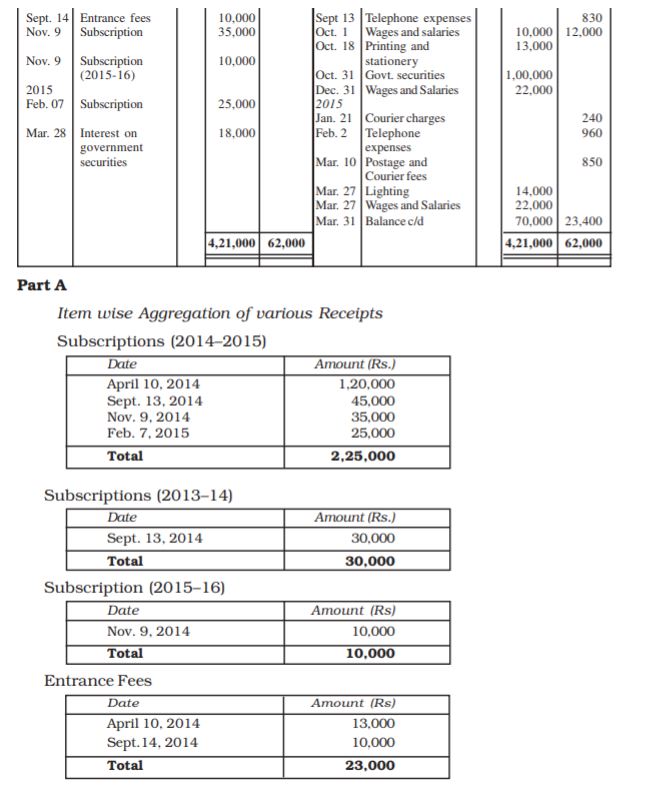

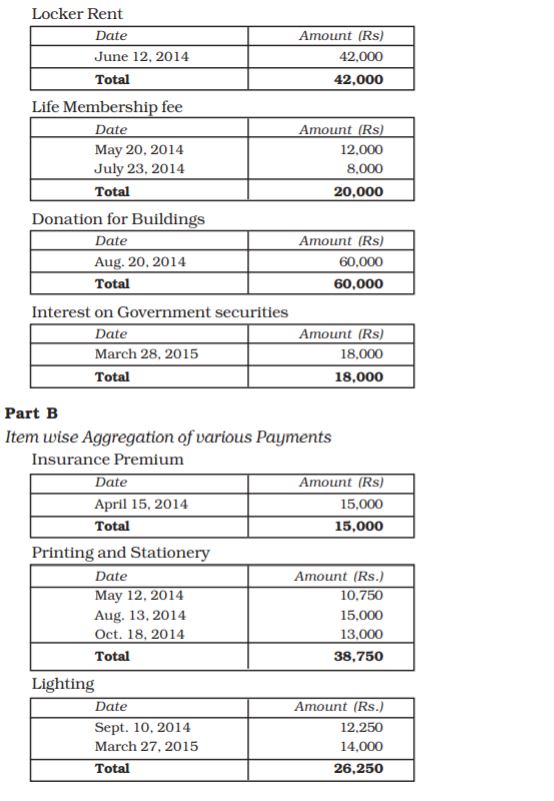

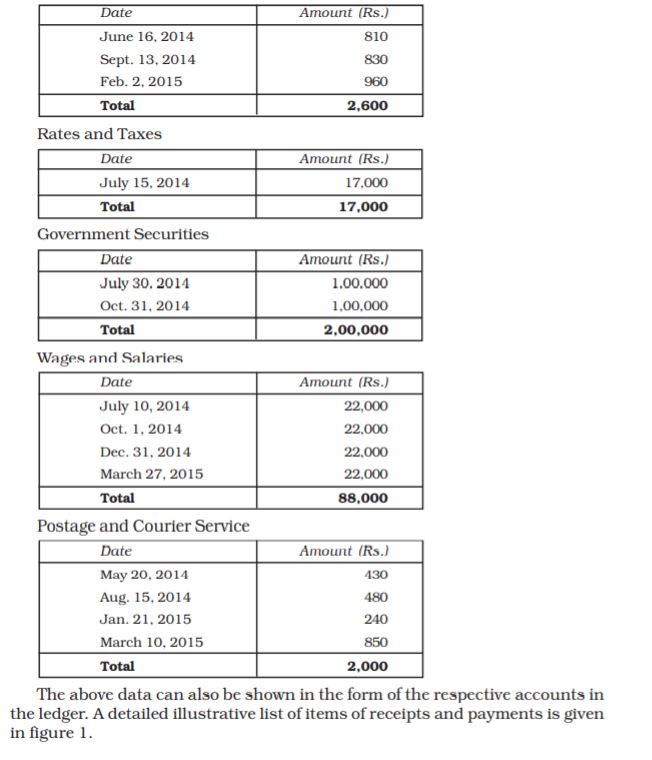

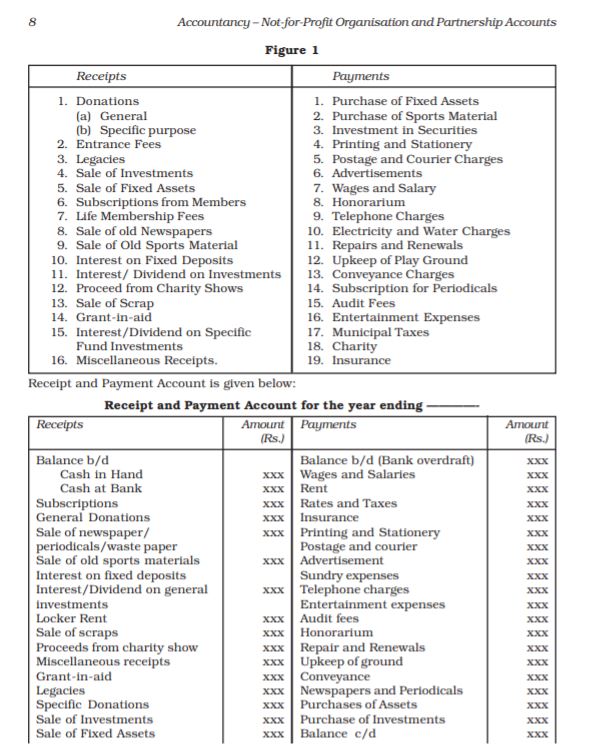

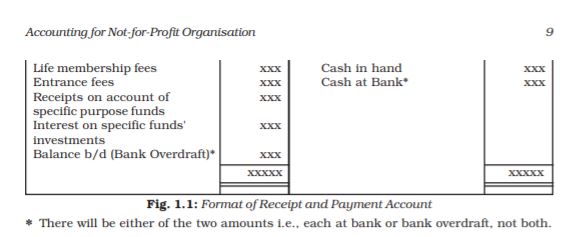

1.3 Receipt and Payment Account

It is prepared at the end of the accounting year on the basis of cash receipts and cash payments recorded in the cash book. It is a summary of cash and bank transactions under various heads. For example, subscriptions received from the members on different dates which appear on the debit side of the cash book, shall be shown on the receipts side of the Receipt and Payment Account as one item with its total amount. Similarly, salary, rent, electricity charges paid from time to time as recorded on the credit side of the cash book but the total salary paid, total rent paid, total electricity charges paid during the year appear on the payment side of the Receipt and Payment Account. Thus, Receipt and Payment Account gives summarised picture of various receipts and payments, irrespective of whether they pertain to the current period, previous period or succeeding period or whether they are of capital or revenue nature. It may be noted that this account does not show any non cash item like depreciation. The opening balance in Receipt and Payment Account represents cash in hand/cash at bank which is shown on its receipts side and the closing balance of this account represents cash in hand and bank balance as at the end of the year, which appear on the credit side of the Receipt and Payment Account. However, if it is bank overdraft at the end it shall be shown on its debit side as the last item. Let us look at the cash book of Golden Cricket Club given in the example to show how the total amount of each item of receipt and payment has been worked out.

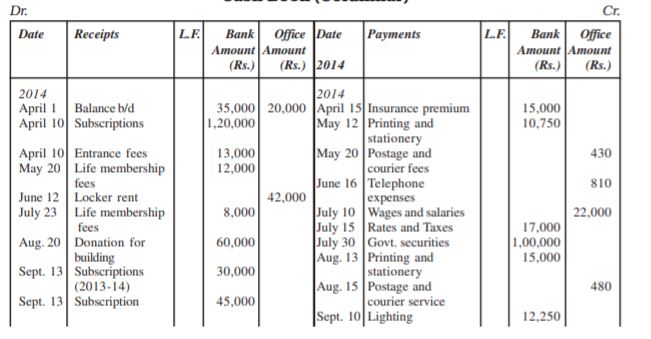

Example 1

Golden Cricket Club

Cash Book (Columnar)

It may be noted that the receipts side of the Receipt and Payment Account gives a list of revenue receipts (for past, current and future periods) as well as capital receipts. Similarly, the payments side of the Receipts and Payments Account lists the Revenue Payments (for past, current and future periods) as well as Capital Payments.

1.3.1 Salient Features

1. It is a summary of the cash book. Its form is identical with that of simple cash book (without discount and bank columns) with debit and credit sides. Receipts are recorded on the debit side while payments are entered on the credit side.

2. It shows the total amounts of all receipts and payments irrespective of the period to which they pertain . For example, in the Receipt and Payment account for the year ending on March 31, 2016, we record the total subscriptions received during 2015–16 including the amounts related to the years 2014–2015 and 2016-2017. Similarly, taxes paid during 2015–16 even if they relate to the years 2014–15 and 2016–2017.

3. It includes all receipts and payments whether they are of capital nature or of revenue nature.

4. No distinction is made in receipts/payments made in cash or through bank. With the exception of the opening and closing balances, the total amount of each receipt and payment is shown in this account.

5. No non-cash items such as depreciation outstanding expenses accrued income, etc. are shown in this account.

6. It begins with opening balance of cash in hand and cash at bank (or bank overdraft) and closes with the year end balance of cash in hand/cash at bank or bank overdraft. In fact, the closing balance in this account (difference between the total amount of receipts and payments) which is usually a debit balance reflects cash in hand and cash at bank unless there is a bank overdraft.

1.3.2 Steps in the Preparation of Receipt and Payment Account

1. Take the opening balances of cash in hand and cash at bank and enter them on the debit side. In case there is bank overdraft at the begining of the year, enter the same on the credit side of this account.

2. Show the total amounts of all receipts on its debit side irrespective of their nature (whether capital or revenue) and whether they pertain to past, current and future periods.

3. Show the total amounts of all payments on its credit side irrespective of their nature (whether capital or revenue) and whether they pertain to past, current and future periods.

4. None of the receivable income and payable expense is to be entered in this account as they do not involve inflow or outflow of cash.

5. Find out the difference between the total of debit side and the total of credit side of the account and enter the same on the credit side as the closing balance of cash/bank. In case, however, the total of the credit side is more than that of the total of the debit side, show the difference on the debit as bank overdraft and close the account.

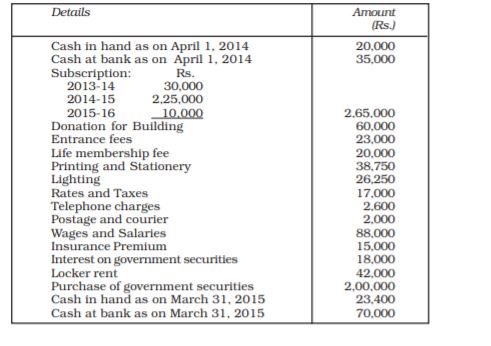

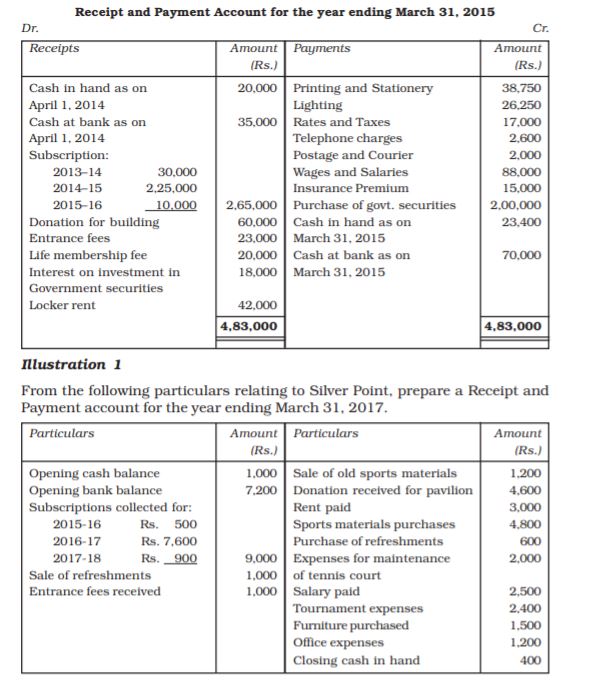

From the following information based on the data assimilated from the cash book given in example 1, at page 4, the Receipt and Payment Account of Golden Cricket Club for the year ended on March 31, 2015 will be prepared as follows:

Summary of Cash Book

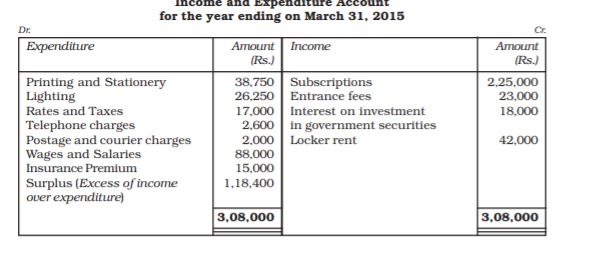

1.4 Income and Expenditure Account

It is the summary of income and expenditure for the accounting year. It is just like a profit and loss account prepared on accrual basis in case of the business organisations. It includes only revenue items and the balance at the end represents surplus or deficit. The Income and Expenditure Account serves the same purpose as the profit and loss account of a business organisation does. All the revenue items relating to the current period are shown in this account, the expenses and losses on the expenditure side and incomes and gains on the income side of the account. It shows the net operating result in the form of surplus (i.e. excess of income over expenditure) or deficit (i.e. excess of expenditure over income), which is transferred to the capital fund shown in the balance sheet.

The Income and Expenditure Account is prepared on accrual basis with the help of Receipts and Payments Account along with additional information regarding outstanding and prepaid expenses and depreciation etc. Hence, many items appearing in the Receipts and Payments need to be adjusted. For example, as shown in Example 1, (Page No. 10) subscription amount of Rs.2, 65,000 received during the year 2014-15 appearing on the receipts side of the Receipt and Payment Account includes receipts for the periods other than the current period. But the subscription amount of Rs. 2,25,000 pertaining to the current year only will be shown as income in Income and Expenditure Account for the year 2014-15.

1.4.1 Steps in the Preparation of Income and Expenditure Account

Following steps may be helpful in preparing an Income and Expenditure Account from a given Receipt and Payment Account:

1. Persue the Receipt and Payment Account thoroughly.

2. Exclude the opening and closing balances of cash and bank as they are not an income.

3. Exclude the capital receipts and capital payments as these are to be shown in the Balance Sheet.

4. Consider only the revenue receipts to be shown on the income side of Income and Expenditure Account. Some of these need to be adjusted by excluding the amounts relating to the preceding and the succeeding periods and including the amounts relating to the current year not yet received.

5. Take the revenue expenses to the expenditure side of the Income and Expenditure Account with due adjustments as per the additional information provided relating to the amounts received in advance and those not yet received.

6. Consider the following items not appearing in the Receipt and Payment Account that need to be taken into account for determining the surplus/deficit for the current year :

(a) Depreciation of fixed assets.

(b) Provision for doubtful debts, if required.

(c) Profit or loss on sale of fixed assets.

Now you will observe how the income and expenditure account is prepared from the receipts and payments account given in example 1, on page 10.

Note that-

1. Opening and closing cash/bank balances have been excluded.

2. Payment for purchase of Government securities being capital expenditure has been excluded.

3. Amount of subscriptions received for the year 2013-14 and 2015-16 have been excluded.

4. Life membership fee is an item of capital receipt and so excluded.

5. Donation for building is a receipt for a specific purpose and so excluded.

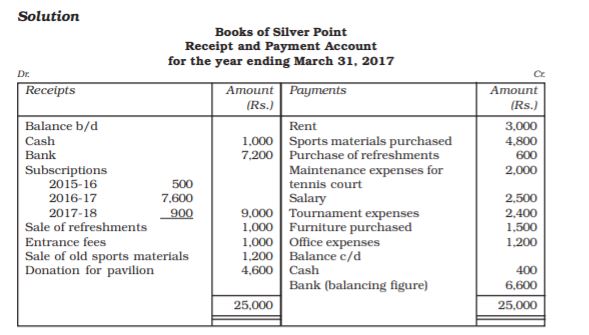

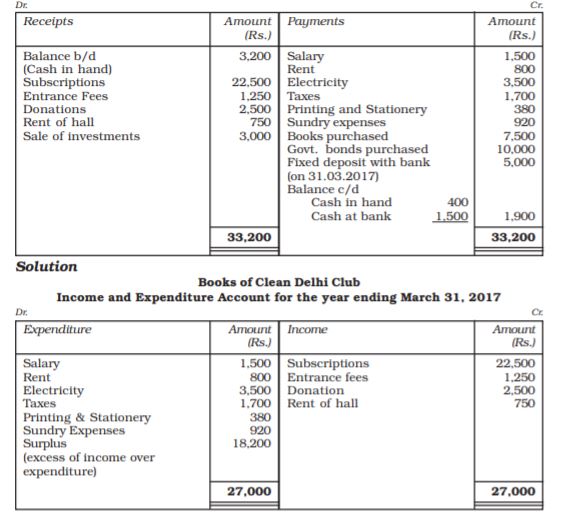

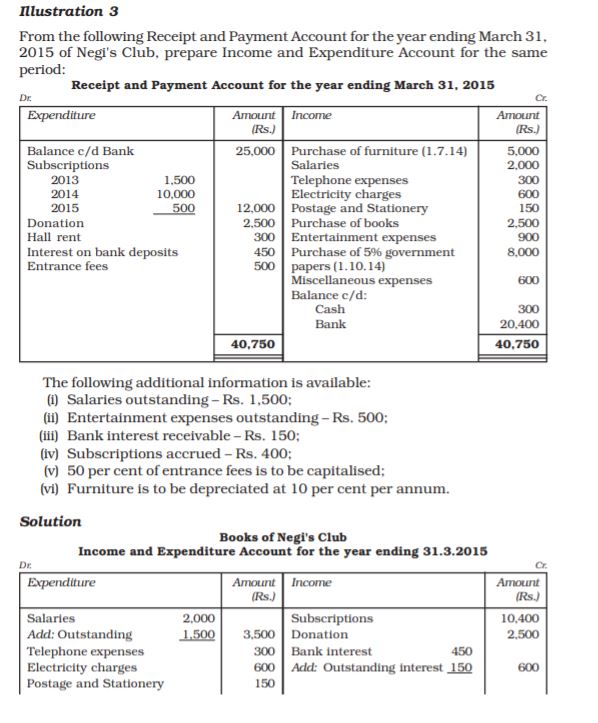

Illustration 2

From the Receipt and Payment Account given below, prepare the Income and Expenditure Account of Clean Delhi Club for the year ended March 31, 2017.

Receipt and Payment Account for the year ending March 31, 2017

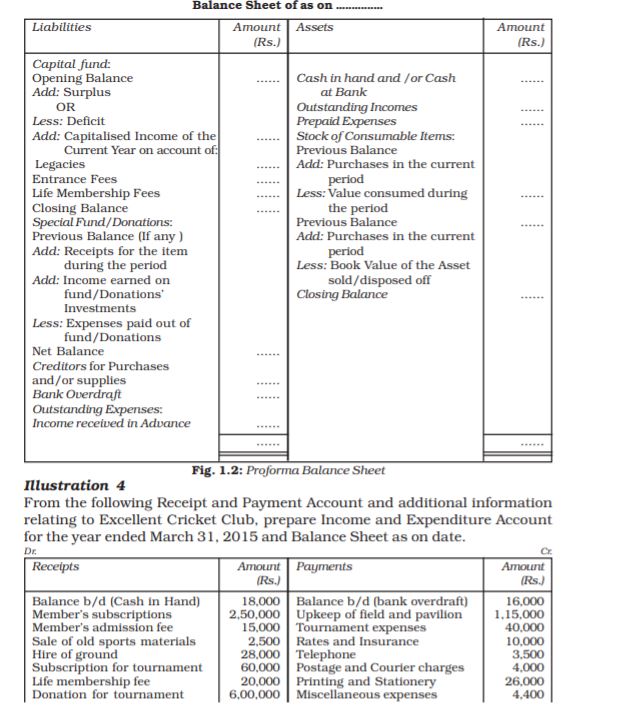

1.5 Balance Sheet

‘Not-for-Profit’ Organisations prepare Balance Sheet for ascertaining the financial position of the organisation. The preparation of their Balance Sheet is on the same pattern as that of the business entities. It shows assets and liabilities as at the end of the year. Assets are shown on the right hand side and the liabilities on the left hand side. However, there will be a Capital Fund or General Fund in place of the Capital and the surplus or deficit as per Income and Expenditure Account which is either added to/deducted from the capital fund, as the case may be. It is also a common practice to add some of the capitalised items like legacies, entrance fees and life membership fees directly in the capital fund.

Besides the Capital or General Fund, there may be other funds created for specific purposes or to meet the requirements of the contributors/donors such as building fund, sports fund, etc. Such funds are shown separately in the liabilities side of the balance sheet.

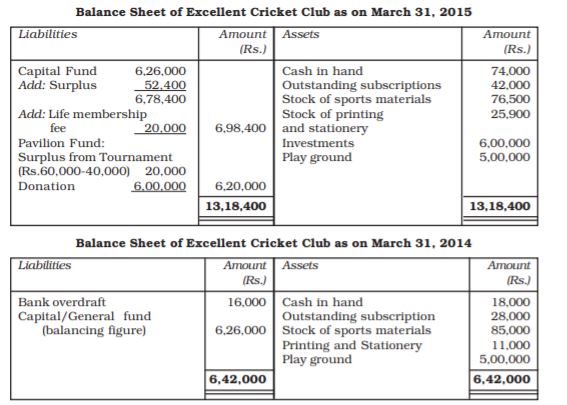

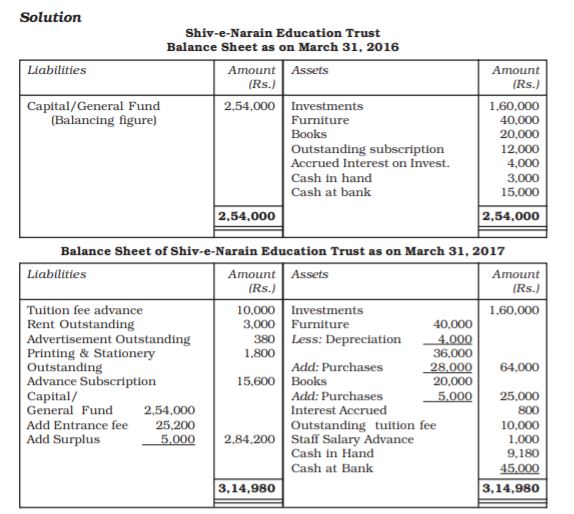

Some times it becomes necessary to prepare Balance Sheet as at the beginning of the year in order to find out the opening balance of the capital/general fund.

1.5.1 Preparation of Balance Sheet

The following procedure is adopted to prepare the Balance Sheet:

1. Take the Capital/General Fund as per the opening balance sheet and add surplus from the Income and Expenditure Account. Further, add entrance fees, legacies, life membership fees, etc. received during the year.

2. Take all the fixed assets (not sold/discarded/or destroyed during the year) with additions (from the Receipts and Payments account) after charging depreciation (as per Income and Expenditure account) and show them on the assets side.

3. Compare items on the receipts side of the Receipts and Payments Account with income side of the Income and Expenditure Account. This is to ascertain the amounts of: (a) subscriptions due but not yet received:

(b) incomes received in advance; (c) sale of fixed assets made during the year; (d) items to be capitalised (i.e. taken directly to the Balance Sheet) e.g. legacies, interest on specific fund investment and so on.

4. Similarly compare, items on the payments side of the Receipt and Payment Account with expenditure side of the Income and Expenditure Account. This is to ascertain the amounts if: (a) outstanding expenses; (b) prepaid expenses; (c) purchase of a fixed asset during the year; (d) depreciation on fixed assets; (e) stock of consumable items like stationery in hand; (f) Closing balance of cash in hand and cash at bank as, and so on.

A proforma Balance Sheet is given for the proper understanding of preparing the balance sheet.

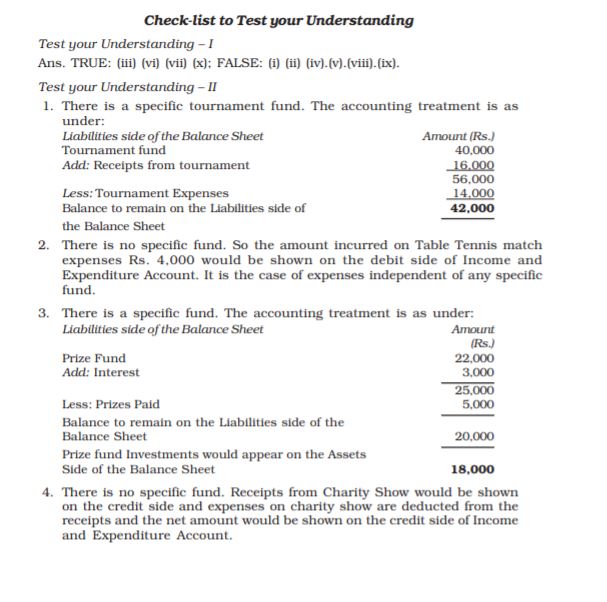

Test your Understanding – I

State with reasons whether the following statements are TRUE or FALSE:

(i) Receipt and Payment Account is a summary of all capital receipts and payments.

(ii) If there appears a sports fund, the expenses incurred on sports activities will be shown on the debit side of Income and Expenditure Account.

(iii) The balancing figure on credit side of Income and Expenditure Account denotes excess of expenses over incomes.

(iv) Scholarships granted to students out of funds provided by government will be debited to Income and Expenditure Account.

(v) Receipt and Payment Account records the receipts and payments of revenue nature only.

(vi) Donations for specific purposes are always capitalized.

(vii) Opening balance sheet is prepared when the opening balance of capital fund is not given.

(viii) Surplus of Income and Expenditure Account is deducted from the capital/general fund.

(ix) Receipt and Payment Account is equivalent to profit and loss account.

(x) Receipt and Payment Account does not differentiate between capital and revenue receipts.

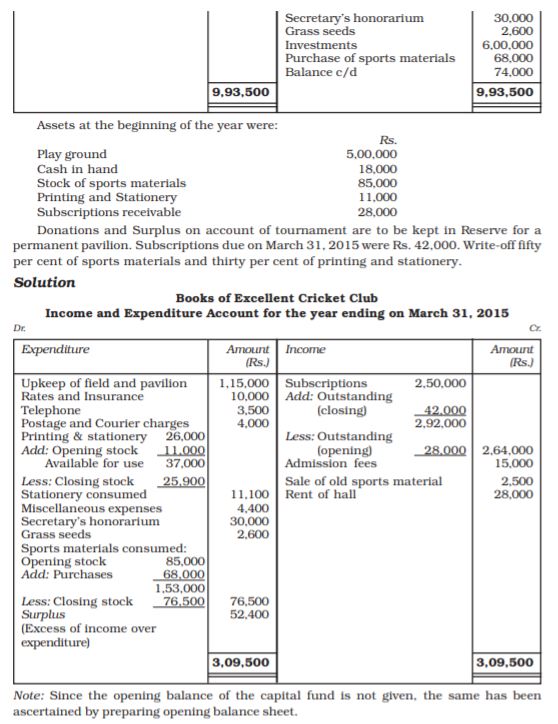

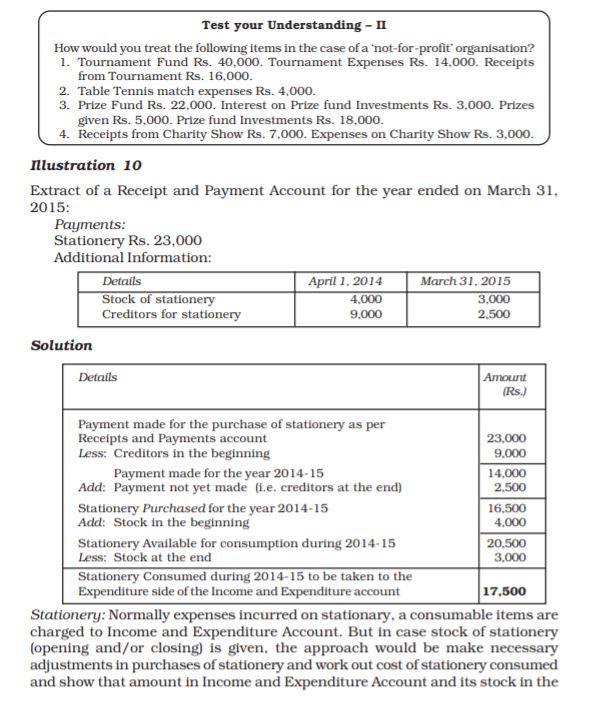

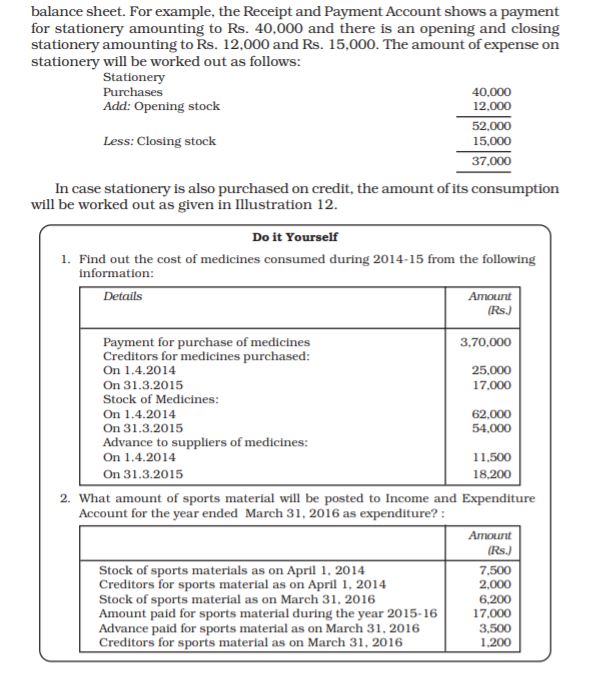

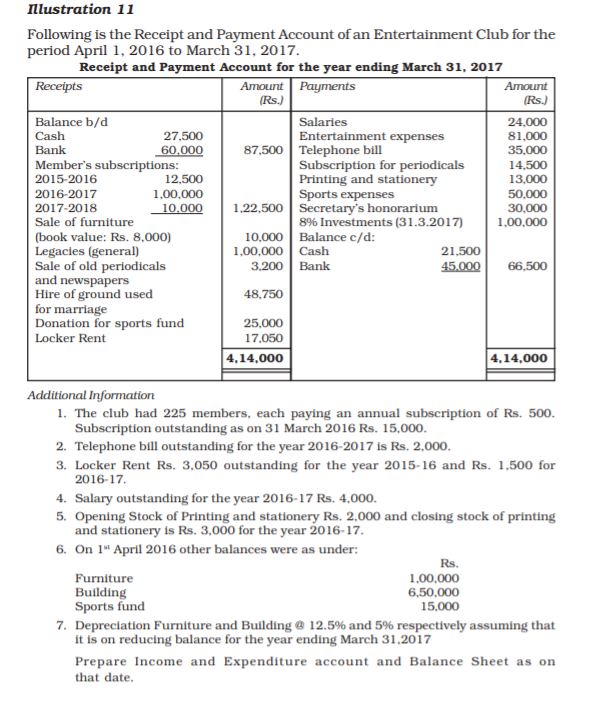

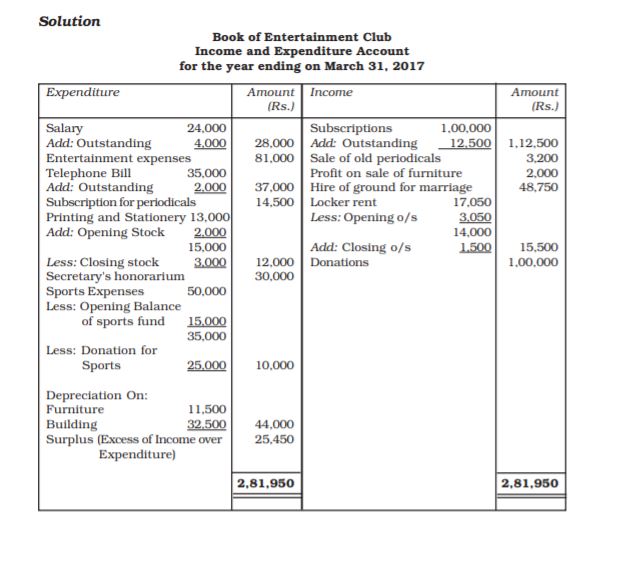

1.6 Some Peculiar Items

Final accounts of the Not-for-Profit organisations are prepared on the similar pattern as that of a business orgnisation. However, a few items of income and expenses of such orgnisations are somewhat different in nature and need special attention in their treatment in final accounts. They are peculiar to these orgnisations. Some of the common peculiar items are explained as under:

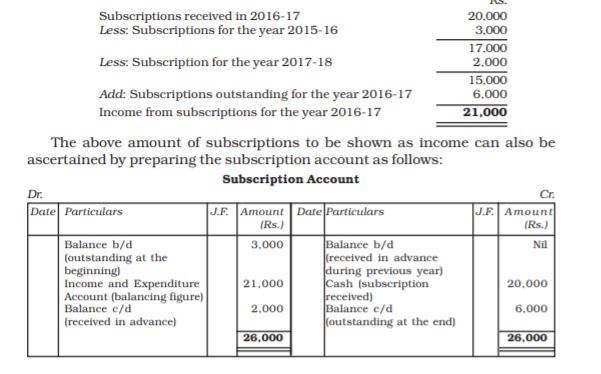

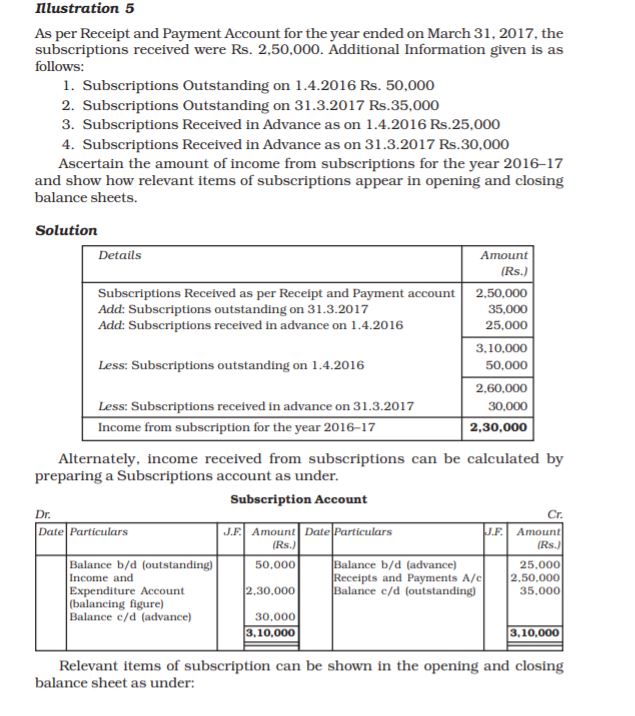

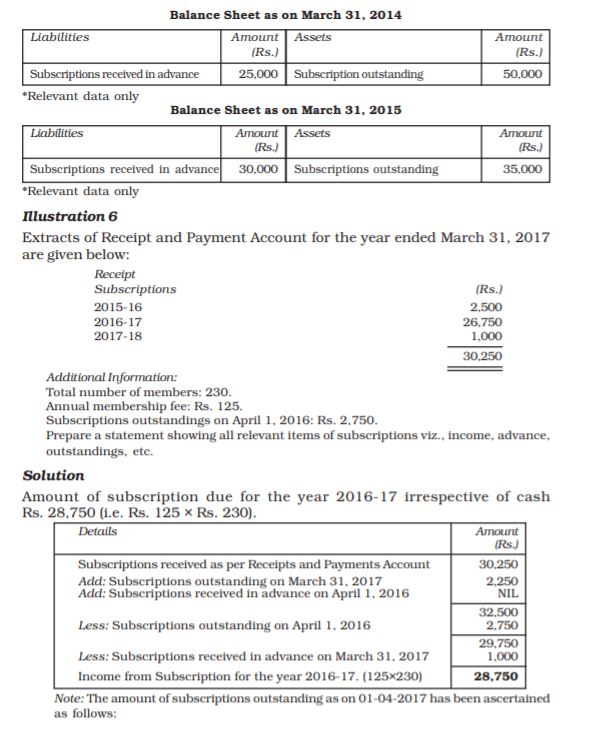

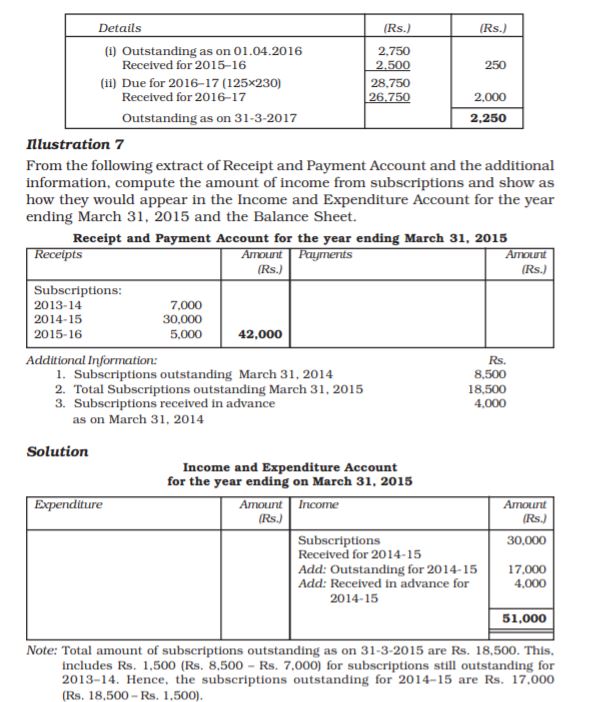

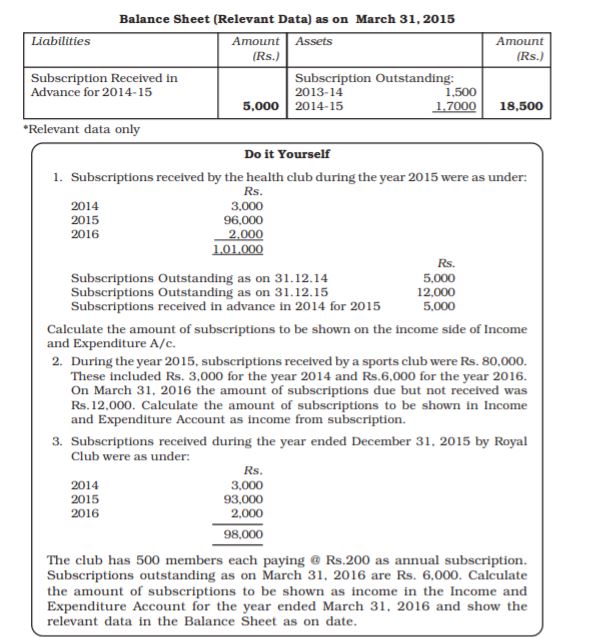

Subscriptions: Subscription is a membership fee paid by the member on annual basis. This is the main source of income of such orgnisations. Subscription paid by the members is shown as receipt in the Receipt and Payment Account and as income in the Income and Expenditure Account. It may be noted that Receipt and Payment Account shows the total amount of subscription actually received during the year while the amount shown in Income and Expenditure Account is confined to the figure related to the current period only irrespective of the fact whether it has been received or not. For example, a club received Rs. 20,000 as subscriptions during the year 2016-17 of which Rs.3,000 relate to year 2015-16 and Rs.2,000 to 2017-18, and at the end of the year 2016-17 Rs.6,000 are still receivable. In this case, the Receipt and Payment Account will show Rs.20,000 as receipt from subscriptions. But the Income and Expenditure Account will show Rs. 21,000 as income from subscriptions for the year 2016-17, the calculation of which is given as below:

Donations: It is a sort of gift in cash or property received from some person or organisation. It appears on the receipts side of the Receipts and Payments Account. Donation can be for specific purposes or for general purposes.

(i) Specific Donations: If donation received is to be utilised to achieve specified purpose, it is called Specific Donation. The specific purpose can be an extension of the existing building, construction of new computer laboratory, creation of a book bank, etc. Such donation is to be capitalised and shown on the liabilities side of the Balance Sheet irrespective of the fact whether the amount is big or small. The intention is to utilise the amount for the specified purpose only.

(ii) General Donations: Such donations are to be utilised to promote the general purpose of the organisation. These are treated as revenue receipts as it is a regular source of income hence, it is taken to the income side of the Income and Expenditure Account of the current year.

Legacies: It is the amount received as per the will of a deceased person who may or may not specify the use of the amount. Legacies, use of which is specified are specific legacy and is shown in the balance sheet as liability. If the use is not specified it is considered as revenue nature and credited to income and expenditure account.

Life Membership Fees: Some members prefer to pay lump sum amount as life membership fee instead of paying periodic subscription. Such amount is treated as capital receipt and credited directly to the capital/general fund.

Entrance Fees: Entrance fee also known as admission fee is paid only once by the member at the time of becoming a member. In case of organisations like clubs and some charitable institutions, is limited and the amount of entrance fees is quite high. Hence, it is treated as non-recurring item and credited directly to capital/general fund.

Sale of old asset: Receipts from the sale of an old asset appear in the Receipts and Payments Account of the year in which it is sold. But any gain or loss on the sale of asset is taken to the Income and Expenditure Account of the year. For example, if an item furniture with a book value of Rs. 800 is sold for Rs. 700, this amount of Rs. 700 will be shown as receipt in Receipts and Payments Account and Rs. 100 on the expenditure side of the Income and Expenditure Account as a loss on sale of old asset and while showing furniture in the balance sheet Rs. 800 will be deducted from its total book value.

Sale of Periodicals: It is an item of recurring nature and shown as the income side of the Income and Expenditure Account.

Sale of Sports Materials: Sale of sports materials (used materials like old balls, bats, nets, etc) is the regular feature with any Sports Club. It is usually shown as an income in the Income and Expenditure Account.

Payments of Honorarium: It is the amount paid to the person who is not the regular employee of the institution. Payment to an artist for giving performance at the club is an example of honorarium. This payment of honorarium is shown on the expenditure side of the Income and Expenditure Account.

Endowment Fund: It is a fund arising from a bequest or gift, the income of which is devoted for a specific purpose. Hence, it is a capital receipt and shown on the Liabilities side of the Balance Sheet as an item of a specific purpose fund.

Government Grant: Schools, colleges, public hospitals, etc. depend upon government grant for their activities. The recurring grants in the form of maintenance grant is treated as revenue receipt (i.e. income of the current year) and credited to Income and Expenditure account. However, grants such as building grant are treated as capital receipt and transferred to the building fund account. It may be noted that some Not-for-Profit organisations receive cash subsidy from the government or government agencies. This subsidy is also treated as revenue income for the year in which it is received.

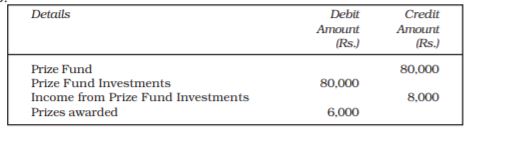

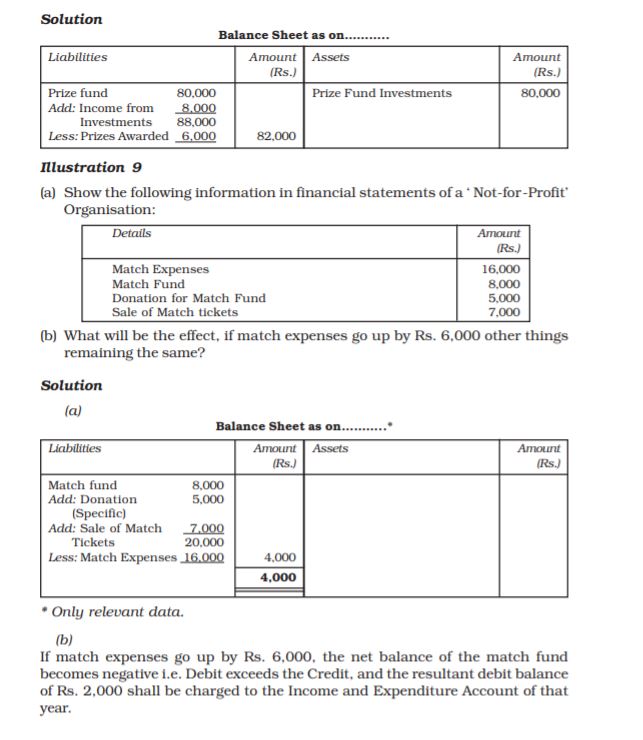

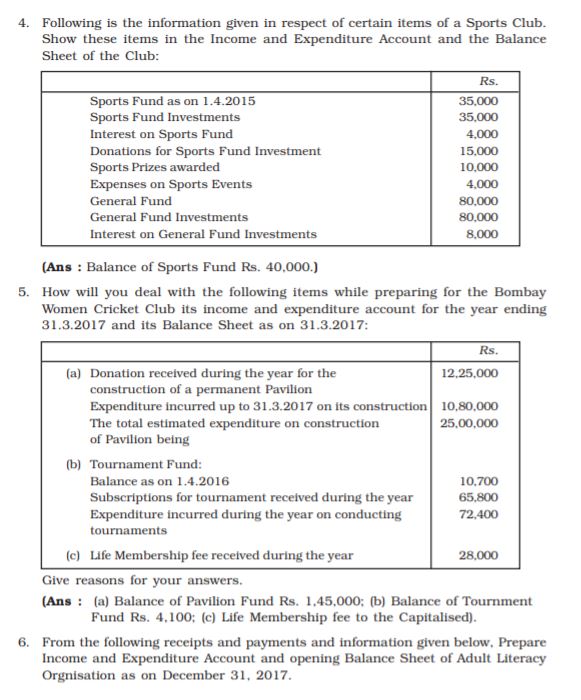

Special Funds

The Not-for-Profit Organisations office create special funds for certain purposes/activities such as 'prize funds', 'match fund' and 'sports fund', etc. Such funds are invested in securities and the income earned on such investments is added to the respective fund, not credited to Income and Expenditure Account. Similarly, the expenses incurred on such specific purposes are also deducted from the special fund. For example, a club may maintain a special fund for sports activities. In such a situation, the interest income on sports fund investments is added to the sports fund and all expenses on sports deducted therefrom. The special funds are shown in balance sheet. However, if, after adjustment of income and expenses the balance in specific or special fund is negative, it is transferred to the debit side of the Income and Expenditure Account or adjusted as per prescribed directions. (see Illustrations 8 and 9.)

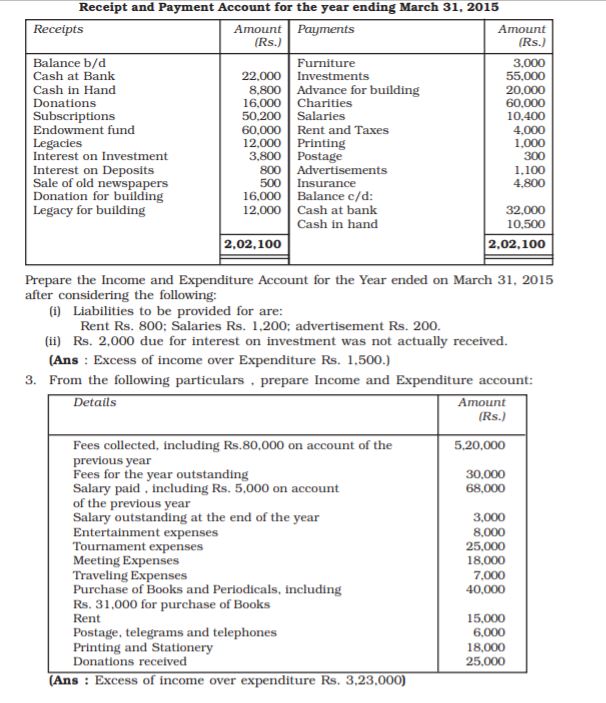

Illustration 8

Show how you would deal with the following items in the financial statements of a Club:

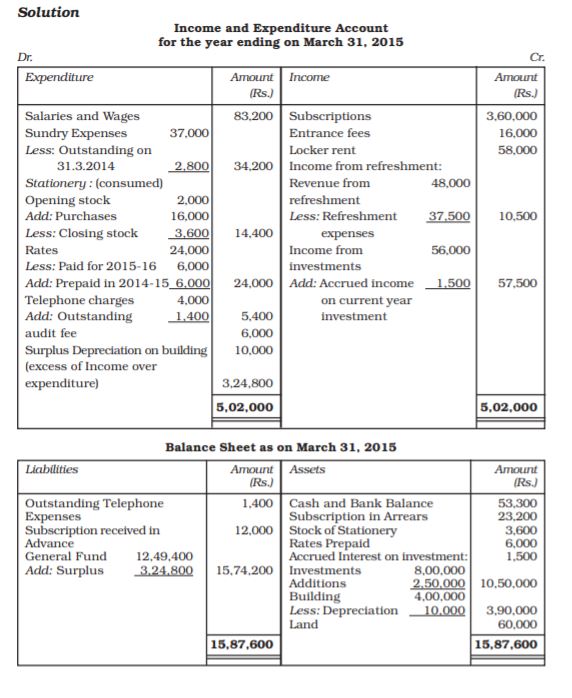

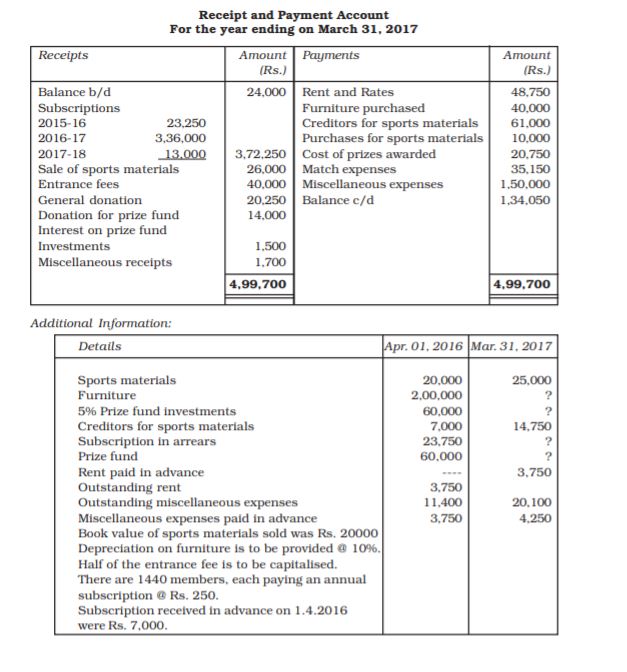

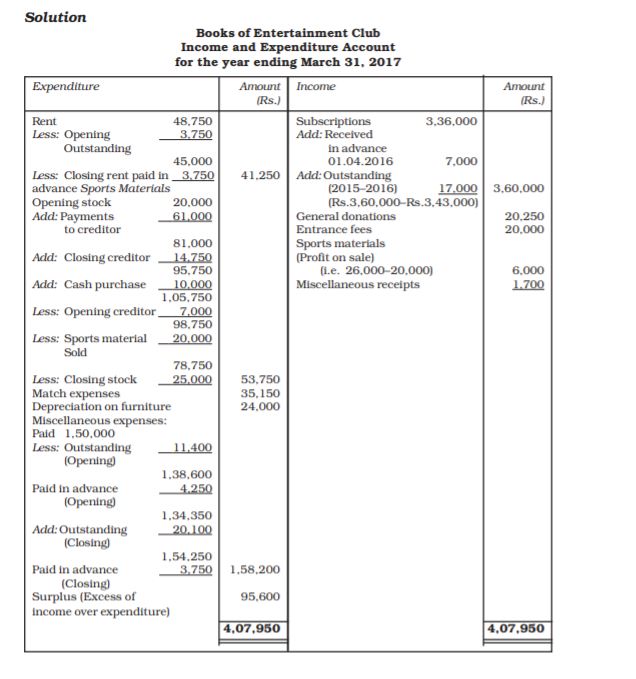

The following additional information is provided to you:

1. There are 1800 members each paying an annual subscription of

Rs. 200, Rs. 8,000 were in arrears for 2013-14 as on April 1, 2014.

2. On March 31, 2015 the rates were prepaid to June 2015; the charge paid every year being Rs. 24,000.

3. There was an outstanding telephone bill for Rs. 1,400 on March 31, 2015.

4. Outstanding sundry expenses as on March 31, 2014 totaled Rs. 2,800.

5. Stock of stationery as on March 31, 2014 was Rs. 2000; on March 31, 2015, it was Rs. 3,600.

6. On March 31, 2014 Building stood at Rs. 4,00,000 and it was subject to depreciation @ 2.5% p. a.

7. Investment on March 31, 2014 stood at Rs. 8,00,000.

8. On March 31, 2015, income accrued on investments purchased during the year amounted to Rs. 1,500.

1.7 Income and Expenditure Account based on Trial Balance

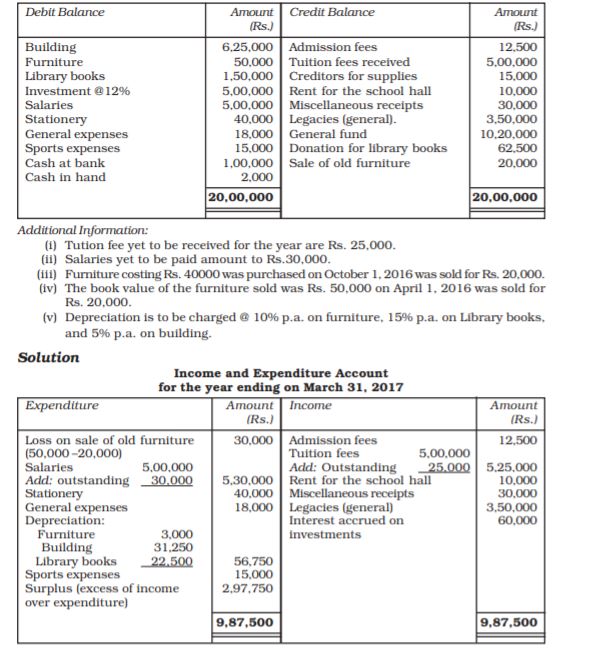

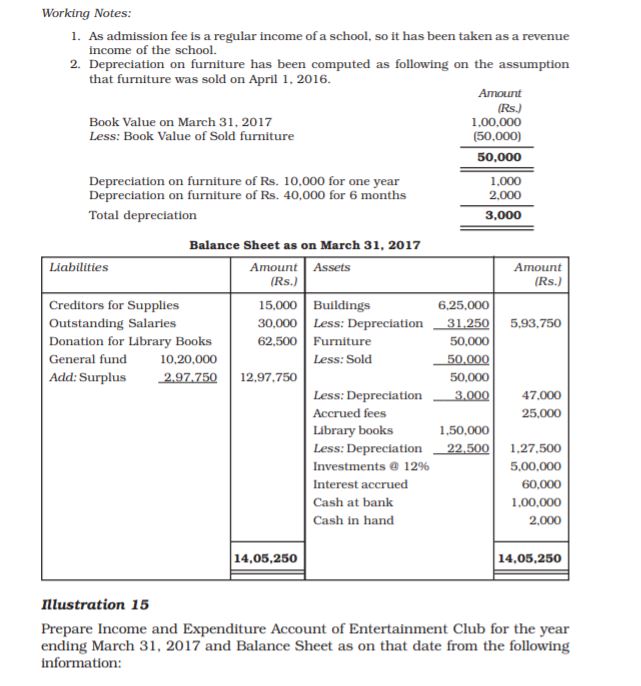

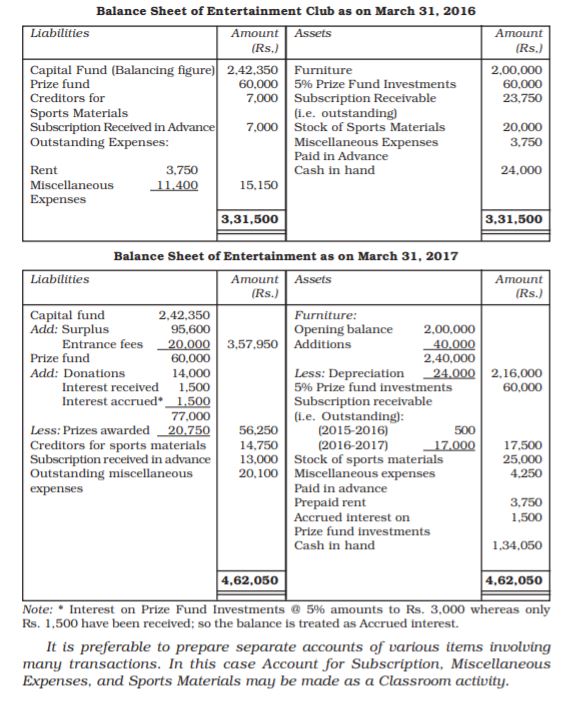

In case of not-for-profit organisations, normally the Income and Expenditure Account and Balance Sheet is prepared based on the Receipts and Payments Account and the additional information given. But, sometimes, the trial balance along with some additional information is given for this purpose. See Illustration 14.

Illustration 14

From the trial balance and other information given below for a school, prepare Income and Expenditure Account for the year ended on 31.3.2017 and a Balance Sheet as on that date:

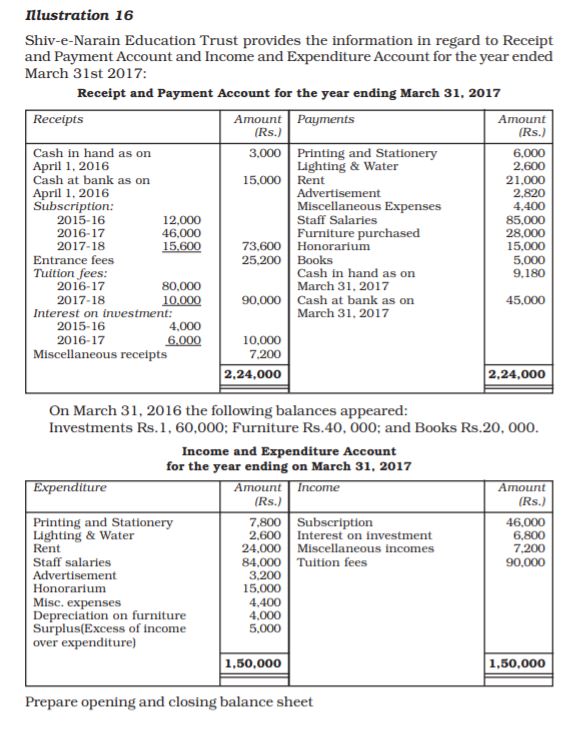

Note:

1. Income and Expenditure Account for the current year shows interest on investment income Rs.6,800 while Receipts and Payments Account shows the receipts of Rs.6,000 the difference of Rs.800 means interest on investment has become due but not yet receivable during the year.

2. Income and Expenditure Account shows Rs.90,000 as income from Tuition fees. However, the Receipts and Payments Account shows Rs.10,000 as tuition fees received for the year 2017-18 and Rs.80,000 for 2015-16. It implies that Rs.10,000 on account of tuition fees for the year 2016-17 are still receivable (i.e. Tuition fees are outstanding).

3. Receipt and Payment Account shows a payment of Rs.85,000 on account of staff salaries, but the Income and Expenditure Account shows expenditure of Rs.84,000 on account of staff salaries. It means the excess of Rs.1,000 shown in the Receipt and Payment Account may either belong to the pervious year or the next year. Their is no evidence that staff salaries of Rs.1,000 was outstanding at the end of the previous year 2013-14. This is why this payment of Rs.1,000 has been considered as an advance salaries to the staff.

Terms Introduced in the Chapter

1. Not-for-Profit Organisation.

2. Receipts and Payments Account

3. Income and Expenditure Account

4. Entrance Fee

5. Life Membership

6. Special Receipts

7. Subscription

8. Donation

9. Incidental Trading Activity

10. Legacy

Summary

1. Difference between Profit Seeking Entities and Not-for-Profit Entities: Profit-seeking entities undertake activities such as manufacturing trading, banking and insurance to bring financial gain to the owners. Not-for-Profit entities exist to provide services to the member or to the society at large. Such entities might sometimes carry on trading activities but the profits arising therefrom are used for further the service objectives.

2. Appreciation of the need for separate Accounting Treatment for Not-for-Profit Organisations: Since not-for-profit entities are guided primarily by a service motive, the decisions made by their managers are different from those made by their counterparts in profit-seeking entities. Differences in the nature of decisions implies that the financial information on which they are based, must also be different in content and presentation.

3. Explanation of the nature of the Principal Financial Statements prepare by Not-for-Profit enterprises: Not-for-Profit Organisations that maintain accounts based on the double-entry system of accounting, generally prepare three principal statements to fulfil their information needs. These include Receipts and Payments Account, Income and Expenditure Account, and a Balance Sheet.

The Receipts and Payments Account is summarised under relevant heads, cash book which records all cash Receipts and cash Payments without distinguishing between capital and revenue items, and between items relating to the current year and those relating to previous or future years.

The Income and Expenditure Account is an income statement which is prepared to ascertain the excess of revenue income over revenue expenditure or vice versa, for a particular accounting year, as a result of the entity’s overall activities. Although it is considered to be a substitute for the Trading and Profit and Loss Account of a profit-seeking entity, there are certain conceptual differences between the two statements. The Balance Sheet is prepared at the end of the entity’s accounting year to depict the financial position on that date. It includes the Capital Fund or Accumulated Fund, special purpose funds, and current liabilities on the left hand or liabilities side, and fixed assets and current assets on the right hand or assets side.

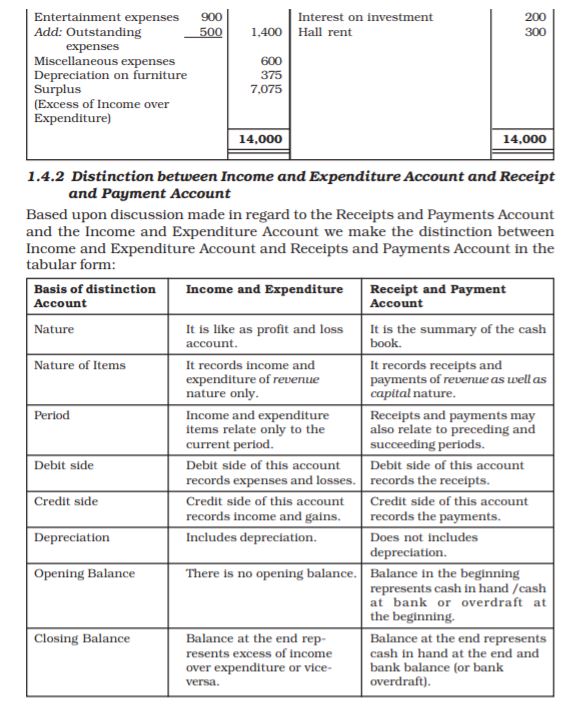

4. Difference between the Receipt and Payment Account and the Income and Expenditure Account: Many differences exist between the Receipt and Payment Account and the Income and Expenditure Account which is evident from the nature and purpose of two statements. While the former records both capital and revenue receipts and payments relating to any accounting year, the latter records only revenue items relating to the current accounting year. Non-cash expenses such as depreciation on fixed assets and outstanding incomes and expenses are shown in the latter but omitted in the former. The Receipt and Payment Account has an opening balance while the Income and Expenditure Account does not. The closing balance of the former account represents cash and bank balances on the closing date while in the latter account it indicates surplus or deficit from the activities of the enterprise.

5. Conversion of a Receipt and Payment Account into an Income and Expenditure Account: This essentially involves five steps namely, (i) adjusting the revenue receipts on the debit side to include accrued incomes and incomes relating to the current year received earlier and to exclude amounts received in arrears or in advance; (ii) adjusting revenue payments on the credit side; (iii) identifying and showing non-cash expenses and losses on the debit side of the Income and Expenditure Account; (iv) computing and showing profits/losses from trading and/or social activities on the credit/debit side of the Income and Expenditure Account; and (v) ascertaining the surplus or deficit as the closing balance of the Income and Expenditure Account.

Questions for Practice

Short Answer Questions

1. What is meant by ‘Not- for- Profit’ Organisations?

2. State the meaning of Receipt and Payment Account.

3. State the meaning of Income and Expenditure Account.

4. State the feature of Receipt and Payment Account.

5. What steps are taken to prepare Income and Expenditure Account from a Receipt and Payment Account?

6. What is subscription? How is it calculated?

7. What is meant by Capital Fund? How is it calculated?

Long Answer Questions

1. Explain the statement: “Receipt and Payment Account is a summarised version of Cash Book”.

2. “Income and Expenditure Account of a Not-for-Profit Organisation is akin to Profit and Loss Account of a business concern”. Explain the statement.

3. Distinguish between Receipts and Payments Account and Income and Expenditure Account.

4. Explain the basic features of Income and Expenditure Account and of Receipt and Payment Account.

5. Show the treatment of the following items by a not-for-profit organisation:

(i) Annual subscription

(ii) Specific donation

(iii) Sale of fixed assets

(iv) Sale of old periodicals

(v) Sale of sports materials

(vi) Life membership fee

6. Show the treatment of items of Income and Expenditure Account when there is a specific fund for those items.

7. What is Receipt and Payment Account? How is it different from Income and Expenditure Account?

8. Distinguish between profit and not-for-profit organisation.

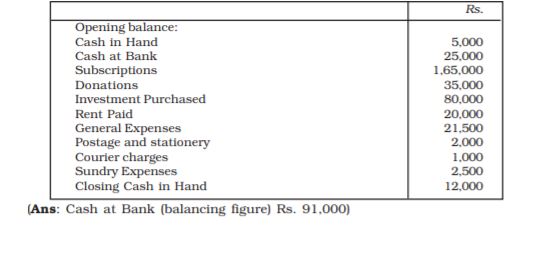

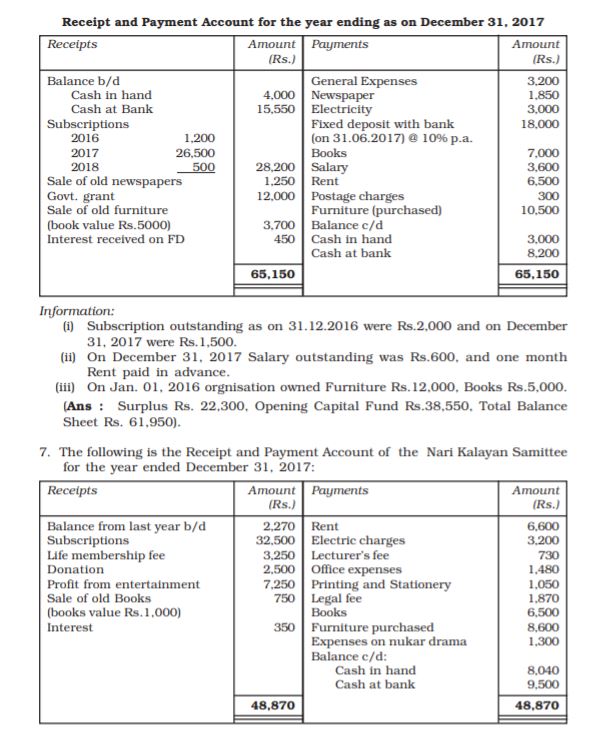

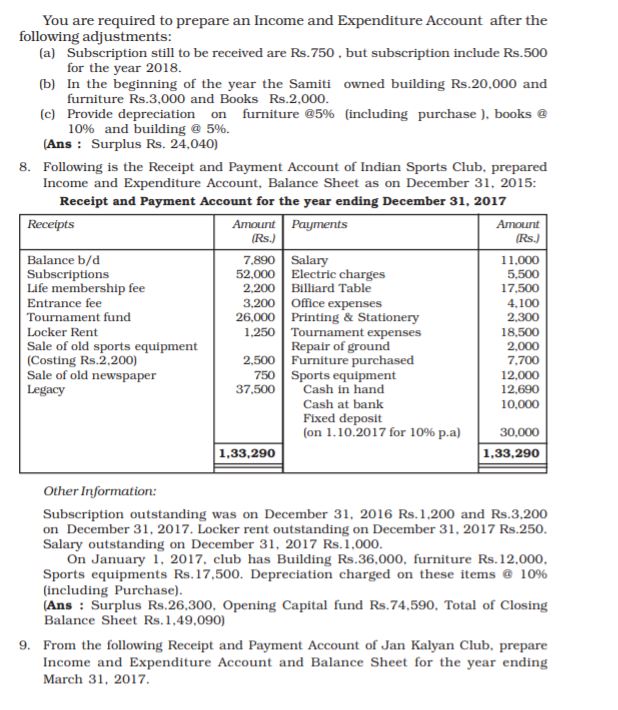

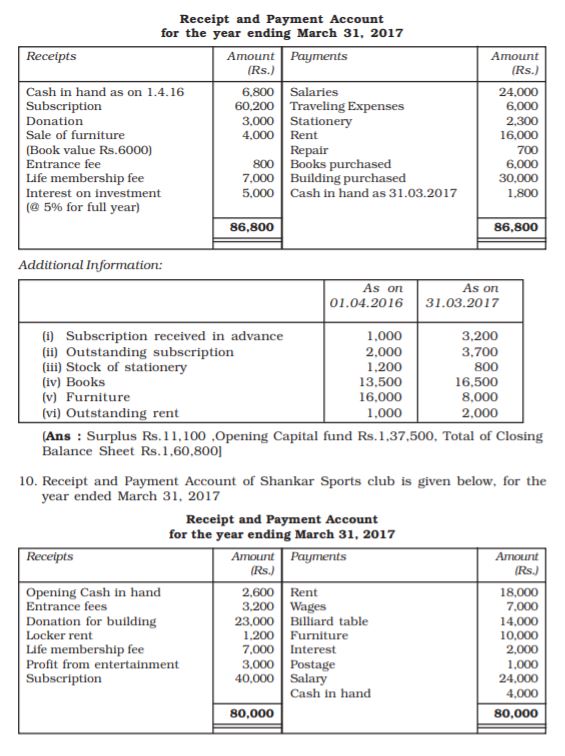

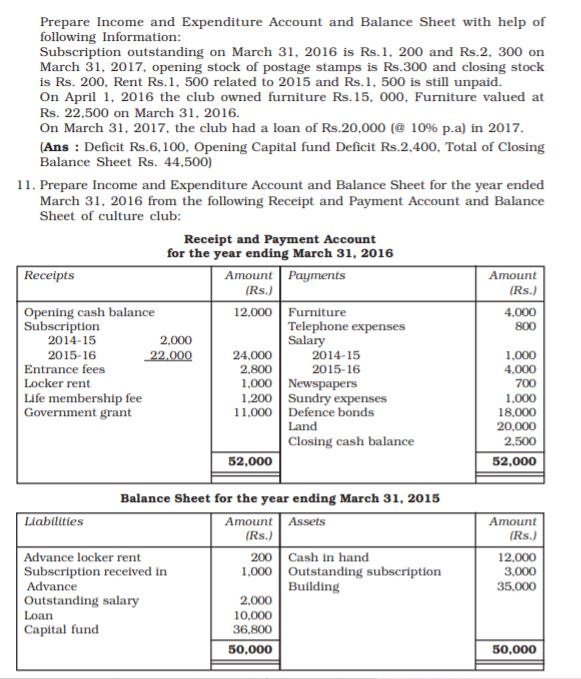

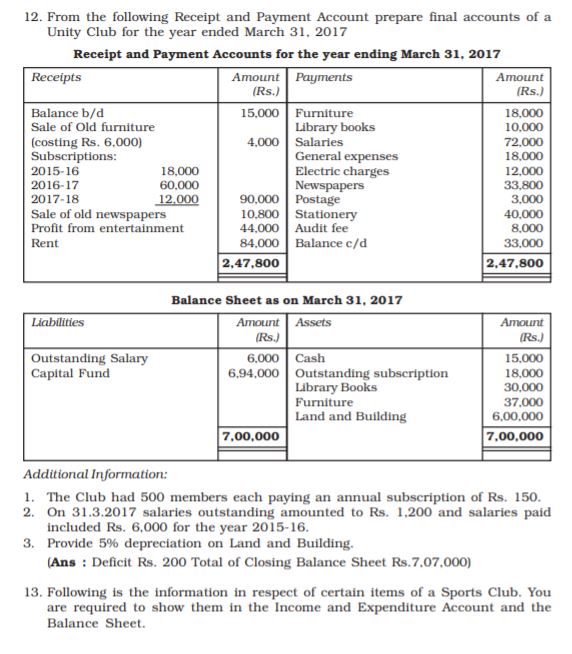

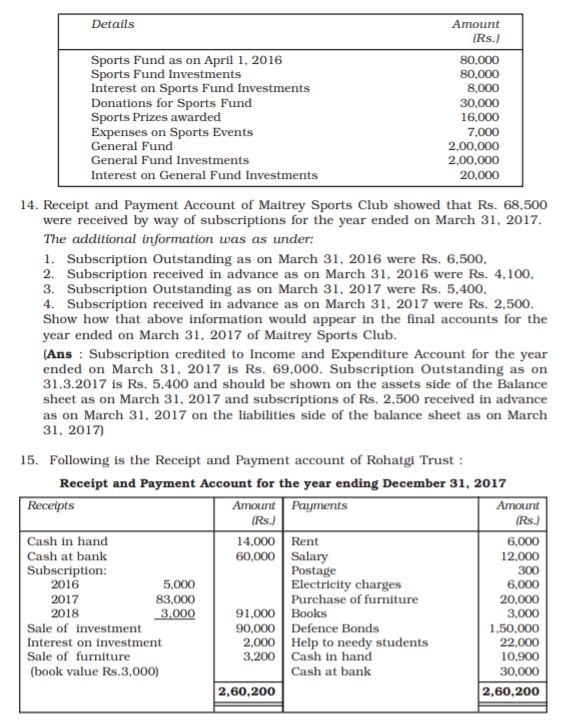

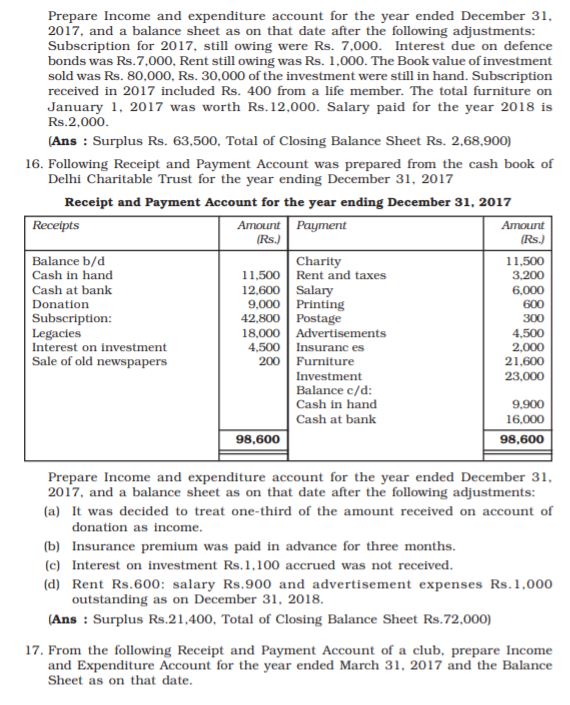

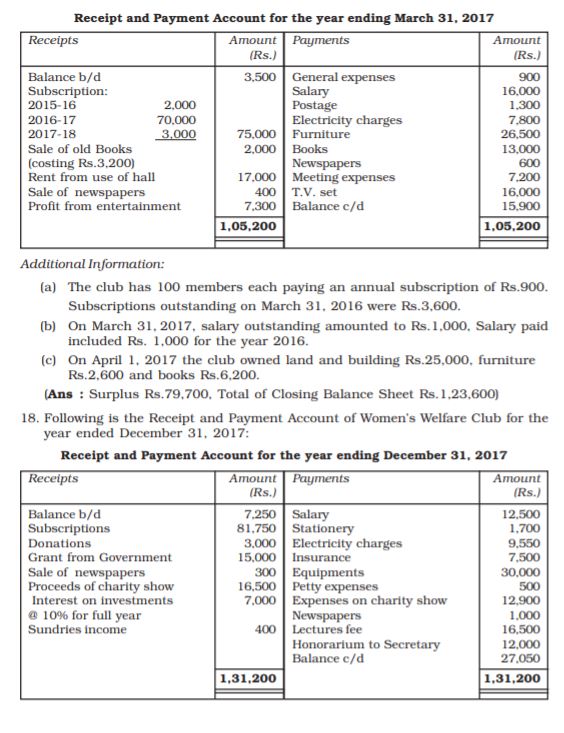

Numerical Questions

1. From the following particulars taken from the Cash Book of a health club, prepare a Receipts and Payments Account.