Table of Contents

4

Reconstitution of a Partnership Firm –Retirement/Death of a Partner

Learning Objectives

After studying this chapter you will be able to:

• calculate new profit sharing ratio and gaining ratio of the remaining partners after the retirement/death of a partner;

• describe the accounting treatment of goodwill in the event of retirement/death of a partner;

• make the necessary entries in respect of unrecorded assets and liabilities;

• make necessary adjust-ment for accumulated profits or losses;

• ascertain the retiring/deceased partner claim against the firm and explain the mode of its settlement;

• prepare the retiring partner’s loan account, if required; and

• prepare the deceased partner’s executor’s account in the case of death of a partner and the balance sheet of a reconstituted firm.

You have learnt that retirement or death of a partner also leads to reconstitution of a partnership firm. On the retirement or death of a partner, the existing partnership deed comes to an end, and in its place, a new partnership deed needs to be framed whereby, the remaining partners continue to do their business on changed terms and conditions. There is not much difference in the accounting treatment at the time of retirement or in the event of death. In both the cases, we are required to determine the sum due to the retiring partner (in case of retirement) and to the legal representatives (in case of deceased partner) after making necessary adjustments in respect of goodwill, revaluation of a assets and liabilities and transfer of accumulated profits and losses. In addition, we may also have to compute the new profit sharing’s ratio among the remaining partners and so also their gaining ratio, This covers all these aspects in detail.

4.1 Ascertaining the Amount Due to Retiring/Deceased Partner

The sum due to the retiring partner (in case of retirement) and to the legal representatives/executors (in case of death) includes:

(i) credit balance of his capital account;

(ii) credit balance of his current account (if any);

(iii) his share of goodwill;

(iv) his share of accumulated profits (reserves);

(v) his share in the gain of revaluation of assets and liabilities;

(vi) his share of profits up to the date of retirement/death;

(vii) interest on his capital, if involved, up to the date of retirement/death; and

(viii) salary/commission, if any, due to him up to the date of retirement/death.

The following deductions, if any, may have to be made from his share:

(i) debit balance of his current account (if any);

(ii) his share of goodwill to be written off, if necessary;

(iii) his share of accumulated losses;

(iv) his share of loss on revaluation of assets and liabilities;

(v) his share of loss up to the date of retirement/death;

(vi) his drawings up to the date of retirement/death;

(vii) interest on drawings, if involved, up to the date of retirement/death.

Thus, similar to admission, the various accounting aspects involved on retirement or death of a partner are as follows:

1. Ascertainment of new profit sharing ratio and gaining ratio;

2. Treatment of goodwill;

3. Revaluation of assets and liabilities;

4. Adjustment in respect of unrecorded assets and liabilities;

5. Distribution of accumulated profits and losses;

6. Ascertainment of share of profit or loss up to the date of retirement/death;

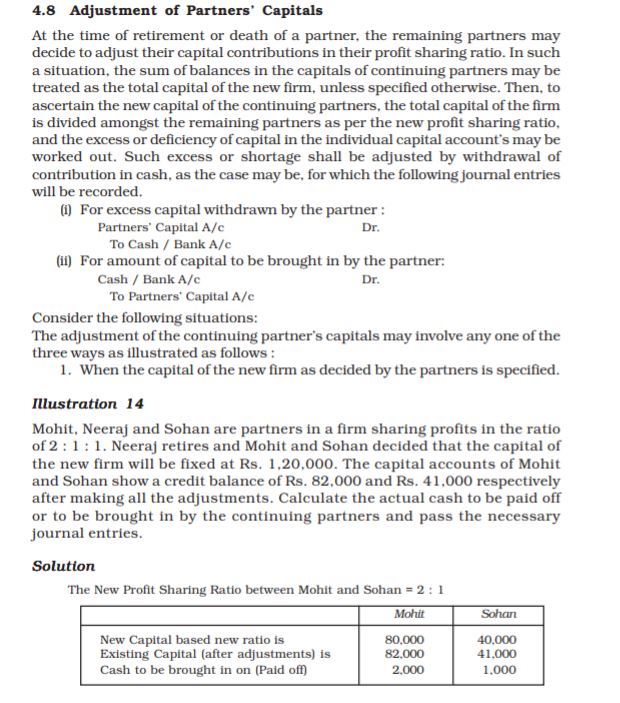

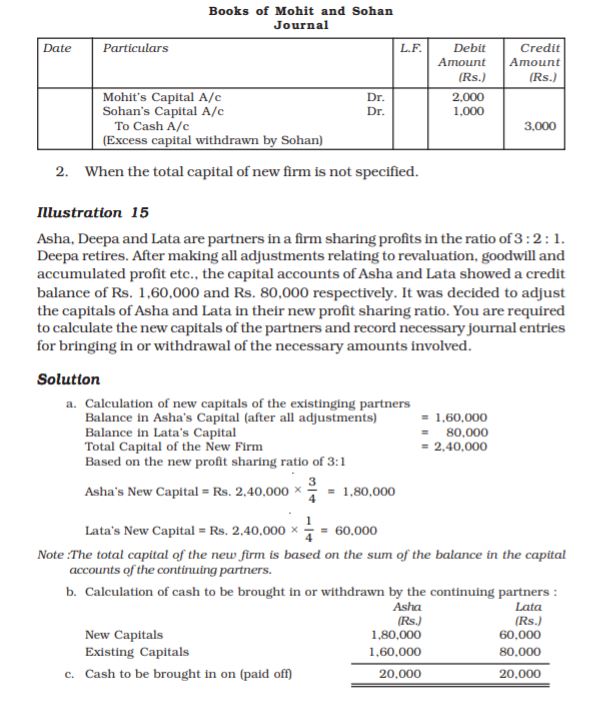

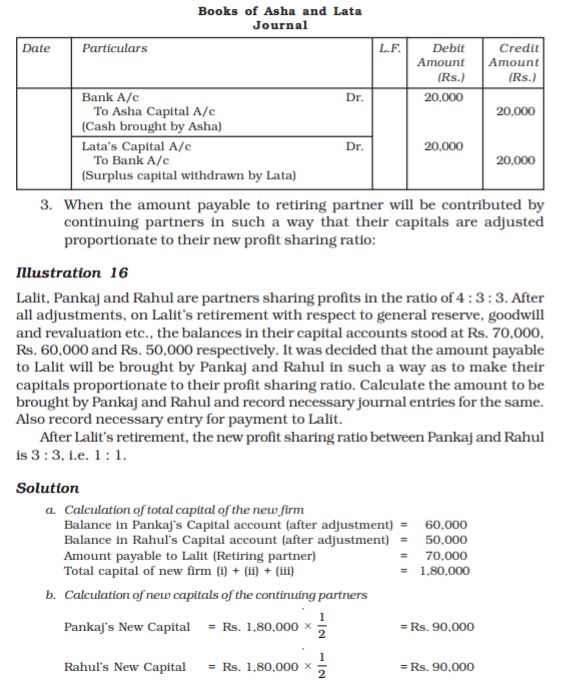

7. Adjustment of capital, if required;

8. Settlement of the amounts due to retired/deceased partner;

4.2 New Profit Sharing Ratio

New profit sharing ratio is the ratio in which the remaining partners will share future profits after the retirement or death of any partner. The new share of each of the remaining partner will consist of his own share in the firm plus the share acquired from the retiring /deceased partner.

Consider the following situations :

(a) normally, the continuing partners acquire the share of retiring or deceased partners in the old profit sharing ratio, and there is no need to compute the new profit sharing ratio among them, as it will be same as the old profit sharing ratio among them. In fact, in the absence of any information regarding profit sharing ratio in which the remaining partners acquire the share of retiring/deceased partner, it is assumed that they will acquire it in the old profit sharing ratio and so share the future profits in their old ratio. For example, Asha, Deepti and Nisha are partners in a firm sharing profits and losses in the ratio of 3:2:1. If Deepti retires, the new profit sharing ratio between Asha and Nisha will be 3:1, unless they decide otherwise.

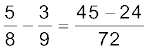

(b) The continuing partners may acquire the share in the profits of the retiring/deceased partner in a proportion other than their old ratio, In that case, there is need to compute the new profit sharing ratio among them. For example: Naveen, Suresh and Tarun are partners sharing profits and losses in the ratio of 5:3:2. Suresh retires from the firm and his share was required by Naveen and Tarun in the ratio 2:1. In such a case, the new share of profit will be calculated as follows:

New share of Continuing Partner = Old Share + Acquired share from

the Outgoing Partner

Gaining Ratio 2 : 1

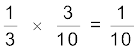

Share acquired by Naveen =

=

Share acquired by Tarun =  of

of

=

Share of Naveen =

Share of Tarun =

Thus, the new profit sharing ratio of Naveen and Tarun will be = 7 : 3.

(c) The contributing partners may agree on a specified new profit sharing ratio: In that case the ratio so specified will be the new profit sharing ratio.

4.3 Gaining Ratio

The ratio in which the continuing partners have acquired the share from the retiring/deceased partner is called the gaining ratio. Normally, the continuing partners acquire the share of retiring/deceased partner in their old profit sharing ratio, In that case, the gaining ratio of the remaining partners will be the same as their old profit sharing ratio among them and there is no need to compute the gaining ratio, Alternatively, proportion in which they acquire the share of the retiring/deceased partner may be duly spacified. In that case, again, there is no need to calculate the gaining ratio as it will be the ratio in which they have acquired the share of profit from the retiring deceased partner. The problem of calculating gaining ratio arises primarily when the new profit sharing ratio of the continuing partners is specified. In such a situation, the gaining ratio should be calculated by, deducting the old share of each continuing partners from his new share i.e., new profit share minus old profit share, i.e., new profit share minus old profit share. For example, Amit, Dinesh and Gagan are partners sharing profits in the ratio of 5:3:2.

Dinesh retires. Amit and Gagan decide to share the profits of the new firm in the ratio of 3:2. The gaining ratio will be calculated as follows :

Amit’s Gaining Share =

Gagan’s Gaining Share =

Thus, Gaining Ratio of Amit and Gagan = 1:2

This implies Amit gains  and Gagan gains

and Gagan gains  of Dinesh’s share of profit.

of Dinesh’s share of profit.

Gaining share of Continuing Partner = New share – Old share

Do it Yourself

Distinguish between Gaining Ratio and Sacrificing Ratio in terms of:

1. Meaning

2. Effect on Partner’s Share of Profit

3. Mode of calculation

4. When to calculate

Illustration 1

Madhu, Neha and Tina are partners sharing profits in the ratio of 5:3:2. Calculate new profit sharing ratio and gaining ratio if

1. Madhu retires

2. Neha retires

3. Tina retires.

Solution

Given old ratio among Madhu : Neha : Tina as 5 : 3 : 2

1. If Madhu retires, new profit sharing Ratio between Neha and Tina will be

Neha : Tina = 3:2 and Gaining Ratio of Neha and Tina =3:2

2. If Neha retires new profit sharing Ratio between Madhu and Tina will be

Madhu : Tina = 5:2

Gaining Ratio of Madhu and Tina = 5:2

3. If Tina retires, new profit sharing ratio between Madhu and Neha will be:

Madhu : Neha = 5:3

Gaining ratio of Madhu and Neha = 5:3

Illustration 2

Alka, Harpreet and Shreya are partners sharing profits in the ratio of 3:2:1. Alka retires and her share is taken up by Harpreet and Shreya in the ratio of 3:2. Calculate the new profit sharing ratio.

Solution

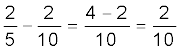

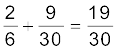

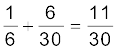

Gaining Given, Ratio of Harpreet and Shreya = 3:2 =

Old Profit Sharing Ratio of between Alka, Harpreet and Shreya 3:2:1 =

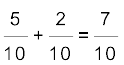

Share acquired by Harpreet =  =

=

Share acquired by Shreya =  =

=

New Share = Old Share + Acquired Share

Harpreet’s New Share =

Shreya’s New Share =

New Profit Sharing Ratio of Harpreet and Shreya = 19:11

Illustration 3

Murli, Naveen and Omprakash are partners sharing profits in the ratio of  and

and  . Murli retires and surrenders 2/3rd of his share in favour of Naveen and the remaining share in favour of Omprakash. Calculate new profit sharing and the gaining ratio of the remaining partners.

. Murli retires and surrenders 2/3rd of his share in favour of Naveen and the remaining share in favour of Omprakash. Calculate new profit sharing and the gaining ratio of the remaining partners.

Solution

Naveen Omprakash

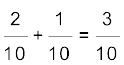

(i) Old Share

(ii) Share Acquired by Naveen and

Omprakash from Murli =

(iii) New Share = (i) + (ii) =

=  or

or  =

=  or

or

Thus, the New profit sharing Ratio =  or 3:1, and the

or 3:1, and the

Gaining Ratio =  or 2:1 [as calculated in (ii)].

or 2:1 [as calculated in (ii)].

Illustration 4

Kumar, Lakshya, Manoj and Naresh are partners sharing profits in the ratio of 3 : 2 : 1 : 4. Kumar retires and his share is acquired by Lakshya and Manoj in the ratio of 3:2. Calculate new profit sharing ratio and gaining ratio of the remaining partners.

Solution

Lakshya Manoj Naresh

(i) Old Share

(ii) Acquired Share from Kumar

Nil

Nil

=  =

=  Nil

Nil

(iii) New share = (i) = (ii)  =

=  =

=  Nil

Nil

=  =

=  =

=

The New Profit Sharing Ratio is 19 : 11 : 20

Gaining ratio is 3 : 2 : 0

Notes : 1. Since Lakshya and Manoj are acquiring Kumar’s share of profit in the ratio of 3:2, hence, the gaining ratio will be 3:2 between Lakshya and Manoj.

2. Naresh has neither sacrificed nor gained.

Illustration 5

Ranjana, Sadhna and Kamana are partners sharing profits in the ratio 4:3:2. Ranjana retires; Sadhna and Kamana decided to share profits in future in the ratio of 5:3. Calculate the Gaining Ratio.

Solution

Gaining Share = New Share – Old Share

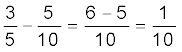

Sadhna’s Gaining Share =  =

=

Kamana’s Gaining Share =  =

=  =

=

Gaining Ratio between Sadhna and Kamana = 21:11.

Do it Yourself

1. Anita, Jaya and Nisha are partners sharing profits and losses in the ratio of 1 : 1 : 1 Jaya retires from the firm. Anita and Nisha decided to share the profit in future in the ratio 4:3. Calculate the gaining ratio.

2. Azad, Vijay and Amit are partners sharing profits and losses in the proportion of  and

and  . Calculate the new profit sharing ratio between continuing partners if (a) Azad retires; (b) Vijay retires; (c) Amit retires.

. Calculate the new profit sharing ratio between continuing partners if (a) Azad retires; (b) Vijay retires; (c) Amit retires.

3. Calculate the gaining ratio in each of the above situations.

4. Anu, Prabha and Milli are partners. Anu retires. Calculate the future profit sharing ratio of continuing partners and gaining ratio if they agree to acquire her share : (a) in the ratio of 5:3; (b) equally.

5. Rahul, Robin and Rajesh are partners sharing profits in the ratio of 3 : 2 : 1. Calculate the new profit sharing ratio of the remaining partners if (i) Rahul retires; (ii) Robin retires; (iii) Rajesh retires.

6. Puja, Priya, Pratistha are partners sharing profits and losses in the ratio of

5 : 3 : 2. Priya retires. Her share is taken by Priya and Pratistha in the ratio of 2 : 1. Calculate the new profit sharing ratio.

7. Ashok, Anil and Ajay are partners sharing profits and losses in the ratio of  and

and  . Anil retires from the firm. Ashok and Ajay decide to share future profits and losses in the ratio of 3 : 2. Calculate the gaining ratio.

. Anil retires from the firm. Ashok and Ajay decide to share future profits and losses in the ratio of 3 : 2. Calculate the gaining ratio.

4.4 Treatment of Goodwill

The retiring or deceased partner is entitled to his share of goodwill at the time of retirement/death because the goodwill has been earned by the firm with the efforts of all the existing partners. Hence, at the time of retirement/death of a partner, goodwill is valued as per agreement among the partners the retiring/deceased partner compensated for his share of goodwill by the continuing partners (who have gained due to acquisition of share of profit from the retiring/deceased partner) in their gaining ratio.

The accounting treatment for goodwill in such a situation depends upon whether or, not goodwill already appears in the books of the firm.

4.4.1 When goodwill does not appear in the books

When goodwill does not appear in the books of the firm, credit in given to the retiring partner for the share in goodwill by debiting the goodwill account to gaining partners capital accounts (individually) in their gaining ratio. The journal entry is :

Gaining Partners Capital A/c Dr. (Individually)

To Retiring Partners Capital A/c

(Share in goodwill of retiring partner adjusted)

Let us take an example to understand the treatment of goodwill.

A, B and C are partners in a firm sharing profits in the ratio of 3:2:1 B retired and the value of goodwill of the firm in valued at Rs. 60,000. A and C continue the business sharing profits in the ratio of 3:1. The journal entry for adjustment of goodwill will be :

A’s Capital A/c Dr. 15,000

C’s Capital A/c Dr. 5,000

To B’s Capital A/c 20,000

(B’s share of goodwill adjusted to remaining partners’ capital accounts in their gaining ratio)

It may also happen that as a result of decision on the new profit sharing ratio among the remaining partners, a continuing partner may also sacrifice a part of his share in future profits. In such a situation his capital account will also be credited along with the retiring/deceased partner’s capital account in proportion to his sacrifice and the other continuing partners’ capital accounts will be debited based on their gain in the future profit ratio.

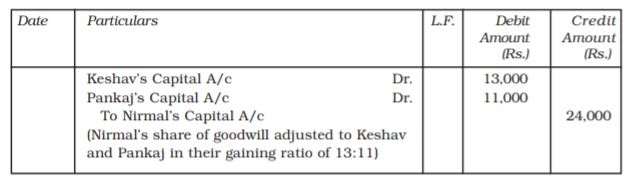

Illustration 6

Keshav, Nirmal and Pankaj are partners sharing profits and losses in the ratio of 4 : 3 : 2. Nirmal retires and the goodwill is valued at Rs. 72,000. Keshav and Pankaj decided to share future profits and losses in the ratio of 5 : 3. Record necessary journal entries.

Solution

Journal

Test your Understanding – I

Choose the correct option in the following questions:

1. Abhishek, Rajat and Vivek are partners sharing profits in the ratio of 5:3:2. If Vivek retires, the New Profit Sharing Ratio between Abhishek and Rajat will be–

(a) 3:2

(b) 5:3

(c) 5:2

(d) None of these

2. The old profit sharing ratio among Rajender, Satish and Tejpal were 2:2:1. The New Profit Sharing Ratio after Satish’s retirement is 3:2. The gaining ratio is–

(a) 3:2

(b) 2:1

(c) 1:1

(d) 2:2

3. Anand, Bahadur and Chander are partners. Sharing Profit equally On Chander’s retirement, his share is acquired by Anand and Bahadur in the ratio of 3:2. The New Profit Sharing Ratio between Anand and Bahadur will be–

(a) 8:7

(b) 4:5

(c) 3:2

(d) 2:3

4. In the absence of any information regarding the acquisition of share in profit of the retiring/deceased partner by the remaining partners, it is assumed that they will acquire his/her share:-

(a) Old Profit Sharing Ratio

(b) New Profit Sharing Ratio

(c) Equal Ratio

(d) None of these

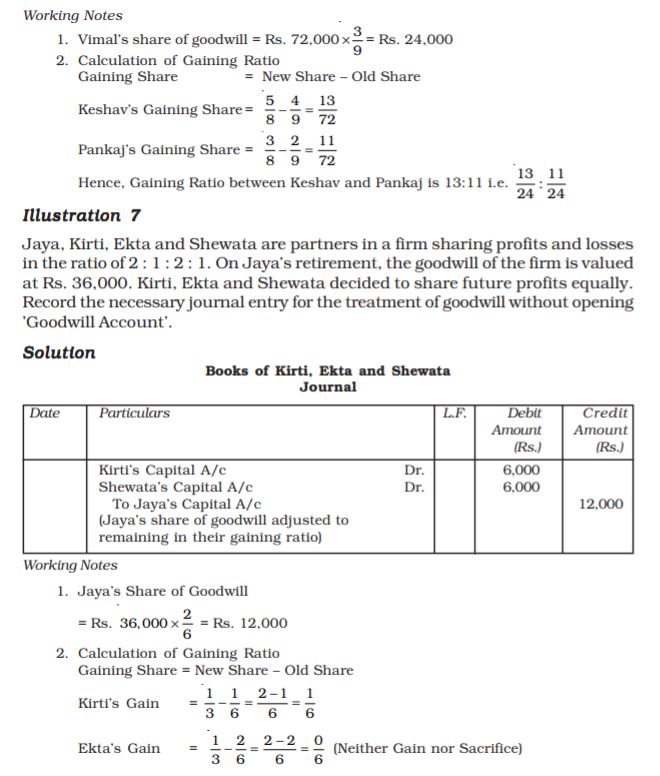

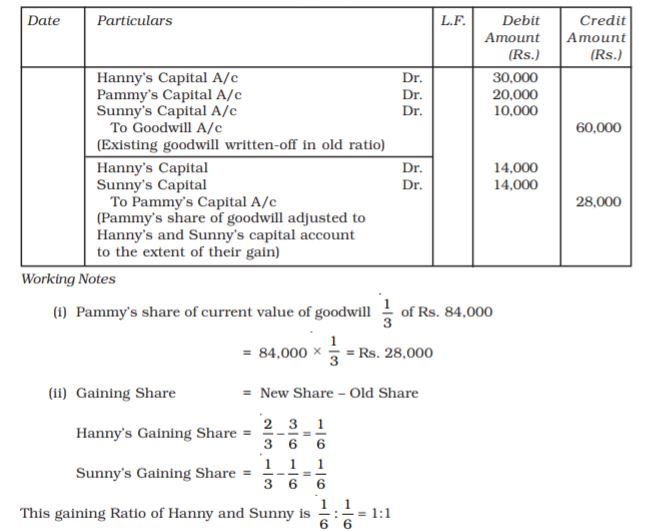

Illustration 9

Hanny, Pammy and Sunny are partners sharing profits in the ratio of 3 : 2 : 1. Goodwill is appearing in the books at a value of Rs. 60,000. Pammy retires and at the time of Pammy’s retirement, goodwill is valued at Rs. 84,000. Hanny and Sunny decided to share future profits in the ratio of 2:1. Record the necessary journal entries.

Solution

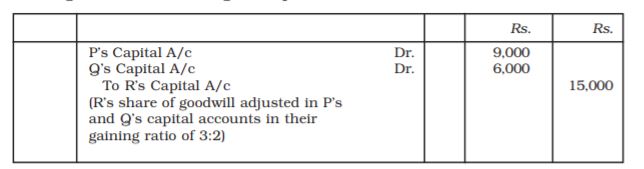

4.4.2 Hidden Goodwill

If the firm has agreed to settle the retiring or deceased partner’s account by paying him a lump sum amount, then the amount paid to him in excess of what is due to him, based on the balance in his capital account after making necessary adjustments in respect of accumulated profits and losses and revaluation of assets and liabilities, etc., shall be treated as his share of goodwill (known as hidden goodwill). For example, P, Q and R are partners in a firm sharing profits in the ratio of 3:2:1. R retires, and the balance in his capital account after making necessary adjustments on account of reserves, revaluation of assets and liabilities workout to be Rs. 60,000, P and Q agreed to pay him Rs. 75,000 in full settlement of his claim. It implies that Rs. 15,000 is R’s share of goodwill of the firm. This will be debits to the capital accounts of P and Q in their gaining ratio (3:2 assuming no change in their own profit sharing ratio) and crediting R’s capital Account as follows:

Test your Understanding – II

Choose the correct option in the following questions:

1. On retirement/death of a partner, the retiring/deceased partner’s capital account will be credited with

(a) his/her share of goodwill.

(b) goodwill of the firm.

(c) shares of goodwill of remaining partners.

(d) none of these.

2. Gobind, Hari and Pratap are partners. On retirement of Gobind, the goodwill already appears in the Balance Sheet at Rs. 24,000. The goodwill will be written-off

(a) by debiting all partners’ capital accounts in their old profit sharing ratio.

(b) by debiting remaining partners’ capital accounts in their new profit sharing ratio.

(c) by debiting retiring partners’ capital accounts from his share of goodwill.

(d) none of these.

3. Chaman, Raman and Suman are partners sharing profits in the ratio of 5:3:2. Raman retires, the new profit sharing ratio between Chaman and Suman will be 1:1. The goodwill of the firm is valued at Rs. 1,00,000 Raman’s share of goodwill will be adjusted

(a) by debiting Chaman’s Capital account and Suman’s Capital Account with Rs 15,000 each.

(b) by debiting Chaman’s Capital account and Suman’s Capital Account with Rs. 21,429 and 8,571 respectively.

(c) by debiting only Suman’s Capital Account with Rs. 30,000.

(d) by debiting Raman’s Capital account with Rs. 30,000.

4. On retirement/death of a partner, the remaining partner(s) who have gained due to change in profit sharing ratio should compensate the

(a) retiring partners only.

(b) remaining partners (who have sacrificed) as well as retiring partners.

(c) remaining partners only (who have sacrificed).

(d) none of these.

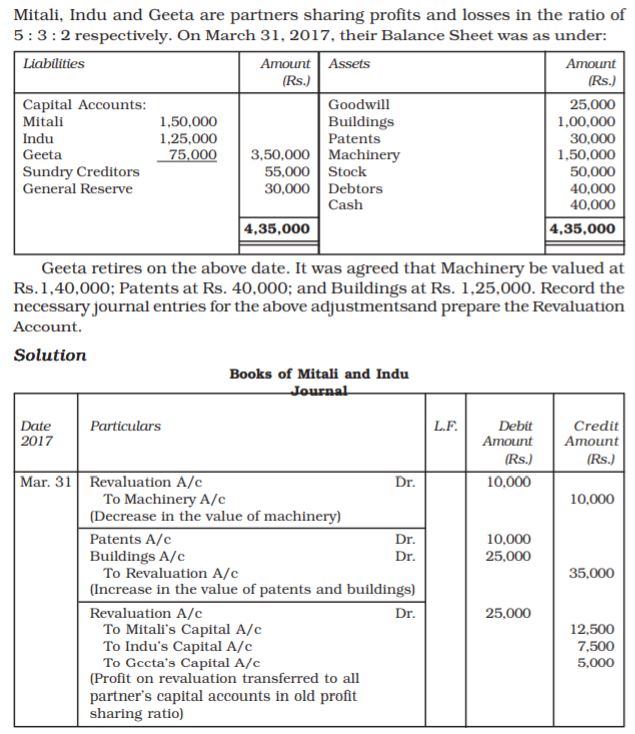

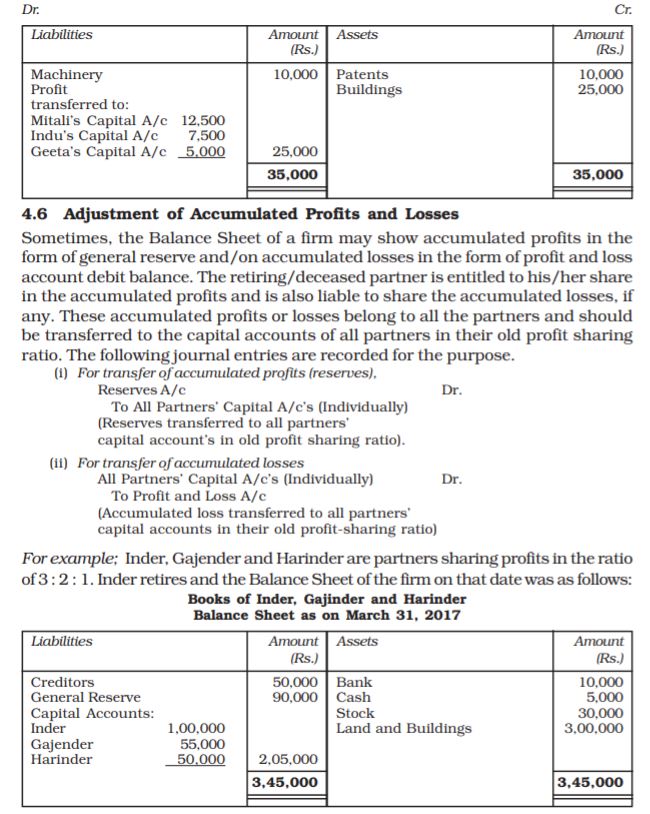

4.5 Adjustment for Revaluation of Assets and Liabilities

At the time of retirement or death of a partner there may be some assets which may not have been shown at their current values. Similarly, there may be certain liabilities which have been shown at a value different from the obligation to be met by the firm. Not only that, there may be some unrecorded assets and liabilities which need to be brought into books. As learnt in case of admission of a partner, a Revaluation Account is prepared in order to ascertain net gain (loss) on revaluation of assets and/or liabilities and bringing unrecorded items into firm’s books and the same is transferred to the capital account of all partners including retiring/deceased partners in their old profit sharing ratio. the Journal entries to be passed for this purpose are as follows:

1. For increase in the value of assets

Assets A/c’s (Individually) Dr.

To Revaluation A/c

(Increase in the value of assets)

2. For decrease in the value of assets

Revaluation A/c Dr.

To Assets A/c’s (Individually)

(Decrease in the value of assets)

3. For increase in the amount of liabilities

Revaluation A/c Dr.

To Liabilities A/c (Individually)

(Increase in the amount of liabilities)

4. For decrease in the amount of liabilities

Liabilities A/c’s (Individually) Dr.

To Revaluation A/c

(Decrease in the amount of liabilities)

5. For an unrecorded asset

Assets A/c Dr.

To Revaluation A/c

(Unrecorded asset brought into book)

6. For an unrecorded liability

Revaluation A/c Dr.

To Liability A/c

(Unrecorded liability brought into books)

7. For distribution of profit or loss on revaluation

Revaluation A/c Dr.

To All Partners’ Capital A/c’s (Individually)

(Profit on revaluation transferred

to partner’s capital)

(or)

All Partners’ Capital A/c’s (Individually) Dr.

To Revaluation A/c

(Loss on revaluation transferred to

partner’s capital accounts)

Illustration 10

4.7 Disposal of Amount Due to Retiring Partner

The outgoing partner’s account is settled as per the terms of partnership deed i.e., in lumpsum immediately or in various instalments with or without interest as agreed or partly in cash immediately and partly in instalment at the agreed intervals. In the absence of any agreement, Section 37 of the Indian Partnership Act, 1932 is applicable, which states that the outgoing partner has an option to receive either interest @ 6% p.a. till the date of payment or such share of profits which has been earned with his/her money (i.e., based on capital ratio). Hence, the total amount due to the retiring partner which is ascertained after all adjustments have been made is to be paid immediately to the retiring partner. In case the firm is not in a position to make the payment immediately, the amount due is transferred to the retiring Partner’s Loan Account, and as and when the amount is paid it is debited to his account. The necessary journal entries recorded are as follows.

1. When retiring partner is paid cash in full.

Retiring Partners’ Capital A/c Dr.

To Cash/Bank A/c

2. When retiring partners’ whole amount is treated as loan.

Retiring Partners’ Capital A/c Dr.

To Retiring Partners’ Loan A/c

3. When retiring partner is partly paid in cash and the remaining amount

treated as loan.

Retiring Partners’ Capital A/c Dr. (Total Amount due)

To Cash/Bank A/c (Amount Paid)

To Retiring Partners’ Loan A/c (Amount of Loan)

4. When Loan account is settled by paying in instalment includes principal and interest.

a) For interest on loan

Interest A/c Dr.

To Retiring Partner’s Loan A/c

b) For payment of instalment

Retiring Partner’s Loan A/c Dr.

To Cash/Bank A/c

Note:

1. The balance of the retiring partner’s loan account is shown on the liabilities side of the Balance Sheet till the last instalment is paid to him/her.

2. Entry number (a) and (b), above will be repeated till the loan is paid off.

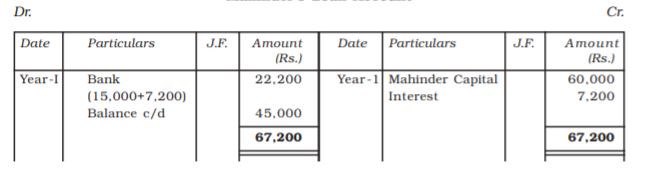

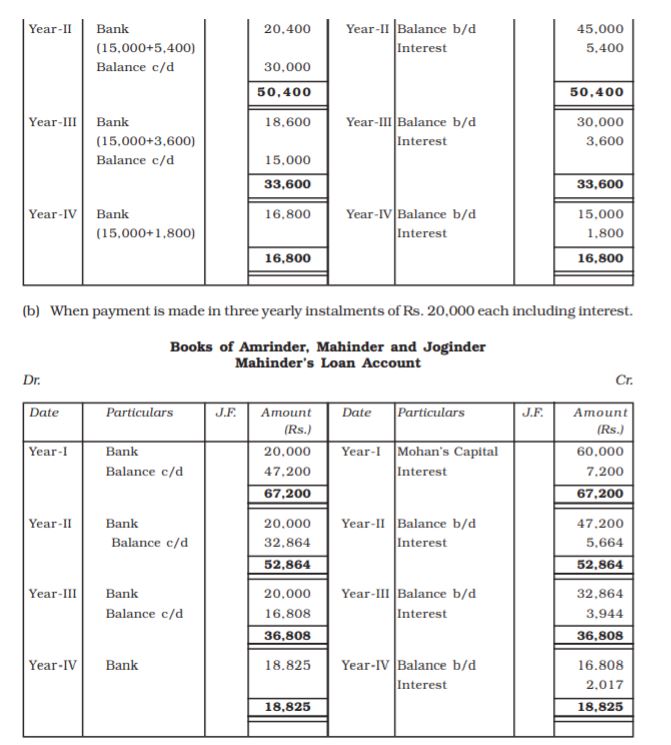

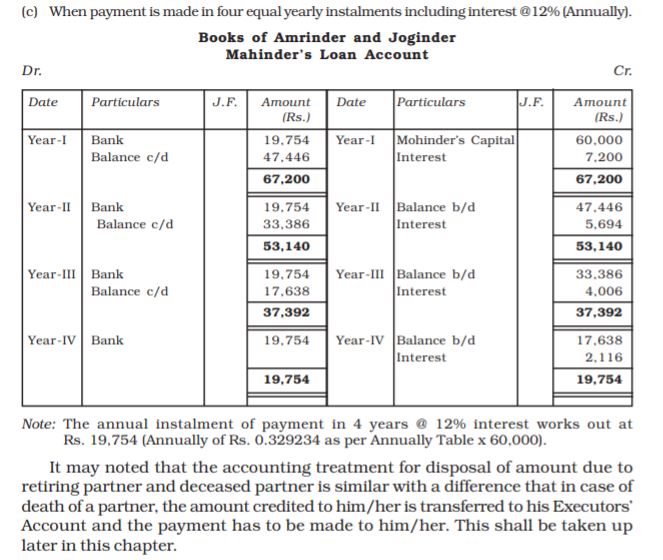

Illustration 11

Amrinder, Mahinder and Joginder are partners in a firm. Mahinder retires from the firm. On his date of retirement, Rs. 60,000 becomes due to him. Amrinder and Joginder promised to pay him in instalments every year at the end of the year to which he agreed. Prepare Mahinder’s Loan Account in the following cases:

1. When payment is made four yearly instalments plus interest @ 12% p.a. on the unpaid balance.

2. When when payment is made in three yearly instalments of Rs. 20,000 including interest @ 12% p.a on the outstanding balance during the first three years and the balance including interest in the fourth year.

3. When payment is made in 4 equal yearly instalment’s including interest @ 12% p.a. on the unpaid balance.

Solution

(a) When payment is made in four yearly instalments plus interest

Do it Yourself

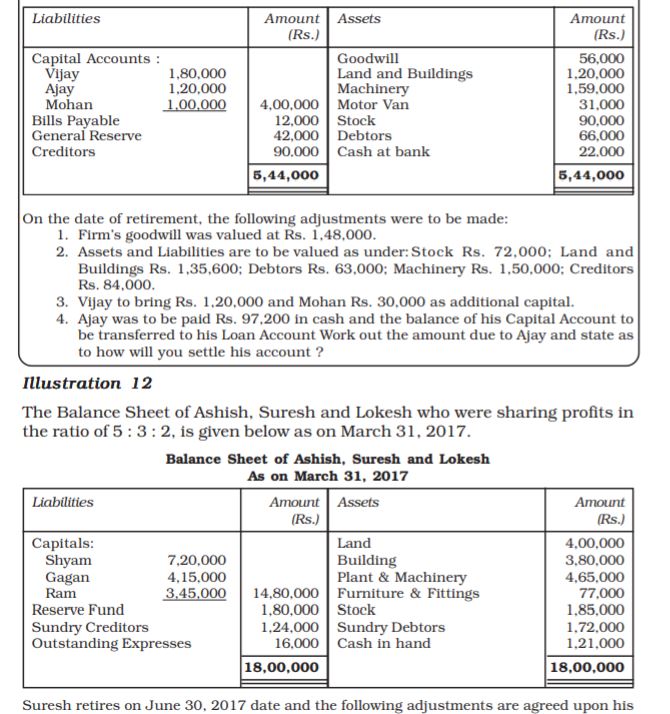

Vijay, Ajay and Mohan are friends. They passed B. Com. (Hons) from Delhi University in June, 2016. They decided to start the business of computer hardware.

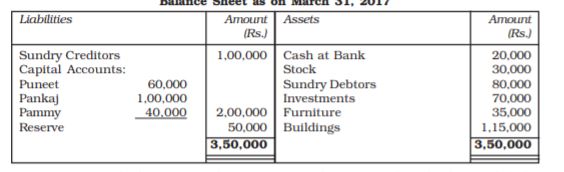

On Ist of August, 2016, they introduced the capital of Rs. 50,000, Rs. 30,000 and Rs. 20,000 respectively and started the business in partnership at Delhi. The profit sharing ratio decided between there was 4:2:1. The business was running successfully. But on Ist February, 2017, due to certain unavoidable circumstances and family circumstances, Ajay decided to settle in Pune and decided to retires from the partnership on 31st March, 2017; with the consent of partners, Ajay retires as on 31st March, 2017, the position of assets and liabilities are as follows:

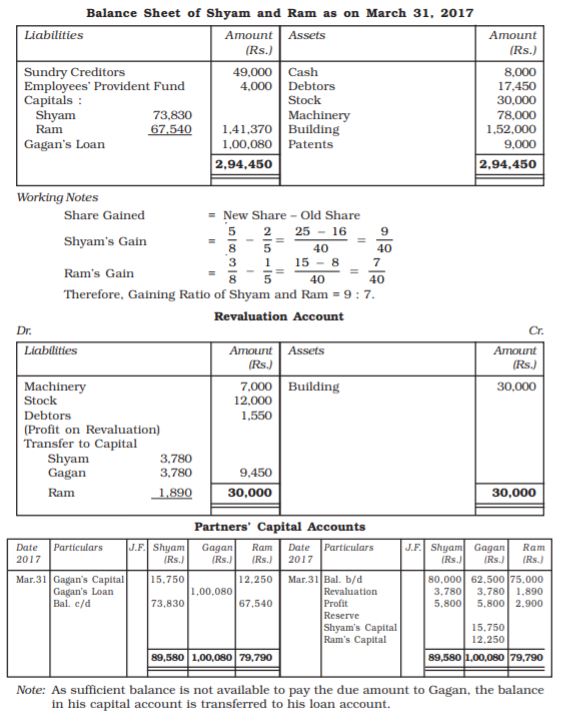

Balance Sheet of Vijay, Ajay and Mohan as on March 31, 2017

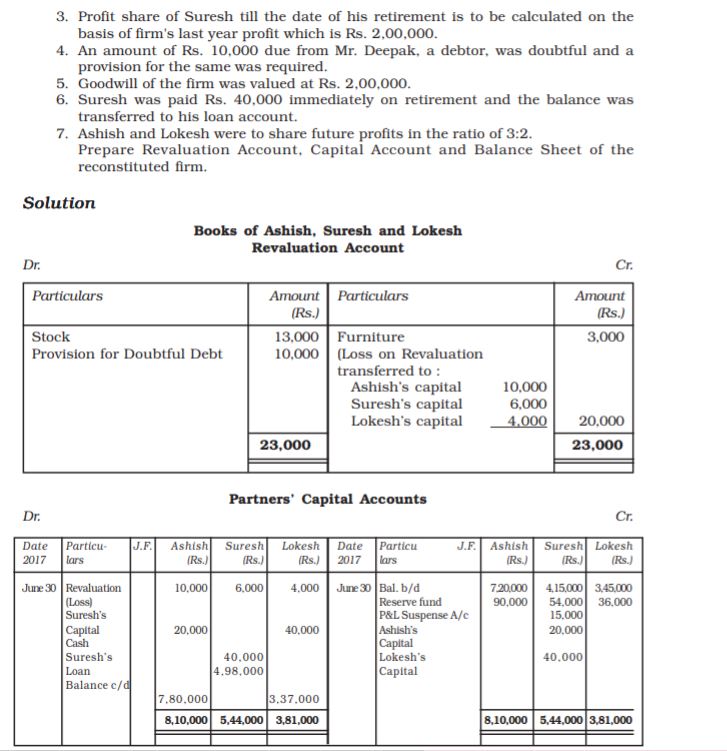

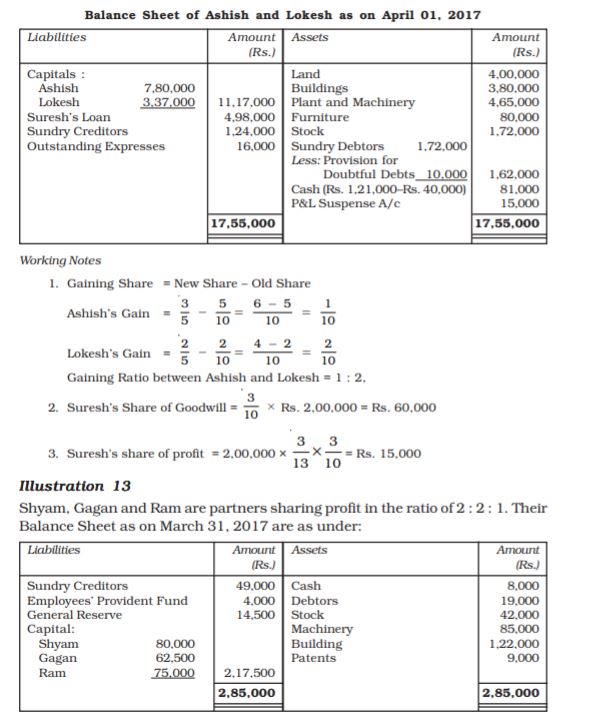

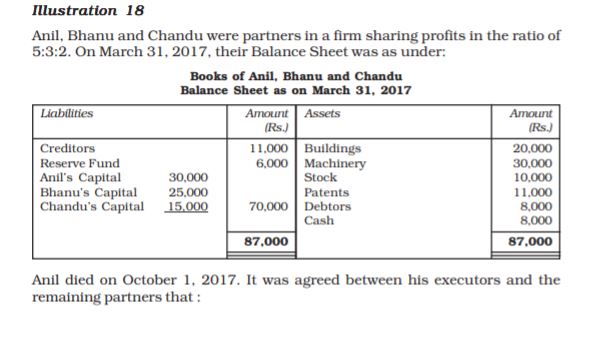

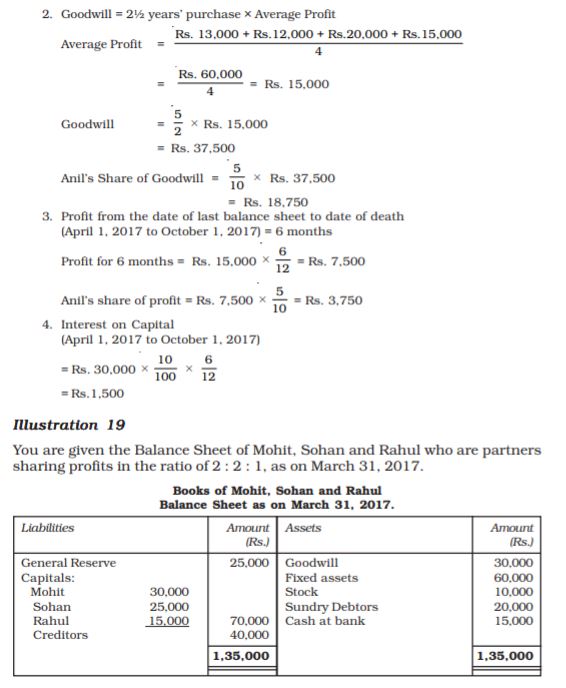

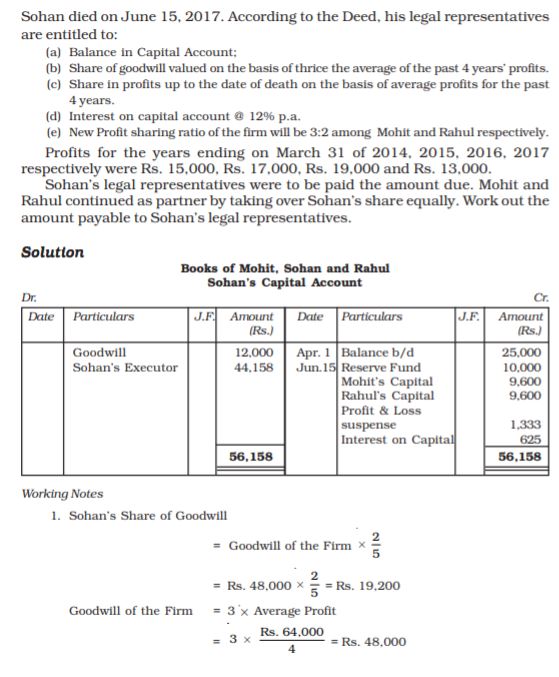

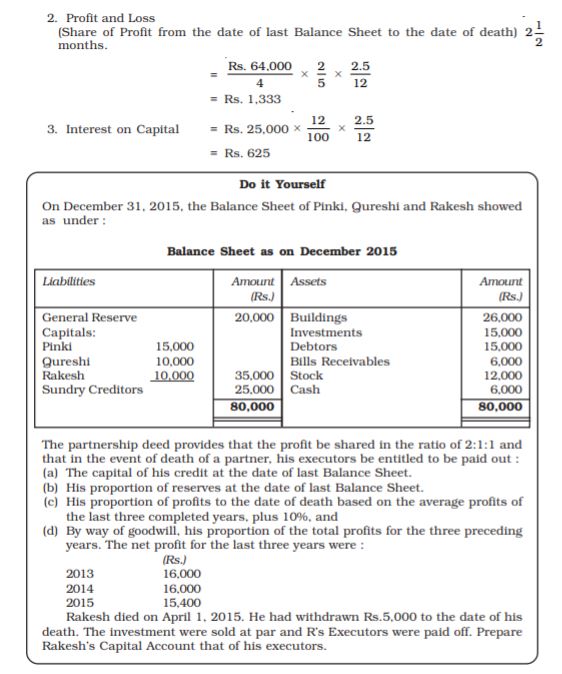

4.9 Death of a Partner

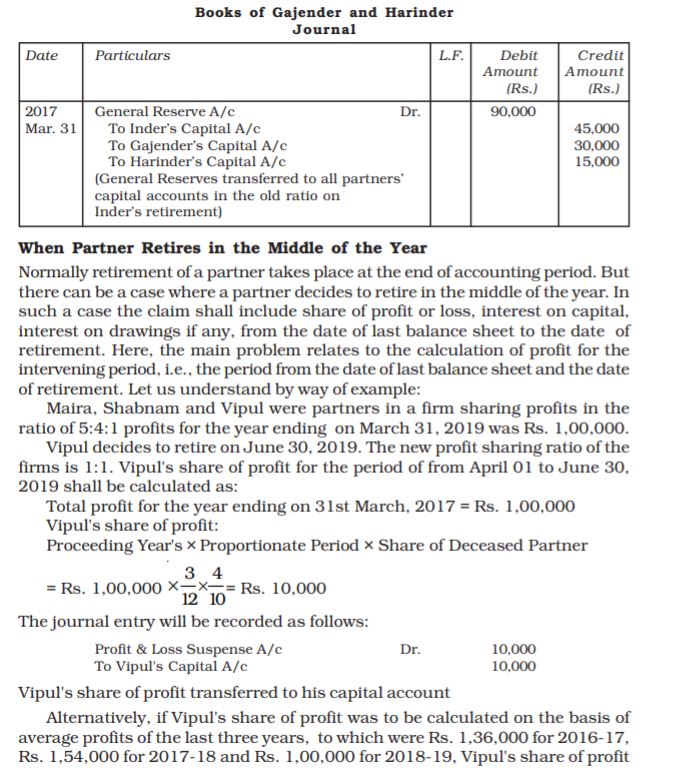

As stated earlier, the accounting treatment in the event of death of a partner is similar to that in case of retirement of a partner, and that in case of death of a partner his claim is transferred to his executors and settled in the same manner as that of the retired partner. However, there is one major difference that, while the retirement normally takes place at the end of an accounting period, the death of a partner may occur any time. Hence, in case of a partner, his claim shall also include his share of profit or loss, interest on capital, interest on drawings (if any) from the date of the last Balance Sheet to the date of his death of these, the main problem relates to the calculation of profit for the intervening period (i.e., the period from date of the last balance sheet and the date of the partner’s death. Since, it is considered cumbersome to close the books and prepare final account, for the period, the deceased partner’s share of profit may be calculated on the basis of last year’s profit (or average of past few years) or on the basis of sales.

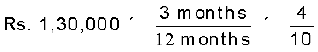

For example, Bakul, Champak and Darshan were partners in a firm sharing profits in the ratio of 5:4:1. The profit of the firm for the year ending on March 31, 2017 was Rs.1,00,000. Champak died on June 30, 2017. Bakul and Darshan decided to share profits equally. Champak’s share of profit for the period from April 1 to June 30, 2017, shall be calculated as follows:

Total profit for the year ending on 31st March, 2017 = Rs.1,00,000

Champak’s share of profit :

Proceeding Year’s Profit  Proportionate Period

Proportionate Period  Share of Deceased Partner

Share of Deceased Partner

= Rs. 1,00,000 = Rs. 10,000

= Rs. 10,000

The journal entry will be recorded as follows :

Profit & Loss Suspense A/c Dr. 10,000

To Champak’s Capital A/c 10,000

(Champak’s share of profit transferred to his capital account)

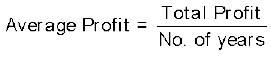

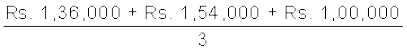

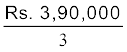

Alternatively, if Champak’s share of profit was to be calculated on the basis of average profits of the last three years, which were Rs. 1,36,000 for 2014-15,

Rs. 1,54,000 for 2015-16 and Rs. 1,00,000 for 2016-17; Champahs share of profit for the period from April 7, 2017 to June 30, 2017 shall be calculated on the basis of average profit based on profits for the last year calculation as follows:

=

=

=  = Rs. 1,30,000

= Rs. 1,30,000

Champak’s share of profit =

= Rs. 13,000

The Journal entry will be:

Profit & Loss Suspense A/c Dr. 13,000

To Champak’s Capital A/c 13,000

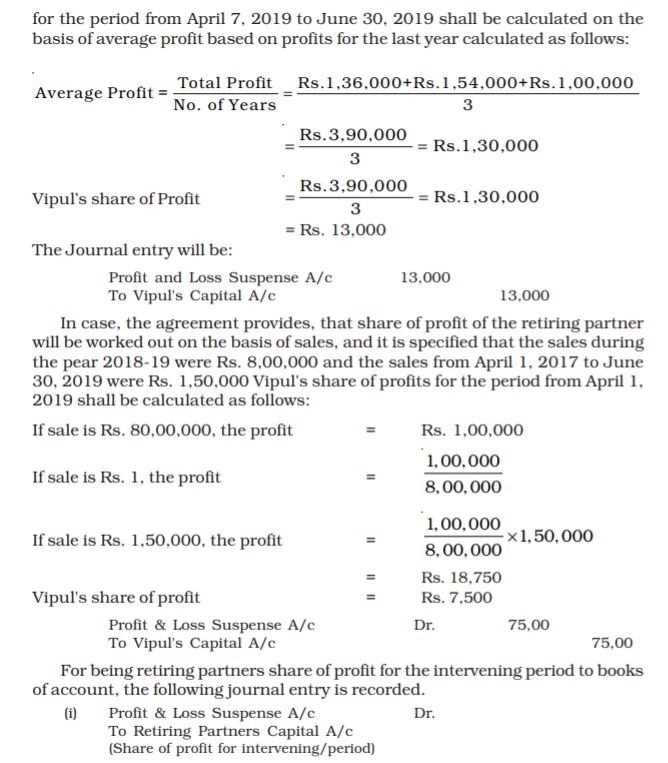

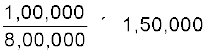

In case, the agreement provides, that share of profit of the deceased partner will be worked out on the basis of sales, and it is specified that the sales during the year 2015-16 were Rs. 8,00,000 and the sales from April 1, 2017 to June 30, 2017 were Rs. 1,50,000 Champak’s share of profits for the period from April 1, 2017 to June 30, 2017 shall be calculated as follows.

If sale is Rs.8,00,000, the profit = Rs.1,00,000

If sale is Rs.1, the profit =

If sale is Rs.1,50,000, the profit =

= Rs. 18,750

Champak’s share of profit = Rs. 7,500

The Journal entry will be:

Profit & Loss Suspense A/c Dr. 2,500

To Champak’s Capital A/c 7,500

For being deceased partner’s share of profits for the intervening period to books of account, the following journal entry is recorded.

(i) Profit and Loss (Supense) A/c Dr.

To Deceased Partner’s Capital A/c

(Share of profit for the intervening period)

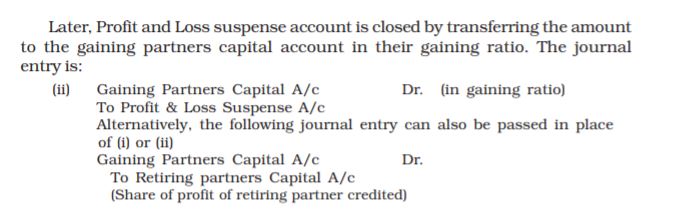

Later Profit and Loss Suspense account is closed by transferring the account to Gaining Partners’ Capital Account in their gaining ratio. The journal entry is:

(ii) Gaining Partners Capital A/c [In gaining ratio]

To Profit and Loss Suspense A/c

(P&L Suspense account transferred).

Alternatively the following journal entry can also be passed in Place of (i) & (ii)

(ii) Gaining Partners’ Capital A/c Dr.

To Deceased Partner Capital A/c

(share of profit of Deceased Partner credited)

Terms Introduced in the Chapter

• Retirement of a Partner. • Executors of deceased Partner

• Death of a Partner. • Executor’s Account.

• Gaining Ratio

Summary

1. New Profit Sharing Ratio: New profit sharing ratio is the ratio in which the remaining partner will share future profits after the retirement or death of any partner.

New Share = Old Share + Acquired Share from the Outgoing partner

2. Gaining Ratio: Gaining ratio is the ratio in which the continuing partners have acquired the share from the retiring deceased partner.

3. Treatment of Goodwill: The basic rule is that gaining partner(s) shared compensate the sacrificing partner to the extent of their gain for the respective share of goodwill.

If goodwill already appears in the books, it will be written off by debiting all partner’s capital account in their old profit sharing ratio.

4. Revaluation of Assets and Liabilities: At the time of retirement/death of a partner, there may be some assets which may not have been shown at their current values. Similarly, there may be certain liabilities which have been shown at a value different from the obligation to be met by the firm.

Besides this, there may be unrecorded assets and liabilities which have to be recorded.

5. Accumulated Profits or Losses: The reserves (Accumulated profits) or losses belong to all the partners and should be transferred to capital account of all partners.

6. Retiring partner/deceased partner may be paid in one lump sum or installments with interest.

7. At the time of retirement/death of a partner, the remaining partner may decide to keep their capital contributions in their profit sharing ratio.

Questions for Practice

Short Answer Questions

1. What are the different ways in which a partner can retire from the firm.

2. Write the various matters that need adjustments at the time of retirement of a partners.

3. Distinguish between sacrificing ratio and gaining tab.

4. Why do firm revaluate assets and reassers their liabilities on retirement or on the event of death of a partner.

5. Why a retiring/deceased partner is entitled to a share of goodwill of the firm.

Long Answer Questions

1. Explain the modes of payment to a retiring partner.

2. How will you compute the amount payable to a deceased partner?

3. Explain the treatment of goodwill at the time of retirement or on the event of death of a partner?

4. Discuss the various methods of computing the share in profits in the event of death of a partner.

Numerical Questions

1. Aparna, Manisha and Sonia are partners sharing profits in the ratio of 3 : 2 : 1. Manisha retires and goodwill of the firm is valued at Rs. 1,80,000. Aparna and Sonia decided to share future in the ratio of 3 : 2. Pass necessary journal entries.

(Ans : Dr. Aparna’s Capital A/c by Rs. 18,000, Dr. Sonia’s Capital A/c by

Rs. 42,000, Cr. Manisha’s Capital A/c by Rs. 60,000).

2. Sangeeta, Saroj and Shanti are partners sharing profits in the ratio of 2 : 3 : 5. Goodwill is appearing in the books at a value of Rs. 60,000. Sangeeta retires and goodwill is valued at Rs. 90,000. Saroj and Shanti decided to share future profits equally. Record necessary journal entries.

3. Himanshu, Gagan and Naman are partners sharing profits and losses in the ratio of 3 : 2 : 1. On March 31, 2017, Naman retires.

The various assets and liabilities of the firm on the date were as follows:

Cash Rs. 10,000, Building Rs. 1,00,000, Plant and Machinery Rs. 40,000, Stock Rs. 20,000, Debtors Rs. 20,000 and Investments Rs. 30,000.

The following was agreed upon between the partners on Naman’s retirement:

(i) Building to be appreciated by 20%.

(ii) Plant and Machinery to be depreciated by 10%.

(iii) A provision of 5% on debtors to be created for bad and doubtful debts.

(iv) Stock was to be valued at Rs. 18,000 and Investment at Rs. 35,000.

Record the necessary journal entries to the above effect and prepare the revaluation account.

4. Naresh, Raj Kumar and Bishwajeet are equal partners. Raj Kumar decides to retire. On the date of his retirement, the Balance Sheet of the firm showed the following: General Reserves Rs. 36,000 and Profit and Loss Account (Dr.)

Rs. 15,000.

Pass the necessary journal entries to the above effect.

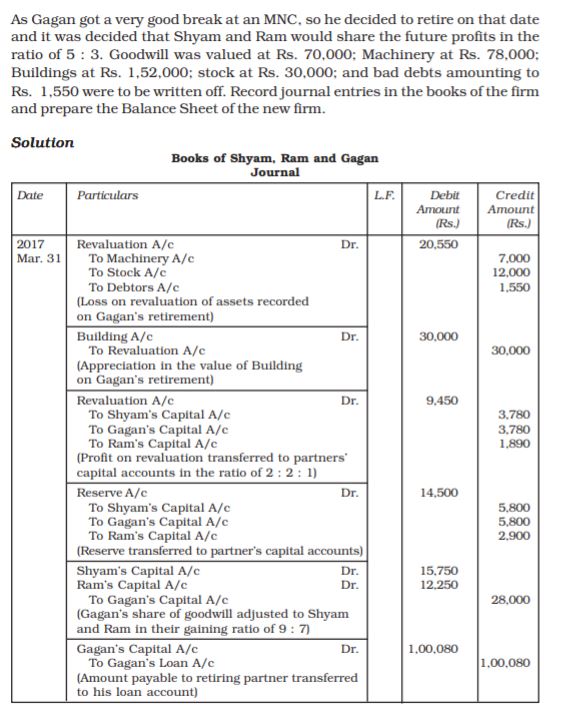

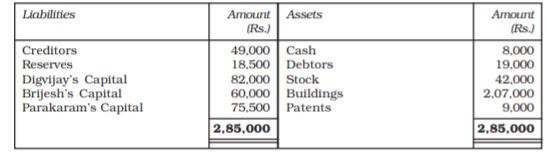

5. Digvijay, Brijesh and Parakaram were partners in a firm sharing profits in the ratio of 2 : 2 : 1. Their Balance Sheet as on March 31, 2017 was as follows:

Brijesh retired on March 31, 2017 on the following terms:

(i) Goodwill of the firm was valued at Rs. 70,000 and was not to appear in the books.

(ii) Bad debts amounting to Rs. 2,000 were to be written off.

(iii) Patents were considered as valueless.

Prepare Revaluation Account, Partners’ Capital Accounts and the Balance Sheet of Digvijay and Parakaram after Brijesh’s retirement.

(Ans : Loss on Revaluation Rs. 11,000, Balance of Capital Accounts: Digvijay Rs. 66,333 and Parakaram Rs. 67,667, Balance Sheet Total Rs. 2,74,000).

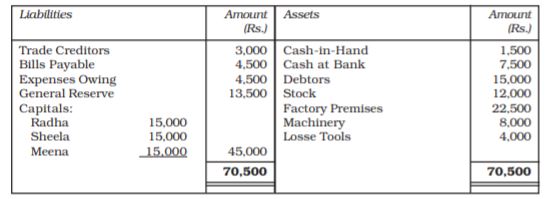

6. Radha, Sheela and Meena were in partnership sharing profits and losses in the proportion of 3:2:1. On April 1, 2017, Sheela retires from the firm. On that date, their Balance Sheet was as follows:

The terms were:

a) Goodwill of the firm was valued at Rs. 13,500.

b) Expenses owing to be brought down to Rs. 3,750.

c) Machinery and Loose Tools are to be valued at 10% less than their book value.

d) Factory premises are to be revalued at Rs. 24,300.

Prepare:

1. Revaluation account

2. Partner’s capital accounts and

3. Balance sheet of the firm after retirement of Sheela.

(Ans : Profit on Revaluation Rs. 1,350, Balance of Capital Accounts: Radha Rs. 19,050 and Meena Rs. 16,350, Balance Sheet Total = Rs. 71,100).

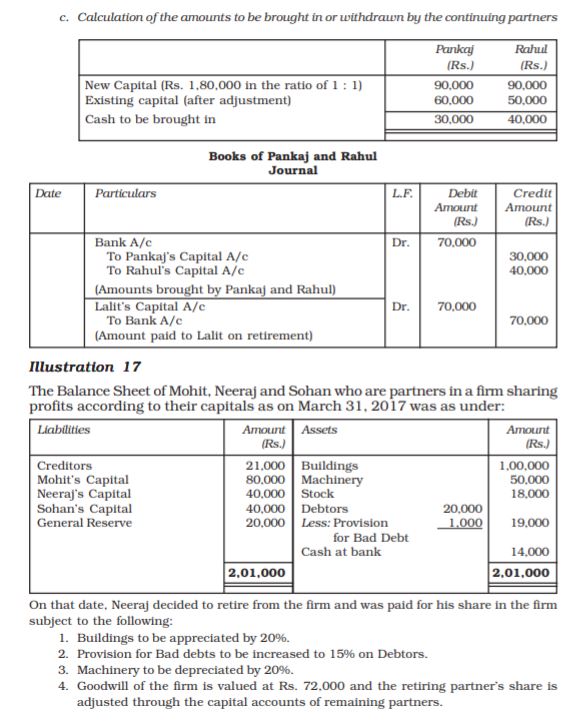

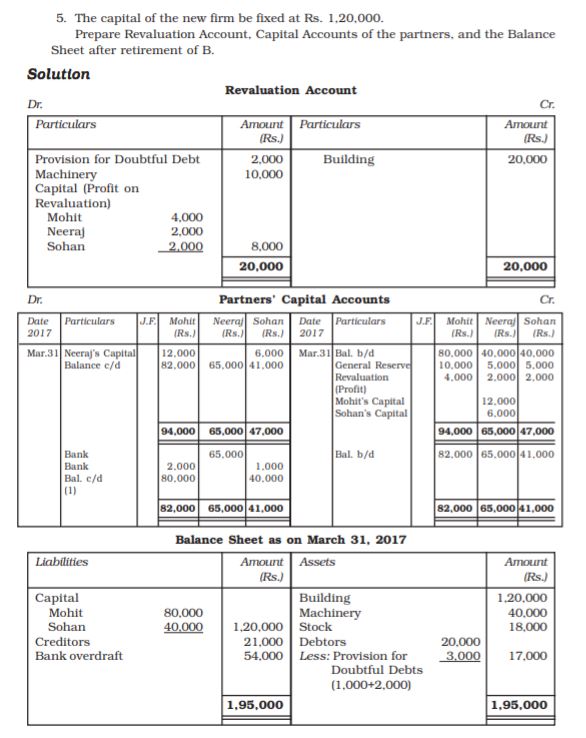

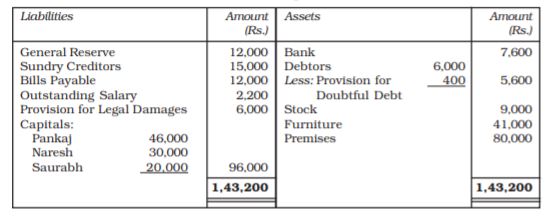

7. Pankaj, Naresh and Saurabh are partners sharing profits in the ratio of 3 : 2 : 1. Naresh retired from the firm due to his illness on Septmber 30, 2017. On that date the Balance Sheet of the firm was as follows:

Additional Information

(i) Premises have appreciated by 20%, stock depreciated by 10% and provision for doubtful debts was to be made 5% on debtors. Further, provision for legal damages is to be made for Rs. 1,200 and furniture to be brought up to Rs. 45,000.

(ii) Goodwill of the firm be valued at Rs. 42,000.

(iii) Rs. 26,000 from Naresh’s Capital account be transferred to his loan account and balance be paid through bank; if required, necessary loan may be obtained form Bank.

(iv) Naresh share of profit till the date of retirement is to be calculated on the basis of last years’ profit, i.e., Rs. 60,000.

(v) New profit sharing ratio of Pankaj and Saurabh is decided to be 5 : 1.

Give the necessary ledger accounts and balance sheet of the firm after Naresh’s retirement.

(Ans : Profit or Revaluation Rs. 18,000, Balance of Capital Account of Pankaj, Rs. 47,000 and of Saurabh, Rs. 25,000).

(Total Amount at Credit in Naresh’s Capital = Rs. 54,000, Balance Sheet Total = Rs. 1,54,800).

8. Puneet, Pankaj and Pammy are partners in a business sharing profits and losses in the ratio of 2 : 2 : 1 respectively. Their balance sheet as on March 31, 2017 was as follows:

Mr. Pammy died on September 30, 2017. The partnership deed provided the following:

(i) The deceased partner will be entitled to his share of profit up to the date of death calculated on the basis of previous year’s profit.

(ii) He will be entitled to his share of goodwill of the firm calculated on the basis of 3 years’ purchase of average of last 4 years’ profit. The profits for the last four financial years are given below:

for 2013–14; Rs. 80,000; for 2014–15, Rs. 50,000; for 2015–16, Rs. 40,000; for 2016–17, Rs. 30,000.

The drawings of the deceased partner up to the date of death amounted to Rs. 10,000. Interest on capital is to be allowed at 12% per annum.

Surviving partners agreed that Rs. 15,400 should be paid to the executors immediately and the balance in four equal yearly instalments with interest at 12% p.a. on outstanding balance.

Show Mr. Pammy’s Capital account, his Executor’s account till the settlement of the amount due.

(Ans : Total amount due is Rs. 75,400)

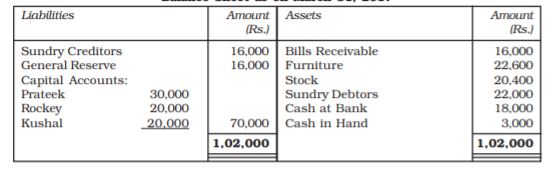

9. Following is the Balance Sheet of Prateek, Rockey and Kushal as on March 31, 2017.

Rockey died on June 30, 2017. Under the terms of the partnership deed, the executors of a deceased partner were entitled to:

a) Amount standing to the credit of the Partner’s Capital account.

b) Interest on capital at 5% per annum.

c) Share of goodwill on the basis of twice the average of the past three years’ profit and

d) Share of profit from the closing date of the last financial year to the date of death on the basis of last year’s profit.

Profits for the year ending on March 31, 2015, March 31, 2016 and March 31, 2017 were Rs. 12,000, Rs. 16,000 and Rs. 14,000 respectively. Profits were shared in the ratio of capitals.

Pass the necessary journal entries and draw up Rockey’s capital account to be rendered to his executor.

(Ans : Sony’s Executor Account is Rs. 33,821)

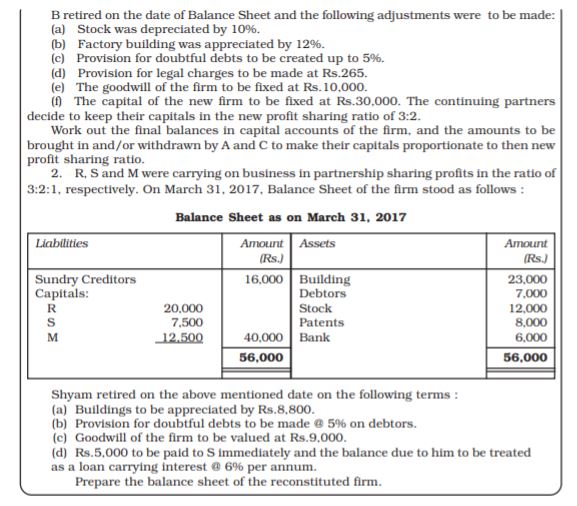

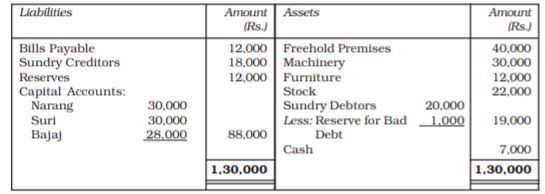

10. Narang, Suri and Bajaj are partners in a firm sharing profits and losses in proportion of  ,

,  and

and  respectively. The Balance Sheet on April 1, 2015 was as follows:

respectively. The Balance Sheet on April 1, 2015 was as follows:

Bajaj retires from the business and the partners agree to the following:

a) Freehold premises and stock are to be appreciated by 20% and 15% respectively.

b) Machinery and furniture are to be reduced by 10% and 7% respectively.

c) Bad Debts reserve is to be increased to Rs. 1,500.

d) Goodwill is valued at Rs. 21,000 on Bajaj’s retirement.

e) The continuing partners have decided to adjust their capitals in their new profit sharing ratio after retirement of Bajaj. Surplus/deficit, if any, in their capital accounts will be adjusted through current accounts.

Prepare necessary ledger accounts and draw the Balance Sheet of the reconstituted firm.

(Ans : Profit on Revaluation, Rs. 6,960; Balance in Capital Accounts of Narang,

Rs. 49,230; and that of Suri, Rs. 16,410. Amount at Credit in Bajaj Capital is Rs. 41,320).

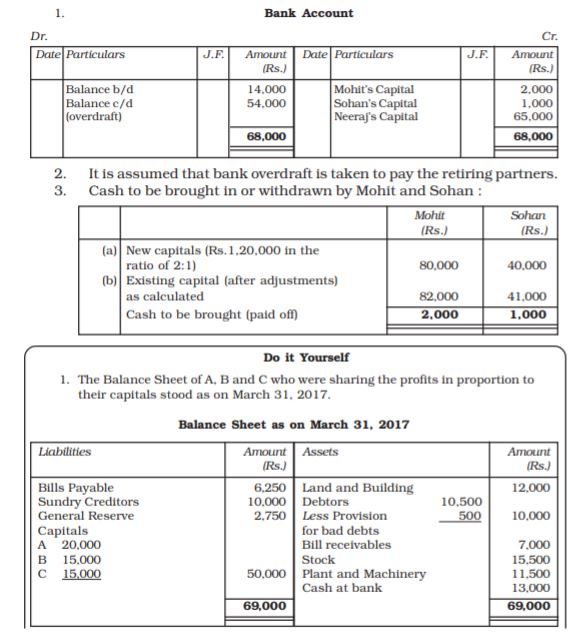

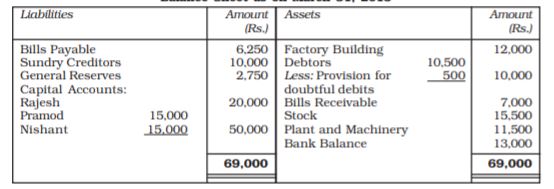

11. The Balance Sheet of Rajesh, Pramod and Nishant who were sharing profits in proportion to their capitals stood as on March 31, 2015:

Pramod retired on the date of Balance Sheet and the following adjustments were made:

a) Stock is to be reduced by 10%.

b) Factory buildings were appreciated by 12%.

c) Provision for doubtful debts be created up to 5%.

d) Provision for legal charges to be made at Rs. 265.

e) The goodwill of the firm be fixed at Rs. 10,000.

f) The capital of the new firm be fixed at Rs. 30,000. The continuing partners decide to keep their capitals in the new profit sharing ratio of 3 : 2.

Pass journal entries and prepare the balance sheet of the reconstituted firm after transferring the balance in Pramod’s Capital account to his loan account.

(Ans : Loss on Revaluation, Rs. 400 ; Balance in Capital Accounts of Rajesh, Rs. 18,940; and of Nishant, Rs. 14,705; Pramod’s Loan Rs. 18,705, Balance Sheet Total = Rs. 65,220).

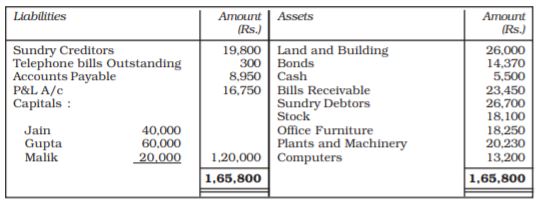

12. Following is the Balance Sheet of Jain, Gupta and Malik as on March 31, 2016.

The partners have been sharing profits in the ratio of 5:3:2. Malik decides to retire from business on April 1, 2016 and his share in the business is to be calculated as per the following terms of revaluation of assets and liabilities :

Stock, Rs.20,000; Office furniture, Rs.14,250; Plant and Machinery Rs.23,530; Land and Building Rs.20,000.

A provision of Rs.1,700 to be created for doubtful debts. The goodwill of the firm is valued at Rs.9,000.

The continuing partners agreed to pay Rs.16,500 as cash on retirement of Malik, to be contributed by continuing partners in the ratio of 3:2. The balance in the capital account of Malik will be treated as loan.

Prepare Revaluation account, capital accounts, and Balance Sheet of the reconstituted firm.

(Ans : Loss on Revaluation, Rs. 6,500. Balance in Capital Accounts goin Rs. 53,900m Gupta Rs. 69,000. Malik’s loan a/c 7,350. Balance Sheet Total = Rs. 1,59,300).

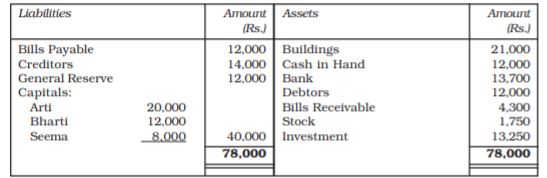

13. Arti, Bharti and Seema are partners sharing profits in the proportion of 3:2:1 and their Balance Sheet as on March 31, 2016 stood as follows :

Bharti died on June 12, 2016 and according to the deed of the said partnership, her executors are entitled to be paid as under :

(a) The capital to her credit at the time of her death and interest thereon @ 10% per annum.

(b) Her proportionate share of reserve fund.

(c) Her share of profits for the intervening period will be based on the sales during that period, which were calculated as Rs.1,00,000. The rate of profit during past three years had been 10% on sales.

(d) Goodwill according to her share of profit to be calculated by taking twice the amount of the average profit of the last three years less 20%. The profits of the previous years were :

2013 – Rs.8,200

2014 – Rs.9,000

2015 – Rs.9,800

The investments were sold for Rs.16,200 and her executors were paid out. Pass the necessary journal entries and write the account of the executors of Bharti.

(Ans : Total amount to executors of Bharati Rs. 23,436).

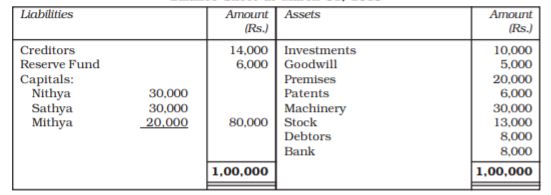

14. Nithya, Sathya and Mithya were partners sharing profits and losses in the ratio of 5:3:2. Their Balance Sheet as on March 31, 2015 was as follows :

Mithya dies on August 1, 2015. The agreement between the executors of Mithya and the partners stated that :

(a) Goodwill of the firm be valued at  times the average profits of last four years. The profits of four years were : in 2011-12, Rs.13,000; in 2012-13, Rs.12,000; in 2013-14, Rs.16,000; and in 2014-15, Rs.15,000.

times the average profits of last four years. The profits of four years were : in 2011-12, Rs.13,000; in 2012-13, Rs.12,000; in 2013-14, Rs.16,000; and in 2014-15, Rs.15,000.

(b) The patents are to be valued at Rs.8,000, Machinery at Rs.25,000 and Premises at Rs.25,000.

(c) The share of profit of Mithya should be calculated on the basis of the profit of 2014-15.

(d) Rs.4,200 should be paid immediately and the balance should be paid in 4 equal half-yearly instalments carrying interest @ 10%.

Record the necessary journal entries to give effect to the above and write the executor’s account till the amount is fully paid. Also prepare the Balance Sheet of Nithya and Sathya as it would appear on August 1, 2015 after giving effect to the adjustments.

(Ans : Amount Transfered to Mithya’s executors loan account Rs. 25,400).

Check-list to Test your Understanding

Test your understanding – I

1. (b), 2. (c), 3. (b), 4. (a).

Test your understanding – II

1. (a), 2. (a), 3. (c), 4. (b).