Table of Contents

1

Accounting for Share Capital 1

Learning Objectives

After studying this chapter, you will be able to :

• Explain the basic nature of a joint stock company as a form of business organisation and the various kinds of companies based on liability of their members;

• describe the types of shares issued by a company;

• explain the accounting treatment of shares issued at par, at premium and at a discount including oversubsription;

• outline the accounting for forfeiture of shares and reissue of forfeited shares under varying situations;

• workout the amounts to be transferred to capital reserve when forfeited account:

A company form of organisation is the third stage in the evolution of forms of organisation. Its capital is contributed by a large number of persons called shareholders who are the real owners of the company. But neither it is possible for all of them to participate in the management of the company nor considered desirable. Therefore, they elect a Board of Directors as their representative to manage the affairs of the company. In fact, all the affairs of the company are governed by the provisions of the Companies Act, 1956. A company means a company incorporated or registered under the Companies Act, 1956 or under any other earlier Companies Acts. According to Chief Justice Marshal, “a company is a person, artificial, invisible, intangible and existing only in the eyes of law. Being a mere creation of law, it possesses only those properties which the charter of its creation confers upon it, either expressly or as incidental to its very existence”.

A company usually raises its capital in the form of shares (called share capital) and debentures (debt capital.) This chapter deals with the accounting for share capital of companies.

1.1 Features of a Company

A company may be viewed as an association of person who contribute money or money’s worth to a common stock and use it for a common purpose. It is an artificial person having or corporate legal entity distinct from its members (shareholders) and has a common seal used for its signature. Thus, it has certain special features which distinguish it from the other forms of organisation. These are as follows:

•Body Corporate: A company is formed according to the provisions of Law enforced from time to time. Generally, in India, the companies are formed and registered under Companies Law except in the case of Banking and Insurance companies for which a separate Law is provided for.

• Separate Legal Entity: A company has a separate legal entity which is distinct and separate from its members. It can hold and deal with any type of property. It can enter into contracts and even open a bank account in its own name. It can sue others as well as be sued by others.

• Limited Liability: The liability of the members of the company is limited to the unpaid amount of the shares held by them. In the case of the companies limited by guarantee, the liability of its members is limited to the extent of the guarantee given by them in the event of the company being wound up.

• Perpetual Succession: The company being an artificial person created by law continues to exist irrespactive of the changes in its membership. A company can be terminated only through law. The death or insanity or insolvency of any member of the company in no way affects the existence of the company. Members may come and go but the company continues.

• Common Seal: The company being an artificial person, cannot sign its name by it self. Therefore, every company is required to have its own seal which acts as an official signatures of the company. Any document which does not carry the common seal of the company is not binding on the company.

• Transferability of Shares: The shares of a public limited company are freely transferable. The permission of the company or the consent of any member of the company is not necessary for the transfer of shares. But the Articles of the company can prescribe the manner in which the transfer of shares will be made.

• May Sue or be Sued: A company being a legal person can enter into contracts and can enforce the contractual rights against others. It can sue and be sued in its name if there is a breach of contract by the company.

1.2 Kinds of a Company

Companies can be classified either on the basis of the liability of its members or on the basis of the number of members. On the basis of liability of its members the companies can be classified into the following three categories:

(i) Companies Limited by Shares: In this case, the liability of its members is limited to the extent of the nominal value of shares held by them. If a member has paid the full amount of the shares, there is no liability on his part whatsoever may be the debts of the company. He need not pay a single paise from his private property. However, if there is any liability involved, it can be enforced during the existence of the company as well as during the winding-up.

(ii) Companies Limited by Guarantee: In this case, the liability of its members is limited to the amount they undertake to contribute in the event of the company being wound up. Thus, the liability of the members will arise only in the event of its winding up.

(iii) Unlimited Companies: When there is no limit on the liability of its members, the company is called an unlimited company. When the company’s property is not sufficient to pay off its debts, the private property of its members can be used for the purpose. In other words, the creditors can claim their dues from its members. Such companies are not found in India even though permitted by the Companies Act.

On the basis of the number of members, a company can be divided into two categories as follows:

(i) Public Company: A public company means a company which (a) is not a private company; (b) is a company which is not a subsidiary of a private company.

Private Company: A private company is one which by its articles:

(a) Restricts the right to transfer its shares;

(b) A private company must have at least 2 persons, except in case of one person company;

(c) Limits the number of its members to 200 (excluding its employees);

(iii) One Person Company (OPC): Sec. 2 (62) of the companies Act, 2013, defines OPC as a “company which has only one person as a member”. Rule 3 of the Companies (Incorporation) Rules, 2014 provides that:

(a) Only a natural person being an Indian citizen and resident in India can form one person company,

(b) It cannot carry out non-banking financial investment activities.

(c) Its paid up share capital is not more than Rs. 50 Lakhs

(d) Its average annual turnover of three years does not exceed Rs. 2 Crores.

1.3 Share Capital of a Company

A company, being an artificial person, cannot generate its own capital which has necessarily to be collected from several persons. These persons are known as shareholders and the amount contributed by them is called share capital. Since the number of shareholders is very very large, a separate capital account cannot be opened for each one of them. Hence, innumerable streams of capital contribution merge their identities in a common capital account called as ‘Share Capital Account’.

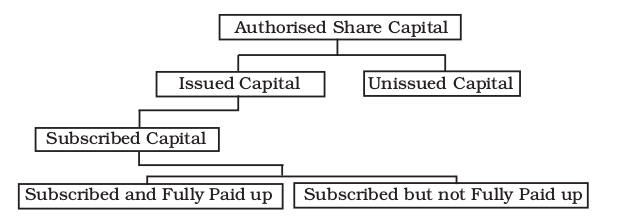

1.3.1 Categories of Share Capital

From accounting point of view the share capital of the company can be classified as follows:

• Authorised Capital: Authorised capital is the amount of share capital which a company is authorised to issue by its Memorandum of Association. The company cannot raise more than the amount of capital as specified in the Memorandum of Association. It is also called Nominal or Registered capital. The authorised capital can be increased or decreased as per the procedure laid down in the Companies Act. It should be noted that the company need not issue the entire authorised capital for public subscription at a time. Depending upon its requirement, it may issue share capital but in any case, it should not be more than the amount of authorised capital.

• Issued Capital: It is that part of the authorised capital which is actually issued to the public for subscription including the shares allotted to vendors and the signatories to the company’s memorandum. The authorised capital which is not offered for public subscription is known as ‘unissued capital’. Unissued capital may be offered for public subscription at a later date.

• Subscribed Capital: It is that part of the issued capital which has been actually subscribed by the public. When the shares offered for public subscription are subscribed fully by the public the issued capital and subscribed capital would be the same. It may be noted that ultimately, the subscribed capital and issued capital are the same because if the number of share, subscribed is less than what is offered, the company allot only the number of shares for which subscription has been received. In case it is higher than what is offered, the allotment will be equal to the offer. In other words, the fact of over subscription is not reflected in the books.

• Called-up Capital: It is that part of the subscribed capital which has been called up on the shares. The company may decide to call the entire amount or part of the face value of the shares. For example, if the face value (also called nominal value) of a share allotted is Rs. 10 and the company has called up only Rs. 7 per share, in that scenario, the called up capital is Rs. 7 per share. The remaining Rs. 3 may be collected from its shareholders as and when needed.

• Paid-up Capital: It is that portion of the called up capital which has been actually received from the shareholders. When the share holders have paid all the call amount, the called-up capital is the same to the paid-up capital. If any of the shareholders has not paid amount on calls, such an amount may be called as ‘calls in arrears’. Therefore, paid-up capital is equal to the called-up capital minus call-in-arrears.

• Uncalled Capital: That portion of the subscribed capital which has not yet been called-up. As stated earlier, the company may collect this amount any time when it needs further funds.

• Reserve Capital: A company may reserve a portion of its uncalled capital to be called only in the event of winding up of the company. Such uncalled amount is called ‘Reserve Capital’ of the company. It is available only for the creditors on winding up of the company.

Exhibit. 1.1 : Categories of Share Capital

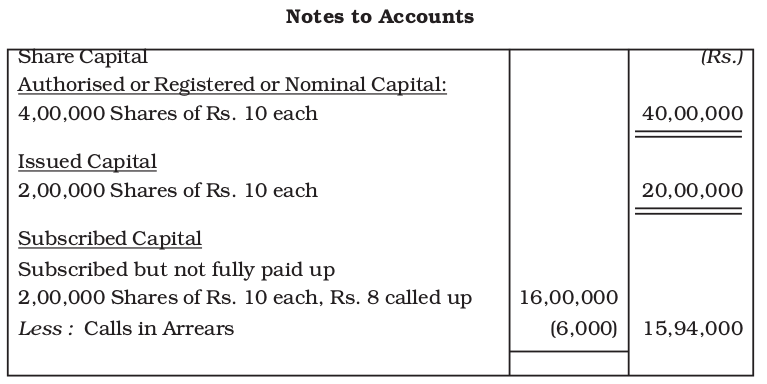

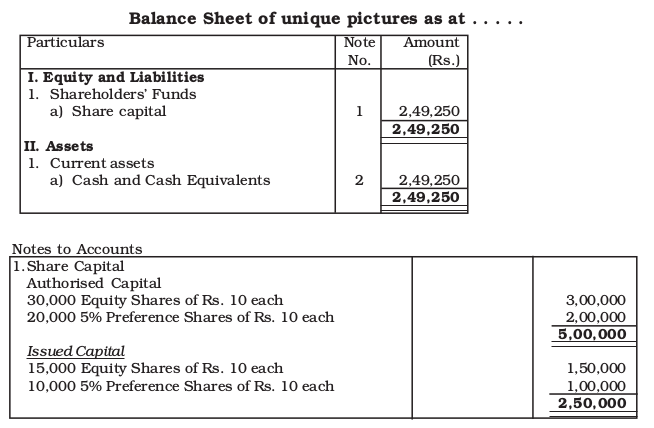

Let us take the following example and show how the share capital will be shown in the balance sheet. Sunrise Company Ltd., New Delhi, has registered its capital as Rs. 40,00,000, divided into 4,00,000 shares of Rs. 10 each. The company offered to the public for subscription of 2,00,000 shares of Rs. 10 each, as Rs. 2 on application, Rs.3 on allotment, Rs.3 on first call and the balance on final call. The company received applications for 2,50,000 shares. The company finalised the allotment on 2,00,000 shares and rejected applications for 50,000 shares. The company did not make the final call. The company received all the amount except on 2,000 shares where call money has not been received. The above amounts will be shown in the Notes to Accounts of the balance sheet of Sunrise Company Ltd. as follows:

1.4 Nature and Classes of Shares

Shares, as applied to the capital of a company, refer to the units into which the total share capital of a company is divided. Thus, a share is a fractional part of the share capital and forms the basis of ownership interest in a company. The persons who contribute money through shares are called shareholders.

The amount of authorised capital, together with the number of shares in which it is divided, is stated in the Memorandum of Association but the classes of shares in which the company’s capital is to be divided, alongwith their respective rights and obligations, are prescribed by the Articles of Association of the company. As per Section 86 of The Companies Act, a company can issue two types of shares (1) preference shares, and (2) equity shares (also called ordinary shares).

1.4.1 Preference Shares

According to Section 85 of The Companies Act, 1956, a preference share is one, which fulfils the following conditions :

a) That it carries a preferential right to dividend to be paid either as a fixed amount payable to preference shareholders or an amount calculated by a fixed rate of the nominal value of each share before any dividend is paid to the equity shareholders.

b) That with respect to capital it carries or will carry, on the winding-up of the company, the preferential right to the repayment of capital before anything is paid to equity shareholders.

However, notwithstanding the above two conditions, a holder of the preference share may have a right to participate fully or to a limited extent in the surpluses of the company as specified in the Memorandum or Articles of the company. Thus, the preference shares can be participating and non-participating. Similarly, these shares can be cumulative or non-cumulative, and redeemable or irredeemable.

1.4.2 Equity Shares

According to Section 85 of The Companies Act, 1956, an equity share is a share which is not a preference share. In other words, shares which do not enjoy any preferential right in the payment of dividend or repayment of capital, are termed as equity shares. The equity shareholders are entitled to share the distributable profits of the company after satisfying the dividend rights of the preference share holders. The dividend on equity shares is not fixed and it may vary from year to year depending upon the amount of profits available for distribution. The equity share capital may be (i) with voting rights; or (ii) with differential rights as to voting, dividend or otherwise in accordance with such rules and subject to such conditions as may be prescribed.

Test your Understanding – I

State which of the following statements are true :

(a) A company is an artificial person.

(b) Shareholders of a company are liable for the acts of the company.

(c) Every member of a company is entitled to take part in its management.

(d) Company’s shares are generally transferable.

(e) Share application account is a personal account.

(f) The director of a company must be a shareholder.

(g) Paid up capital can exceed called up capital.

(h) Capital reserves are created from capital profits.

(i) At the time of issue of shares, the maximum rate of securities premium is 10%.

(j) The part of capital which is called up only on winding up is called reserve capital.

1.5 Issue of Shares

A salient characteristic of the capital of a company is that the amount on its shares can be gradually collected in easy instalments spread over a period of time depending upon its growing financial requirement. The first instalment is collected along with application and is thus, known as application money, the second on allotment (termed as allotment money), and the remaining instalment are termed as first call, second call and so on. The word final is sufixed to the last instalment. However, this in no way prevents a company from calling the full amount on shares right at the time of application.

The important steps in the procedure of share issue are :

• Issue of Prospectus: The company first issues the prospectus to the public. Prospectus is an invitation to the public that a new company has come into existence and it needs funds for doing business. It contains complete information about the company and the manner in which the money is to be collected from the prospective investors.

• Receipt of Applications: When prospectus is issued to the public, prospective investors intending to subscribe the share capital of the company would make an application along with the application money and deposit the same with a scheduled bank as specified in the prospectus. The company has to get minimum subscription (Refer Box 1) within 120 days from the date of the issue of the prospectus. If the company fails to receive the same within the said period, the company cannot proceed for the allotment of shares and application money should be returned within 130 days of the date of issue of prospectus.

• Allotment of Shares: If minimum subscription has been received, the company may proceed for the allotment of shares after fulfilling certain other legal formalities. Letters of allotment are sent to those whom the shares have been alloted, and letters of regret to those to whom no allotment has been more. When allotment is made, it results in a valid contract between the company and the applicants who now became the shareholders of the company.

Minimum Subscription

The minimum amount that, in the opinion of directors, must be raised to meet the needs of business operations of the company relating to:

» the price of any property purchased, or to be purchased, which has to be met wholly or partly out of the proceeds of issue;

» preliminary expenses payable by the company and any commission payable

in connection with the issue of shares;

» the repayment of any money borrowed by the company for the above two

matters;

» working capital; and

» any other expenditure required for the usual conduct of business operations.

It is to be noted that ‘minimum subscription’ of capital cannot be less than 90% of the issued amount according to SEBI (Disclosure and Investor Protection) Guidelines, 2000 [6.3.8.1 and 6.3.8.2]. If this condition is not satisfied, the company shall forthwith refund the entire subscription amount received. If a delay occurs beyond 8 days from the date of closure of subscription list, the company shall be liable to pay the amount with interest at the rate of 15% [Section 73(2)].

Shares of a company are issued either at par or at a premium. Shares are to be issued at par when their issue price is exactly equal to their nominal value according to the terms and conditions of issue. When the shares of a company are issued more than its nominal value (face value), the excess amount is called premium.

Irrespective of the fact that shares are issued at par or at a premium, the share capital of a company as stated earlier, is collected in instalments to be paid at different stages.

1.6 Accounting Treatment

On application : The amount of money paid with various instalment represents the contribution to share capital and should ultimately be credited to share capital. However, for the sake of convenience, initially individual accounts are opened for each instalment. All money received along with application is deposited with a scheduled bank in a separate account opened for the purpose. The journal entry is as follows:

Bank A/c Dr.

To Share Application A/c

(Amount received on application for — shares @ Rs. ______ per share).

On allotment : When minimum subscription has been received and certain legal formalities on the allotment of shares have been duly complied with, the directors of the company proceed to make the allotment of shares.

The allotment of shares implies a contract between the company and the applicants who now become the allottees and assume the status of share-holders or members.

Allotment of Shares

(Implications from accounting point of view)

- It is customary to ask for some amount called “Allotment Money” from the allottees on the shares allotted to them as soon as the allotment is made.

- With the acceptance to the offer made by the applicants, the amount of application money received has to be transferred to share capital account as it has formally become the part of the same.

- The money received on rejected applications should either be fully returned to the applicant within Prescribed period of law/SEBI

- In case lesser number of shares have to be allotted, than those applied for the excess application money must be adjusted towards the amount due on allotment from the allottees.

- The effect of the later two steps is to close the share application account which is only a temporary account for share capital transactions.

The journal entries with regard to allotment of shares are as follows:

1. For Transfer of Application Money

Share Application A/c Dr.

To Share Capital A/c

(Application money on _____ Shares allotted/transferred to Share Capital)

2. For Money refunded on rejected application

Share Application A/c Dr.

To Bank A/c

(Application money returned on rejected application for — shares).

3. For Amount Due on Allotment

Share Allotment A/c Dr.

To Share Capital A/c

4. For Adjustment of Excess Application Money

Share Application A/c Dr.

To Share Allotment A/c

(Application Money on — Shares @ Rs. per shares adjusted to the amount due on allotment).

5. For Receipt of Allotment Money

Bank A/c Dr.

To Share Allotment A/c

(Allotment money received on — Shares @ Rs. — per share Combined Account)

Sometimes a combined account for share application and share allotment called ‘Share Application and Allotment Account’ is opened in the books of a company. The combined account is based on the reasoning that allotment without application is impossible while application without allotment is meaningless. These two stages of share capital are closely inter-related. When a combined account is maintained, journal entries are recorded in the following manner:

1. For Receipt of Application and Allotment

Bank A/c Dr.

To Share Application and Allotment A/c

(Money received on applications for shares @ Rs. _____ per share).

2. For Transfer of Application Money and Allotment Amount Due

Share Application and Allotment A/c Dr.

To Share Capital A/c

(Transfer of application money to Share Capital Account for amount due or allotment of — Share @ Rs. _____ per share)

3. For Money Refunded on Rejected Applications

Share Application and Allotment A/c Dr.

To Bank A/c

(Application money returned on rejected applicationfor ___ shares).

4. On Receipt of Allotment Amount

Bank A/c Dr.

To Share Application and Allotment A/c

(Balance of Allotment Money Received).

On Calls : Calls play a vital role in making shares fully paid-up and for realising the full amount of shares from the shareholders. In the event of shares not being fully called-up till the completion of allotment, the directors have the authority to ask for the remaining amount on shares as and when they decide about the same. It is also possible that the timing of the payment of calls by the shareholders is determined at the time of share issue itself and given in the prospectus.

Two points are important regarding the calls on shares. First, the amount on any call should not exceed 25% of the face value of shares. Second, there must be an interval of at least one month between the making of two calls unless otherwise provided by the articles of association of the company.

When a call is made and the amount of the same is received, the journal entries are as given below:

1. For Call Amount Due

Share Call A/c Dr.

To Share Capital A/c

(Call money due on — Shares @ Rs. ____ per share)

2. For Receipt of Call Amount

Bank A/c Dr.

To Share Call A/c

(Call money received)

The word/words First, Second, or Third must be added between the words “Share” and ‘Call’ in the Share Call account depending upon the identity of the call made. For example, in case of first call it will be termed as ‘Share First Call Account’, in case of second call it will be ‘Share Second Call Account’ and so on. Another point to be noted is that the words ‘and Final’ will also be added to the last call, say, if second call is the last call it will be termed as ‘Second and Final Call’ and if it is the third call which is the last call, it will be termed as ‘Third and Final Call’. It is also possible that the whole balance after allotment may be collected in one call only. In that case the first call itself, shall be termed as the ‘First and Final Call’.

The following points should be kept in mind while issuing the share capital for public subscription :

1. The application money should be at least 5% of the face value of the share.

2. Calls are to be made as per the provisions of the articles of association.

3. Where there is no articles of association of its own, the following provisions of Table A will apply:

(a) A period of one month must elapse between two calls;

(b) The amount of call should not exceed 25% of the face value of the share;

(c) A minimum of 14 days’ notice is given to the shareholders to pay the amount; and

(d) Calls must be made on a uniform basis on all shares within the same class.

4. The procedure for accounting for the issue of both equity and preference shares is the same. To differentiate between the two the words ‘Equity’ and ‘Preference’ is prefixed to each and every instalment.

Illustration 1

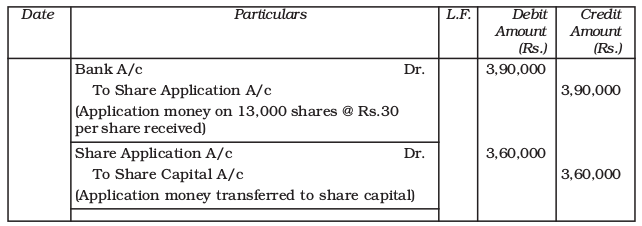

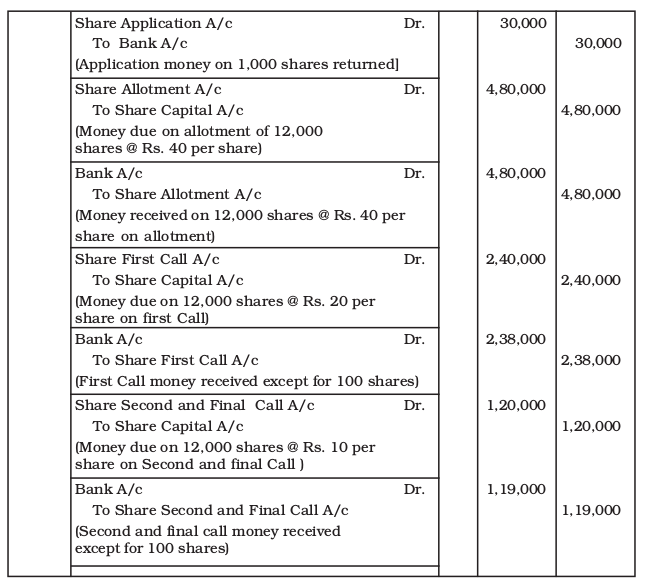

Mona Earth Mover Ltd. decided to issue 12,000 shares of Rs.100 each payable at Rs.30 on application, Rs.40 on allotment, Rs.20 on first call and balance on second and final call. Applications are received for 13,000 shares. The directors decided to reject application of 1,000 shares and their application money being refunded in full. The allotment money is duly received on all the shares, and all sums due on calls are received except on 100 shares.

Record the transactions in the books of Mona Earth Movers Limited

Solution

Books of Mona Earth Movers Limited

Journal

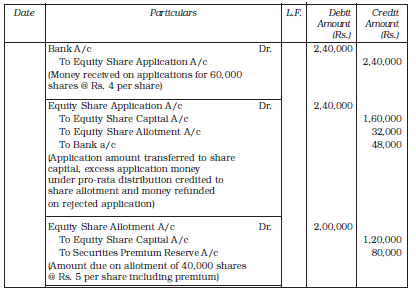

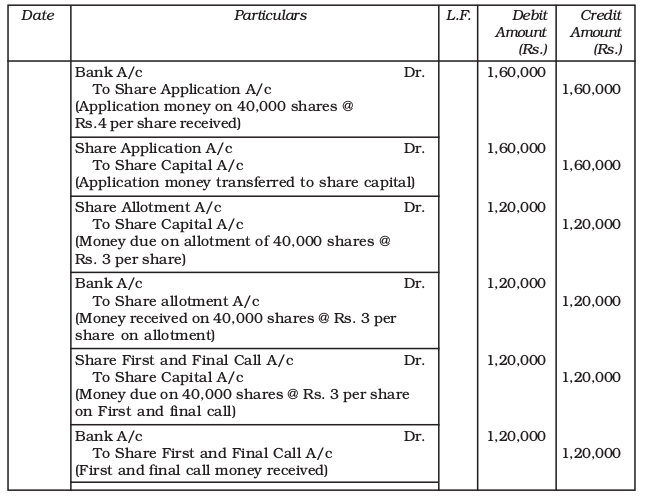

Illustration 2

Eastern Company Ltd. issued 40,000 shares of Rs. 10 each to the public for the subscription of its share capital, payable at Rs. 4 on application,

Rs. 3 on allotment and the balance on Ist and final call. Applications were received for 40,000 shares. The company made the allotment to the applicants in full. All the amounts due on allotment and first and final call were duly received.

Give the journal entries in the books of the company.

Solution

Books of Eastern Company Limited

Journal

Do it Yourself

On April 01, 2015, a limited company was incorporated with an authorised capital of Rs. 40,000 divided into shares of Rs. 10 each. It offered to the public for subscription of 3,000 shares payable as follows:

On Application Rs. 3 per share

On Allotment Rs. 2 per share

On First Call (One month after allotment) Rs. 2.50 per share

On Second and Final Call Rs. 2.50 per share

The shares were fully subscribed for by the public and application money duly received on April 15, 2015. The directors made the allotment on May 1, 2015.

How will you record the share capital transactions in the books of a company if the amounts due has been duly received, and the company maintains the combined account for application and allotment.

1.6.1 Calls in Arrears

It may happen that shareholders do not pay the call amount on due date. When any shareholder fails to pay the amount due on allotment or on any of the calls, such amount is known as ‘Calls in Arrears’/‘Unpaid Calls’. Calls in Arrears represent the debit balance of all the calls account. Such amount shall appear as ‘Note to Accounts (Refer Chapter 3). However, where a company maintains ‘Calls in Arrears’ Account, it needs to pass the following additional journal entry:

Calls in Arrears A/c Dr.

To Share First Call Account A/c

To Share Second and Final Call Account A/c

(Calls in arrears brought into account)

The Articles of Association of a company usually empower the directors to change interest at a stipulated rate on calls in arrears. In case the articles are silent in this regard, the rule contained in Table F shall be applicable which states that the interest at a rate not exceeding 10% p.a. shall have to be paid on all unpaid amounts on shares for the period intervening between the day fixed for payment and the time of actual payment thereof.

On receipt of the call amount together with interest, the amount of interest shall be credited to interest account while call money shall be credited to the respective call account or to calls-in-arrears account. When the shareholder makes the payment of calls-in-arrears together with interest, the entry will be as follows:

Bank A/c Dr.

To Calls-in-Arrears A/c

To Interest A/c

(Call in arrears returned with interest)

Note: If nothing is specified, there is no need to take the interest on calls-in-arrears account and record the above entry

Illustration 3

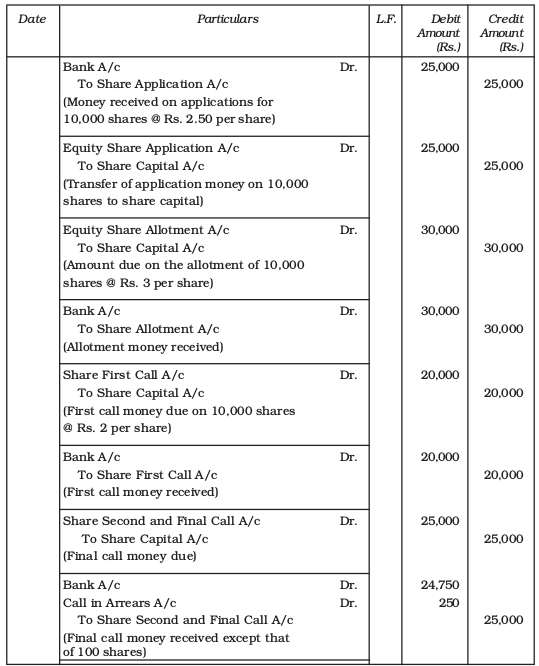

Cronic Limited issued 10,000 equity shares of Rs. 10 each payable at Rs. 2.50 on application, Rs. 3 on allotment, Rs. 2 on first call, and the balance of Rs. 2.50 on the final call. All the shares were fully subscribed and paid except of a shareholder having 100 shares who could not pay for the final call. Give journal entries to record these transactions.

Solution

Books of Cronic Limited

Journal

1.6.2 Calls in Advance

Sometimes some shareholders pay a part or the whole of the amount of the calls not yet made. The amount so received from the shareholders is known as “Calls in Advance”. The amount received in advance is a liability of the company and should be credited to ‘Call-in-Advance Account.” The amount received will be adjusted towards the payment of calls as and when they becomes due. Table A of the Companies Act provides for the payment of interest on calls in advance at a rate not exceeding 12% per annum.

The following journal entry is recorded for the amount of calls received in advance.

Bank A/c Dr.

To Calls-in-Advance A/c

(Amount received on call-in-advance)

On the due date of the calls, the amount of ‘Calls in Advance’ is adjusted by the following entry :

Calls-in-Advance A/c Dr.

To Particular Call A/c

(Calls-in-advance adjusted with the call money due)

The balance in ‘Calls-in-Advance’ account is shown as a separate item on the liabilities side of company’s balance sheet under the heading ‘Share Capital’ but is not added to the amount of paid-up capital.

As Calls-in-Advance is a liability of the company, it is under obligation if provided by the Articles, to pay interest on such amount from the date of its receipt up to the date when appropriate call is due for payment. A stipulation is generally made in the Articles regarding the rate at which interest is payable. However, if Articles are silent on this account, Table F is applicable which provides for interest on calls in advance at a rate not exceeding 12% p.a.

The accounting treatment of interest on calls in advance is as follows:

1. For Payment of Interest

Interest on Calls in Advance A/c Dr.

To Bank A/c

(Interest paid on Calls-in-Advance)

Or

2. For Interest due

Interest on Calls-in-Advance A/c Dr.

To Sundry Shareholder’s A/c

(Interest paid on Calls-in-Advance)

2.(b) For Interest Paid

Sundry Shareholder’s A/c Dr.

To Bank A/c

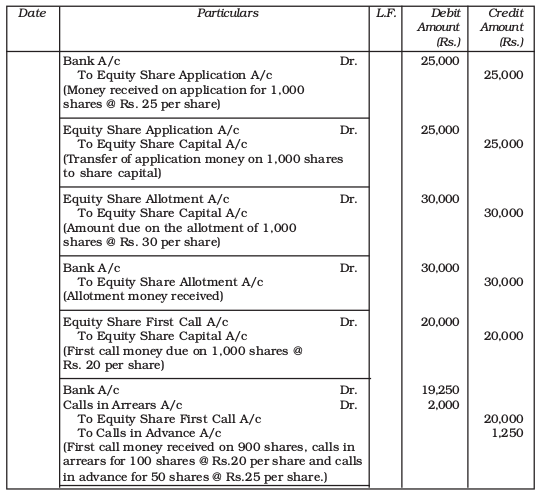

Illustration 4

Konica Limited registered with an authorised equity capital of Rs. 2,00,000 divided into 2,000 shares of Rs. 100 each, issued for subscription of 1,000 shares payable at Rs. 25 per share on application, Rs. 30 per share on allotment, Rs. 20 per share on first call and the balance as and when required.

Application money on 1,000 shares was duly received and allotment was made to them. The allotment amount was received in full, but when the first call was made, one shareholder failed to pay the amount on 100 shares held by him and another shareholder with 50 shares, paid the entire amount on his shares. The company did not make any other call.

Give the necessary journal entries in the books of the company to record these share capital transactions.

Solution

Books of Konica

Journal

In practice the entries for the amount received are recorded in the cash book and not in the journal. (See Illustration 5)

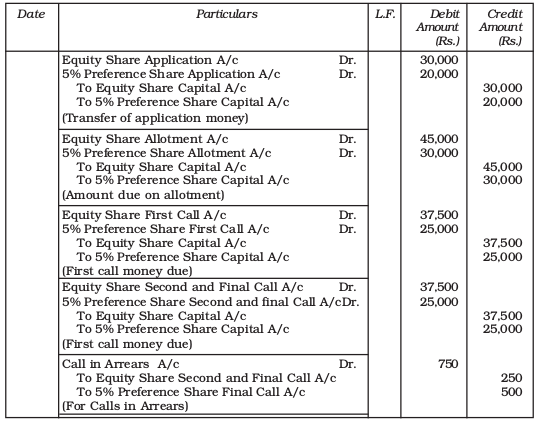

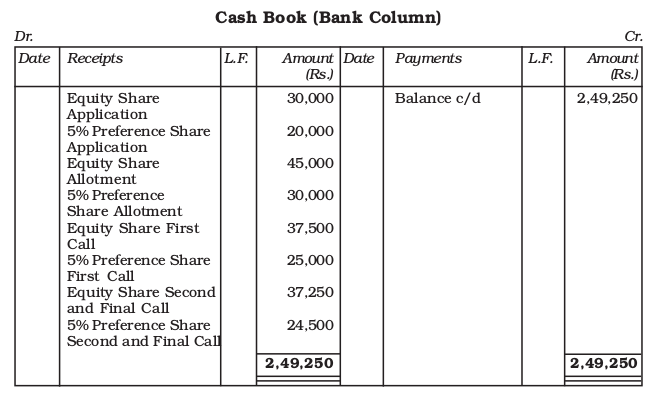

Illustration 5

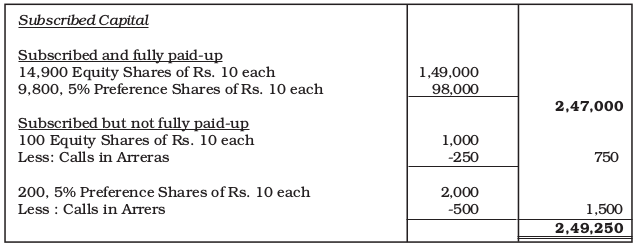

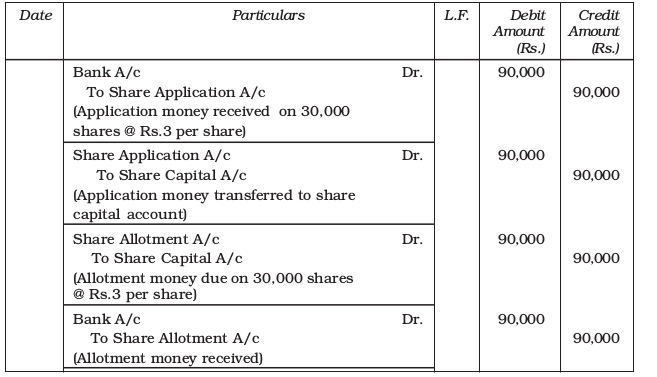

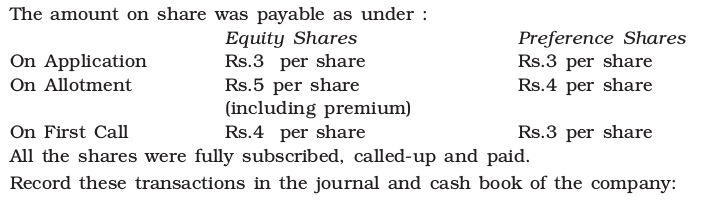

Unique Pictures Ltd. was registered with an authorised capital of Rs. 5,00,000 divided into 20,000, 5% preference shares of Rs. 10 each and 30,000 equity shares of Rs. 10 each. The company issued 10,000 preference and 15,000 equity shares for public subscription. Calls on shares were made as under :

| Equity Shares(Rs.) | Preference Shares(Rs.) | |

| Application | 2 | 2 |

| Allotment | 3 | 3 |

| First Call | 2.50 | 2.50 |

| Second and Final Call | 2.50 | 2.50 |

All these shares were fully subscribed. All the dues were received except the second and final call on 100 equity shares and on 200 preference shares. Record these transactions in journal. You are also required to prepare the cash book and balance sheet.

Solution

Books of Unique Pictures Limited

Journal

Illustration 6

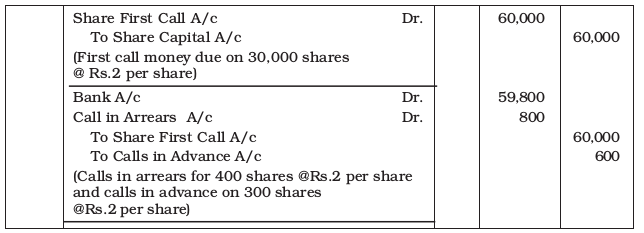

Rohit and Company issued 30,000 shares of Rs.10 each payable Rs.3 on application, Rs.3 on allotment and Rs.2 on first call after two months. All money due on allotment was received, but when the first call was made a shareholder having 400 shares did not pay the first call and a shareholder of 300 shares paid the money for the second and final call of Rs.2 which had not been made as yet.

Give the necessary journal entries in the books of the company.

Solution

Books of Rohit & Company

Journal

Do it Your self

1. A company issued 20,000 equity shares of Rs.10 each payable at Rs.3 on application, Rs.3 on allotment, Rs.2 on first call and Rs.2 on second and the final call. The allotment money was payable on or before May 01, 2015; first call money on or before August Ist, 2015; and the second and final call on or before October Ist, 2015; ‘X’, whom 1,000 shares were allotted, did not pay the allotment and call money; ‘Y’, an allottee of Rs.600 shares, did not pay the two calls; and ‘Z’, whom 400 shares were allotted, did not pay the final call. Pass journal entries and prepare the Balance Sheet of the company.

2. Alfa company Ltd. issued 10,000 shares of Rs.10 each for cash payable at Rs.3 on application, Rs.2 on allotment and the balance in two equal instalments. The allotment money was payable on or before March 31, 2015; the first call money on or before 30 June, 2006; and the final call money on or before 31st August, 2015. Mr. ‘A’, whom 600 shares were allotted, paid the entire remaining face value of shares allotted to him on allotment. Record journal entries in company’s books and also prepare their balance sheet on the date.

1.6.3 Over Subscription

There are instances when applications for more shares of a company are received than the number offered to the public for subscription. This usually happens in respect of share issues of well-managed and financially strong companies and is said to be a case of ‘Over Subscription’.

In such a condition, three alternatives are available to the directors to deal with the situation: (1) they can accept some applications in full and totally reject the others; (2) they can make a pro-rata allotment to all; and (3) they can adopt a combination of the above two alternatives which happens to be the most common course adopted in practice.

The problem of over subscription is finally resolved with the allotment of shares. Therefore, from the accounting point of view, it is better to place the situation of over subscription within the total frame of application and allotment, i.e. receipt of application amount, amount due on allotment and its receipt from the shareholders, and the same has been observed in the pattern of entries.

First Alternative : When the directors decide to fully accept some applications and totally reject the others, the application money received from rejected applications is fully refunded. For example, a company invited applications for 20,000 shares and received the applications for 25,000 shares. The directors totally rejected the applications for 5,000 shares which are in excess of the required number and refunded their application money in full. In this case, the journal entries on application and allotment will be as follows :

The journal entries on application and allotment according to this alternative are as follows:

1 Bank A/c Dr.

To Share Application A/c

(Money received on application for 25,000 shares @ Rs. _ per share)

2 Share Application A/c Dr.

To Share Capital A/c

To Bank A/c

(Transfer of money on application 20,000 forshares allotted and money refunded on applications for _ shares rejected)

3 Share Allotment A/c Dr.

To Share Capital A/c

(Amount due on the allotment of _ shares @ Rs. _ per Share)

4 Bank A/c Dr.

To Share Allotment A/c

(Allotment money received)

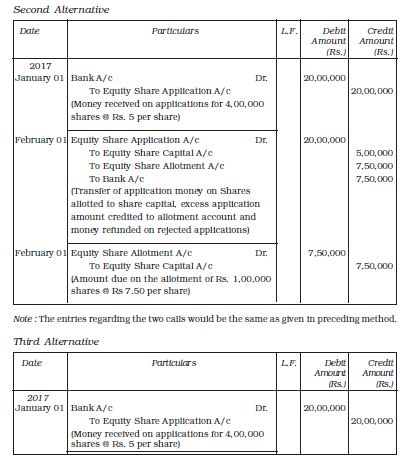

Second Alternative : When the directors opt to make a proportionate allotment to all the applicants (called ‘pro-rata’ allotment), the excess application money received is normally adjusted towards the amount due on allotment. In case, however, the excess application money received is more than the amount due on allotment of shares, such excess amount may either be refunded or credited to calls in advance.

For example, in the event of applications for 20,000 shares being invited and those received are for 25,000 shares, it is decieded to allot shares in the ratio of 4:5 to all applicants. It is a case of pro-rata allotment and the excess application money received on 5,000 shares would be adjusted towards the amount due on the allotment of 20,000 shares. In this case, the journal entries on application and allotment will be as follows.

1 Bank A/c Dr.

To Share Application A/c

(Application money received on 25,000 shares @ Rs. _ per Share)

2 Share Application A/c Dr.

To Share Capital A/c

To Share Allotment A/c

(Transfer of application money to share capital and the excess application money credited to share allotment.)

3 Share Allotment A/c Dr.

To Share Capital A/c

(Amount due on the Allotment of 25,000 share @ Rs. _ per Share)

4 Bank A/c Dr.

To Share Allotment A/c

(Allotment money received after adjusting the amount already received as excess application money)

Third Alternative : When the application for some shares are rejected outrightly; and pro-rata allotment is made to the remaining applicants, the money on rejected applications is fully refunded and the excess application money received from applicants to whom prorata allotment has been made is adjusted towrds the amount due on the allotment of shares allotted.

For example, a company invited applications for 10,000 shares and received applications for 15,000 shares. the directors decided to reject the applications for 2,500 shares outright and to make a pro-rata allotment of 10,000 shares to the applicants for the remaining 12,500 shares so that four shares are allotted for every five shares applied. In this case, the money on applications for 2,500 shares rejected would be refunded fully and that on the remaining 2,500 shares (12,500 shares – 10,000 shares) would be adjusted against the allotment amount due on 10,000 shares allotted and credited to share allotment account, the journal entries on application and allotment recorded as follows:

1 Bank A/c Dr.

To Share Application A/c

(Money received on application for 15,000 shares @ Rs. _ per share)

2 Share Application A/c Dr.

To Share Capital A/c

To Share Allotment A/c

To Bank A/c

(Transfer of application money to share capital, and the excess application amount of pro-rata allottees credited to share allotment and the amount on rejected applications refunded)

3 Share Allotment A/c Dr.

To Share Capital A/c

(Amount due on the Allotment of 10,000 shares @ Rs. _ per share)

4 Bank A/c Dr.

To Share Allotment A/c

(Allotment money received after adjusting the amount already received as excess application money.)

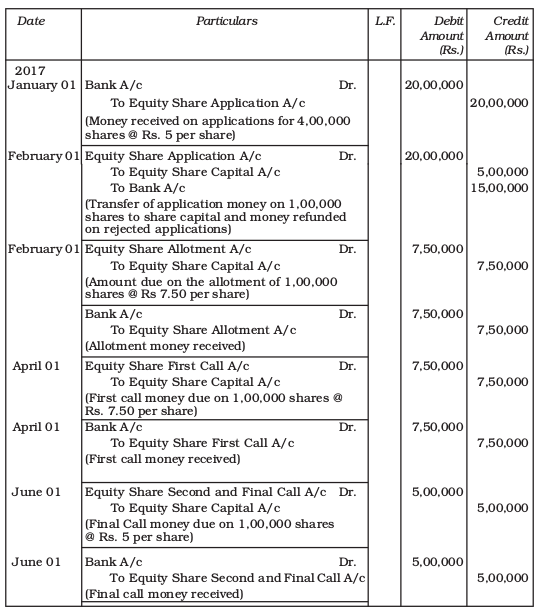

Illustration 7

Janta Papers Limited invited applications for 1,00,000 equity shares of Rs. 25 each payable as under:

On Application Rs. 5.00 per share

On Allotment Rs. 7.50 per share

On First Call Rs. 7.50 per share

(due two months after allotment)

On Second and Final Call Rs. 5.00 per share

(due two months after First Call)

Applications were received for 4,00,000 shares on January 01, 2017 and allotment was made on February 01, 2017.

Record journal entries in the books of the company to record these share capital transactions under each of the following circumstances:

1 The directors decide to allot 1,00,000 shares in full to selected applicants and the applications for the remaining 3,00,000 shares were rejected outright.

2 The directors decide to make a pro-rata allotment of 25 per cent of the shares applied for to every applicant; to apply the balance of application money towards amount due on allotment; and to refund the amount remaining thereafter.

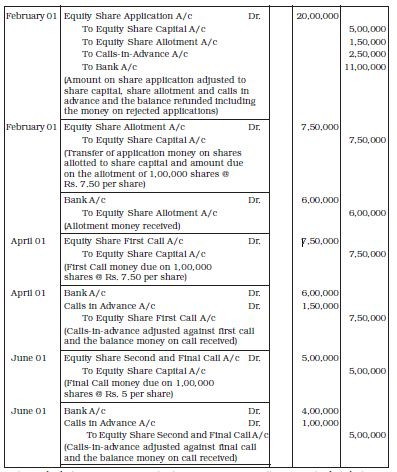

3 The directors totally reject applications for 2,00,000 shares, accept full applications for 80,000 shares and make a pro-rata allotment of the 20,000 shares to remaining applicants the excess of application money is to be adjusted towards allotment and calls to be made.

Solution

Books of Janta Papers Limited

Journal

First Alternative

Note: The balance of excess application money as a result of pro-rata distribution in journal entry 3 above is large enough to meet the demands on allotted shares in respect of the allotment and the two call money, as well as to leave an amount to be refunded along with that on the rejected applications.

Working Notes:

1.6.4 Undersubscription

Under subscription is a situation where number of shares applied for is less than the number for which applications have been invited for subscription. For example, a comapny offered 2 lakh shares for subscription to the public but the applications were received for 1,90,000 share, only. In such a situation, the allotment will be confirmed to 1,90,000 share and entries shall be made accordingly. However, as stated earlier, it must be ensured that the company has received the minimum subscriptions and the company will have to refund the entire subscription amount received.

1.6.5 Issue of Shares at a Premium

It is quite common for the shares of financially strong and well-managed companies to be issued at a premium, i.e. at an amount more than the nominal or par value of shares. Thus, when a share of the nominal value of Rs. 100 is issued at Rs. 105, it is said to have been issued at a premium of 5 per cent.

When the issue of shares is at a premium, the amount of premium may technically be called at any stage of the issue of shares. However, premium is generally called with the amount due on allotment, sometimes with the application money and rarely with the call money. The premium amount is credited to a separate account called ‘Securities Premium Account’ and is shown on the liabilities side of the company’s balance sheet under the heading ‘Reserves and Surpluses’. It can be used only for the following five purposes:

(a) to issue fully paid bonus shares to an extent not exceeding unissued share capital of the company;

(b) to write-off preliminary expenses of the company;

(c) to write-off the expenses of, or commission paid, or discount allowed on any securities of the company; and

(d) to pay premium on the redemption of preference shares or debentures of the company.

(e) Purchase of its own shares (i.e., buy back of shares). The journal entries for shares issued at a premium are as follows:

1. For Premium Amount called with Application money

(a) Bank A/c Dr.

To Share Application A/c

(Money received on application for — shares @ Rs. — per share including premium)

(b) Share Application A/c Dr.

To Share Capital A/c

To Securities Premium Reserve A/c

(Transfer of application money to share capital and securities premium account)

2. Premium Amount called with Allotment Money

(a) Share Allotment A/c Dr.

To Share Capital A/c

To Securities Premium Reserve A/c

(Amount due on allotment of shares @ Rs — per share including premium)

(b) Bank A/c Dr.

To Share Allotment A/c

(Allotment money received including premium)

3. Premium Amount called with Call Money

(a) Share Application A/c

To Share Capital Reserve A/c

To Securities Premium A/c

(Amount due on Ist/2nd call @Rs— per share including premium)

(b) Bank A/c Dr.

To Share Call A/c

(Call money received including premium)

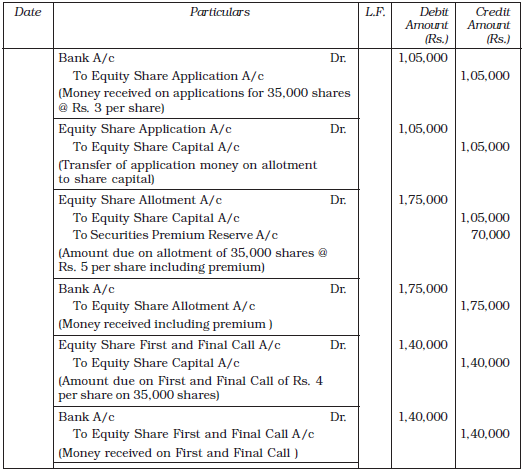

Illustration 8

Jupiter Company Limited issued 35,000 equity shares of Rs. 10 each at a premium of Rs.2 payable as follows:

On Application Rs. 3

On Allotment Rs. 5 (including premium)

Balance on First and Final Call

The issue was fully subscribed. All the money was duly received.

Record journal entries in the books of the company.

Solution

Books of Jupiter Company Limited

Journal

1.6.6 Issue of Shares at a Discount

There are instances when the shares of a company are issued at a discount, i.e. at an amount less than the nominal or par value of shares, the difference between the nominal value and issue price representing discount on the issue of shares. For example, when a share of the nominal value of Rs. 100 is issued at Rs. 98, it is said to have been issued at a discount of two per cent.

As a general rule, a company cannot ordinarily issue shares at a discount. It can do so only in cases such as ‘reissue of forfeited shares’ (to be discussed later) and issue of sweat equity shares.

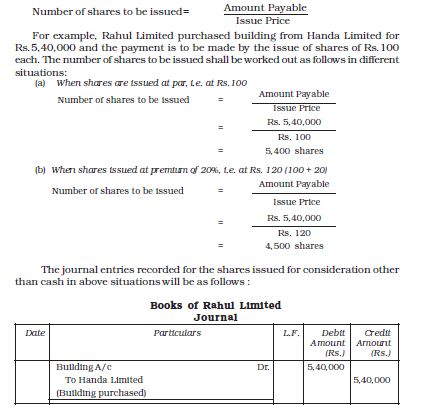

1.6.7 Issue of Shares for Consideration other than Cash

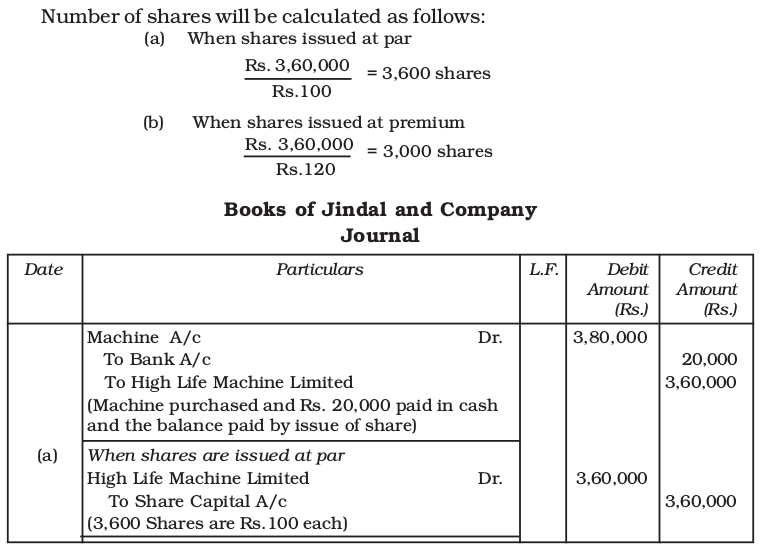

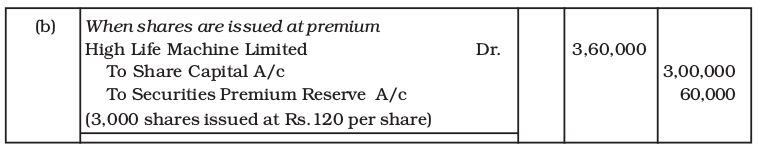

There are instances where a company enters into an arrangement with the vendors from whom it has purchased assets, whereby the latter agrees to accept, the payment in the form of fully paid shares of the company issued to them. Normally, no such cash is received for issue of shares. These shares can also be issued either at par, at premium or at discount, and the number of shares to be issued will depend upon the price at which the shares are issued and the amount payable to the vendor. The number of shares to be issued to the vendor will be calculated as follows:

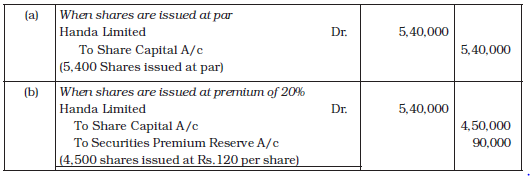

Illustration 9

Jindal and Company purchased a machine from High Life Machine Limited for Rs.3,80,000. As per purchase agreement, Rs. 20,000 were paid in cash and balance by issue of shares of Rs.100 each. What will be the entries passed if the shares are issued :

(a) at par

(b) at 20% premium

Solution

Test your Understanding – II

Choose the correct answer.

(a) Equity shareholders are:

(i) creditors

(ii) owners

(iii) customers of the company

(iv) none of the above

(b) Nominal share capital is :

(i) that part of the authorised capital which is issued by the company.

(ii) the amount of capital which is actually applied for by the prospective shareholders.

(iii) the maximum amount of share capital which a company is authorised to issue.

(iv) the amount actually paid by the shareholders.

(c) Interest on calls in arrears is charged according to “Table F” at :

(i) 10%

(ii) 6%

(iii) 8%

(iv) 11%

(d) Money received in advance from shareholders before it is actually called-up by the directors is :

(i) debited to calls in advance account

(ii) credited to calls in advance account

(iii) debited to calls account

(iv) none of the above

(e) Shares can be forfeited :

(i) for non-payment of call money

(ii) for failure to attend meetings

(iii) for failure to repay the loan to the bank

(iv) for which shares are pledged as a security

(f) The Profit on reissue of forfeited shares is transferred to :

(i) general reserve

(ii) capital redemption reserve

(iii) capital reserve

(iv) reveneue reserve

(g) Balance of share forfeiture account is shown in the balance sheet under the item :

(i) current liabilities and provisions

(ii) reserves and surpluses

(iii) share capital

(iv) unsecured loans

1.7 Forfeiture of Shares

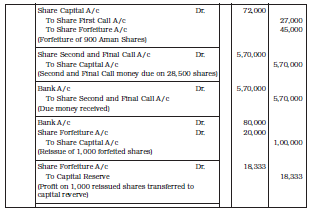

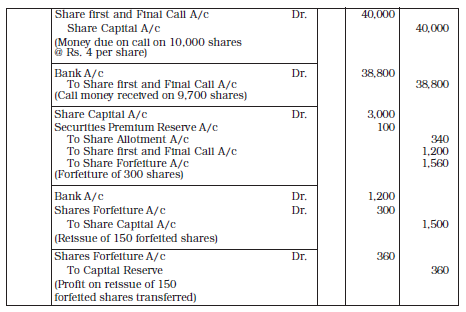

It may happen that some shareholders fail to pay one or more instalments, viz. allotment money and/or call money. In such circumstances, the company can forfeit their shares, i.e. cancel their allotment and treat the amount already received thereon as forfeited to the company within the framework of the provisions in its articles. These provisions are usually based on Table F which authorise the directors to forefeit the shares for non-payment of calls made. For this purpose, they have to strictly follow the procedure laid down in this regard. Following is the accounting treatment of shares issued at par, premium or at a discount. When shares are forefeited all entries relating to the shares forfeited except those relating to premium, already recorded inthe accounting records must be reversed. Accordingly, share capital account is debited with the amount called-up in respect of shares are forfeited and crediting the respective unpaid calls accounts’s or calls in arrears account with the amount already received. Thus, the journal entry will be as follows:

(a) Forfeiture of Shares issued at Par:

Share Capital A/c..........(Called up amount) Dr.

To Share Forfeiture A/c...........(Paid up amount)

To Share Allotment A/c

To Share Calls A/c (individually)

(..... shares forfeited for non-payment of

allotment money and calls made)

It may be noted here that when the shares are forfeited, all entries relating to the forfeited shares must be reversed except the entry relating to share premium received, if any. Accordingly, the share capital is debited to the extent to called-up capital and credited to (i) respective unpaid calls account i.e., calls in arrears and (ii) share forfeiture account with the amount already received on shares.

The balance of shares forfeited account is shown as an addition to the total paid-up capital of the company under the head ‘Share Capital’ under title ‘Equity and Liabilities’ of the Balance Sheet till the forfeited shares are reissued.

Illustration 10

Handa Limited issued 10,000 equity shares of 100 each payable at follows:

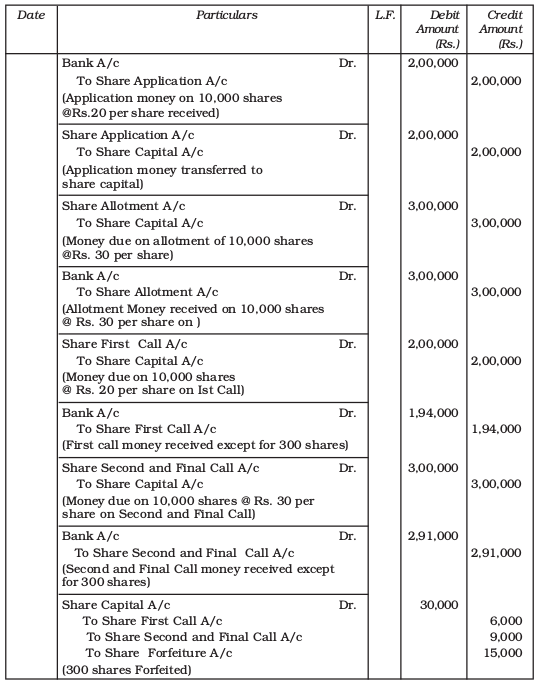

Rs. 20 on application, Rs. 30 on allotment, Rs. 20 on first call and Rs. 30 on second and final call 10,000 shares were applied for and allotment. All money due was received with the exception of both calls on 300 shares held by Supriya. These shares were forfeited. Give necessary journal entries.

Solution

Books of Handa Limited

Journal

Forfeiture of Shares issued at a Premium: Where shares were originally issued at a premium and the premium amount has been fully realised, and later on some share are forfeited due to non-payment of call money, the accounting treatment of forfeiture would be on the same pattern as in the case of shares issued at par. The important point to be noted in this context is that the share premium account is not to be debited at the time of forfeiture if the premium has been received in respect of the forefeited share.

In case, however, if the premium amount has not been received, either wholly or partially, in respect of the shares forfeited, the Share Reserve Premium Account will also be debited with the amount of premium not received along-with the Share Capital Account at the time forfeiture. This will usually be the case when even the amount due on allotment has not been received. Thus, the journal entry to record the forfeiture of shares issued at a premium on which premium has not been fully received, will be :

Share Capital A/c Dr.

Securities Premium Reserve A/c Dr.

To Share Forfeiture A/c

To Share Allotment A/c

and/or

To Share Calls A/c (individually)

(..... shares forefeited for non-payment of

allotment money and calls made)

Note: Where Calls-in-Arrears Account is maintained, Calls-in-Arrears Account is credited and not Share Allotment and/or Share Call/Calls Accounts.

Illustration 11

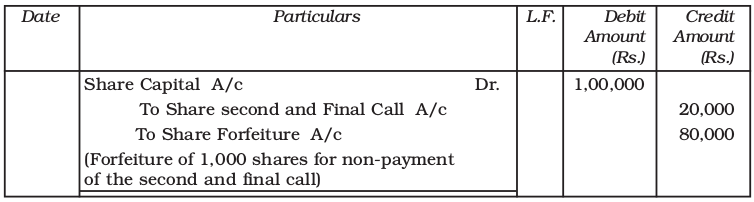

Sahil, a share holder, failed to pay the share second and final call of Rs. 20 on 1,000 shares issued to him at Rs. 120 (face value of Rs. 100 per share). His shares were forfeited after the second and final call. Give the necessary journal entry for forefeiture of the shares.

Solution

Illustration 12

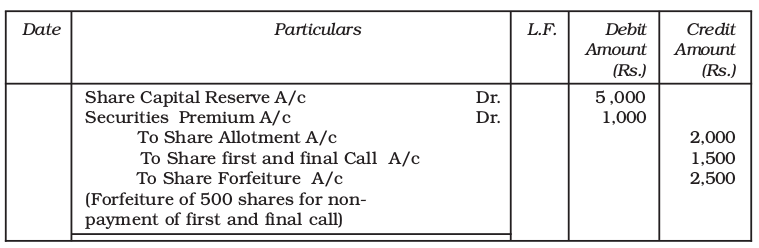

Sunena, a shareholder holding 500 shares of Rs.10 each, did not pay the allotment money of Rs. 4 per share (including a premium of Rs. 2) and the first and final call of Rs. 3. Her shares were forfeited after the first and final call. Give journal entry for forefeiture of the shares.

Solution

Illustration 13

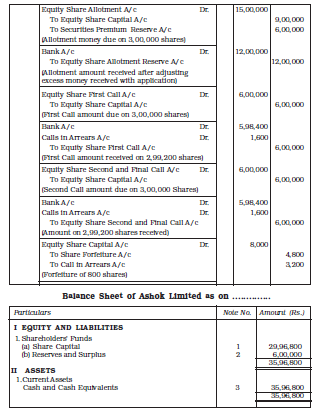

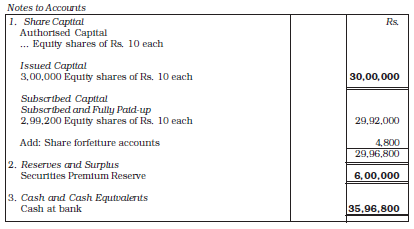

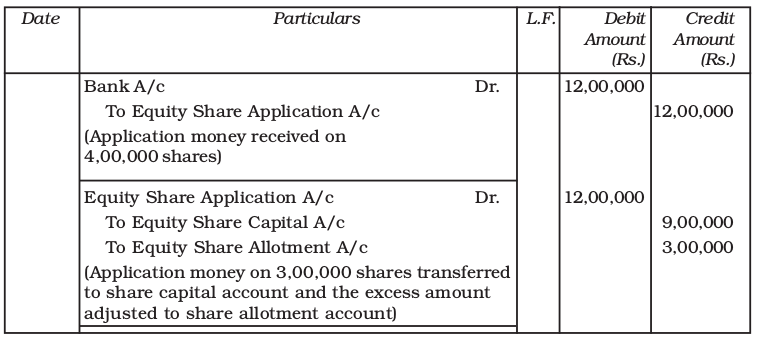

Ashok Limited issued 3,00,000 equity shares of Rs. 10 each at a premium of Rs. 2 per share, payable at Rs. 3 on application, Rs. 5 on allotment (including premium) and the balance in two calls of equal amount.

Applications were received for 4,00,000 shares and pro-rata allotment was made to all the applicants. The excess application money was adjusted towards allotment. Mukesh who was allotted 800 shares failed to pay both the calls and his shares were forfeited after the second call. Record necessary journal entries in the books of Ashok Limited and also show the balance sheet:

Solution

Books of Ashok Limited

Journal

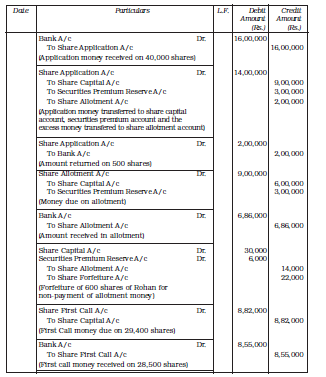

Illustration 14

High Light India Ltd. invited applications for 30,000 Shares of Rs. 100 each at a premium of Rs. 20 per share payable as follows :

On Application Rs. 40 (including Rs.10 premium)

On Allotment Rs. 30 (including Rs.10 premium)

On First Call Rs. 30

On Second & Final Call Rs. 20

Applications were received for 40,000 shares and pro-rata allotment was made on the application for 35,000 share. Excess application money is to be utilised towards allotment.

Rohan to whom 600 Shares allotted failed to pay the allotment money and his shares were forfeited after allotment.

Aman who applied for 1,050 shares failed to pay first call and his share were forfeited after Ist Call.

Second and final call was made. All the money due on IInd call have been received.

Of the shares forfeited, 1,000 share were reissued as fully paid-up for Rs. 80 per share, which included the whole of Aman’s shares.

Record necessary journal entries in the books of High Light India Ltd.

Solution

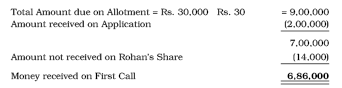

Working Notes :

(I) Excess amount received on Rohan’s application

Rohan has been alloted = 600 Shares

He must have applied for  700 Shares

700 Shares

Amount received from Rohan = 700 × Rs. 40 28,000

Amount Adjusted on Application = 600 × Rs. 40 (24,000)

Amount Adjusted on Allotment 4,000

Money due on Allotment = 600 × Rs. 30 18,000

Money Adjusted (4,000)

Balance due on Allotment 14,000

(II) Amount recieved on allotment

(III) First Call money due on 29,400 shares

(IV) 1000 shares have been reissued including 900 shares of Aman and Balance 100 shares of Rohan

(V) Balance in Share Forfeiture Account of 500 shares

Rs. 22,000/600 x 500

= Rs. 23,334

Do it Yourself

1. A company forfeited 100 equity shares of Rs.10 each issued at a premium of 20% for non-payment of final call of Rs.5 including the premium. Show the journal entry to be passed for forefeiture of shares.

2. A company forfeited 800 equity shares of Rs.10 each issued at a discount of 10% for non-payment of two calls of Rs.2 each. Calculate the amount forfeited by the company and pass the journal entry for forefeiture of the shares.

Illustration 15

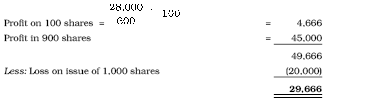

X Ltd. issued for public subscription 40,000 equity shares of Rs. 10 each at premium of Rs. 2 per share payable as under :

On application Rs. 4 per share

On Allotment Rs. 5 per share (including premium)

On Call Rs. 3 per share

Applications were received for 60,000 shares. Allotment was made pro-rata to the applicants for 48,000 shares, the remaining applications being rejected. Money overpaid on application was applied towards sums due on allotment.

Shri Chitnis, to whom 1,600 shares were allotted, failed to pay the allotment money and Shri Jagdale, to whom 2,000 shares were allotted, failed to pay the call money. These shares were subsequently forfeited.

Record journal entries in the books of the company to record the above transactions.

Solution

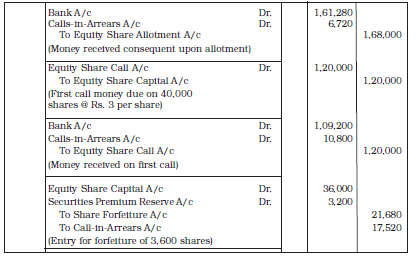

Books of X Ltd.

Journal

Working Notes :

I. Amount received on allotment Rs.

a) Amount due on allotment 2,00,000

40,000 shares × Rs. 5 per share

b) Amount actually due on allotment 2,00,000

Amount due on allotment

Less excess Application amount 32,000

Applied to allotment

Amount actually due 1,68,000

c) Allotment amount due from Chitnis 8,000

Allotment money on Chitnis’s share

1,600 shares × Rs. 5 per share

Less excess application money paid 1,280

Due to pro-rata distribution –

(1,920 shares – 1,600 shares) 320 × 4 6,720

Allotment amount due from Chitnis

According to the ratio of pro-rata distribution (40,000 shares : 48,000 shares), for 1,600 shares to be allotted, Chitnis must have applied for 1,920 shares (1,600 shares × 6/5).

d) Allotment money received 1,68,000

(Amount actually due on Allotment)

Less Amount unpaid by Chitnis (6,720)

Amount received 1,61,280

II. Balance on Shares Forfeited Account

Amount paid by Chitnis :

1,920 Shares applied for × Rs. 4 per share 7,680

Amount paid by Jagdale :

2,000 Shares × (Rs. 4 + Rs. 3) 14,000

Total balance 21,680

Note : Premium amount on Jagdale’s shares will not be taken into account as it has been received in full by the company.

1.7.1 Re-issue of Forfeited Shares

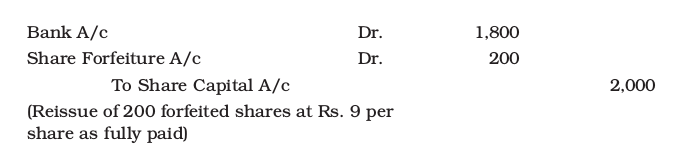

The directors can either cancel or re-issue the forefeited shares. In most cases, however, they reissue special shares which may be at par, at premium or at a discount. Normally, the forfeited shares are reissued as fully paid and at a discount. In this context, it may be noted that the amount of discount allowed cannot exceed the amount that had been received on forfeited shares on their original issue, and that the discount allowed on reissue of forfeited shares should be debited to the ‘Share Forfeited Account’. The balance, if any, left in the Share-Forfeited Account, should be treated as capital profit and transferred to Capital Reserve Account. For example, when a company forfeits 200 shares of Rs. 10 each on which Rs. 600 had been received, it can allow a maximum discount of Rs. 600 on their reissue. Assuming that the company reissues these shares for Rs. 1,800 as fully paid, the necessary journal entry will be:

This shall leave a balance of Rs. 400 in share forfeited account which should be transferred to Capital Reserve Account by recording the following journal entry:

Another important point to be noted in this context is that the capital profit arises only in respect of the forefited share reissued, and not on all forefeited shares. Hence, when a part of the forfeited shares are reissued, the whole balance of Share Forfeited Account cannot be transferred to the capital reserve. In such a situation, it is only the proportionate amount of balance that relates to the forefeited shares reissued which should that relates to the forefeited shares reissued which should be transferred to capital reserve, ensuring that the remaining balance in Share forefeited Account is equal to the amount forefeited on shares not yet reissued.

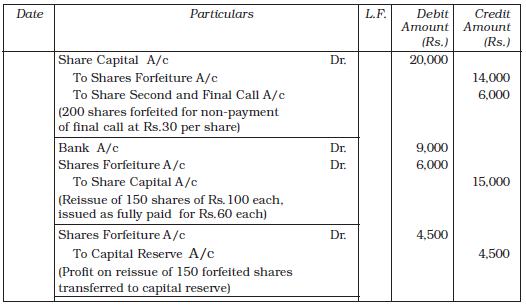

Illustration 16

The director of Poly Plastic Limited resolved that 200 equity shares of Rs.100 each be forfeited for non-payment of the IInd and final call of Rs.30 per share. Out of these, 150 shares were re-issued at Rs.60 per share to Mohit.

Show the necessary journal entries .

Solution

Books of Poly Plastic Limited

Journal

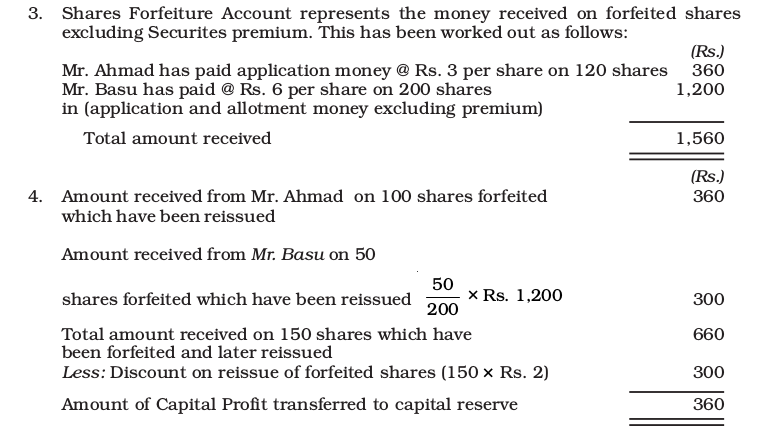

Working Notes :

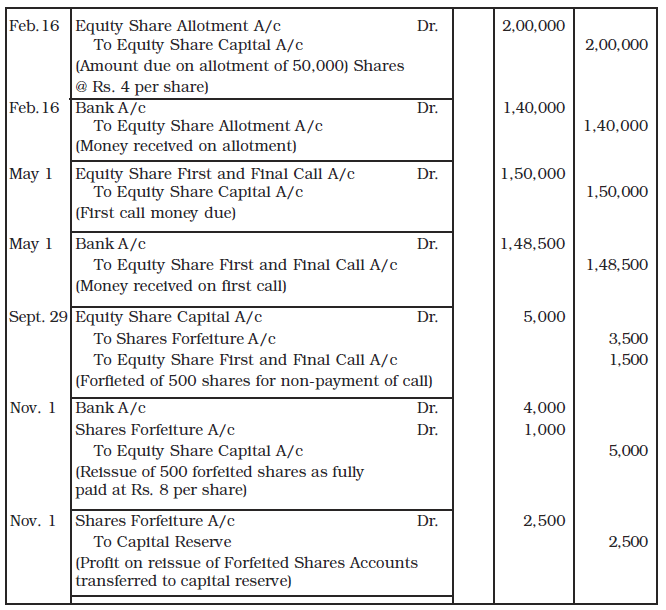

Illustration 17

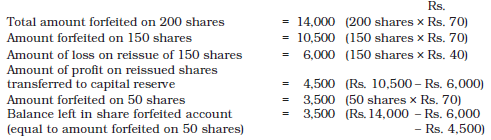

On January 1, 2015, the director of X Ltd. issued for public subscription 50,000 equity shares of Rs. 10 each at Rs. 12 per share payable as to Rs. 5 on application (including premium), Rs. 4 on allotment and the balance on call in May 01, 2015.

The lists were closed on February 10, 2015 by which date applications for 70,000 were received. Of the cash received Rs. 40,000 was returned and Rs.60,000 was applied to the amount due on allotment, the balance of which was paid on February 16, 2015

All the shareholders paid the call due on May 01, 2015 with the exception of an allottee of 500 shares.

These shares were forfeited on September 29, 2015 and reissued us fully paid at Rs. 8 per share on November 01, 2015.

The company, as a matter of policy, does not maintain a Calls-in-Arrears Account.

Give journal entries to record these share capital transactions in the books of X. Ltd.

Solution

Book of X. Ltd.

Journal

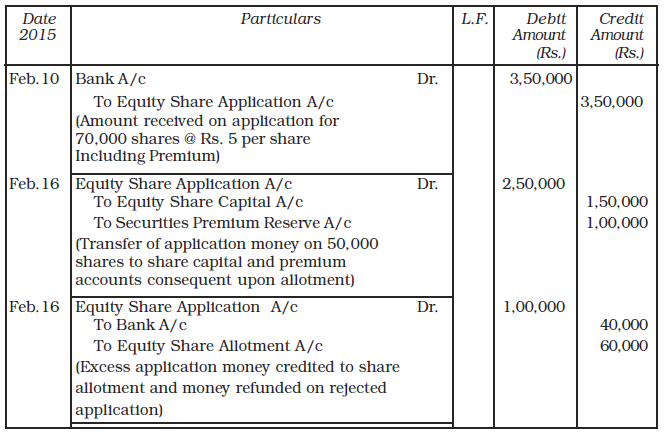

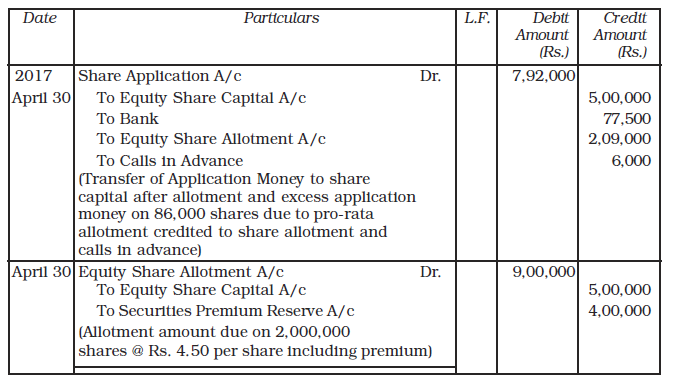

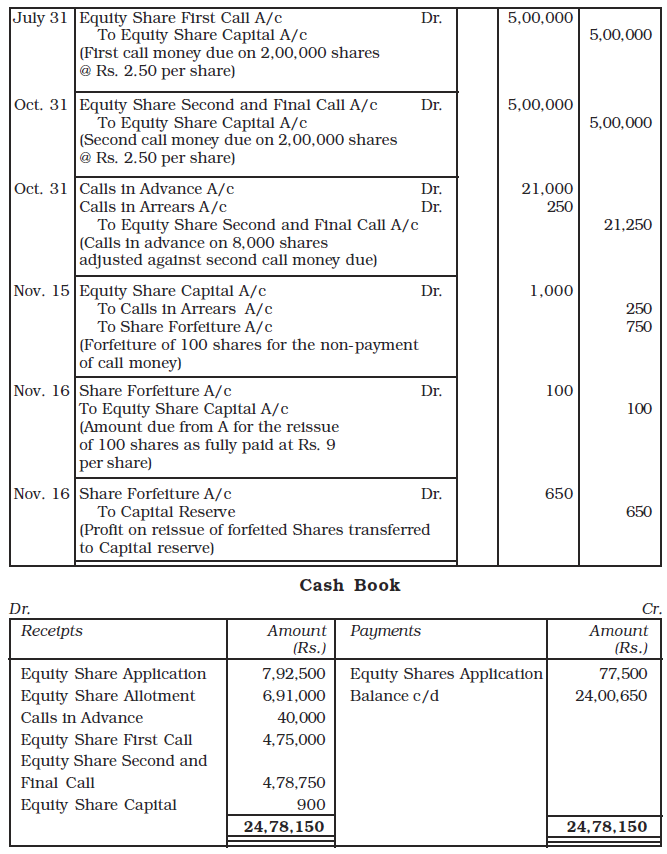

Illustration 18

O Limited issued a prospectus offering 2,00,000 Equity Shares of Rs. 10 each, at a premium of Rs. 2 per share, payable as follows:

On Application Rs. 2.50 per share

On Allotment Rs. 4.50 per share

(including premium)

On First Call (three months from allotment) Rs. 2.50 per share

On Second Call (three months after call) Rs. 2.50 per share

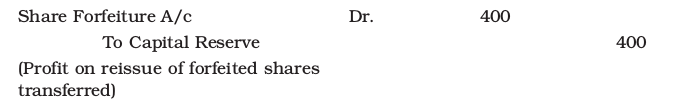

Subscriptions were received for 3,17,000 shares on April 23, 2017 and the allotment made on April 30, was as under :

Shares Allotted

(i) Allotment in full (two applicants paid in 38,000

full on allotment in respect of 4,000 shares each)

(ii) Allotment of two shares for every 1,60,000

three shares applied for

(iii) Allotment of one share for every 2,000

four shares applied for

Cash amounting to Rs. 77,500 (being application money received with applications on 31,000 shares upon which no allotments were made) was returned to applicants on May 6, 2017.

The amounts called from the allottees were received on the due dates with the exception of the final call on 100 shares. These shares were forfeited on November 15, 2017 and reissued to A on November 16 for payment of Rs. 9 per share.

goRecord journal entries other than those relating to cash, in the books of O Limited, and also show how to transactions would appear in the Balance Sheet, assuming that the company paid interest due from it on October 31, 2017.

Solution

Book of O Limited

Journal

* Date column omitted.

Working Notes :

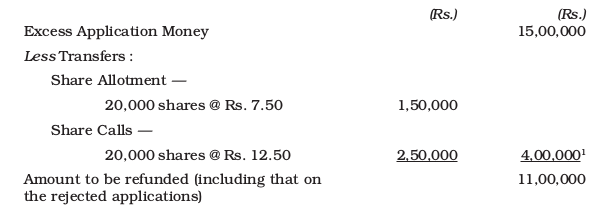

1. Excess Application Money

2. Amount of Calls-in-Advance

As two allotees, each holding 4,000 shares, paid the full amount on allotment, amount of calls-in-advance is thus :

8,000 shares × (Rs. 2.50 + Rs. 2.50) = Rs. 40,000

Buy-Back of Shares : When a company purchased its own shares, it is called ‘Buy-Back of Shares’. Section 68 of the Companies Act, 2013 provides such a facility to the companies and can buy its own shares from either of the following :

(a) Existing equity shareholders on a proportionate basis

(b) Open Market

(c) Odd lot shareholders

(d) Employees of the company

The company can buy back its own shares either from the free reserves, securities premium or from the proceeds of any shares or other specified securities. In case shares are bought back out of free reserves, the company must transfer a sum equal to the nominal value of shares bought back to ‘Capital Redemption Reserve Account’.

The following procedures have been laid down for buy back of shares :

(a) The Articles of the Association must authorise the company for the buy-back of shares.

(b) A special resolution must be passed in the companies’ Annual General Body meeting.

(c) The amount of buy-back of shares should not exceed 25% of the paid-up capital and free reserves.

(d) The debt-equity ratio should not be more than a ratio of 2:1 after the buy-back.

(e) All the shares of buy-back should be fully paid-up.

(f) The buy-back of the shares should be completed within 12 months from the date of passing the special resolution.

(g) The company should file a solvency declaration with the Registrar and SEBI which must be signed by at least two directors of the company.

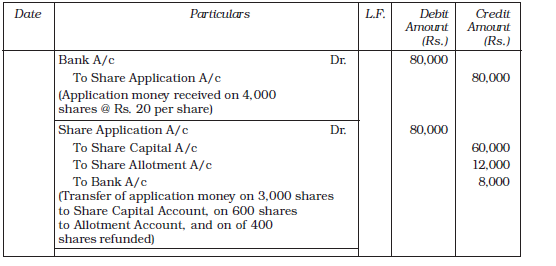

Illustration 19

Garima Limited issued a prospectus inviting applications for 3,000 shares of Rs. 100 each at a premium of Rs.20 payable as follows:

On Application Rs.20 per share

On Allotment Rs.50 per share (Including premium)

On First call Rs.20 per share

On Second call Rs.30 per share

Applications were received for 4,000 shares and allotments made on pro-rata basis to the applicants of 3,600 shares, the remaining applications being rejected, money received on application was adjusted on account of sums due on allotment.

Renuka whom 360 shares were allotted failed to pay allotment money and calls money, and her shares were forfeited.

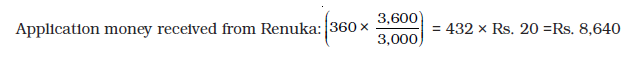

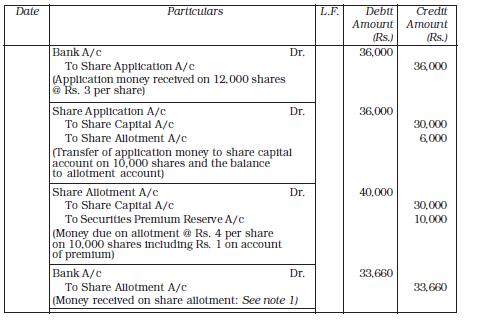

Kanika, the applicant of 200 shares failed to pay the two calls, her shares were also forfeited. All these shares were sold to Naman as fully paid for Rs.80 per share. Show the journal entries in the books of the company.

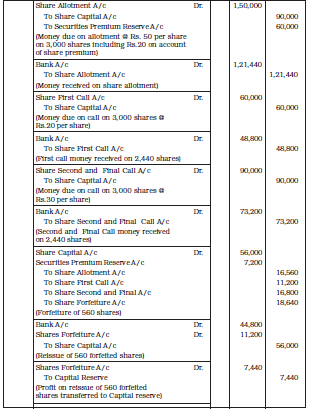

Solution

Books of Garima Limited

Journal

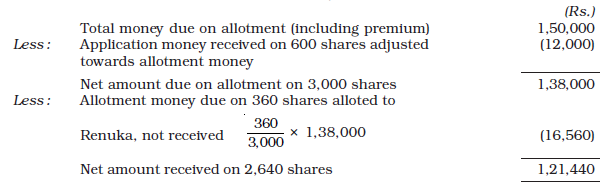

Working Notes :

Amount received on allotment has been calculated as follows:

Since the allotment money which includes securities premium of Rs. 20 per share has not been received. on 360 shares held by Renuka (now forfeited) has been debited to share premium account as per rules.

Amount forefeited has been worked out as follows :-

Application and Allotment money received from Kanika on 200 shares Rs. 10,000

Total amount received on forefeited shares Rs. 18,640

Do it Yourself

Excell Company Limited made an issue of 1,00,000 Equity Shares of Rs.10 each, payable as follows :

On Application Rs.2.50 per share

On Allotment Rs.2.50 per share

On Ist and Final Call Rs.5.00 per share

X, the holder of 400 shares did not pay the call money and his shares were forfeited. Two hundred of the forfeited shares were reissued as fully paid at Rs.8 per share. Draft necessary journal entries and prepare Share Capital and Share Forfeited’ accounts in the books of the company.

Test your Understanding – III

(a) If a Share of Rs. 10 on which Rs. 8 is called-up and Rs. 6 is paid is forfeited. State with what amount the Share Capital account will be debited.

(b) If a Share of Rs. 10 on which Rs. 6 has been paid is forfeited, at what minimum price it can be reissued.

(c) Allhuwalia Ltd. issued 1,000 equity shares of Rs. 100 each as fully paid-up in consideration of the purchase of plant and machinery worth Rs. 1,00,000. What entry will be recorded in company’s journal.

Illustration 20

Sunrise Company Limited offered for public subscription 10,000 shares of Rs.10 each at Rs. 11 per share. Money was payable as follows:

Rs. 3 on application

Rs. 4 on allotment (including premium)

Rs. 4 on first and final call.

Applications were received for 12,000 shares and the directors made pro-rata allotment.

Mr. Ahmad, an applicant for 120 shares, could not pay the allotment and call money, and Mr. Basu, a holder of 200 shares, failed to pay the call. All these shares were forfeited.

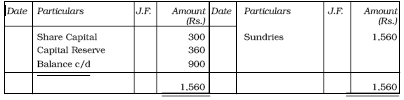

Out of the forfeited shares, 150 shares (the whole of Mr. Ahmad’s shares being included) were issued at Rs. 8 per share. Record journal entries for the above transactions and prepare the share forfeited account.

Solution

Books of Sunrise Company Limited

Journal

Share Forfeiture Account

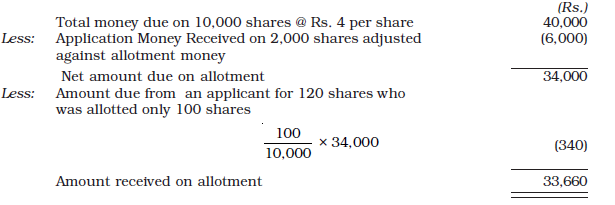

Working Notes :

1. Amount received on allotment has been calculated as follows:

2. Securities Premium Account has been debited only with Rs. 100 relating to 100 shares allotted Mr. Ahmad’s shares from whom the allotment money (including premium) has not been received.

Illustration 21

Devam Limited issued a prospectus inviting application for 30,000 equity shares of Rs.10 each at a premium of Rs. 4 per share payable as follows:

With Application (including premium Rs.1) Rs. 3

On Allotment (including premium Rs.1) Rs. 4

On First call (including premium Rs.1) Rs. 4

On Second and Final call Balance

Applications were received for 45,000 shares. 20% of the applications received were rejected and their application money was refunded. Remaining applicants were allotted shares on pro-rata basis.

Mr. Sudhir, who has applied for 600 shares, failed to pay the allotment money and his shares were forfeited immediately after that.

Ms. Muskan, to whom 750 shares were allotted failed to pay the first call and hence her shares were forfeited.

The forfeited shares of Mr. Sudhir were re-issued to Lakshya for Rs. 8 per share as fully paid up.

Final call was made due on remaining applicants and was received except on 1,000 shares of Amit. These shares were forfeited.

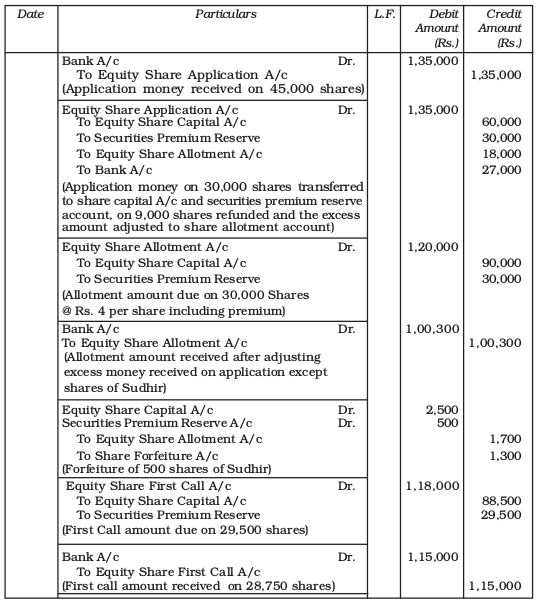

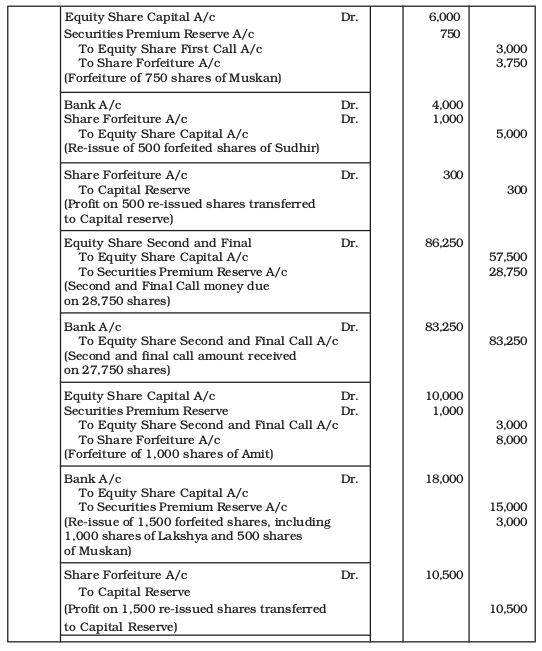

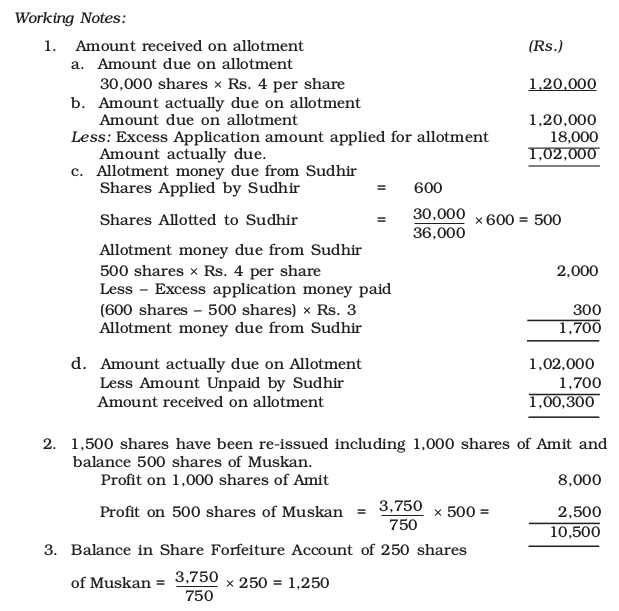

Of the shares forfeited, 1,500 shares were re-issued to Devika for Rs. 12 per share as fully paid up, the whole of Lakshya’s share being included. Record journal entries in the books of the company.

Solution:

Books of Devam Limited

Journal

Do it Yourself

Journalise the following :

(a) The directors of a company forfeited 200 equity shares of Rs. 10 each on which Rs. 800 had been paid. The Shares were re-issued upon payment of Rs. 1,500.

(b) A holds 100 shares of Rs. 10 each on which he has paid Re. 1 per share on application. B holds 200 Shares of Rs. 10 each on which he has paid Re. 1 on application Rs. 2 on allotment. C holds 300 shares of Rs. 10 each who has paid Re. 1 on applications, Rs. 2 on allotment and Rs. 3 on first call. They all failed to pay their arrears and second call of Rs. 4 per share as well. All the shares of A, B and C were forfeited and subsequently reissued at Rs. 11 per share as fully Paid-up.

Terms Introduced in the Chapter

1. Joint Stock Company

2. Share Capital

3. Authorised Capital

4. Issued Capital

5. Unissued Capital

6. Subscribed Capital

7. Subscribed and fully paid-up

8. Subscribed but not fully paid up

9. Paid-up Capital

10. Reserve Capital

11. Shares

12. Preference Shares

13. Non-redeemable Preference Shares

14. Equity Shares

15. Issue of Shares for Consideration

Other than Cash

16. Premium on Shares

17. Application Money

18. Minimum Subscription

19. Calls on Shares

20. Calls in Arrears

21. Calls in Advance

22. Over subscription

23. Under subscription

24. Forfeiture of Shares

25. Reissue of forfeited shares

26. Buy-back of Shares

Summary

Company: An organisation consisting of individuals called ‘shareholders’ by virtue of their holding the shares of a company, who can act as one legal person as regards its business through an elected board of directors.

Share: Fractional part of the capital, and forms the basis of ownership in a company; shares are generally of two types, viz. equity shares and preference shares, according to the provisions of The Companies Act, 1956. Preference shares again are of different types based on varying shades of rights attached to them.

Share Capital of a company is collected by issuing shares to either a select group of persons through the route of private placements and/or offered to the public for subscription. Thus, the issue of shares is basic to the capital of a company. Shares are issued either for cash or for consideration other than cash, the former being more common. Shares are said to be issued for consideration other than cash when a company purchases business, or some asset/assets, and the vendors have agreed to receive payment in the form of fully paid shares of a company.

Stages of Share Issue: The issue of shares for cash is required to be made in strict conformity with the procedure laid down by law for the same. When shares are issued for cash, the amount on them can be collected at one or more of the following stages:

(i) Application for shares

(ii) Allotment of shares

(iii) Call/Calls on shares.

Calls in arrears: Sometimes, the full amount called on allotment and/or call (calls) is not received from the allottees/shareholders. The amount not so received are cumulatively called ‘Unpaid calls’ or ‘Calls-in-Arrears’. However, it is not mandatory for a company to maintain a separate Calls-in-

Arrears Account. There are also instances where some shareholders consider it descreet to pay a part or whole of the amount not yet called-up on the shares allotted to them. Any amount paid by a shareholder in the excess of the amount due from him on allotment/call (calls) is known as ‘Calls-in-Advance’ for which a separate account is maintained. A company has the power to charge interest on calls-in-arrears and is under an obligation to pay interest on calls-in-advance if it accepts them in accordance with the provisions of Articles of Association.

Over Subscription: It is possible for the shares of some companies to be over

subscribed which means that applications for more shares are received than the number offered for subscription.

If the amount of minimum subscription is not received to the extent of 90%, the issue devolves. In case the applications received are less than the number of shares offered to the public, the issue is termed as ‘under subscribed’.

Issue of Shares at Premium: Irrespective of the fact that shares have been issued for consideration other than cash, they can be issued either at par or at premium. The issue of shares at par implies that the shares have been issued for an amount exactly equal to their face or nominal value. In case shares are issued at a premium, i.e. at an amount more than the nominal or par value of shares, the amount of premium is credited to a separate account called ‘Securities Premium Reserve Account’, the use of which is strictly regulated by law.

Issue of Shares at Discount: Shares can as well be issued at a discount, i.e. on an amount less than the nominal or par value of shares provided the company fully complies with the provisions laid down by law with regard to the same. Apart from such compliance, shares of a company cannot ordinarily be issued at a discount. When shares are issued at a discount.According to the Companies Act, 2013, only sweat equity shares can be issued at a discount.When shares are issued at a discount, the amount of discount is debited to ‘Discount on Issue of Share Account’, which is in the nature of capital loss for the company.

Forfeiture of Shares: Sometimes, shareholders fail to pay one or more instalments on shares allotted to them. In such a case, the company has the authority to forfeit shares of the defaulters. This is called ‘Forfeiture of Shares’. Forfeiture means the cancellation of allotment due to breach of contract and to treat the amount already received on such shares as forfeited to the company. The precise accounting treatment of share forfeiture depends upon the conditions on which the shares have been issued — at par, premium or discount. Generally speaking, accounting treatment on forfeiture is to reverse the entries passed till the stage of forfeiture, the amount already received on the shares being credited to Forfeited Shares Account.

Re-issue of Shares: The management of a company is vested with the power to reissue the shares once forfeited by it, subject of course, to the terms and conditions in the articles of association relating to the same. The shares can be reissued even at a discount provided the amount of discount allowed does not exceed the credit balance of forfeited shares’ account relating to shares being reissued. Therefore, discount allowed on the reissue of forfeited shares is debited to forfeited shares’ account.

Once all the forfeited shares have been reissued, any credit balance on forfeited shares’ account is transferred to Capital Reserve representing profit on forfeiture of shares. In the event of all forfeited share not being reissued, the credit amount on forfeited shares’ account relating to shares yet to be reissued is carried forward and the remaining balance on the account only is credited to capital reserve account.

Question for Practice

Short Answer Questions

1. What is public company?

2. What is a private company.

3. When can shares be Forfeited?

4. What is meant by Calls in Arrears?

5. What do you mean by a listed company?

6. What are the uses of securities premium?

7. What is meant by Calls in Advance?

8. Write a brief note on “Minimum Subscription”.

Long Answer Questions

1. What is meant by the word ‘Company’? Describe its characteristics.

2. Explain in brief the main categories in which the share capital of a company is divided.

3. What do you mean by the term ‘share’? Discuss the type of shares, which can be issued under the Companies Act, 2013 as amended to date.

4. Discuss the process for the allotment of shares of a company in case of over subscription.

5. What is a ‘Preference Share’? Describe the different types of preference shares.

6. Describe the provisions of law relating to ‘Calls-in-Arrears’ and ‘Calls-in-Advance’.

7. Explain the terms ‘Over-subscription’ and ‘Under-subscription’. How are they dealt with in accounting records?

8. Describe the purposes for which a company can use ‘Securities Premium.

9. State clearly the conditions under which a company can issue shares at a discount.

10. Explain the term ‘Forfeiture of Shares’ and give the accounting treatment on forfeiture.

Numerical Questions

1. Anish Limited issued 30,000 equity shares of Rs.100 each payable at Rs.30 on application, Rs.50 on allotment and Rs.20 on Ist and final call. All money was duly received.

Record these transactions in the journal of the company.

2. The Adersh Control Device Ltd was registered with the authorised capital of Rs.3,00,000 divided into 30,000 shares of Rs.10 each, which were offered to the public. Amount payable as Rs.3 per share on application, Rs.4 per share on allotment and Rs.3 per share on first and final call. These share were fully subscribed and all money was dully received. Prepare journal and Cash Book.