Table of Contents

Learning Objectives

After studying this chapter, you will be able to :

• explain the nature and significance of financial analysis;

• identify the objectives of financial analysis;

• describe the various tools of financial analysis;

• state the limitations of financial analysis;

• prepare comparative and commonsize statements and interpret the data given therein; and

• calculate the trend percentages and interpret them.

You have learnt about the financial statements (Income Statement and Balance Sheet) of companies. Basically, these are summarised financial reports which provide the operating results and financial position of companies, and the detailed information contained therein is useful for assessing the operational efficiency and financial soundness of a company. This requires proper analysis and interpretation of such information for which a number of techniques (tools) have been developed by financial experts. In this chapter we will have an overview of these techniques.

4.1 Meaning of Analysis of Financial Statements

The process of critical evaluation of the financial information contained in the financial statements in order to understand and make decisions regarding the operations of the firm is called ‘Financial Statement Analysis’. It is basically a study of relationship among various financial facts and figures as given in a set of financial statements, and the interpretation thereof to gain an insight into the profitability and operational efficiency of the firm to assess its financial health and future prospects.

The term ‘financial analysis’ includes both ‘analysis and interpretation’. The term analysis means simplification of financial data by methodical classification given in the financial statements. Interpretation means explaining the meaning and significance of the data. These two are complimentary to each other. Analysis is useless without interpretation, and interpretation without analysis is difficult or even impossible.

Financial statement analysis is very aptly defined by Bernstein as, “a judgemental process which aims to estimate current and past financial positions and the results of the operation of an enterprise, with primary objective of determining the best possible estimates and predictions about the future conditions.” It essentially involves regrouping and analysis of information provided by financial statements to establish relationships and throw light on the points of strengths and weaknesses of a business enterprise, which can be useful in decision-making involving comparison with other firms (cross sectional analysis) and with firms’ own performance, over a time period (time series analysis).

4.2 Significance of Financial Analysis

Financial analysis is the process of identifying the financial strengths and weaknesses of the firm by properly establishing relationships between the various items of the balance sheet and the profit and loss account. Financial analysis can be undertaken by management of the firm, or by parties outside the firm, viz. owners, trade creditors, lenders, investors, labour unions, analysts and others. The nature of analysis will differ depending on the purpose of the analyst. A technique frequently used by an analyst need not necessarily serve the purpose of other analysts because of the difference in the interests of the analysts. Financial analysis is useful and significant to different users in the following ways:

(a) Finance manager: Financial analysis focusses on the facts and relationships related to managerial performance, corporate efficiency, financial strengths and weaknesses and creditworthiness of the company. A finance manager must be well-equipped with the different tools of analysis to make rational decisions for the firm. The tools for analysis help in studying accounting data so as to determine the continuity of the operating policies, investment value of the business, credit ratings and testing the efficiency of operations. The techniques are equally important in the area of financial control, enabling the finance manager to make constant reviews of the actual financial operations of the firm to analyse the causes of major deviations, which may help in corrective action wherever indicated.

(b) Top management: The importance of financial analysis is not limited to the finance manager alone. Its scope of importance is quite broad which includes top management in general and the other functional managers. Management of the firm would be interested in every aspect of the financial analysis. It is their overall responsibility to see that the resources of the firm are used most efficiently, and that the firm’s financial condition is sound. Financial analysis helps the management in measuring the success or otherwise of the company’s operations, appraising the individual’s performance and evaluating the system of internal control.

(c) Trade creditors: A trade creditor, through an analysis of financial statements, appraises not only the urgent ability of the company to meet its obligations, but also judges the probability of its continued ability to meet all its financial obligations in future. Trade creditors are particularly interested in the firm’s ability to meet their claims over a very short period of time. Their analysis will, therefore, confine to the evaluation of the firm’s liquidity position.

(d) Lenders: Suppliers of long-term debt are concerned with the firm’s long-term solvency and survival. They analyse the firm’s profitability overtime, its ability to generate cash to be able to pay interest and repay the principal and the relationship between various sources of funds (capital structure relationships). Long-term tenders do analyse the historical financial statements. But they place more emphasis on the firm’s projected financial statements to make analysis about its future solvency and profitability.

(e) Investors: Investors, who have invested their money in the firm’s shares, are interested about the firm’s earnings. As such, they concentrate on the analysis of the firm’s present and future profitability. They are also interested in the firm’s capital structure to ascertain its influences on firm’s earning and risk. They also evaluate the efficiency of the management and determine whether a change is needed or not. However, in some large companies, the shareholders’ interest is limited to decide whether to buy, sell or hold the shares.

(f) Labour unions: Labour unions analyse the financial statements to assess whether it can presently afford a wage increase and whether it can absorb a wage increase through increased productivity or by raising the prices.

(g) Others: The economists, researchers, etc. analyse the financial statements to study the present business and economic conditions. The government agencies need it for price regulations, taxation and other similar purposes.

4.3 Objectives of Financial Analysis

Analysis of financial statements reveals important facts concerning managerial performance and the efficiency of the firm. Broadly speaking, the objectives of the analysis are to apprehend the information contained in financial statements with a view to know the weaknesses and strengths of the firm and to make a forecast about the future prospects of the firm thereby, enabling the analysts to take decisions regarding the operation of, and further investment in, the firm. To be more specific, the analysis is undertaken to serve the following purposes (objectives):

• to assess the current profitability and operational efficiency of the firm as a whole as well as its different departments so as to judge the financial health of the firm.

• to ascertain the relative importance of different components of the financial position of the firm.

• to identify the reasons for change in the profitability/financial position of the firm.

• to judge the ability of the firm to repay its debt and assessing the short-term as well as the long-term liquidity position of the firm.

Through the analysis of financial statements of various firms, an economist can judge the extent of concentration of economic power and pitfalls in the financial policies pursued. The analysis also provides the basis for many governmental actions relating to licensing, controls, fixing of prices, ceiling on profits, dividend freeze, tax subsidy and other concessions to the corporate sector.

4.4 Tools of Financial Analysis

The most commonly used techniques of financial analysis are as follows:

2. Common Size Statements: These are the statements which indicate the relationship of different items of a financial statement with some common item by expressing each item as a percentage of the common item. The percentage thus calculated can be easily compared with the results corresponding percentages of the previous year or of some other firms, as the numbers are brought to common base. Such statements also allow an analyst to compare the operating and financing characteristics of two companies of different sizes in the same industry. Thus, common-size statements are useful, both, in intra-firm comparisons over different years and also in making inter-firm comparisons for the same year or for several years. This analysis is also known as ‘Vertical analysis’.

3. Trend Analysis: It is a technique of studying the operational results and financial position over a series of years. Using the previous years’ data of a business enterprise, trend analysis can be done to observe the percentage changes over time in the selected data. The trend percentage is the percentage relationship, in which each item of different years bear to the same item in the base year. Trend analysis is important because, with its long run view, it may point to basic changes in the nature of the business. By looking at a trend in a particular ratio, one may find whether the ratio is falling, rising or remaining relatively constant. From this observation, a problem is detected or the sign of good or poor management is detected.

4. Ratio Analysis: It describes the significant relationship which exists between various items of a balance sheet and a profit and loss account of a firm. As a technique of financial analysis, accounting ratios measure the comparative significance of the individual items of the income and position statements. It is possible to assess the profitability, solvency and efficiency of an enterprise through the technique of ratio analysis.

5. Cash Flow Analysis: It refers to the analysis of actual movement of cash into and out of an organisation. The flow of cash into the business is called as cash inflow or positive cash flow and the flow of cash out of the firm is called as cash outflow or a negative cash flow. The difference between the inflow and outflow of cash is the net cash flow. Cash flow statement is prepared to project the manner in which the cash has been received and has been utilised during an accounting year as it shows the sources of cash receipts and also the purposes for which payments are made. Thus, it summarises the causes for the changes in cash position of a business enterprise between dates of two balance sheets.

In this chapter, we shall have a brief idea about the first three techniques, viz. comparative statements common size statements and trend analysis. The ratio analysis and cash flow analysis is covered in detail in chapters 5 and 6 respectively.

Test your Understanding – I

Fill in the blanks with appropriate word(s),

1. Analysis simply means—————data.

2. Interpretation means —————data.

3. Comparative analysis is also known as ———————— analysis.

4. Common size analysis is also known as ———————— analysis.

5. The analysis of actual movement of money inflow and outflow in an organisation is called——————— analysis.

4.5 Comparative Statements

As stated earlier, these statements refer to the Profit and Loss Account and Balance Sheet prepared by providing columns for the figures for both the current year as well as for the previous year and for the changes during the year, both in absolute and relative terms. As a result, it is possible to find out not only the balances of account as on different dates and summaries of different operational activities of different periods, but also the extent of their increase or decrease between these dates. The figures in the comparative statements can be used for identifying the direction of changes and also the trends in different indicators of performance of an organisation.

The following steps may be followed to prepare the comparative statements:

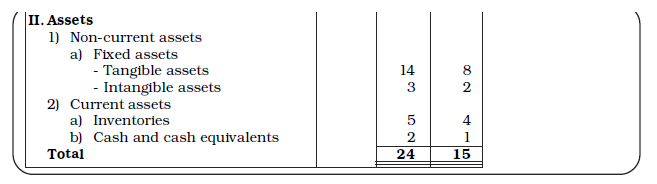

Step 1 : List out absolute figures in rupees relating to two points of time (as shown in columns 2 and 3 of Figure 4.1.).

Step 2 : Find out change in absolute figures by subtracting the first year (Col.2) from the second year (Col.3) and indicate the change as increase (+) or decrease (–) and put it in column 4.

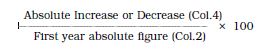

Step 3 : Preferably, also calculate the percentage change as follows and put it in Column 5.

| Particulars | First Year | Second Year | Absolute Increase (+) or Decrease (–) | Percentage Increase (+) or Decrease (–) |

| Column 1 | 2 | 3 | 4 | 5 |

| Rs. | Rs. | Rs. | %. | |

Exhibit 4.1

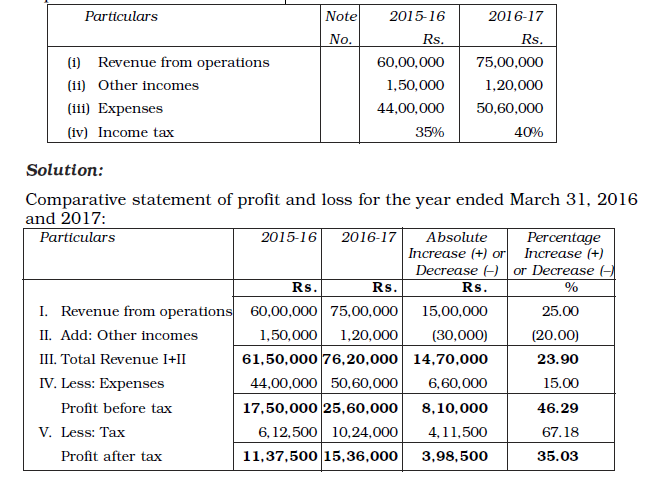

Illustration 1

Convert the following statement of profit and loss into the comparative statement of profit and loss of BCR Co. Ltd.:

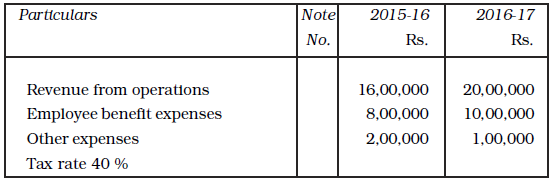

Illustration 2

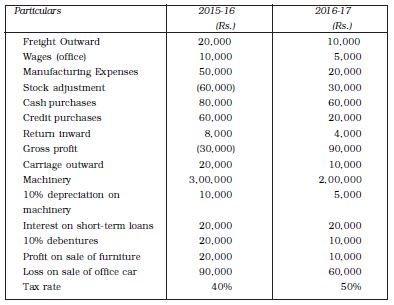

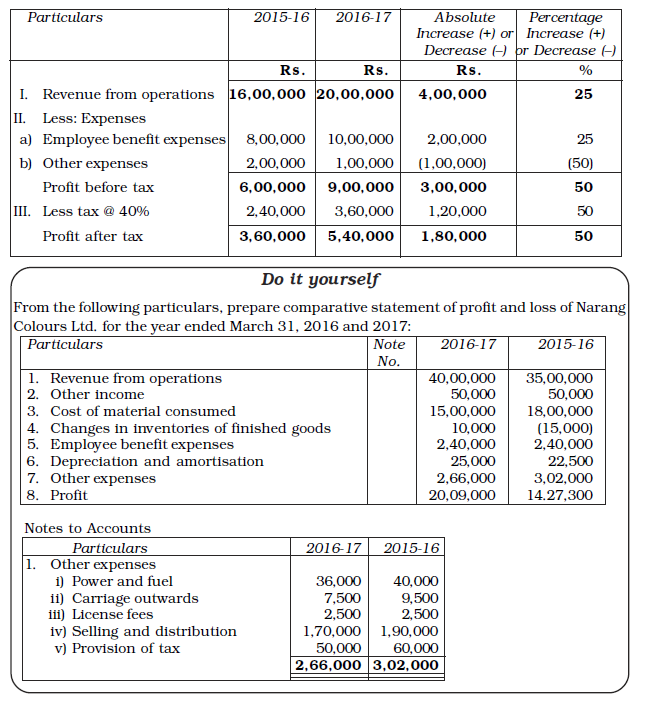

From the following statement of profit and loss of Madhu Co. Ltd., prepare comparative statement of profit and loss for the year ended March 31, 2016 and 2017:

Solution:

Comparative statement of profit and loss of Madhu Co. Limited

for the year ended March 31, 2016 and 2017:

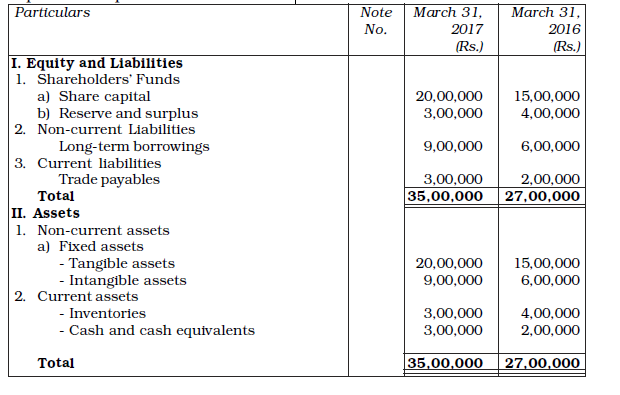

Illustration 3

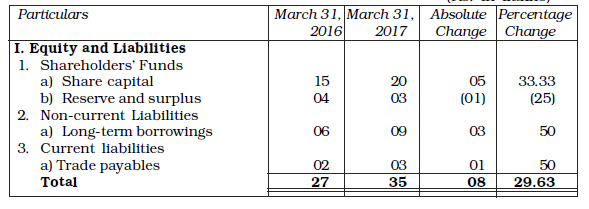

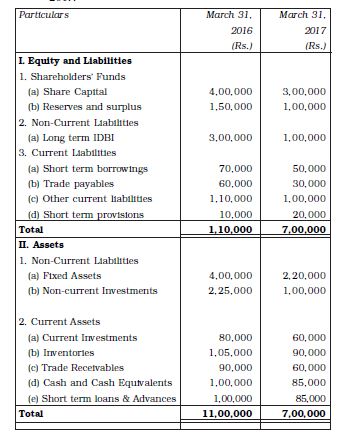

The following are the Balance Sheets of J. Ltd. as at March 31, 2016 and 2017. Prepare a Comparative balance sheet.

Solution

Comparative Balance Sheet of J. Limited

as at March 31, 2016 and March 2017:

(Rs in Lakhs)

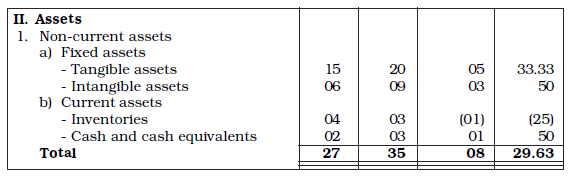

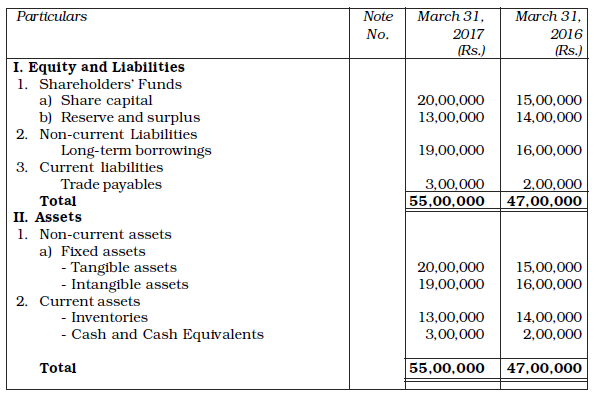

Illustration 4

From the following Balance Sheets of Amrit Limited as at March 31, 2016 and 2017, prepare a comparative balance sheet:

Solution

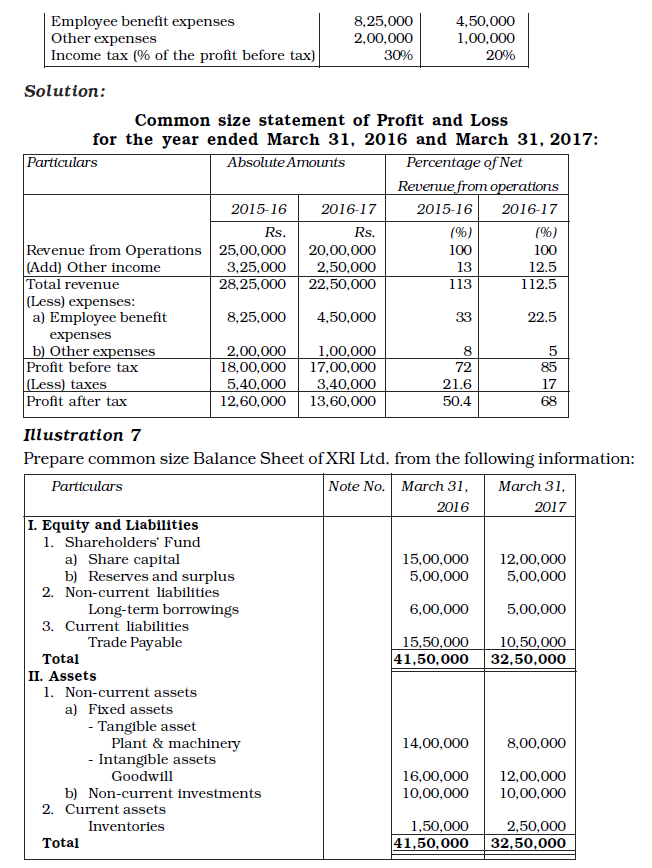

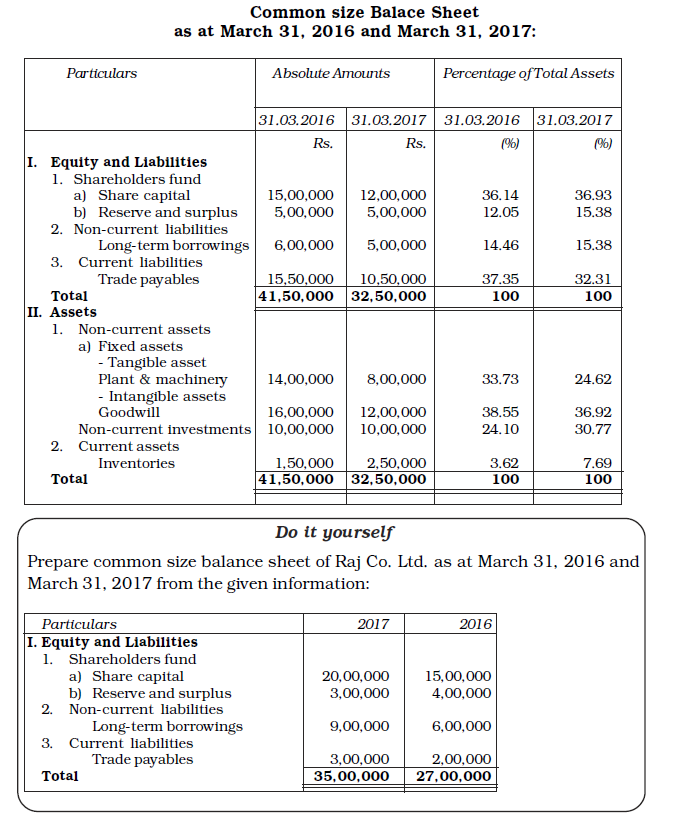

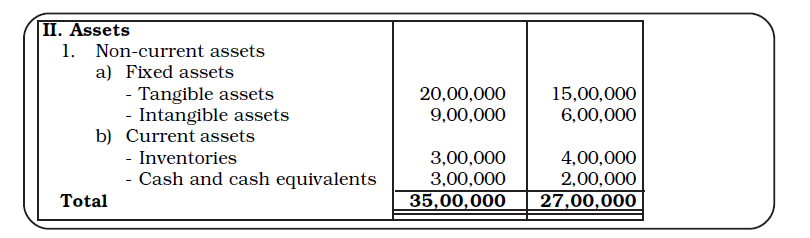

4.6 Common Size Statement

Common Size Statement, also known as component percentage statement, is a financial tool for studying the key changes and trends in the financial position and operational result of a company. Here, each item in the statement is stated as a percentage of the aggregate, of which that item is a part. For example, a common size balance sheet shows the percentage of each asset to the total assets, and that of each liability to the total liabilities. Similarly, in the common size statement of profit and loss, the items of expenditure are shown as a percentage of the net revenue from operations. If such a statement is prepared for successive periods, it shows the changes of the respective percentages over a period of time.

Common size analysis is of immense use for comparing enterprises which differ substantially in size as it provides an insight into the structure of financial statements. Inter-firm comparison or comparison of the company’s position with the related industry as a whole is possible with the help of common size statement analysis.

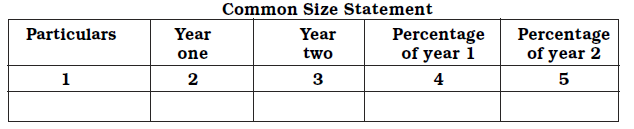

The following procedure may be adopted for preparing the common size statements.

1. List out absolute figures in rupees at two points of time, say year 1, and year 2 (Column 2 & 4 of Exhibit 4.2).

2. Choose a common base (as 100). For example, revenue from operations may be taken as base (100) in case of statement of profit and loss and total assets or total liabilities (100) in case of balance sheet.

3. For all items of Col. 2 and 3 work out the percentage of that total. Column 4 and 5 shows these percentages in Exhibit 4.2.

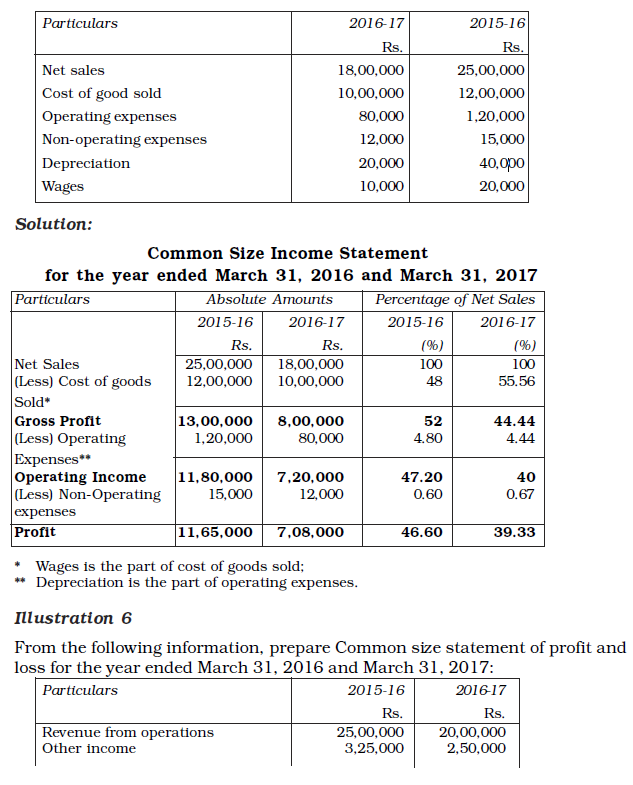

Illustration 5

From the following information, prepare a Common size Income Statement for the year ended March 31, 2016 and March 31, 2017:

Test your Understanding – III

Choose the right answer :

1. The financial statements of a business enterprise include:

(a) Balance sheet

(b) Statement of Profit and loss account

(c) Cash flow statement

(d) All the above

2. The most commonly used tools for financial analysis are:

(a) Horizontal analysis

(b) Vertical analysis

(c) Ratio analysis

(d) All the above

3. An Annual Report is issued by a company to its:

(a) Directors

(b) Auditors

(c) Shareholders

(d) Management

4. Balance Sheet provides information about financial position of the enterprise:

(a) At a point in time

(b) Over a period of time

(c) For a period of time

(d) None of the above

5. Comparative statements are also known as:

(a) Dynamic analysis

(b) Horizontal analysis

(c) Vertical analysis

(d) External analysis

Test your Understanding – III

4.7 Limitations of Financial Analysis

Though financial analysis is quite helpful in determining financial strengths and weaknesses of a firm, it is based on the information available in financial statements. As such, the financial analysis also suffers from various limitations of financial statements. Hence, the analyst must be conscious of the impact of price level changes, window dressing of financial statements, changes in accounting policies of a firm, accounting concepts and conventions, personal judgement, etc. Some other limitations of financial analysis are:

1. Financial analysis does not consider price level changes.

2. Financial analysis may be misleading without the knowledge of the changes in accounting procedure followed by a firm.

3. Financial analysis is just a study of reports of the company.

4. Monetary information alone is considered in financial analysis while non-monetary aspects are ignored.

5. The financial statements are prepared on the basis of accounting concept, as such, it does not reflect the current position.

Terms Introduced in the Chapter

1. Financial Analysis

2. Common Size Statements

3. Comparative Statements

4. Trend Analysis

5. Ratio Analysis

6. Cash Flow Statement

7. Intra Firm Comparison

8. Inter Firm Comparison

9. Horizontal Analysis

10. Vertical Analysis

Summary

Major Parts of an Annual Report

An annual report contains basic financial statements, viz. Balance Sheet, Profit and Loss Account and Cash Flow Statement. It also carries management’s discussion of corporate performance of the year under review and peeps into the future prospects.

Tools of Financial Analysis

Commonly used tools of financial analysis are: Comparative statements, Common size statement, trend analysis, ratio analysis, funds flow analysis and cash flow analysis.

Comparative Statement

Comparative statement captures changes in all items of financial statements in absolute and percentage terms over a period of time for a firm or between two firms.

Common Size Statement

Common size statements expresses all items of a financial statements as a percentage of some common base such as sales for profit and loss account and total assets for balance sheet.

Question for Practice

A. Short Answer Questions

1. List the techniques of Financial Statement Analysis.

2. Distinguish between Vertical and Horizontal Analysis of financial data.

3. Explain the meaning of Analysis and Interpretation.

4. Bring out the importance of Financial Analysis?

5. What are Comparative Financial Statements.

6. What do you mean by Common Size Statements?

B. Long Answer Questions

1. Describe the different techniques of financial analysis and explain the limitations of financial analysis.

2. Explain the usefulness of trend percentages in interpretation of financial performance of a company.

3. What is the importance of comparative statements? Illustrate your answer with particular reference to comparative income statement.

4. What do you understand by analysis and interpretation of financial statements? Discuss their importance.

5. Explain how common size statements are prepared giving an example.

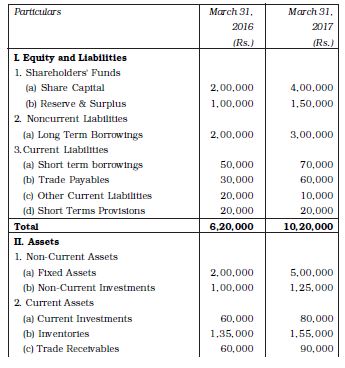

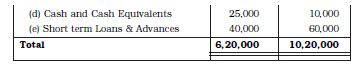

Numerical Questions

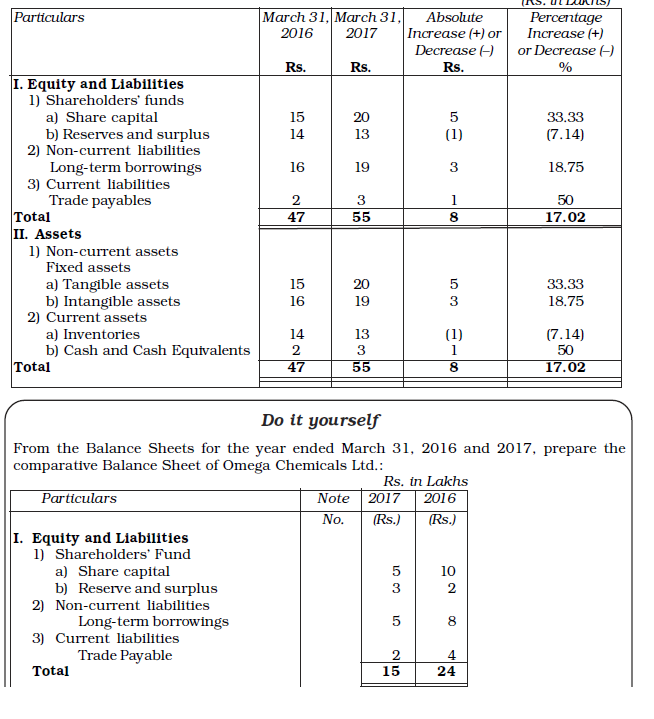

1. Following are the balance sheets of Alpha Ltd., as at March 31, 2016 and 2017:

You are required to prepare a Comparative Balance Sheet.

2. Following are the balance sheets of Beta Ltd. at March 31, 2016 and 2017:

Prepare comparative Balance Sheet.

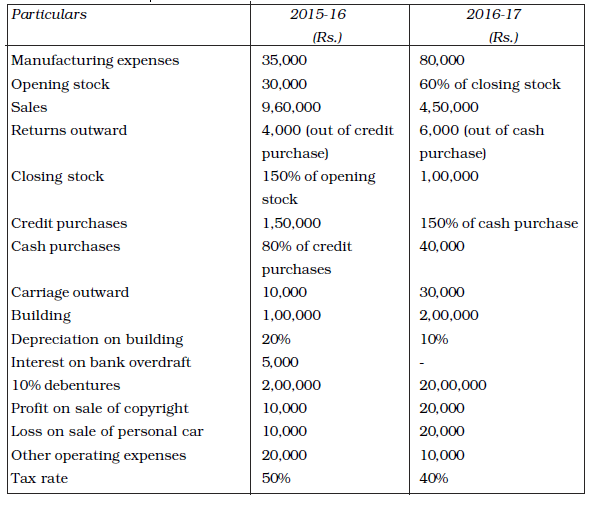

3. Prepare Comparative Statement of profit and loss from the following information:

4. Prepare Comparative Statement of Profit and Loss from the following information:

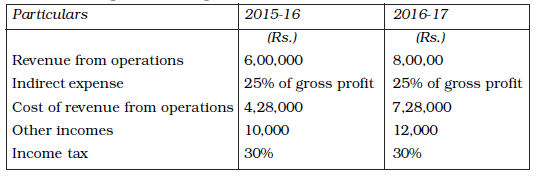

5. Prepare a Common size statement of profit and loss of Shefali Ltd. with the help of following information:

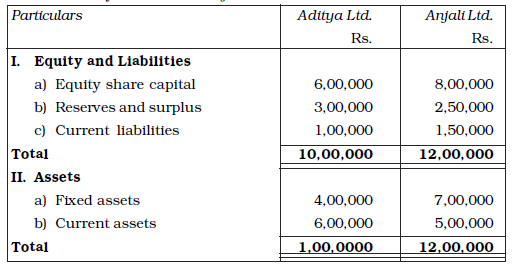

6. Prepare a Common Size balance sheet from the following balance sheet of Aditya Ltd., and Anjali Ltd.:

Answers to Test your Understanding

Test your Understanding – I

1. Simplifying 2. explaining the impact of 3. horizontal 4. vertical 5. cash flow.

Test your Understanding – II

1 (d) 2 (d) 3 (c) 4 (a) 5 (b)

Test your Understanding – III

(a) True (b) True (c) True (d) True (e) True (f) False (g) True (h) True (i) True (j) True