Table of Contents

CHAPTER 10

FINANCIAL MARKETS

Learning Objectives

After studying this chapter, you should be able to:

- explain the meaning of Financial Market;

- explain the meaning of Money Market and describe its major Instruments;

- explain the nature and types of Capital Market;

- distinguish between Money Market and Capital Market;

- explain the meaning and functions of Stock Exchange;

- describe the functioning of NSEI and OTCEI; and

- describe the role of SEBI in investor protection.

Sensex- The Bombay Stock Exchange Sensitive Index

Have you counted the number of times newspaper headlines in the past few weeks have been discussing the SENSEX? It goes up and down all the time and seems to be very important part of buisness and economic news. Has that made you wonder what the SENSEX actually is?

The SENSEX is the benchmark index of the BSE. Since the BSE has been the leading exchange of the Indian secondary market, the SENSEX has been an important indicator of the Indian stock market. It is the most frequently used indicator while reporting on the state of the market. An index has just one job: to capture the price movement. So a stock index will reflect the price movements of the shares while a bond index captures the manner in which bond prices go up or down. If the SENSEX rises, it indicates the market is doing well. Since stocks are supposed to reflect what companies expect to earn in the future, a rising index indicates that investors expect better earnings from companies. It is also a measure of the state of the Indian economy. If Indian companies are expected to do well, obviously the economy should do well too.

The SENSEX, launched in 1986 is made upto of 30 of the most actively traded stocks in the market. In fact, they account for half the BSE's market capitalisation. They represent 13 sectors of the company and are leaders in their respective industries.

INTRODUCTION

You all know that a business needs finance from the time an entrepreneur makes the decision to start it. It needs finance both for working capital requirements such as payments for raw materials and salaries to its employees, and fixed capital expenditure such as the purchase of machinery or building or to expand its production capacity. The above example gives a fair picture of how companies need to raise funds from the capital markets. Idea Cellular decided to enter the Indian capital market for its needs of expansion. In this chapter you will study concepts like private placement, Initial public Offer (IPO) and capital markets which you come across in the example of Idea Cellular. Business can raise these funds from various sources and in different ways through financial markets. This chapter provides a brief description of the mechanism through which finances are mobilised by a business organisation for both short term and long term requirements. It also explains the institutional structure and the regulatory measures for different financial markets.

CONCEPT OF FINANCIAL MARKET

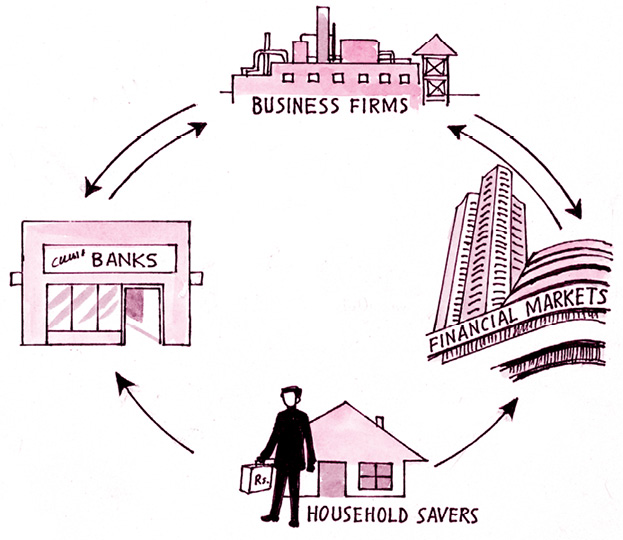

A business is a part of an economic system that consists of two main sectors – households which save funds and business firms which invest these funds. A financial market helps to link the savers and the investors by mobilizing funds between them. In doing so it performs what is known as an allocative function. It allocates or directs funds available for investment into their most productive investment opportunity. When the allocative function is performed well, two consequences follow:

- The rate of return offered to households would be higher

- Scarce resources are allocated to those firms which have the highest productivity for the economy.

There are two major alternative mechanisms through which allocation of funds can be done: via banks or via financial markets. Households can deposit their surplus funds with banks, who in turn could lend these funds to business firms. Alternately, households can buy the shares and debentures offered by a business using financial markets. The process by which allocation of funds is done is called financial intermediation. Banks and financial markets are competing intermediaries in the financial system, and give households a choice of where they want to place their savings.

A financial market is a market for the creation and exchange of financial assets. Financial markets exist wherever a financial transaction occurs. Financial transactions could be in the form of creation of financial assets such as the initial issue of shares and debentures by a firm or the purchase and sale of existing financial assets like equity shares, debentures and bonds.

FUNCTIONS OF FINANCIAL MARKET

Financial markets play an important role in the allocation of scarce resources in an economy by performing the following four important functions.

1. Mobilisation of Savings and Channeling them into the most Productive Uses: A financial market facilitates the transfer of savings from savers to investors. It gives savers the choice of different investments and thus helps to channelise surplus funds into the most productive use.

2. Facilitating Price Discovery: You all know that the forces of demand and supply help to establish a price for a commodity or service in the market. In the financial market, the households are suppliers of funds and business firms represent the demand. The interaction between them helps to establish a price for the financial asset which is being traded in that particular market.

3. Providing Liquidity to Financial Assets: Financial markets facilitate easy purchase and sale of financial assets. In doing so they provide liquidity to financial assets, so that they can be easily converted into cash whenever required. Holders of assets can readily sell their financial assets through the mechanism of the financial market.

4. Reducing the Cost of Transactions: Financial markets provide valuable information about securities being traded in the market. It helps to save time, effort and money that both buyers and sellers of a financial asset would have to otherwise spend to try and find each other. The financial market is thus, a common platform where buyers and sellers can meet for fulfillment of their individual needs.

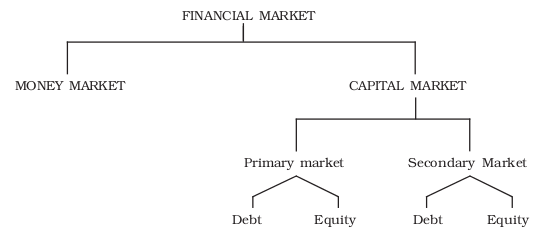

Financial markets are classified on the basis of the maturity of financial instruments traded in them. Instruments with a maturity of less than one year are traded in the money market. Instruments with longer maturity are traded in the capital market.

MONEY MARKET

The money market is a market for short term funds which deals in monetary assets whose period of maturity is upto one year. These assets are close substitutes for money. It is a market where low risk, unsecured and short term debt instruments that are highly liquid are issued and actively traded everyday. It has no physical location, but is an activity conducted over the telephone and through the internet. It enables the raising of short-term funds for meeting the temporary shortages of cash and obligations and the temporary deployment of excess funds for earning returns.

Classification of Financial Markets

The major participants in the market are the Reserve Bank of India (RBI), Commercial Banks, Non-Banking Finance Companies, State Governments, Large Corporate Houses and Mutual Funds.

MONEY MARKET INSTRUMENTS

1. Treasury Bill: A Treasury bill is basically an instrument of short-term borrowing by the Government of India maturing in less than one year. They are also known as Zero Coupon Bonds issued by the Reserve Bank of India on behalf of the Central Government to meet its short-term requirement of funds. Treasury bills are issued in the form of a promissory note. They are highly liquid and have assured yield and negligible risk of default. They are issued at a price which is lower than their face value and repaid at par. The difference between the price at which the treasury bills are issued and their redemption value is the interest receivable on them and is called discount. Treasury bills are available for a minimum amount of Rs 25,000 and in multiples thereof.

Example: Suppose an investor purchases a 91 days Treasury bill with a face value of Rs. 1,00,000 for Rs. 96,000. By holding the bill until the maturity date, the investor receives Rs. 1,00,000. The difference of Rs. 4,000 between the proceeds received at maturity and the amount paid to purchase the bill represents the interest received by him.

2. Commercial Paper: Commercial paper is a short-term unsecured promissory note, negotiable and transferable by endorsement and delivery with a fixed maturity period. It is issued by large and creditworthy companies to raise short-term funds at lower rates of interest than market rates. It usually has a maturity period of 15 days to one year. The issuance of commercial paper is an alternative to bank borrowing for large companies that are generally considered to be financially strong. It is sold at a discount and redeemed at par. The original purpose of commercial paper was to provide short-terms funds for seasonal and working capital needs. For example companies use this instrument for purposes such as bridge financing.

Example: Suppose a company needs long-term finance to buy some machinery. In order to raise the long term funds in the capital market the company will have to incur floatation costs (costs associated with floating of an issue are brokerage, commission, printing of applications and advertising etc.). Funds raised through commercial paper are used to meet the floatation costs. This is known as Bridge Financing.

3. Call Money: Call money is short term finance repayable on demand, with a maturity period of one day to fifteen days, used for inter-bank transactions. Commercial banks have to maintain a minimum cash balance known as cash reserve ratio. The Reserve Bank of India changes the cash reserve ratio from time to time which in turn affects the amount of funds available to be given as loans by commercial banks. Call money is a method by which banks borrow from each other to be able to maintain the cash reserve ratio. The interest rate paid on call money loans is known as the call rate. It is a highly volatile rate that varies from day-to-day and sometimes even from hour-to-hour. There is an inverse relationship between call rates and other short-term money market instruments such as certificates of deposit and commercial paper. A rise in call money rates makes other sources of finance such as commercial paper and certificates of deposit cheaper in comparison for banks raise funds from these sources.

4. Certificate of Deposit: Certificates of deposit (CD) are unsecured, negotiable, short-term instruments in bearer form, issued by commercial banks and development financial institutions. They can be issued to individuals, corporations and companies during periods of tight liquidity when the deposit growth of banks is slow but the demand for credit is high. They help to mobilise a large amount of money for short periods.

5. Commercial Bill: A commercial bill is a bill of exchange used to finance the working capital requirements of business firms. It is a short-term, negotiable, self-liquidating instrument which is used to finance the credit sales of firms. When goods are sold on credit, the buyer becomes liable to make payment on a specific date in future. The seller could wait till the specified date or make use of a bill of exchange. The seller (drawer) of the goods draws the bill and the buyer (drawee) accepts it. On being accepted, the bill becomes a marketable instrument and is called a trade bill. These bills can be discounted with a bank if the seller needs funds before the bill matures. When a trade bill is accepted by a commercial bank it is known as a commercial bill.

CAPITAL MARKET

The term capital market refers to facilities and institutional arrangements through which long-term funds, both debt and equity are raised and invested. It consists of a series of channels through which savings of the community are made available for industrial and commercial enterprises and for the public in general. It directs these savings into their most productive use leading to growth and development of the economy. The capital market consists of development banks, commercial banks and stock exchanges.

An ideal capital market is one where finance is available at reasonable cost. The process of economic development is facilitated by the existence of a well functioning capital market. In fact, development of the financial system is seen as a necessary condition for economic growth. It is essential that financial institutions are sufficiently developed and that market operations are free, fair, competitive and transparent. The capital market should also be efficient in respect of the information that it delivers, minimise transaction costs and allocate capital most productively.

The Capital Market can be divided into two parts:

a. Primary Market

b. Secondary Market

Distinction between Capital Market and Money Market

The major points of distinction between the two markets are as follows:

(i) Participants: The participants in the capital market are financial institutions, banks, corporate entities, foreign investors and ordinary retail investors from members of the public. Participation in the money market is by and large undertaken by institutional participants such as the RBI, banks, financial institutions and finance companies. Individual investors although permitted to transact in the secondary money market, do not normally do so.

(ii) Instruments: The main instruments traded in the capital market are – equity shares, debentures, bonds, preference shares etc. The main instruments traded in the money market are short term debt instruments such as T-bills, trade bills reports, commercial paper and certificates of deposit.

(iii) Investment Outlay: Investment in the capital market i.e. securities does not necessarily require a huge financial outlay. The value of units of securities is generally low i.e. Rs 10, Rs 100 and so is the case with minimum trading lot of shares which is kept small i.e. 5, 50, 100 or so. This helps individuals with small savings to subscribe to these securities. In the money market, transactions entail huge sums of money as the instruments are quite expensive.

(iv) Duration: The capital market deals in medium and long term securities such as equity shares and debentures. Money market instruments have a maximum tenure of one year, and may even be issued for a single day.

(v) Liquidity: Capital market securities are considered liquid investments because they are marketable on the stock exchanges. However, a share may not be actively traded, i.e. it may not easily find a buyer. Money market instruments on the other hand, enjoy a higher degree of liquidity as there is formal arrangement for this. The Discount Finance House of India (DFHI) has been established for the specific objective of providing a ready market for money market instruments.

(vi) Safety: Capital market instruments are riskier both with respect to returns and principal repayment. Issuing companies may fail to perform as per projections and promoters may defraud investors. But the money market is generally much safer with a minimum risk of default. This is due to the shorter duration of investing and also to financial soundness of the issuers, which primarily are the government, banks and highly rated companies.

(vii) Expected return: The investment in capital markets generally yield a higher return for investors than the money markets. The possibility of earnings is higher if the securities are held for a longer duration. First, there is the scope of earning capital gains in equity share. Second, in the long run, the prosperity of a company is shared by shareholders by way of high dividends and bonus issues.

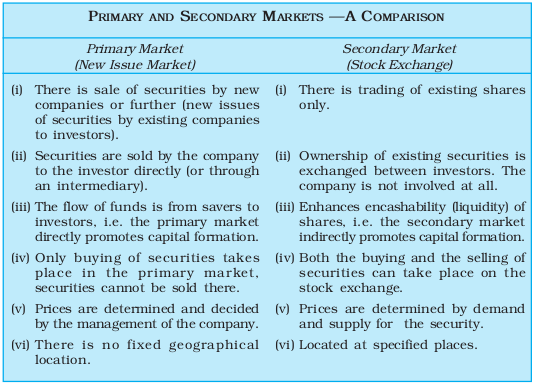

PRIMARY MARKET

The primary market is also known as the new issues market. It deals with new securities being issued for the first time. The essential function of a primary market is to facilitate the transfer of investible funds from savers to entrepreneurs seeking to establish new enterprises or to expand existing ones through the issue of securities for the first time. The investors in this market are banks, financial institutions, insurance companies, mutual funds and individuals.

A company can raise capital through the primary market in the form of equity shares, preference shares, debentures, loans and deposits. Funds raised may be for setting up new projects, expansion, diversification, modernisation of existing projects, mergers and takeovers etc.

Methods of Floatation

There are various methods of floating new issues in the primary market :

1. Offer through Prospectus: Offer through prospectus is the most popular method of raising funds by public companies in the primary market. This involves inviting subscription from the public through issue of prospectus. A prospectus makes a direct appeal to investors to raise capital, through an advertisement in newspapers and magazines. The issues may be underwritten and also are required to be listed on at least one stock exchange. The contents of the prospectus have to be in accordance with the provisions of the Companies Act and SEBI disclosure and investor protection guidelines.

2. Offer for Sale: Under this method securities are not issued directly to the public but are offered for sale through intermediaries like issuing houses or stock brokers. In this case, a company sells securities enbloc at an agreed price to brokers who, in turn, resell them to the investing public.

3. Private Placement: Private placement is the allotment of securities by a company to institutional investors and some selected individuals. It helps to raise capital more quickly than a public issue. Access to the primary market can be expensive on account of various mandatory and non-mandatory expenses. Some companies, therefore, cannot afford a public issue and choose to use private placement.

4. Rights Issue: This is a privilege given to existing shareholders to subscribe to a new issue of shares according to the terms and conditions of the company. The shareholders are offered the ‘right’ to buy new shares in proportion to the number of shares they already possess.

5. e-IPOs: A company proposing to issue capital to the public through the on-line system of the stock exchange has to enter into an agreement with the stock exchange. This is called an Initial Public Offer (IPO). SEBI registered brokers have to be appointed for the purpose of accepting applications and placing orders with the company. The issuer company should also appoint a registrar to the issue having electronic connectivity with the exchange. The issuer company can apply for listing of its securities on any exchange other than the exchange through which it has offered its securities. The lead manager coordinates all the activities amongst intermediaries connected with the issue.

SECONDARY MARKET

The secondary market is also known as the stock market or stock exchange. It is a market for the purchase and sale of existing securities. It helps existing investors to disinvest and fresh investors to enter the market. It also provides liquidity and marketability to existing securities. It also contributes to economic growth by channelising funds towards the most productive investments through the process of disinvestment and reinvestment. Securities are traded, cleared and settled within the regulatory framework prescribed by SEBI. Advances in information technology have made trading through stock exchanges accessible from anywhere in the country through trading terminals. Along with the growth of the primary market in the country, the secondary market has also grown significantly during the last ten years.

History of the Stock Market in India

The history of the stock market in India goes back to the end of the eighteenth century when long-term negotiable securities were first issued. In 1850 the Companies Act was introduced for the first time bringing with it the feature of limited liability and generating investor interest in corporate securities. The first stock exchange in India was set-up in 1875 as The Native Share and Stock Brokers Association in Bombay. Today it is known as the Bombay Stock Exchange (BSE). This was followed by the development of exchanges in Ahmedabad (1894), Calcutta(1908) and Madras(1937). It is interesting to note that stock exchanges were first set up in major centers of trade and commerce.

Until the early 1990s, the Indian secondary market comprised regional stock exchanges with BSE heading the list. After the reforms of 1991, the Indian secondary market acquired a three tier form. This consists of:

- Regional Stock Exchanges

- National Stock Exchange (NSE)

- Over the Counter Exchange of India (OTCEI)

STOCK EXCHANGE

A stock exchange is an institution which provides a platform for buying and selling of existing securities. As a market, the stock exchange facilitates the exchange of a security (share, debenture etc.) into money and vice versa. Stock exchanges help companies raise finance, provide liquidity and safety of investment to the investors and enhance the credit worthiness of individual companies.

Meaning of Stock Exchange

According to Securities Contracts (Regulation) Act 1956, stock exchange means any body of individuals, whether incorporated or not, constituted for the purpose of assisting, regulating or controlling the business of buying and selling or dealing in securities.

Functions of a Stock Exchange

The efficient functioning of a stock exchange creates a conducive climate for an active and growing primary market for new issues. An active and healthy secondary market in existing securities leads to positive environment among investors. The following are some of the important functions of a stock exchange.

1. Providing Liquidity and Market-ability to Existing Securities: The basic function of a stock exchange is the creation of a continuous market where securities are bought and sold. It gives investors the chance to disinvest and reinvest. This provides both liquidity and easy marketability to already existing securities in the market.

2. Pricing of Securities: Share prices on a stock exchange are determined by the forces of demand and supply. A stock exchange is a mechanism of constant valuation through which the prices of securities are determined. Such a valuation provides important instant information to both buyers and sellers in the market.

3. Safety of Transaction: The membership of a stock exchange is well- regulated and its dealings are well defined according to the existing legal framework. This ensures that the investing public gets a safe and fair deal on the market.

4. Contributes to Economic Growth: A stock exchange is a market in which existing securities are resold or traded. Through this process of disinvestment and reinvestment savings get channelised into their most productive investment avenues. This leads to capital formation and economic growth.

5. Spreading of Equity Cult: The stock exchange can play a vital role in ensuring wider share ownership by regulating new issues, better trading practices and taking effective steps in educating the public about investments.

6. Providing Scope for Speculation: The stock exchange provides sufficient scope within the provisions of law for speculative activity in a restricted and controlled manner. It is generally accepted that a certain degree of healthy speculation is necessary to ensure liquidity and price continuity in the stock market.

TRADING AND SETTLEMENT PROCEDURE

Trading in securities is now executed through an on-line, screen-based electronic trading system. Simply put, all buying and selling of shares and debentures are done through a computer terminal.

Electronic Trading System

There was a time when in the open outcry system, securities were bought and sold on the floor of the stock exchange. Under this auction system, deals were struck among brokers, prices were shouted out and the shares sold to the highest bidder. However, now almost all exchanges have gone electronic and trading is done in the broker’s office through a computer terminal. A stock exchange has its main computer system with many terminals spread across the country. Trading in securities is done through brokers who are members of the stock exchange. Trading has shifted from the stock market floor to the brokers office.

Every broker has to have access to a computer terminal that is connected to the main stock exchange. In this screen-based trading, a member logs on to the site and any information about the shares (company, member, etc.) he wishes to buy or sell and the price is fed into the computer. The software is so designed that the transaction will be executed when a matching order is found from a counter party. The whole transaction is carried on the computer screen with both the parties being able to see the prices of all shares going up and down at all times during the time that business is transacted and during business hours of the stock exchange. The computer in the brokers office is constantly matching the orders at the best bid and offer price. Those that are not matched remain on the screen and are open for future matching during the day.

Electronic trading systems or screen-based trading has certain advantages:

1. It ensures transparency as it allows participants to see the prices of all securities in the market while business is being transacted. They are able to see the full market during real time.

2. It increases efficiency of information being passed on, thus helping in fixing prices efficiently. The computer screens display information on prices and also capital market developments that influence share prices.

3. It increases the efficiency of operations, since there is reduction in time, cost and risk of error.

4. People from all over the country and even abroad who wish to participate in the stock market can buy or sell securities through brokers or members without knowing each other. That is, they can sit in the broker’s office, log on to the computer at the same time and buy or sell securities. This system has enabled a large number of participants to trade with each other, thereby improving the liquidity of the market.

5. A single trading platform has been provided as business is transacted at the same time in all the trading centres. Thus, all the trading centres spread all over the country have been brought onto one trading platform, i.e., the stock exchange, on the computer.

Now, screen-based trading or on-line trading is the only way in which you can buy or sell shares. Shares can be held either in physical form or an electronic book entry form of holding and transferring shares can also be adopted. This electronic form is called dematerialised form.

Steps in the Trading and Settlement Procedure

It has been made compulsory to settle all trades within 2 days of the trade date, i.e., on a T+2 basis, since 2003. Prior to the reforms, securities were bought and sold, i.e., traded and all positions in the stock exchange were settled on a weekly/fortnightly settlement cycle whether it was delivery of securities or payment of cash. This system prevailed for a long time as it increased the volume of trading on the exchange and provided liquidity to the system. However, since trades were to be settled on specified dates, this gave rise to speculation and price of shares used to rise and fall suddenly due to trading and defaults by brokers. A new system, i.e, rolling settlement, was introduced in 2000, so that whenever a trade took place it would be settled after some days. Since 2003, all shares have to be covered under the rolling settlement system on a T+2 basis, meaning thereby that transactions in securities are settled within 2 days after the trade date. Since rolling settlement implies fast movement of shares, it requires effective implementation of electronic fund transfer and dematerialisation of shares.

The following steps are involved in the screen-based trading for buying and selling of securities:

1. If an investor wishes to buy or sell any security he has to first approach a registered broker or sub-broker and enter into an agreement with him. The investor has to sign a broker-client agreement and a client registration form before placing an order to buy or sell securities. He has also to provide certain other details and information. These include:

- PAN number (This is mandatory)

- Date of birth and address.

- Educational qualification and occupation.

- Residential status (Indian/NRI).

- Bank account details.

- Depository account details.

- Name of any other broker with whom registered.

- Client code number in the client registration form.

The broker then opens a trading account in the name of the investor.

2. The investor has to open a ‘demat’ account or ‘beneficial owner’ (BO) account with a depository participant (DP) for holding and transferring securities in the demat form. He will also have to open a bank account for cash transactions in the securities market.

3. The investor then places an order with the broker to buy or sell shares. Clear instructions have to be given about the number of shares and the price at which the shares should be bought or sold. The broker will then go ahead with the deal at the above mentioned price or the best price available. An order confirmation slip is issued to the investor by the broker.

4. The broker then will go on-line and connect to the main stock exchange and match the share and best price available.

5. When the shares can be bought or sold at the price mentioned, it will be communicated to the broker’s terminal and the order will be executed electronically. The broker will issue a trade confirmation slip to the investor.

6. After the trade has been executed, within 24 hours the broker issues a Contract Note. This note contains details of the number of shares bought or sold, the price, the date and time of deal, and the brokerage charges. This is an important document as it is legally enforceable and helps to settle disputes/claims between the investor and the broker. A Unique Order Code number is assigned to each transaction by the stock exchange and is printed on the contract note.

7. Now, the investor has to deliver the shares sold or pay cash for the shares bought. This should be done immediately after receiving the contract note or before the day when the broker shall make payment or delivery of shares to the exchange. This is called the pay-in day.

8. Cash is paid or securities are delivered on pay-in day, which is before the T+2 day as the deal has to be settled and finalised on the T+2 day. The settlement cycle is on T+2 day on a rolling settlement basis, w.e.f. 1 April 2003.

9. On the T+2 day, the exchange will deliver the share or make payment to the other broker. This is called the pay-out day. The broker then has to make payment to the investor within 24 hours of the pay-out day since he has already received payment from the exchange.

10. The broker can make delivery of shares in demat form directly to the investor’s demat account. The investor has to give details of his demat account and instruct his depository participant to take delivery of securities directly in his beneficial owner account.

Project Work

1. Study the website of Mumbai Stock Exchange, i.e. www.bseindia.com and compile information which you find useful. Discuss it in your class and find out how it can help you should you decide to invest in the stock market. Preapre a report on your findings with the help of your teacher.

2. Prepare a report on the role of SEBI in regulating the Indian stock market. You can get this information on its website namely www. sebi. gov.in. Do you think something else should be done to increase the number of investors in the stock market?

Dematerialisation and Depositories

All trading in securities is now done through computer terminals. Since all systems are computerised, buying and selling of securities are settled through an electronic book entry form. This is mainly done to eliminate problems like theft, fake/forged transfers, transfer delays and paperwork associated with share certificates or debentures held in physical form.

This is a process where securities held by the investor in the physical form are cancelled and the investor is given an electronic entry or number so that she/he can hold it as an electronic balance in an account. This process of holding securities in an electronic form is called dematerialisation. For this, the investor has to open a demat account with an organisation called a depository. In fact, now all Initial Public Offers (IPOs) are issued in dematerialisation form and more than 99% of the turnover is settled by delivery in the demat form.

The Securities and Exchange Board of India (SEBI) has made it mandatory for the settlement procedures to take place in demat form in certain select securities. Holding shares in demat form is very convenient as it is just like a bank account. Physical shares can be converted into electronic form or electronic holdings can be reconverted into physical certificates (rematerialisation). Dematerialisation enables shares to be transferred to some other account just like cash and ensures settlement of all trades through a single account in shares. These demat securities can even be pledged or hypothecated to get loans. There is no danger of loss, theft or forgery of share certificates. It is the broker’s responsibility to credit the investor’s account with the correct number of shares.

Working of the Demat System

1. A depository participant (DP), either a bank, broker, or financial services company, may be identified.

2. An account opening form and documentation (PAN card details, photograph, power of attorney) may be completed.

3. The physical certificate is to be given to the DP along with a dematerialisation request form.

4. If shares are applied in a public offer, simple details of DP and demat account are to be given and the shares on allotment would automatically be credited to the demat account.

5. If shares are to be sold through a broker, the DP is to be instructed to debit the account with the number of shares.

6. The broker then gives instruction to his DP for delivery of the shares to the stock exchange.

7. The broker then receives payment and pay the person for the shares sold.

8. All these transactions are to be completed within 2 days, i.e., delivery of shares and payment received from the buyer is on a T+2 basis, settlement period.

Depository

Just like a bank keeps money in safe custody for customers, a depository also is like a bank and keeps securities in electronic form on behalf of the investor. In the depository a securities account can be opened, all shares can be deposited, they can be withdrawn/sold at any time and instruction to deliver or receive shares on behalf of the investor can be given. It is a technology driven electronic storage system. It has no paper work relating to share certificates, transfer, forms, etc. All transactions of the investors are settled with greater speed, efficiency and use as all securities are entered in a book entry mode.

In India, there are two depositories. National Securities Depositories Limited (NSDL) is the first and largest depository presently operational in India. It was promoted as a joint venture of the IDBI, UTI, and the National Stock Exchange.

The Central Depository Services Limited (CDSL) is the second depository to commence operations and was promoted by the Bombay Stock Exchange and the Bank of India. Both these national level depositories operate through intermediaries who are electronically connected to the depository and serve as contact points with the investors and are called depository participants.

The depository participant (DP) serves as an intermediary between the investor and the Depository (NSDL or CSDL) who is authorised to maintain the accounts of dematerialised shares. Financial institutions, banks, clearing corporations, stock brokers and non-banking finance corporations are permitted to become depository participants. If the investor is buying and selling the securities through the broker or the bank or a non-banking finance corporation, it acts as a DP for the investor and complete the formalities.

NATIONAL STOCK EXCHANGE OF INDIA (NSE)

The National Stock Exchange is the latest, most modern and technology driven exchange. It was incorporated in 1992 and was recognised as a stock exchange in April 1993. It started operations in 1994, with trading on the wholesale debt market segment. Subsequently, it launched the capital market segment in November 1994 as a trading platform for equities and the futures and options segment in June 2000 for various derivative instruments. NSE has set up a nationwide fully automated screen based trading system.

The NSE was set up by leading financial institutions, banks, insurance companies and other financial intermediaries. It is managed by professionals, who do not directly or indirectly trade on the exchange. The trading rights are with the trading members who offer their services to the investors. The Board of NSE comprises senior executives from promoter institutions and eminent professionals, without having any representation from trading members.

Stock Market Index

A stock market index is a barometer of market behaviour. It measures overall market sentiment through a set of stocks that are representative of the market. It reflects market direction and indicates day-to-day fluctuations in stock prices. An ideal index must represent changes in the prices of securities and reflect price movements of typical shares for better market representation. In the Indian markets the BSE, SENSEX and NSE, NIFTY are important indices. Some important global stock market indices are:

- Dow Jones Industrial Average is among the oldest quoted stock market index in the US.

- NASDAQ Composite Index is the market capitalisation weightages of prices for stocks listed in the NASDAQ stock market.

- S and P 500 Index is made up of 500 biggest publicly traded companies in the US. The S and P 500 is often treated as a proxy for the US stock market.

- FTSE 100 consists of the largest 100 companies by full market value listed on the London Stock Exchange. The FTSE 100 is the benchmark index of the European market.

OBJECTIVES OF NSE

NSE was set up with the following objectives:

a. Establishing a nationwide trading facility for all types of securities.

b. Ensuring equal access to investors all over the country through an appropriate communication network.

c. Providing a fair, efficient and transparent securities market using electronic trading system.

d. Enabling shorter settlement cycles and book entry settlements.

e. Meeting international benchmarks and standards.

Within a span of ten years, NSE has been able to achieve its objectives for which it was set up. It has been playing a leading role as a change agent in transforming the Indian capital market. NSE has been able to take the stock market to the door step of the investors. It has ensured that technology has been harnessed to deliver the services to the investors across the country at the lowest cost. It has provided a nation wide screen based automated trading system with a high degree of transparency and equal access to investors irrespective of geographical location.

MARKET SEGMENTS OF NSE

The Exchange provides trading in the following two segments.

(i) Whole Sale Debt Market Segment: This segment provides a trading platform for a wide range of fixed income securities that include central government securities, treasury bills, state development loans, bonds issued by public sector undertakings, floating rate bonds, zero coupon bonds, index bonds, commercial paper, certificate of deposit, corporate debentures and mutual funds.

(ii) Capital Market Segment: The capital market segment of NSE provides an efficient and transparent platform for trading in equity, preference, debentures, exchange traded funds as well as retail Government securities.

Some Common Stock Market Terms

You would have often come across the following terms in magazines or newspapers when you read about the stock market.

BOURSES is another word for the stock market

BULLS and BEARS – The term does not refer to animals but to market sentiment of the investors. A Bullish phase refers to a period of optimism and a Bearish phase to a period of perssimism on the Bourses.

BADLA – This refers to a carry forward system of settlement, particularly at the BSE. It is a facility that allows the postponement of the delivery or payment of a transaction from one settlement period to another.

ODD LOT TRADING – Trading in multiples of 100 stocks or less.

PENNY STOCKS – These are securities that have no value on the stock exchange but whose trading contributes to speculation.

BSE (BOMBAY STOCK EXCHANGE LTD.)

BSE Ltd (formerly known as Bombay Stock Exchange Ltd) was established in 1875 and was Asia’s first Stock Exchange. It was granted permanent recognition under the Securities Contract (Regulation) Act, 1956. It has contributed to the growth of the corporate sector by providing a platform for raising capital. It is known as BSE Ltd but was established as the Native Share Stock Brokers Association in 1875. Even before the actual legislations were enacted, BSE Ltd already had a set of Rules and Regulations to ensure an orderly growth of the securities market. As discussed earlier, a stock exchange can be set up as a corporate entity with different individuals (who are not brokers) as members or shareholders. BSE is one such exchange set up as a corporate entity with a broad shareholder base. It has the following objectives:

(a) To provide an efficient and transparent market for trading in equity, debt instruments, derivatives, and mutual funds.

(b) To provide a trading platform for equities of small and medium enterprises.

(c) To ensure active trading and safeguard market integrity through an electronically-driven exchange.

(d) To provide other services to capital market participants, like risk management, clearing, settlement, market data, and education.

(e) To conform to international standards.

Besides having a nation-wide presence, BSE has a global reach with customers around the world. It has stimulated innovation and competition across all market segments. It has established a capital market institute, called the BSE Institute Ltd, which provides education on financial markets and vocational training to a number of people seeking employment with stock brokers. The exchange has about 5000 companies listed from all over the country and outside, and has the largest market capitalisation in India.

SECURITIES AND EXCHANGE BOARD OF INDIA (SEBI)

The Securities and Exchange Board of India was established by the Government of India on 12 April 1988 as an interim administrative body to promote orderly and healthy growth of securities market and for investor protection. It was to function under the overall administrative control of the Ministry of Finance of the Government of India. The SEBI was given a statutory status on 30 January 1992 through an ordinance. The ordinance was later replaced by an Act of Parliament known as the Securities and Exchange Board of India Act, 1992.

Reasons for the Establishment of SEBI

The capital market has witnessed a tremendous growth during 1980’s, characterised particularly by the increasing participation of the public. This ever expanding investors population and market capitalisation led to a variety of malpractices on the part of companies, brokers, merchant bankers, investment consultants and others involved in the securities market. The glaring examples of these malpractices include existence of self – styled merchant bankers unofficial private placements, rigging of prices, unofficial premium on new issues, non-adherence of provisions of the Companies Act, violation of rules and regulations of stock exchanges and listing requirements, delay in delivery of shares etc. These malpractices and unfair trading practices have eroded investor confidence and multiplied investor grievances. The Government and the stock exchanges were rather helpless in redressing the investor’s problems because of lack of proper penal provisions in the existing legislation. In view of the above, the Government of India decided to set-up a separate regulatory body known as Securities and Exchange Board of India.

Purpose and Role of SEBI

The basic purpose of SEBI is to create an environment to facilitate efficient mobilisation and allocation of resources through the securities markets. It also aims to stimulate competition and encourage innovation. This environment includes rules and regulations, institutions and their interrelationships, instruments, practices, infrastructure and policy framework.

This environment aims at meeting the needs of the three groups which basically constitute the market, viz,

the issuers of securities (Companies), the investors and the market intermediaries.

- To the issuers, it aims to provide a market place in which they can confidently look forward to raising finances they need in an easy, fair and efficient manner.

- To the investors, it should provide protection of their rights and interests through adequate, accurate and authentic information and disclosure of information on a continuous basis.

- To the intermediaries, it should offer a competitive, professionalised and expanding market with adequate and efficient infrastructure so that they are able to render better service to the investors and issuers.

Objectives of SEBI

The overall objective of SEBI is to protect the interests of investors and to promote the development of, and regulate the securities market. This may be elaborated as follows:

1. To regulate stock exchanges and the securities industry to promote their orderly functioning.

2. To protect the rights and interests of investors, particularly individual investors and to guide and educate them.

3. To prevent trading malpractices and achieve a balance between self regulation by the securities industry and its statutory regulation.

4. To regulate and develop a code of conduct and fair practices by intermediaries like brokers, merchant bankers etc., with a view to making them competitive and professional.

Functions of SEBI

Keeping in mind the emerging nature of the securities market in India, SEBI was entrusted with the twin task of both regulation and development of the securities market. It also has certain protective functions.

Regulatory Functions

1. Registration of brokers and sub-brokers and other players in the market.

2. Registration of collective investment schemes and Mutual Funds.

3. Regulation of stock brokers, portfolio exchanges, underwriters and merchant bankers and the business in stock exchanges and any other securities market.

4. Regulation of takeover bids by companies.

5. Calling for information by under-taking inspection, conducting enquiries and audits of stock exchanges and intermediaries.

6. Levying fee or other charges for carrying out the purposes of the Act.

7. Performing and exercising such power under Securities Contracts (Regulation) Act 1956, as may be delegated by the Government of India.

Development Functions

1. Training of intermediaries of the securities market.

2. Conducting research and publishing information useful to all market participants.

3. Undertaking measures to develop the capital markets by adapting a flexible approach.

Protective Functions

1. Prohibition of fraudulent and unfair trade practices like making mis-leading statements, manipulations, price rigging etc.

2. Controlling insider trading and imposing penalties for such practices.

3. Undertaking steps for investor protection.

4. Promotion of fair practices and code of conduct in securities market.

The Organisation Structure of SEBI

As SEBI is a statutory body there has been a considerable expansion in the range and scope of its activities. Each of the activities of the SEBI now demands more careful, closer, co-ordinated and intensive attention to enable it to attain its objectives. Accordingly, SEBI has been restructured and rationalised in tune with its expanded scope. It has decided its activities into five operational departments. Each department is headed by an executive director. Apart from its head office at Mumbai, SEBI has opened regional offices in Kolkalta, Chennai, and Delhi to attend to investor complaints and liaise with the issuers, intermediaries and stock exchanges in the concerned region.

The SEBI also formed two advisory committees. They are the Primary Market Advisory Committee and the Secondary Market Advisory Committee. These committees consist of the market players, the investors associations recognised by the SEBI and the eminent persons in the capital market. They provide important inputs to the SEBI’s policies.

The objectives of the two Committees are as follows:

a. To advise SEBI on matters relating to the regulation of intermediaries for ensuring investors protection in the primary market.

b. To advise SEBI on issues related to the development of primary market in India.

c. To advise SEBI on disclosure requirements for companies.

d. To advise for changes in legal framework to introduce simplification and transparency in the primary market.

e. To advise the board in matters relating to the development and regulation of the secondary market in the country.

The committees are however non-statutory in nature and the SEBI is not bound by the advise of the committee. These committees are a part of SEBI’s constant endeavor to obtain a feedback from the market players on various issues relating to the regulations and development of the market.

KEY TERMS

| Financial Market |

| Money Market |

| Treasury Bills |

| Commercial Paper |

| Call Money |

| Certificate of Deposit |

| Commercial Bill |

| Money Market |

| Mutual Fund Capital |

| Market |

| Primary Market |

| Secondary Market |

| Stock Exchange |

| SEBI, NSE |

| OTCEI |

SUMMARY

Financial Market is a market for creation and exchange of financial assets. It helps in mobilisation and channelising the savings into most productive uses. Financial markets also helps in price discovery and provide liquidity to

financial assets.

Money Market is a market for short-term funds. It deals in monetory assets whose period of maturity is less than one year. The instruments of money market includes treasury bills, commercial paper, call money, Certificate of deposit, commercial bills, participation certificates and money market mutual funds.

Capital Market is a place where long-term funds are mobilised by the corporate undertakings and Government. Capital Market may be devided into primary market and secondary market. Primary market deals with new securities which were not previously tradable to the public. Secondary market is a place where existing securities are bought and sold.

Stock Exchanges are the organisations which provide a platform for buying and selling of existing securities. Stock exchanges provide continuous market for securities, helps in price discovery, widening share ownership and provide scope for speculation.

Securities and Exchange Board of India was established in 1988 and was given statutory status through an Act in 1992. The SEBI was set-up to protect the interests of investors, development and regulation of securities market.

EXERCISES

Very Short Answer Type

1. What is Treasury Bill?

2. Name the segments of the National Stock Exchange (NSE).

3. State any two reasons why investing public can expect a safe and fair deal in the stock market. (Point w.r.t. safety of Transactions- Functions of the Stock Exchange).

4. What is the common name for Beneficiary Owner Account, which is to be opened by the investors for trading in securities?

5. Name any two details that need to be provided by the investors to the broker while filling a client registeration form.

Short answer type

1. What are the functions of a financial market?

2. “Money Market is essentially a Market for short term funds.” Discuss.

3. Distinguish between Capital Market and Money Market.

4. What are the functions of a Stock Exchange?

5. What are the objectives of the SEBI?

6. State the objectives of the NSE.

7. Name the document prepared in the process of online trading of securities that is legally enforceable and helps to settle disputes/ claims between the investors and the broker.

Long-answer type

1. Explain the various Money Market Instruments.

2. Explain the recent Capital Market reforms in India.

3. Explain the objectives and functions of the SEBI

4. India's largest domestic investor Life Insurance Corporation of India has once again come to government's rescue by subscribing 70% of Hindustan Aeronautics' Rs. 4200- crore initial public offering.

a. Which market is being reflected in the above case?

b. State which method of floatation in the above identified market is being highlighted in the case? (Primary Market)

c. Explain any two other methods of floatation. (Private placement, Offer through prospectus, offer for sale).

5. Lalita wants to buy shares of Akbar Enterprises, through her broker Kushvinder. She has a Demat Account and a bank account for cash transactions in the securities market. Discuss the subsequent steps involved in the screen based trading for buying and selling of securities in this case.